Entertainment

AMC Entertainment: Decoding The Financials And Outlining Why The Deck’s Stacked Against It

Matthew Nichols

I have been bearish on AMC Entertainment (NYSE:AMC) for some time, and while I don’t have any direct exposure to the company, there are so many better opportunities in the market. The obsession with investing in companies because they go viral is perplexing to me. AMC could absolutely prove me wrong and turn the current situation around, but the deck is stacked against them as the financials tell a different story. When you invest in a company, you become an owner in the company’s equity. Whether AMC investors want to admit it or not, financials matter. Shares of AMC gained some traction after shareholders rejected an executive comp plan that was issued by AMC and approved an equity incentive plan instead. This action allows executives to benefit if they generate value for shareholders, which further aligns the executive team with shareholders. I have been bearish on AMC for years, and it’s declined -93.64% since my first article back in 2022. I think the competition is becoming too much for AMC to compete with, and the cost of operating its chains doesn’t leave much upside or future growth on the horizon. I will deconstruct AMC’s financials and discuss why I am still bearish and see limited upside in their future.

Following up on my previous article about AMC

In my last article about AMC, which was published on May 8th of 2023 (can be read here) I had discussed how their earnings were uninspiring and why there weren’t many reasons to get excited. Since my first article about AMC, shares have declined by -93.61%, and since my article on May 8th, 2023, shares have declined by -89.63%. It’s been just over a year since I wrote that article, and I wanted to follow up on my investment thesis by deconstructing the financials and providing a fresh look at the state of AMC. While I am still bearish, I could be incorrect, and AMC could absolutely turn things around. The opportunity risk of investing in AMC over an S&P 500 index fund and the number of things that need to go right for AMC to exit its current financial predicament is too much of a risk for me to get excited about AMC in the 2nd half of 2024.

Risks to investing in AMC or not investing in AMC

At this point, the largest risk of investing in AMC is the additional opportunity cost. Shares of AMC look as if they have flatlined while the S&P 500 and the Nasdaq are experiencing a bull market. Investors who stuck with AMC lost a tremendous amount of value, while big tech led the broad market higher. Investing in AMC now or continuing to remain invested in AMC could create further downside losses for shareholders as the financials do not tell a compelling story. The one thing that AMC has is a loyal investor base, which could allow AMC to raise capital by issuing more stock. Hypothetically, AMC could continue to conduct capital raises while eliminating near-term debt obligations and creating an extended runway of capital. This would buy them some time until the debt markets become less restrictive, but unless AMC figures out a way to improve their margins, the debt load will continue to cripple any value shareholders hope to be unlocked. AMC could pull off what I consider improbable, and shares could skyrocket, but hoping for completing a Hail Mary isn’t a great reason to invest in AMC.

Deconstructing the financials to outline why I believe shares will continue to decline over time

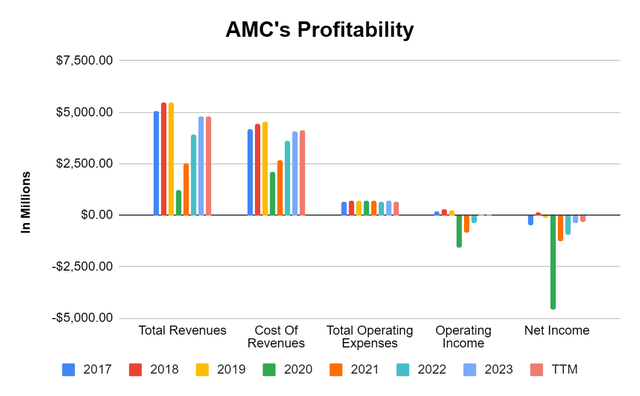

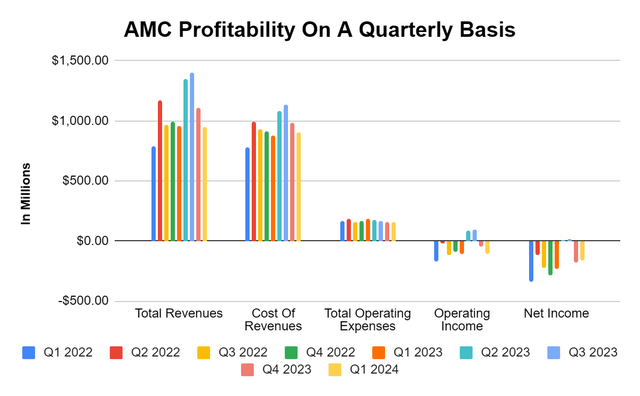

AMC’s financials paint a concerning scenario. We’re in the 2nd half of 2024, and the world has moved past mask mandates and staying indoors. The first problem for AMC is its income statement. AMC is still generating less revenue on an annualized basis than they did pre-pandemic. AMC generated $5.08 billion in revenue for their 2017 fiscal year, $5.46 billion in 2018, and $5.47 billion in 2019. In 2023, AMC generated $4.81 billion in revenue, and in the TTM, AMC produced $4.8 billion. This is a business model that is still having trouble getting back to its pre-pandemic top-line levels. The bottom line is that since the 2017 fiscal year and, including the TTM, AMC has generated $33.31 billion in revenue, but they haven’t been profitable in the process. AMC’s cost of revenue has been $29.79 billion, while their operating expenses amounted to $5.5 billion. AMC has operated at a -$1.97 billion operating level and has lost -$8.08 billion in net income.

Steven Fiorillo, Seeking Alpha

When I exclude the pre-pandemic years, and look at what AMC has done from 2022 to Q1 2024, the scenario doesn’t get better. Over the past 9 quarters, AMC has generated $9.68 billion in revenue, but it cost them $8.61 billion to produce it. AMC’s operating expenses amounted to $1.53 billion, which made it lose $463 million on an operating level. AMC has lost -$1.53 billion over this period after taxes and interest are accounted for. AMC strung together 2 consecutive profitable quarters as they produced $8.6 million in profitability in Q2 of 2023 and $12.3 million in Q3 of 2023. In the last 2 quarters alone, AMC has lost $345.50 million, and its best quarter hasn’t even come close to the lowest amount of money it has lost over the past 9 quarters of $121.6 million. The income statements present a scenario that looks bearish as AMC has been unable to exceed its previous levels of revenue and continues to operate in the red on a quarterly and annual basis.

Steven Fiorillo, Seeking Alpha

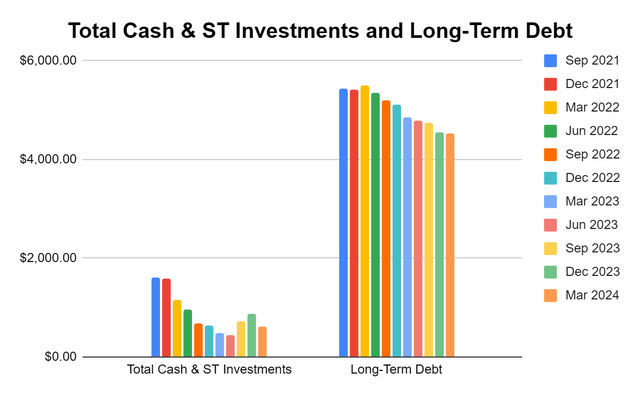

Not turning a profit is detrimental to AMC’s fragile balance sheet and leaves them in a position where the only viable option is further dilution with issuing more shares to extend their operating runway. Since Q1 2021, AMC has drawn down on its cash position by 61.29% as it’s utilized $988.3 million of its cash on hand. Over the last 11 quarters, AMC’s cash position has declined from $1.61 billion to $624.20 million. While AMC has been able to raise equity from capital raises by issuing shares, its long-term debt still remains at $4.52 billion. AMC had a cash-to-long-term debt ratio of 29.68% in Q3 of 2021, and this has declined to 13.82%. AMC has increased its share count from 58.2 million to $295.6 million since Q3 2021, while its book value and equity position remain negative. There is -$2.03 billion in total equity on the balance sheet as the liabilities exceed assets, and shares have a -$7.70 book value.

Steven Fiorillo, Seeking Alpha

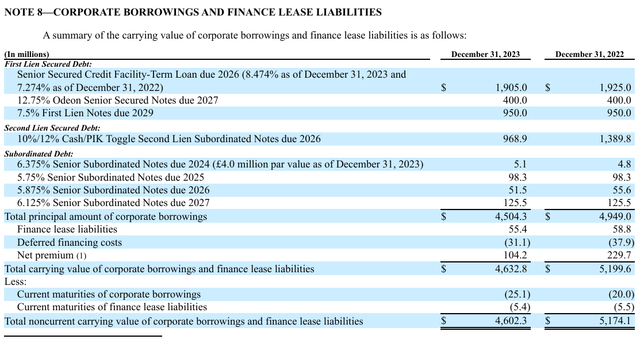

The financials don’t indicate a great scenario for the underlying business or the ability to repay its debt obligations. AMC has $25.1 million in debt maturing in 2024, with an additional $118.3 million coming due in 2025. While these amounts aren’t necessarily large, AMC is not turning a profit and will need to either draw down on their cash to meet their debt obligations or refinance out into the future. The pivotal year is 2026, as AMC has $2.89 billion in debt maturing, with an additional $525.5 million in 2027. Unless AMC can get shareholders to agree on a large capital raise, their cash position can’t carry them past 2026, and if AMC is able to refinance at a better rate than the 7.274% or 8.474% that is tied to most of the 2026 debt, they will still be incurring interests cost every year. If AMC was in a position of profitability, this would be less of an issue because they could continue to refinance and pay the interest, but AMC hasn’t been profitable since the 2018 fiscal year, and analysts are not expecting AMC to turn a profit in the next several years. From 2014-2018, AMC had 4 profitable years but in totality, lost -$97.4 million as their losses in 2017 exceeded the combined profitability in 2014, 2015, 2016, and 2018.

Outside of the financials, there are other reasons I am still bearish on AMC

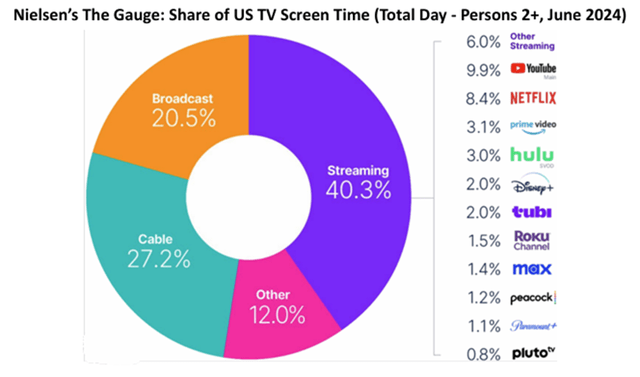

The reality is that streaming is becoming a dominant factor in the entertainment industry. According to the Nielson share of TV Screen time for June 2024, streaming accounted for 40.3% of the totals. The fact is that there are more options than ever before to grab an individual’s attention, and there are tens of billions allocated to original programing. This isn’t the 1980s or 1990s when the only choices were to go to the movies, or go to Blockbuster to watch a movie. AMC is competing with original and existing content being available at a moment’s notice. AMC is also dependent on how attractive the movie slate is from the big studios. The other problem is that you can pay for a new movie through Amazon Prime that, in some cases, is either still in the theaters or just out of the theaters if you want to see it before it hits streaming services, which cuts AMC out of the revenue mix.

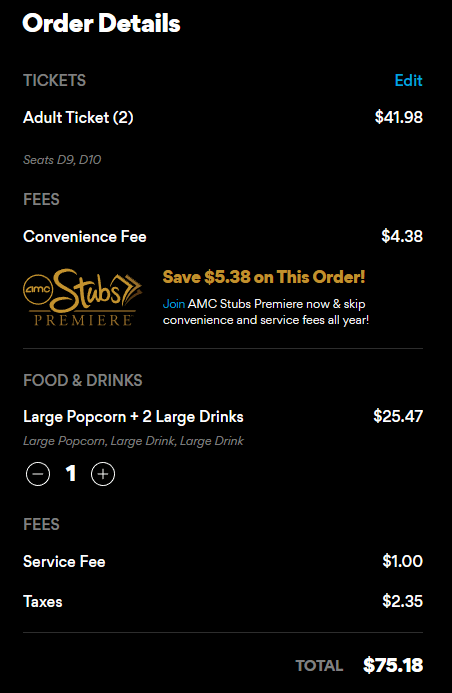

Advancements in technology are also a negative to the movies. While some individuals truly enjoy going to the movie theater, there are more reasons not to. It’s not uncommon for a household to have a 65-85 inch TV in their home with multiple streaming services. Technology has made it where you can get a great experience in your home, and while nothing can replace going to an IMAX theater, it looks like more people are choosing not to go to the movies, considering AMC’s revenue isn’t consonantly growing past its previous levels in 2019. The other thing to consider is that individuals, young and old, have placed a larger emphasis on video games and streaming services for their digital content rather than going to the movies. I believe that the golden days of cinema are in the past, as there are more options in the digital entertainment space than ever before. I just went to the AMC site, and the other thing that bulls of AMC need to remember is that AMC needs to have something so appealing that it will make you want to go to the theatre. I just went to the AMC website, and of all the movies, the only movie that I would consider seeing is Bad Boys: Ride or Die, and I will defiantly wait until it is on a streaming service to watch it as there is no reason for me to head to a movie theater to watch it. Going to the movies is also more expensive than ever. For 2 people to see Bad Boys, getting 2 large drinks and a large popcorn would cost $75.18. Taking a family of 4 would easily exceed $100 and probably be between $125-150. I don’t believe the economics of going to the movies makes sense anymore, and this has become a once-in-a-blue-moon outing rather than a normalized occurrence that happens each month or every other month for many people.

AMC

Conclusion

Everything about AMC scares me, from the financials to competition, to the sheer cost for 2 people to see a movie. AMC hasn’t been able to turn a profit for the past 6 months, and since Q3 of 2021, it has lost -$1.53 billion. AMC is getting closer and closer to 2026, where there is $2.89 billion in debt maturing, and before they get there, management will need to find a way to outrun its declining cash position. Unless AMC can drastically improve its margins or find a way to generate sustainable profitability, I don’t think they will have a choice but to either tap the debt markets or issue a large capital raise by issuing more shares to meet their future financial obligations. Too much has to go right for this investment to work out. While it’s not impossible, the cost of seeing a movie is too high, in my opinion, for individuals to make it a normal occurrence. Competition is continuing to cut into AMC’s viability. While AMC could absolutely stay afloat, from an investment standpoint, I don’t believe it will generate better returns than the S&P 500 over a long period of time, which makes it uninvertible to me. I’m still bearish and see less of a reason to be interested in AMC as things aren’t really getting better for them after the world has normalized from the pandemic.