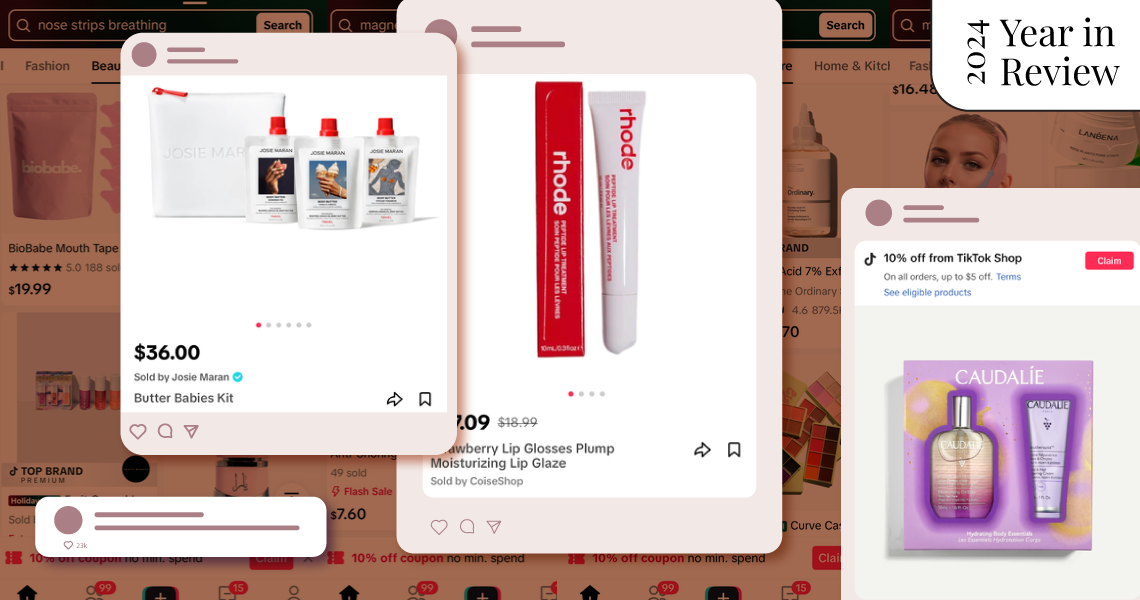

Shopping

2024 was TikTok Shop’s beauty moment

Despite the looming possibility of a TikTok ban on January 19, many beauty brands are still all in on TikTok Shop.

At a little over a year old, TikTok’s shopping extension, which allows its users to buy and sell products without leaving the app, has grown to be a more popular retailer among Americans than Shein, Sephora and home shopping TV (QVC), based on sales. That’s according to a 2025 consumer trends report by investment firm Coefficient Capital and Dan Frommer, founder of digital publication The New Consumer.

TikTok has over 120.5 million daily active users in the U.S. alone. And according to data from Shopify, by the end of 2024, TikTok will have at least 35.8 million social commerce users. By 2027, TikTok Shop users will spend at least $144.5 billion annually, up from $67 billion in 2023. What’s more, the consumer trends report, which includes data from 11 surveys of over 3,000 U.S. consumers, found that 45% of surveyed Americans have purchased through TikTok Shop, with beauty ranking as the No. 2 most-shopped category.

E-commerce spending in the U.S. is back to pre-pandemic levels. However, many experts and analysts credit TikTok Shop’s meteoric rise to more than just a return to spending. TikTok Shop’s popularity also reflects the growing dominance of social commerce, especially among digitally native Gen-Z and millennial consumers.

As of November, average monthly spending on TikTok Shop had increased 165% year-over-year. Beauty was a big driver. Over a 12-month period ending in November, TikTok Shop consumers spent about $35, on average. Those who also shopped at Sephora spent about the same at the beauty retailer.

As TikTok Shop continues to grow, beauty brands have been slowly joining the marketplace, and many have seen their bottom lines increase as a result. Buzzy brands such as Tarte Cosmetics, One Size, uCoolMe Lashes and The Ordinary cashed in on the growing opportunity, earning over $104 million in revenue combined, based on data from e-commerce intelligence platform Charm.io.

“The cost of entry is almost zero,” said Yuriy Boykiv, CEO of Front Row, an e-commerce and marketing agency. “If you’re a beauty brand, you just need to make sure that you have product in stock, and then if there is a sale, you pay commission to the affiliate or influencer or content creator. [TikTok’s] advantage is that it figured out the algorithm and how to convert attention into sales, which is something that other social platforms have not yet mastered.”

What’s worked best to drive sales for brands on the platform are live shopping events. For example, during Black Friday 2024, brands and creators hosted over 30,000 shopping events on the platform, generating over $100 million in sales that day. Stormi Steele, founder of beauty brand Canvas Beauty, told Business Insider that her brand has driven $2 million in sales in a single day.

“Consumers have fatigue around the way influencers and ads have been showing up in longer form content, but with [livestreams], you have more authentic influence through micro-influencers who can endorse [products] more authentically,” said Camila Caldas, senior strategist at advertising company Mother.

“The way [these lives] are naturally integrated into your feed makes it feel like a normal video. … It’s a competitive advantage of TikTok. They have the algorithm to serve you things that feel natural to your feed and, since you’re already a captive audience, it’s easy to engage,” added Mother strategist Emily Day.

In 2025, U.S. live-streaming e-commerce is going to generate around $56.7 billion in revenue, Sunny Zheng, an analyst at Coresight Research, told Glossy.

“Eventually, [TikTok Shop] is going to be a strategy adopted by large companies and driven by influencer economy, which will drive significant live events,” Boykiv said.

While live shopping events have been a trending strategy adopted by brands, it isn’t the only method that has proven successful. For some, holiday sales and simply opening up a storefront, giving consumers easier access to products, has been enough.

Boykiv, who has helped launch beauty brands on TikTok Shop, shared with Glossy that when his team relaunched beauty brand No7’s TikTok storefront, it saw immediate success. “It started at zero, and now it’s doing close to a million dollars [per year] in revenue,” he said. “We started small, testing the waters, but building the right storefront [with the right product assortment] and using affiliates and influences to drive sales [has helped it] become a meaningful channel.”

No 7 wasn’t the only high-profile brand that launched a storefront this year. Indie and heritage brands alike, including hair-care favorite Wavytalk, Makeup Forever, E.l.f. Cosmetics and L’Oréal Paris were among the brands that made their TikTok Shop debut in 2024.

“TikTok Shop just made sense,” said Sonika Malhotra, CMO at Makeup Forever. “What we’ve seen this year, particularly, is that there was this big community for the brand and our specific products [on the platform]. … What better than to [launch a storefront] to a community that loves the brand and talks about it? We [were able to] give them access to the product while they’re enjoying or listening to a piece of content.”

Launching on the platform doesn’t come without its challenges, though. For some brands, the costs associated with building a dedicated TikTok Shop team, curating an assortment specifically for the storefront and creating an affiliate marketing strategy equate to a barrier to entry. During Glossy’s Beauty and Wellness Summit in November 2024, beauty founders also shared frustration with TikTok Shop over the logistical challenges.

“It has taken about eight months and three companies to help us, and we are finally verified and ready to go. [We had no luck with the] AI-powered backend — as soon as we got connected, it would shut us down. My advice is you have to have physical people to help you do it. Our rep and companies [made it possible for us]. It’s not that easy,” one founder told Glossy at the summit.