Shopping

5 Key Gifting Trends as Holiday Shopping Wraps Up

This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

With Christmas just over a week away and many Americans lagging behind on their shopping, the rush to complete holiday lists is in full swing. As gifting remains top of mind, CivicScience has compiled five key trends that retailers and brands should consider as holiday shopping reaches its peak.

1. Self-gifting is way up, especially among Republicans.

Post-election, CivicScience found that the percentage of people buying themselves a gift has increased by 10 percentage points. In October, 32% said they planned to self-gift, now that figure stands at 42%. Leading this trend are Gen Z, women, and those with an income under $50K. Notably, Republicans have also grown nearly 10 percentage points more likely to self-gift post-election than they were pre-election. Intended gift budgets are rising as well – compared to early Q4, more self-gifters plan to spend over $200 on themselves. Lastly, we found that self-gifters tend to splurge on themselves. Check out the categories where they’re most likely to splurge.

Join the Conversation: Do you plan on getting gifts for yourself this holiday season?

2. Gift card giving is on the upswing.

Gift card purchasing appears likely to increase this year. More than two-thirds of Americans report being at least ‘somewhat’ likely to purchase gift cards this holiday season, up two percentage points from 2023 and four percentage points from 2022 (excluding those who answered ‘I’m not sure’). Curious about what’s driving the increase in gift card buying? Find out here.

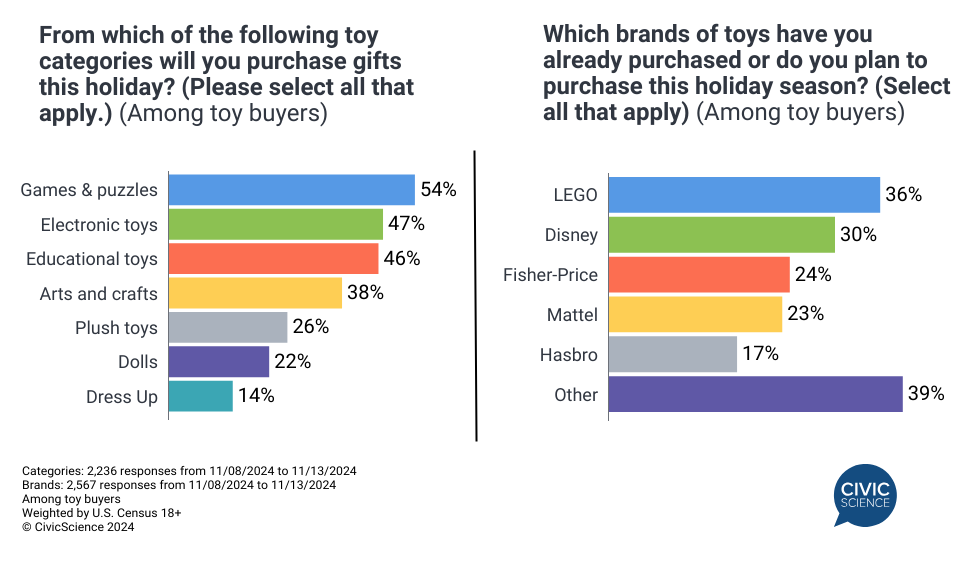

3. Americans are spending more on toys this year, with LEGO and Disney being the most popular brands.

Per CivicScience’s yearly toy tracking, toys are set to play a slightly larger role in holiday shopping this year. Sixty-four percent of U.S. adults plan to purchase toys this holiday season (up 2pp from 2023), and 14% expect to spend over $200 (up 3pp from 2023). Toy-buyers are most likely to shop for toys at online-only retailers, such as Amazon, followed by big-box stores (either in person or online) – while shopping at online-only retailers has increased, shopping at big-box stores has decreased from last year. Lastly, games, puzzles, electronics, and educational toys are expected to be the most popular this year, especially from brands like LEGO and Disney. Read more here, including what factors are most important to toy buyers.

Let us Know: Do you plan on buying toys this year for the holiday season?

4. Clothing and apparel make for a common holiday gift this year.

One standout holiday gift category is clothing – nearly two in five respondents have either already purchased or plan to buy apparel as holiday gifts. Sweaters/pullovers/hoodies and t-shirts are among the top gift choices. In particular, parents are most likely to purchase clothing-related gifts this year, as they are more likely to buy clothing gifts compared to non-parents and grandparents. Read more.

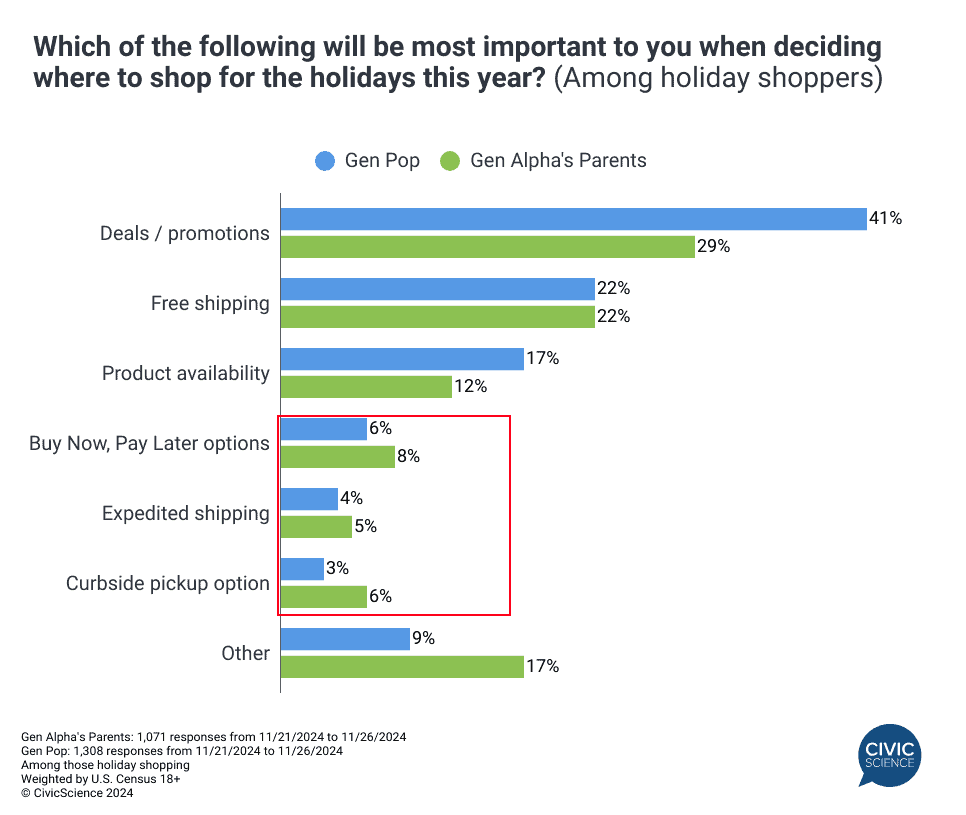

5. Parents of Gen Alpha are buying their children clothes, big-box shopping, and more.

CivicScience took a close look at the youngest and up-and-coming consumers, Gen Alpha, by studying their parents (those with children under 14 years old). We found that clothing, shoes, and accessories are topping shopping lists; big-box stores are most popular for gift-buying; deals and promotions dictate where Gen Alpha’s parents shop, yet they still value convenience options like Buy Now, Pay Later and curbside pickup. Discover the full picture here.

As the holiday gifting season wraps up, these trends offer key insights into consumer behavior, from the rise in self-gifting and gift card purchases to increased interest in toys and clothing. Retailers and brands can leverage these insights to better meet shopper demands and make the most of the final days of holiday spending.