Gambling

Gambling.com: A Strong Player, But Industry Headwinds Warrant Caution (NASDAQ:GAMB)

John Lamb

Introduction

Gambling.com (NASDAQ:GAMB) connects gamblers with online casinos, acting as a knowledgeable concierge for the industry. Their diverse website network and focus on high-quality content have positioned them well in a competitive landscape. However, considering the industry’s expected slowdown, potential regulatory changes, and Gambling.com’s own projected decline in growth, a ‘Hold’ recommendation is warranted.

Business Overview

According to its 20-F, Gambling.com operates in the online gambling industry but is not a casino or betting platform. It operates a network of over 50 websites, each tailored to different user locations and markets. These websites provide information and reviews related to online gambling, like news, odds comparisons, and recommendations. By attracting potential gamblers, Gambling.com connects them with reputable online casinos, sports betting platforms, and fantasy sports options.

The company earns money in two main ways. First, it partners with licensed online gambling operators and gets a commission whenever someone it refers signs up and deposits money based on a revenue-sharing or Cost-per-Acquisition (CPA) model. Second, it generates income through subscriptions, thanks to the recent acquisition of Roto Sports.

Competitive Landscape and Industry

The gambling marketing industry is characterized by young companies (less than 20 years old) that have grown at double-digit rates in the last ten years. In this sense, EGR Power Affiliates Summit suggests that Gambling.com’s main competitors are Better Collective (OTCPK:BTRCF), GiG Media (a Gaming Innovation Group (OTC:GIGI) subsidiary), Raketech, Catena Media (OTCPK:CTTMF), Clever Advertising, and XLMedia (OTCPK:XLMDF). The two biggest competitors in the industry are Gaming Innovation Group and Better Collective; the latter concentrates on the sports segment and has the most extensive networks of sport-betting-related websites and has partnered with some non-gambling companies, such as The Telegraph, New York Post, and The Philadelphia Inquirer, to increase the number of new depositing customers (NDC).

Better Collective

Generally, like Better Collective, most companies have websites that serve various purposes (sports, casinos, or sports fantasy). Due to this, the biggest marketing affiliate companies rely on multiple locations, segments, and sites to generate revenue. In this regard, many companies have partnered (as Better Collective has) with other media companies to broaden their ability to deliver NDC to gambling operators. For example, Catena Media partnered with Lee Enterprises, XLMedia with Star Tribune, and Gambling.com with The McClatchy Company, Gannett Co., and The Independent. Furthermore, akin to Gambling.com, most firms depend on revenue share and hybrid models instead of a pure CPA model. The latter is more volatile as it hinges on online casino marketing spend, which can decrease in challenging economic conditions. For instance, according to its latest annual report, Catena Media experienced decreasing revenue as the competition increased and online casino marketing investment decreased, incentivizing the management to make a strategic change to a more recurring model.

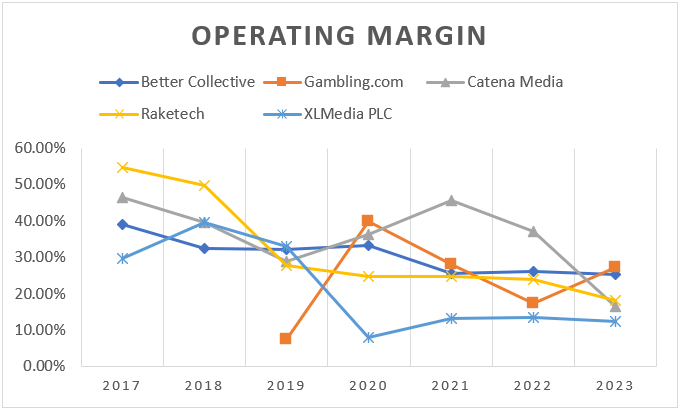

Due to the high growth rates a lot of fresh betting marketing companies emerged. Their presence diminished the profit margins of existing firms. Firms need to change their plans and bring in new ideas to remain in the competition.

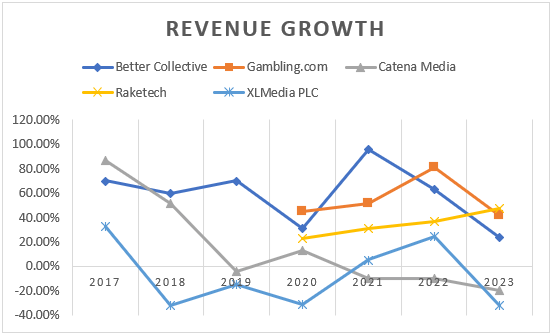

Author’s Elaboration with data from QuickFS and Annual Reports

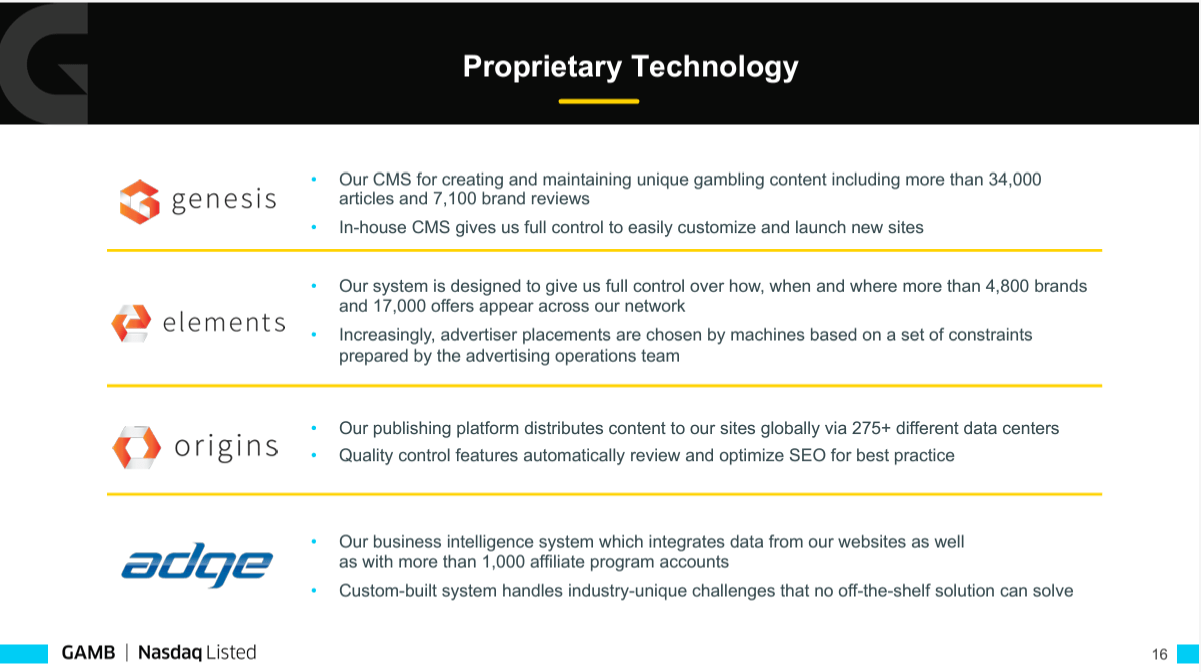

Firms use data science tools like machine learning and AI for an edge. One example is Gambling.com, which took four initiatives to enhance SEO, keep customers, and convert leads better. The following graph shows its main technological innovations:

Gambling.com Investors Presentation

Despite lagging behind, certain companies strive to catch up with Gambling.com. An example is Better Collective constructing its own ad platform (AdTech platform) while using AI in its Technology Platform. Also, Catena Media explores integrating AI into content creation processes.

Another factor affecting the competitive environment is the highly fragmented state of the industry. Therefore, acquisitions are an available path for the most prominent players to keep high growth rates. For instance, Better Collective has acquired over 30 companies since 2017, and Gambling.com has completed nine acquisitions (including the recent Freebets.com Agreement). From my perspective, the acquisitions allow companies to improve their value proposition to casinos as they can increase their reach, raising the number of NDCs that can be led to casinos. At the same time, acquisitions diversify companies’ revenue streams across different segments and locations. Furthermore, until a certain point, acquisitions of new websites may expand profitability as the content created for one location or website can be used for other similar websites and locations, spreading fixed costs over a large base of NDC.

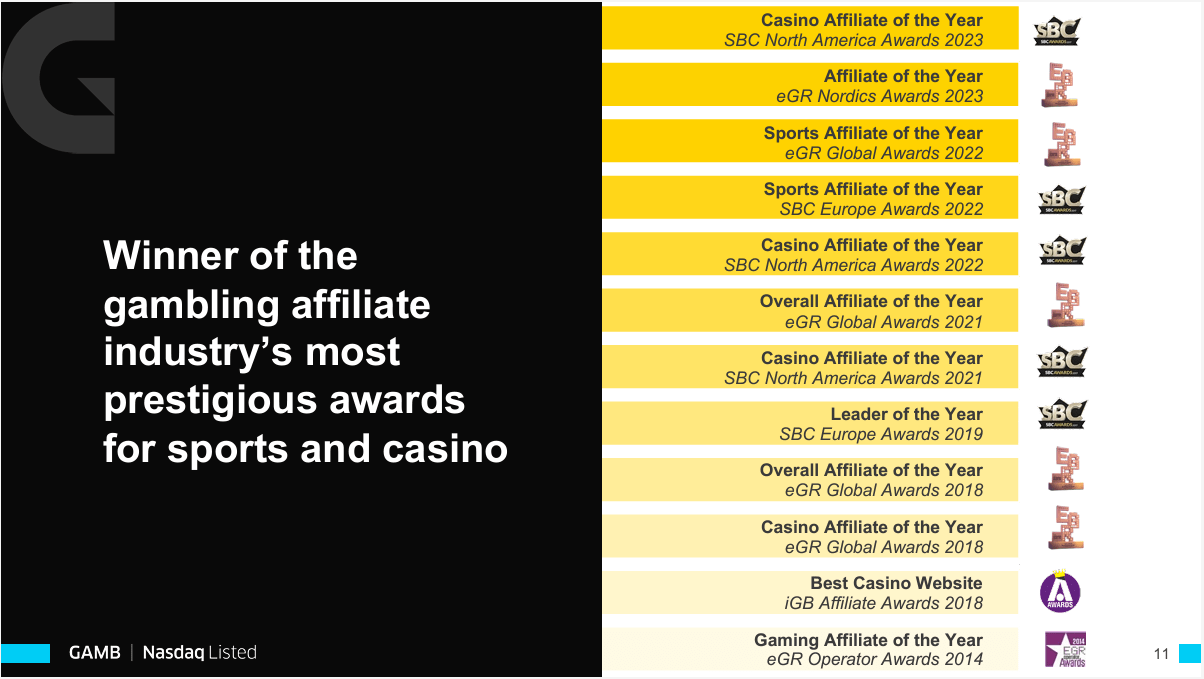

Consequently, I believe Gambling.com enjoys a solid competitive position. The company has a large base of websites in online sports betting, online casinos, and fantasy sports betting, providing a well-diversified product portfolio and a more extensive reach to gamblers than most competitors. Furthermore, recalling the operating margin graph, Gambling.com has sustained higher margins than most competitors if 2022 is excluded. Thus, Gambling.com seems to have a more competitive cost structure than competitors. Additionally, in my opinion, Gambling.com has a product superiority compared to other companies as it has been constantly awarded by the EGR and SBC. These competitive advantages should inspire confidence in Gambling.com’s ability to maintain its market position.

Gambling.com Investors Presentation

Another evidence of Gambling.com’s competitive strengths is that the company has grown every year while other competitors have started to struggle to grow. For instance, Catena Media experienced a tough 2023 due to scaling back its operations in the US and stiffer competition. On this basis, Raketech had to reevaluate its portfolio of branded products, as it had to prioritize higher quality over quantity, suggesting that competition was making some products suffer.

Author’s Elaboration with data from QuickFS and Annual Reports

Another insight from the above graph is that growth is slowing down, which is plausible to expect as many of these companies have grown over 30% annually in the last six years through a combination of organic growth and acquisitions. These growth rates are unsustainable, and I expect lower and lower revenue growth as acquisition opportunities become scarce, and the industry gets saturated.

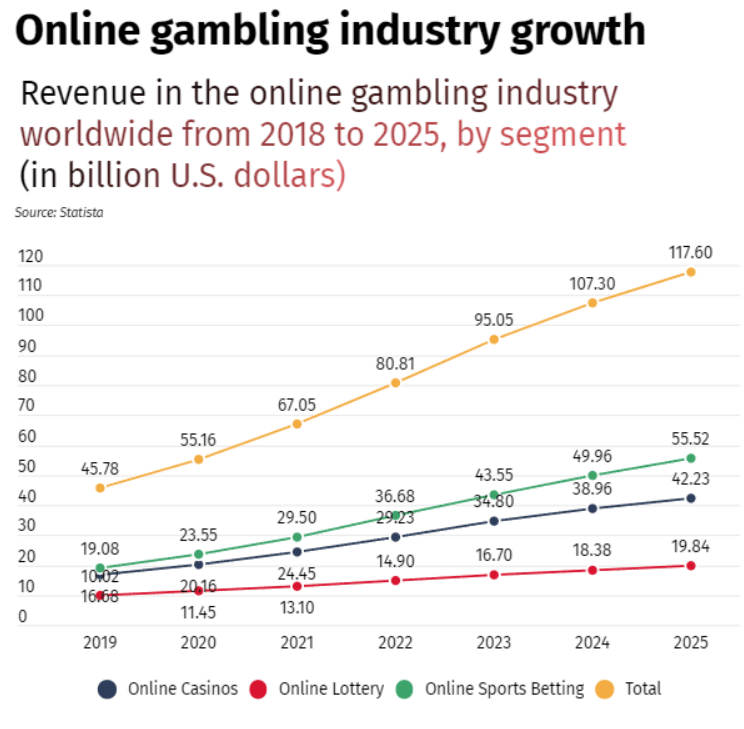

Furthermore, the online gambling industry has doubled in size in the last four years, experiencing a CAGR of 20.04%; this fast growth, alongside acquisitions, has allowed marketing affiliates to rapidly expand their operations and revenue across different markets, especially the US and the UK.

Focus on Business

Nevertheless, the industry is not expected to replicate its past growth. Instead, most projections aim at a growth rate range of around 6.20% to 12%. In comparison, Eilers & Krejcik Gaming (cited in the last Catena Media annual report) estimates 17% in the North American market. Therefore, I believe growth rates in the online gambling affiliates industry will at least halve in the next five years as the online gambling industry grows slower and acquisition opportunities decrease.

In addition, the consolidation process in the online gambling industry is likely to bring down marketing investment as casinos and sports betting companies will not have to compete as fiercely as today for new customers and also will likely increase the bargaining power of these consolidated casinos when negotiating with Gambling.com or similar companies; thus, profit margins may suffer if these consolidated casinos keep acquiring other companies.

Lastly, I think the barriers to entry in this industry are mid-low, as new entrants can invest in marketing and infrastructure for content creation with a relatively low sum of money. Nevertheless, scale and scope are crucial to success in the industry; online casinos are less likely to consider a small marketing affiliate company because its scope is limited. A small marketing affiliate company will face a disadvantageous cost structure because it has fewer customers to dilute its content creation expenses.

Financial Performance

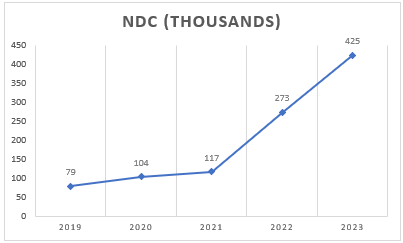

According to the company’s annual reports, its most important KPI is NDCs, as they represent effective customers converted from leads. This KPI measures the company’s efficacy in driving revenue to gambling operators.

Author’s Elaboration with data from Gambling.com

Most of the growth came in 2022, when the company experienced an outstanding expansion in the US thanks to a combination of organic growth and the acquisitions of BonusFinder and Roto Sports. In 2023, most of the growth was due to the accelerated expansion in the US market, which was fueled by strong organic growth, industry solid growth, and increasing market share.

Gambling.com has bet the US will be its growth fuel, as it has invested heavily in this market. For instance, in 2021, the company had $186 thousand in non-current assets in the US, while in 2023, it already had over $24 million in non-current assets. Due to heavy investment in this market, the company’s revenue took off.

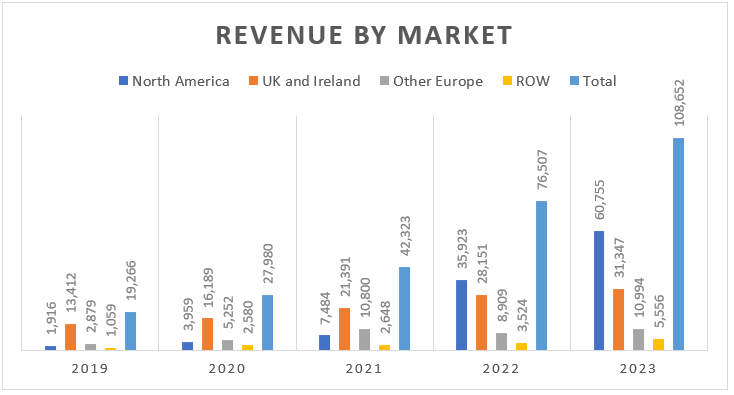

Author’s Elaboration with data from Gambling.com’s 20-F

The North American market has been the company’s largest since 2022 and has grown faster than the other three markets. Nevertheless, all markets grew at double-digit rates in 2023 and 2022, except for Other Europe, which decreased during 2022.

In another order of ideas, the company had no outstanding debt (only leasings) as of December 2023. However, most of its assets are intangible assets (63.28% of total assets), specifically website domains, which, in my opinion, are more vulnerable to competition than general PP&E or cash. These domains can be impaired if competition increases or changes in the search algorithm decrease their traffic. Thus, impairments may be likely in challenging environments.

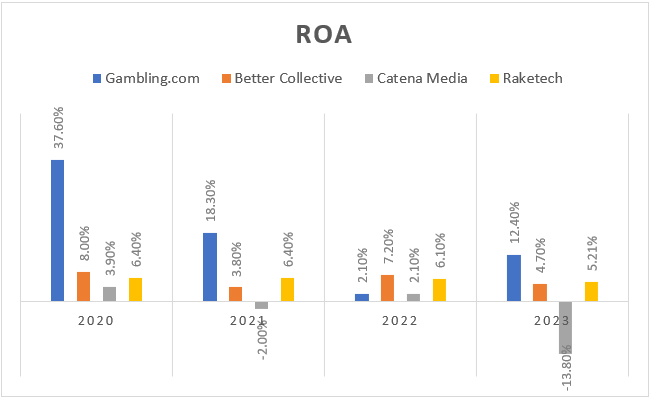

Finally, even if industry returns are decreasing, the company continues to outperform its peers based on ROA; thus, Gambling.com seems to be better managed than its peers, as its returns over assets are significantly higher.

Author’s Elaboration with data from QuickFS

Risks

Competition

Profit margins are compressing, the online gambling industry is expected to grow slower, and casinos and sports betting companies are consolidating. Hence, it’s plausible to expect tougher competition among marketing affiliate companies in the gambling industry. Even if I believe Gambling.com has the competitive advantages to remain in business, I don’t think it will escape from these competitive pressures that may continue to put downward pressure on margins and growth rates.

Customer Concentration

The top ten customers represented 48% of revenue in 2023, and the largest customers accounted for 16% of revenue. Even if the 48% is better than the 50% and 52% in 2022 and 2021, the largest customer gained a significant share of the company’s revenue compared to past years (9% in 2022 and 13% in 2021). Moreover, the high customer concentration raises concerns about how the online gambling casino industry is already consolidated and how future acquisitions may increase the bargaining power of customers.

Regulatory Risk

The company faces regulatory risks because the online gambling industry is heavily regulated, and these regulations can change quickly. These changes could restrict their ability to advertise or hurt their online gambling operator customers, both of which could hurt the company’s bottom line. Examples of recent regulatory changes include bans on certain types of advertising or restrictions on who can endorse gambling products, such as the UK Gambling Commission banning celebrities and social media influencers from appearing in gambling advertisements or the Ontario’s Alcohol and Gaming Commission of Ontario prohibited gambling operators from signing athletes and celebrities. Even if these regulations don’t directly affect the company, they signal that governments may impose more restricting rules in the gambling marketing industry.

Artificial Intelligence

AI can potentially disrupt how we search online; Gambling.com relies on search engines to bring traffic to their websites. Therefore, the value of its websites may be impaired if the team is not capable of adapting to a new form of searching online.

Valuation

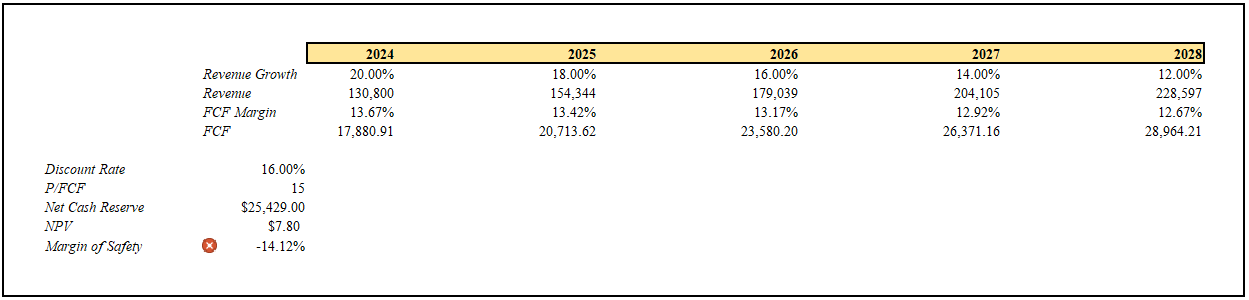

According to the company’s guidance for 2024, the company expects revenue to be around $129-133 million for FY24, signaling a significant slowdown in revenue growth. Based on this and the industry’s expected growth, I expect the revenue growth rate to decrease by 200 bps annually until 2028 when revenue growth will be similar to industry growth. Moreover, the FCF margin will start at 13.67% (historical average excluding 2020 due to overstating FCF due to a lack of investing activities). Still, it will decrease by 25 bps annually, as I expect tougher competition as growth slows down and customers gain bargaining power.

The 10-year Treasury rate is 4.51%, and the company has what I consider not-so-strong competitive advantages; I will add an 11.5% premium over the risk-free rate to discount future cash flow from the company.

Finally, I’ll use a P/FCF of 15 as the terminal value, which is lower than current valuation multiples because the company’s growth rate will decrease, and competitive forces continue to pressure margins and returns.

Author’s Elaboration

Given these premises, Gambling.com’s stock intrinsic value is $7.80, which is lower than the current price of $8.90, giving a negative margin of safety. Based on these premises, I think Gambling.com is currently a ‘Hold.’

Conclusion

Gambling.com acts as a bridge between gamblers and online gambling businesses, generating revenue through referrals and subscriptions. While they boast a robust competitive position with a diversified website portfolio and high margins, the online gambling affiliate industry faces headwinds, including slowing growth, decreasing margins, gambling operator consolidation, and potential regulatory changes. These factors and an expected decline in Gambling.com’s growth rate suggest a cautious investment outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.