Bussiness

Amazon Stock: Excellence Across All Business Lines (NASDAQ:AMZN)

4kodiak/iStock Unreleased via Getty Images

Investment thesis

I believe that my previous bullish thesis about Amazon (NASDAQ:AMZN) aged well, despite the stock slightly underperforming compared to the broader market since late March. My optimism is backed by Amazon’s rock-solid leadership in one of the hottest industries at the moment, cloud infrastructure. Strong growth momentum in AWS together with cost discipline helps the company in aggressively expanding its free cash flow [FCF] metrics, which is the most crucial for me as a long-term investor. The stock is around 35% undervalued, according to my valuation analysis. All in all, I reiterate my “Strong Buy” rating for AMZN.

Recent developments

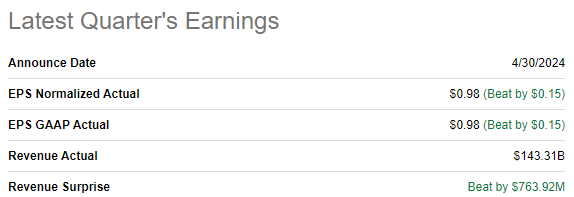

AMZN released its latest quarterly earnings on April 30 when the company surpassed consensus revenue and EPS estimates. Revenue grew by 12.5% YoY, the adjusted EPS expanded from $0.31 to $0.98. E-commerce business demonstrated strength both in North America and Internationally. The Cloud business also demonstrated robust momentum with a 17% AWS revenue growth. Digital advertising is also gaining momentum with an impressive 24% YoY growth.

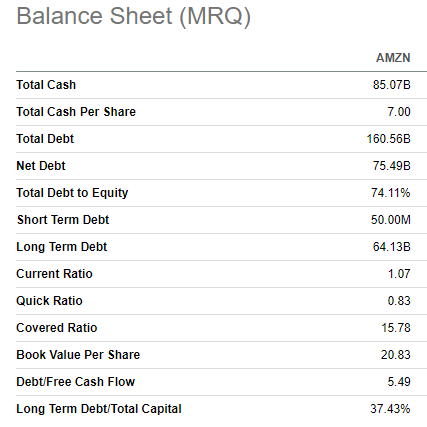

Seeking Alpha

Strong topline performance across all business lines helped in exercising operating leverage. The operating margin expanded from 3.8% to 10.7% on a YoY basis, which is a massive improvement. The strong quarter allowed Amazon to generate $5.6 billion in free cash flow. This was a solid contribution to the company’s already strong financial position. AMZN finished Q1 2024 with a massive $85 billion cash pile and total debt far less than the company’s $1.9 trillion market cap. Amazon’s fortress balance sheet is its competitive strength because it provides the company with vast opportunities to invest in growth and innovation.

Seeking Alpha

AWS remains the undisputed leader in cloud infrastructure business with its 31% global market share. The gap with Microsoft (MSFT) is solid, but AMZN’s major competitor has been aggressively striving to close the gap in recent quarters. To protect its dominance in the industry, AMZN is investing aggressively in cloud and AI-related ventures. The company plans to invest $150 billion in data centers for AI over the next 15 years, which indicates the management’s strong commitment to save AMZN’s leadership in cloud business.

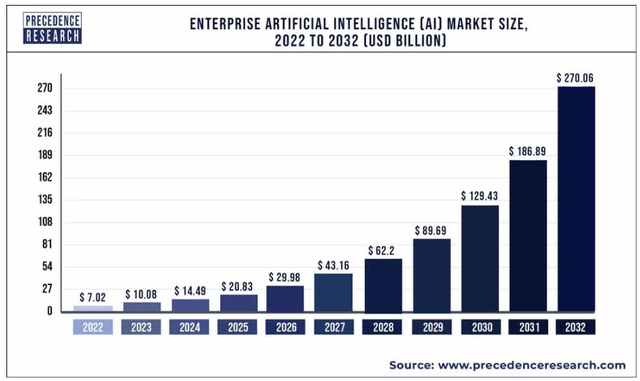

Moreover, AWS is expanding its AI capabilities to power business applications for enterprises. According to recent news, Amazon’s Bedrock platform will become available on SAP’s (SAP) infrastructure service to accelerate AI adoption by businesses. This partnership looks potentially extremely strong given Amazon’s undisputed dominance in cloud and the fact that SAP’s applications are used by 9 out of 10 Fortune 500 companies. Apart from the potential for synergies, I have to underline that the industry of AI solutions for enterprises is booming and Precedence Research forecasts a 44% CAGR for the industry over the next decade.

AWS not only partners with giants like SAP and invests billions in its data centers, but also seeks for potential superstars among AI startups. And Amazon often does not even need to pay cash to support these young companies as it offers AWS credits for them. That said, the strategic approach of AWS to sustain its strength in AI looks holistic as the company invests billions in in-house R&D and its infrastructure, seeks for strategic partnerships with other giants to expand its reach, and looks for potential stars among early-stage startups. This approach looks sound, in my opinion.

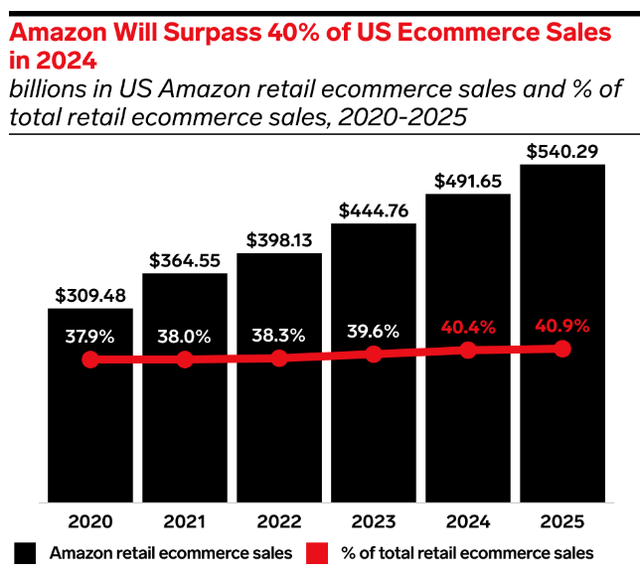

The company’s by far largest business by revenue, e-commerce, still has an unparalleled position in the industry. According to EMarketer, Amazon’s U.S. e-commerce market share is expected to continue expanding in 2024-2025 and will go above 40%.

The Amazon Prime subscription-based business continues developing and recently a partnership with Grubhub was announced. With this partnership Amazon continues adding more value to its Prime subscribers as they will get additional perks from Grubhub as a result of this collaboration. The company also works on improving Prime members’ e-commerce experience and Q1 showed the company’s fastest delivery speeds ever. According to the Q1 earnings call, across the top 60 largest U.S. metro areas, nearly 60% of Prime members orders arrived the same or next day. With new collaborations and the commitment to improve the experience of paid subscribers, this business also has strong potential to contribute to the company’s overall success.

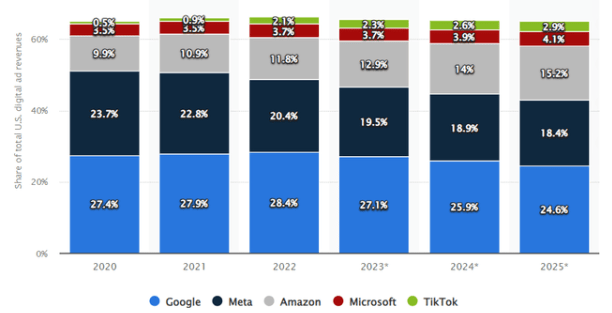

Strength in expanding its e-commerce business also helps in building other promising businesses. For example, Amazon’s vast e-commerce customer base allowed the company to build a solid digital advertising business, which is thriving with a 24% revenue growth in Q1 2024. In the below bar chart, we see that Amazon’s market share growth in the digital advertising industry demonstrates strong momentum and is expected to command a formidable 15% market share by 2025.

Statista.com

To summarize this part, Amazon continues demonstrating strength across all its businesses. AWS is likely to remain Amazon’s primary growth driver in the foreseeable future, and I like the management’s holistic approach to protect its market leadership and maximizing its potential in AI. An unparalleled position in e-commerce makes Amazon an attractive partner for other services and new collaborations add value to Prime members, which will likely help Amazon in sustaining momentum for its subscription-based business.

Valuation update

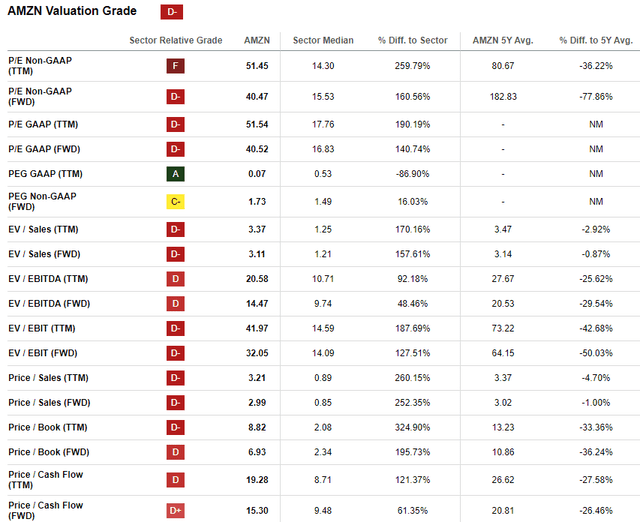

The stock rallied by 45% over the last 12 months, outperforming the broader U.S. market. YTD performance is also solid and notably ahead of the S&P 500 with a 21% share price increase. Valuation ratios are mostly lower than historical averages, meaning that the stock is likely undervalued.

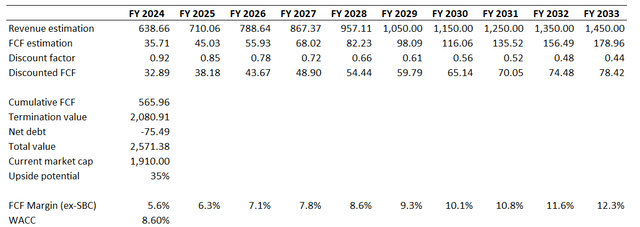

As usual, I rely on the discounted cash flow [DCF] approach the most when make conclusions about a company’s valuation. I use an 8.6% WACC for AMZN, recommended by valueinvesting.io. Consensus revenue estimates project a 9.54% revenue CAGR for the next decade, which I consider conservative enough for my DCF model. This confidence is bolstered by Amazon’s historical revenue growth levels and its dominance in cloud and e-commerce. Moreover, Amazon invests vast amounts in R&D, which increases the potential to grow a new stellar business.

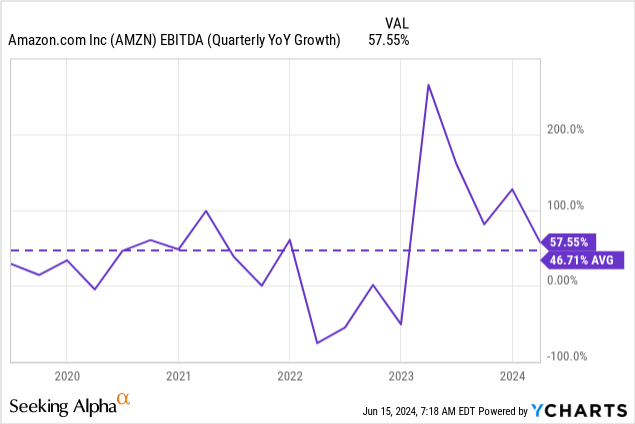

EBITDA also demonstrated aggressive growth over the last five years, which adds a lot of optimism to me about the company’s ability to drive aggressive FCF margin expansion. Therefore, I expect that the company will be able to expand its 5.6% TTM ex-SBC FCF margin by at least 50 basis points every year.

According to my DCF simulation, AMZN’s fair capitalization is almost $2.6 trillion. This is 35% higher than the current market cap. That said, the upside potential is compelling, and I can confidently conclude that AMZN’s stock is a bargain at the current share price.

Risks update

My valuation analysis is based on long-term revenue growth and FCF margin expansion expectations. There are strong reasons to believe in Amazon’s growth potential, given its dominance in cloud infrastructure and e-commerce. Apart from strong strategic positioning, my optimism is also firmly backed by Amazon’s historical success. However, we all have to remember that past success does not guarantee future growth. There are numerous significant risks which can erode Amazon’s growth potential.

While Amazon’s position in e-commerce is unrivaled, competition risks in the cloud business are much higher. Amazon competes with Microsoft and Google in cloud. MSFT has dominated the PC software market over the last three decades. GOOGL’s positioning in digital advertising is unparalleled, which made this company a FCF machine capable of investing in AI R&D and acquisitions. Due to Amazon’s scale, antitrust bodies might also pose regulatory obstacles to the company’s growth prospects.

As Amazon’s international e-commerce business is expanding, the foreign exchange risk is likely to expand as well. The strength of the U.S. dollar will highly likely be a constraint for the company’s international operations’ profitability.

Bottom line

To conclude, AMZN is still a “Strong Buy”. Recent developments increase my confidence in the company’s growth prospects as it demonstrates strength across all its business lines and vast investments in growth are likely to pay off over the long-term. AMZN’s valuation is still extremely attractive, with a 35% upside potential.