Fitness

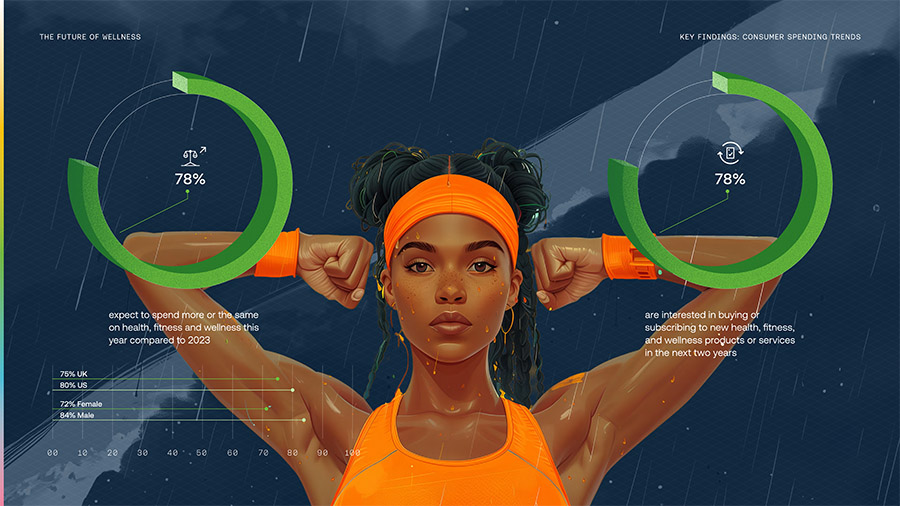

4 in 5 consumers plan new wellness and fitness purchases by 2025

New insight from PA Consulting suggests that almost four-in-five consumers have made sport and wellness purchases in the last two years, and the same number will expand that spend in the coming two years. However, growth is slower in the UK, possibly due to the country still having some semblance of a socialised healthcare.

Around the world, the global health and fitness industry is expanding rapidly – as consumers look to continue their lockdown workout habits beyond the lockdown era. Health and wellness from home were high on the agenda during the height of the pandemic, with 30% of consumers intending to regularly work out at home even after lockdown measures eased.

Other contributing factors also include the lack of support that the world’s increasingly privatised health systems offer individuals. With an underlining implication that most governments simply advice people “don’t get sick, or it’ll cost you”, consumers are doing what they can to improve their odds of avoiding illness.

Source: PA Consulting Sport Wellness Survey

In this context, it might not be so surprising that the US is the market which seems to be leading the charge for the global health and wellness market. According to a new survey of 4,000 consumers on either side of the Atlantic, PA Consulting found that a 78% portion of respondents had purchased sport and wellness equipment, products or technology in the last two years.

The firm also found a conspicuously similar number would be maintaining that spend in the coming two years. The same 78% margin said they would spend more or the same on fitness in the coming year, and 78% also said they were interested in buying new health or wellness products or services in the next two years.

That might sound like the same people already buying health products will continue to do so. But according to PA’s reckoning, this will manifest in meteoric growth for the wellness market, expanding by almost $3 trillion before the end of 2027 – to a value of $8.5 trillion.

David Knies, wellness and innovation expert at PA Consulting, said, “The global wellness economy is booming across all sectors as people prioritise healthier choices, and consumer spending is on the up. Brands that can offer more hyper-personalised solutions – whilst addressing consumer concerns around trust, inclusivity, and affordability – will be best-placed to reap the long-term rewards.”

Source: PA Consulting Sport Wellness Survey

But more may be at play than just people wanting to make “healthier choices”. If this growth is realised, it seems it will be disproportionately buoyed by US consumers – where health advice is more expensive to access, and generally is more profit-driven when it is accessed. While 81% of consumers said they had purchased wellness equipment in the past two years, that fell to 76% in the UK. And US consumers were more likely to maintain that spend, too – at 80%, compared to 75% in the UK.

Possible causes for this discrepancy may be the state of healthcare in both countries. Maybe exemplifying this, while the UK’s NHS has been characterised as standing at a historic crises, with huge waiting lists and staffing shortages resulting from a decade of austerity cuts, dietary advice is still free and easy to come by, and from professionals who are not yet fully marketised. So, only 64% of UK respondents said they were receiving personalised vitamins or supplements (something which has no proven benefit if a person already has a healthy diet), while that rose to 70% in the US. Meanwhile, the number of UK respondents to trust private-sector wellness technology was lower than the US – at 48% to 54% respectively.

PA, which also populated its report with AI art – including a young woman seemingly being rained on by Gatorade, a woman using her phone with a six-fingered hand, and a weight-lifter with an alarmingly long neck – offered some advice for wellness providers to improve trust in their technological solutions. This included convincing consumers “of the benefits of sharing their biomedical data to achieve their wellness ambitions. But with UK consumers still able to rely on publicly funded advice on health conditions – for now at least – it may be a long time before they are won over to that end.