Gambling

Gambling.com Shifts Focus Amid Google Changes (NASDAQ:GAMB)

SolStock

Investment Outlook

Gambling.com (NASDAQ:GAMB) provides a range of performance marketing capabilities for online gambling and sports betting sites worldwide.

I previously wrote about GAMB in August 2022 with a Buy outlook due to promising growth prospects in North America.

Recently, Google has instituted major changes to the digital media affiliate landscape, down-ranking affiliate sites and requiring companies like GAMB to retool their efforts toward owned and operated sites and complementary businesses.

Adjusting to this new environment will take at least several quarters, and management has materially reduced its forward guidance, so I’m Neutral (Hold) on GAMB for the near term.

Gambling.com’s Market And Approach

According to a 2020 market research report by Grand View Research, the global market for online gambling was an estimated $53.7 billion in 2019 and is forecast to reach $128 billion by 2027.

If achieved, this growth would represent a forecasted relatively strong CAGR of 11.5% from 2020 to 2027.

The main reasons for this expected growth are the continued penetration of Internet usage and mobile phone usage by individuals at home or in public places.

Also, increased legalization of online gambling and a more culturally permissive approach are contributing to demand in large markets such as North America and Europe.

Below is a chart showing the historical and projected future growth trajectory of the U.S. online gambling market size by type:

Grand View Research

Major competitive or other industry participants include:

-

Better Collective

-

Catena Media

-

GAN Limited

-

Genius Sports

-

Ruby Digital

-

Natalis

-

Affiliate Magic

-

Performcomm

-

MediaVision

Key differentiators in the industry include advanced data-driven strategies, compliance and regulation management and owned and operated marketing sites.

Recent Financial Trends

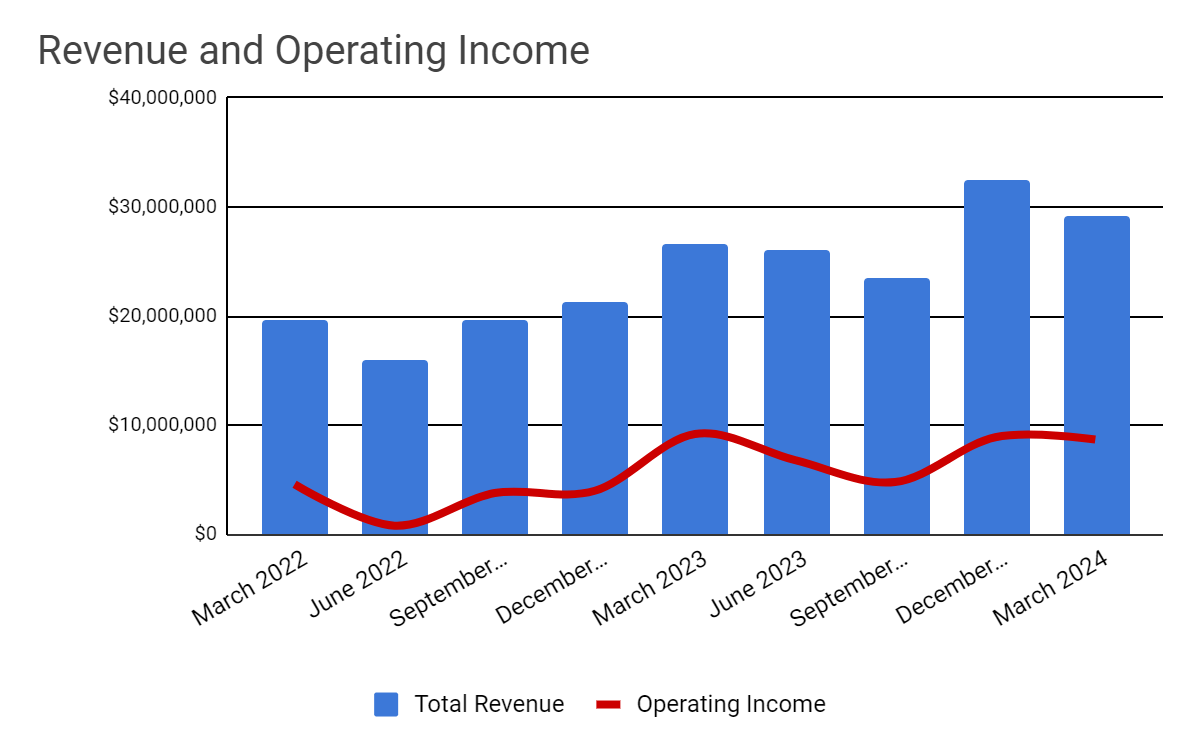

Total revenue by quarter (columns) has continued to grow, subject to seasonal variation. Operating income by quarter (red line) has plateaued in the two most recent quarters on lower gross margin effects.

Seeking Alpha

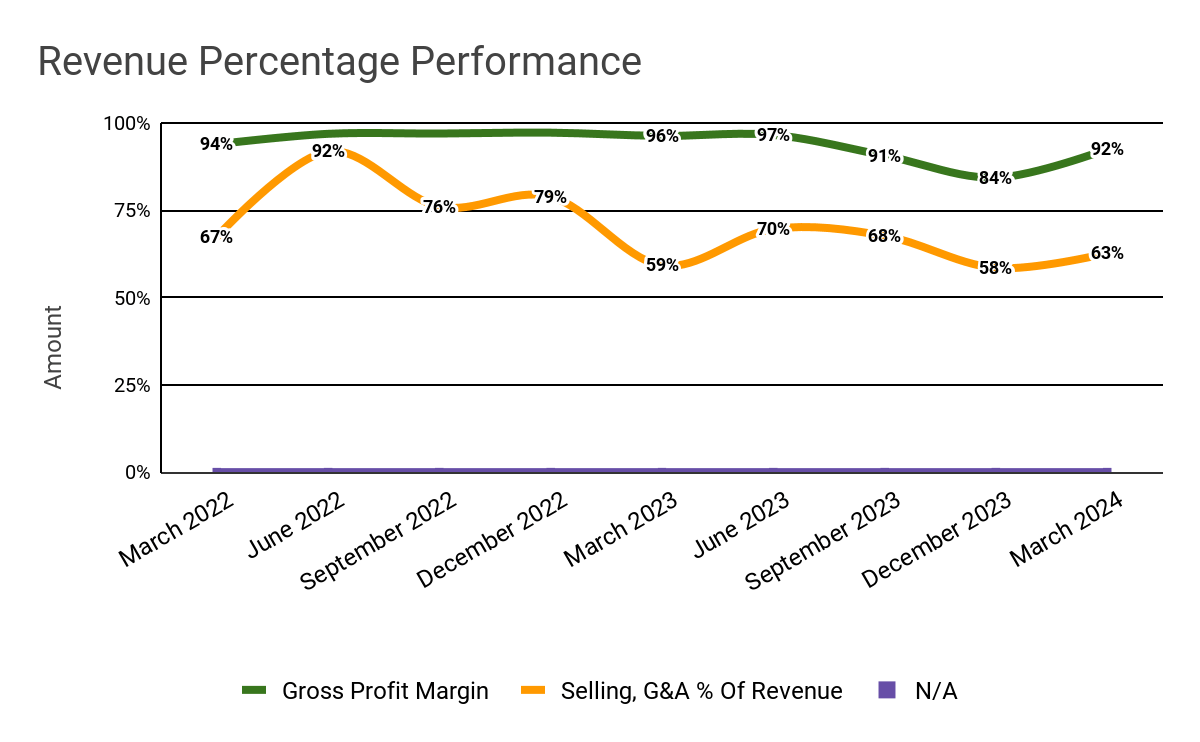

Gross profit margin by quarter (green line) has generally trended lower in recent quarters as a result of changes in partnership relationships and payments. Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have varied within a range as management continues to focus on cost controls even as revenue grows.

Seeking Alpha

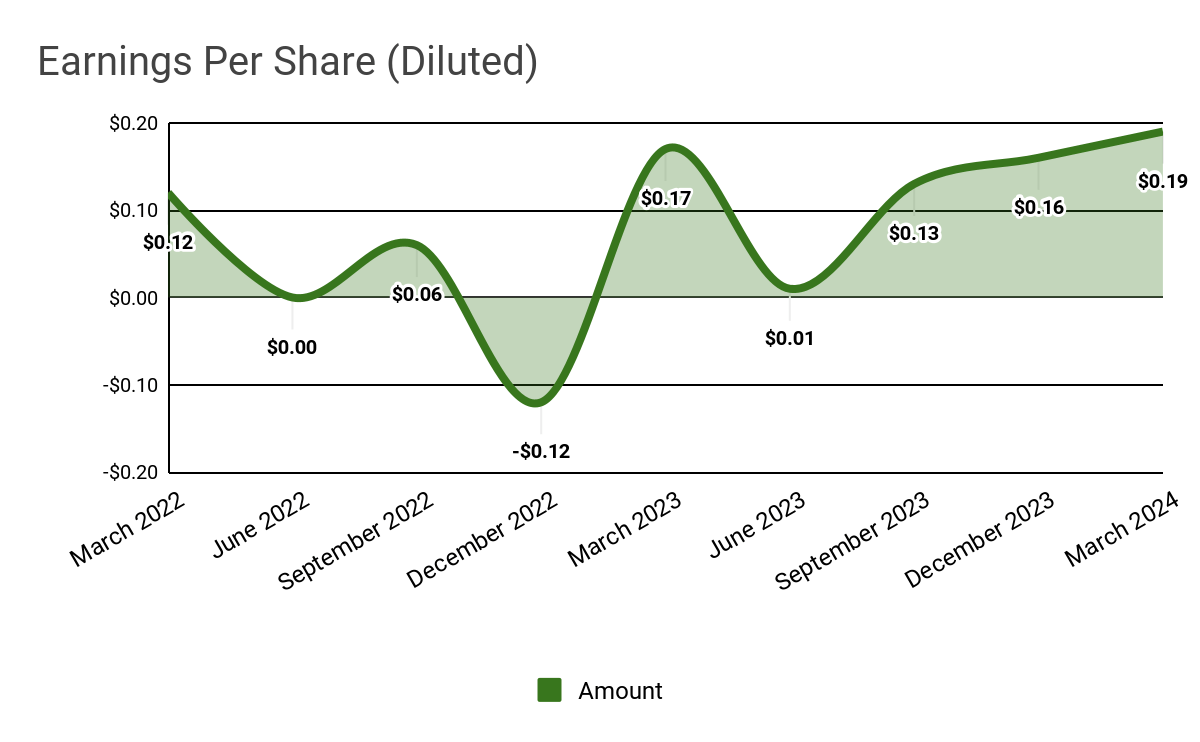

Earnings per share (Diluted) have trended higher in recent quarters, although I expect interest costs from its credit facility drawdown to acquire Freebets to begin to affect earnings in subsequent quarters.

Seeking Alpha

(All data in the above charts is GAAP.)

For balance sheet results, GAMB ended the quarter with $25.5 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $19.2 million, and capital expenditures were $0.4 million. The company paid $3.6 million in stock-based compensation, or SBC, in the last four quarters.

A major metrics table that provides a handy reference for financial and operating metrics is shown here:

|

Metric |

Amount |

|

EV/Sales (“FWD”) |

2.5 |

|

EV/EBITDA (“FWD”) |

7.0 |

|

Price/Sales (“TTM”) |

2.9 |

|

Revenue Growth (“YoY”) |

33.0% |

|

Net Income Margin |

17.1% |

|

EBITDA Margin |

26.9% |

|

Market Capitalization |

$319,750,000 |

|

Enterprise Value |

$295,820,000 |

|

Operating Cash Flow |

$19,630,000 |

|

Earnings Per Share (Fully Diluted) |

$0.49 |

|

2024 FWD EPS Estimate |

$0.73 |

|

Rev. Growth Estimate (“FWD”) |

21.6% |

|

Free Cash Flow/Share (“TTM”) |

$0.29 |

|

Seeking Alpha Quant Score |

Sell – 2.00 |

(Source: Seeking Alpha)

Why I’m Neutral On Gambling.com

Gambling.com has been affected by a change in Google’s spam policy change related to third-party pages commonly used for affiliate marketing purposes.

The policy is resulting in reduced revenue from these partnership sites due to them now being classified as “spam” content by Google and de-ranked accordingly.

As a result, Gambling.com has been changing its strategy to focus more of its efforts on its owned and operated sites.

The company also closed the acquisition of Freebets for a midpoint price of $40 million just after the end of Q1, which will enable it to grow its European affiliate market.

The deal required GAMB to tap its $50 million credit facility for $16 million to complete the transaction.

However, the company will need at least six months to convert Freebets over to its existing technology stack, so investors will need to wait to see the potential of that acquisition.

Management appears to be widening “the aperture” for future M&A deal types, moving its focus away from SEO-driven affiliate businesses to high-margin businesses that can drive traffic to its customer sites via channels outside of SEO, as well as to subscription-type businesses.

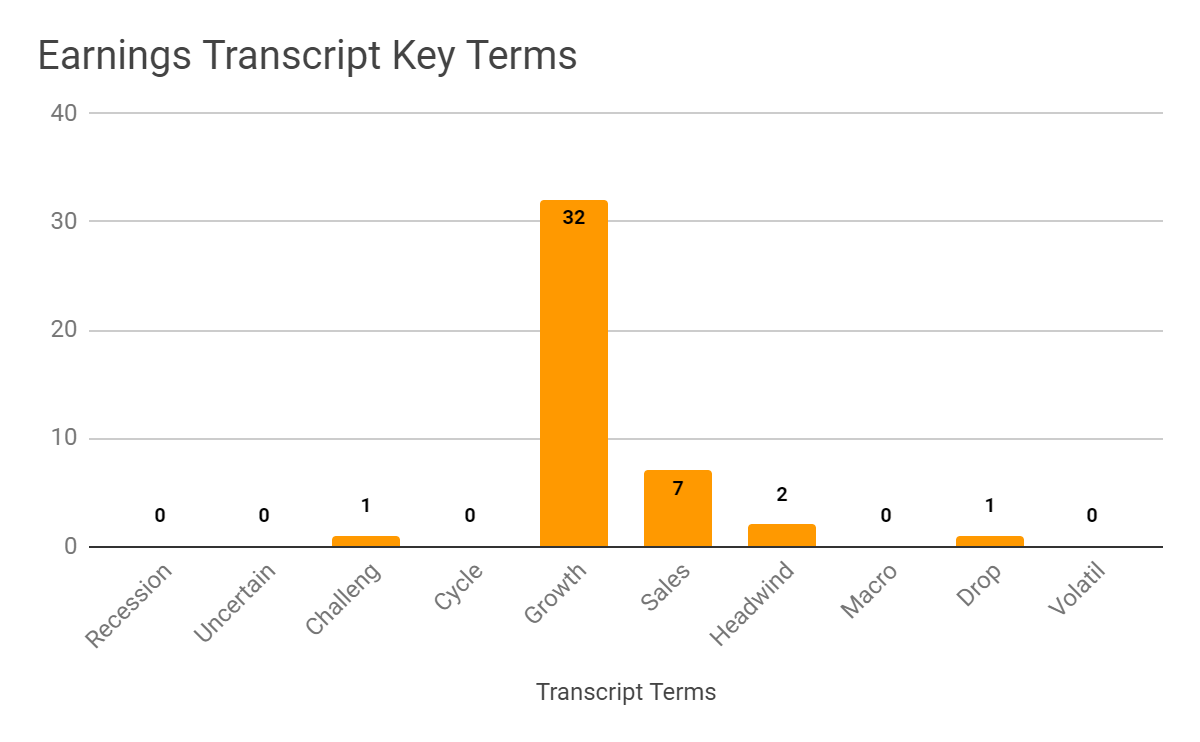

I also track the frequency of various keywords and terms in management’s analyst calls, with the most recent call shown in the graphic below.

Seeking Alpha

I’m interested primarily in the instances of negative keywords, which, in the case of GAMB, show as “headwinds” the company and the wider industry are facing with needing to retool their operations in the wake of Google’s site spam policy changes.

So, the company is facing a new environment of reduced revenue from media partnerships but potentially higher profitability from its direct traffic generation efforts.

In that environment, management’s apparent increase in M&A appears to make sense as it seeks to expand its owned and operated network and the related capabilities it can offer clients.

But the integration of acquisitions like Freebets and making the necessary changes to its business model will take several quarters.

In the meantime, the company has materially reduced its revenue and adjusted EBITDA guidance for 2024.

As a result, my outlook on GAMB in the near term is Neutral (Hold) as the company works to retool its approach to a changed online digital media landscape.