Gambling

Nvidia: Looks More Like Gambling Than Investing At Current Valuation (NASDAQ:NVDA)

BING-JHEN HONG

My thesis

I have run multiple discounted cash flow [DCF] scenarios for Nvidia (NASDAQ:NVDA), and only unrealistic assumptions justify the current $3 trillion market cap. I give Nvidia’s stock a neutral Hold rating despite significant overvaluation because I am not brave enough to bet against the company which appears to be the biggest winner in the artificial intelligence revolution.

Despite Nvidia’s apparent fundamental strength, paying around 50% premium over the stock’s intrinsic value does not look like a prudent investment decision in my opinion. Of course, the sentiment around the stock is extremely positive, and I think that the FOMO effect also helps NVDA to rally. Buying at the current share price looks like gambling to me, where you bet that the FOMO effect will last further. NVDA is definitely constantly on my watchlist, but I will not approach it before a good fair correction happens to the stock.

NVDA stock analysis

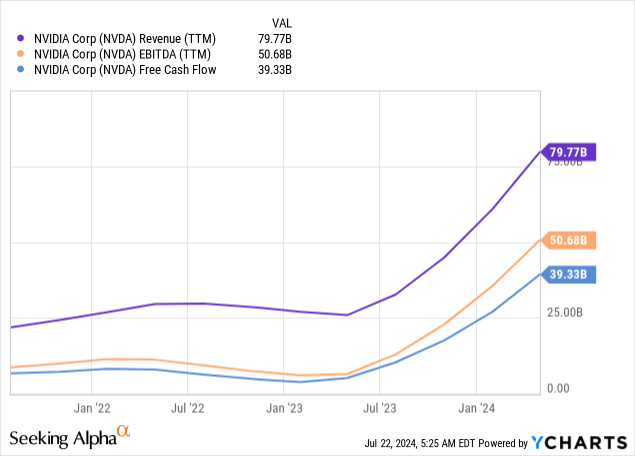

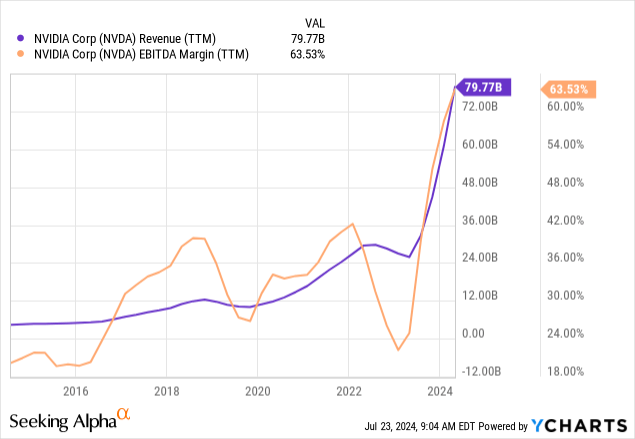

Nvidia’s stock has been historically very popular among investors, but prior performance is difficult to compare to the last couple of years. The stock is on with the share price increasing tenfold since Autumn 2022. The rally has been fundamentally justified because it is explained by the exponential growth of the company’s key financial metrics in a few recent quarters.

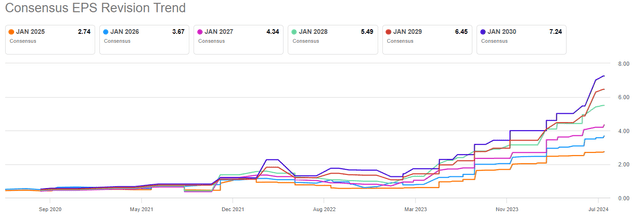

Apart from the exponential growth over a few recent quarters, there were several aggressive upgrades to the company’s expected long-term revenue and EPS growth forecasts from Wall Street analysts. According to the earnings revisions information provided by Seeking Alpha, in January 2023 analysts projected NVDA’s FY 2030 EPS to be $1.25. However, the latest revisions suggest that consensus expects the metric to be $7.24 in FY 2030.

Such a spike in financial metrics and growth expectations is explained by the surge in graphic processing units, or GPU, in recent years. The term “artificial intelligence” is not something brand new, as its history traces back to the 1950s. However, the public availability of large language models (LLMs) in recent years has been a real disruptor.

Despite being young, OpenAI’s ChatGPT, the most widely known LLM, already leverages hundreds of millions of active users. The reason for such rapid adoption of this generative AI tool is its positive effect on productivity by automating routine tasks. According to IBM’s (IBM) CEO Arvind Krishna, around 30% of back office roles in his company can be replaced by AI in the next five years. McKinsey expects a substantial productivity boost thanks to AI tools, which could add the equivalent of $2.6 trillion to $4.4 trillion annually to the global economy.

Due to the expected massive positive economic effect, there is a high probability that governments and businesses across the world will allocate massive resources to maximize potential benefits from using AI tools. There are various large examples underscoring that the fierce AI race has already started.

For example, an oil-rich Abu Dhabi targets a $100 billion AUM fund which will invest in AI ventures. A few months earlier, another rich economy of the Middle East, Saudi Arabia, announced plans to pour $40 billion into AI. The largest U.S. technological companies also have plans to invest in AI and data centers, and the amounts are also impressive and comparable to oil-rich states. Over the last few months, Microsoft (MSFT) invested billions in AI projects in different countries like Malaysia, Japan, France, and Sweden. Other technological giants like Google (GOOGL) and Amazon (AMZN) show the same level of ambitions in AI, as these companies are also very aggressive in their AI and cloud investments. Despite already being a $600 billion market, the cloud computing industry is still expected to compound with a 20.3% CAGR.

Nvidia is likely to be the biggest winner of this massive trend, as its GPUs are the “brains” of data centers and LLMs. The industry of this “brains” is dominated by Nvidia, where the company commands an 88% market share. AMD (AMD) and Intel (INTC) are considered to be main competitors, but when Nvidia holds almost 90% of the market, it is difficult to say that there are any real competitors. The company is not willing to lose its dominance and constantly releases upgrades to its main products. This year, the company released its new powerful Blackwell family of chips, which received positive publicity from industry experts.

Apart from the recognition from industry experts, we also see that Blackwell’s potential to power AI is also highly valued by prominent business names. For example, some sources suggest that Elon Musk wants to purchase 300,000 Blackwell GPUs to power his Grok LLM. It is highly likely that not only Mr. Musk is highly interested in Blackwell, since Nvidia recently increased Blackwell orders from Taiwan Semiconductor (TSM) by 25% to address high demand.

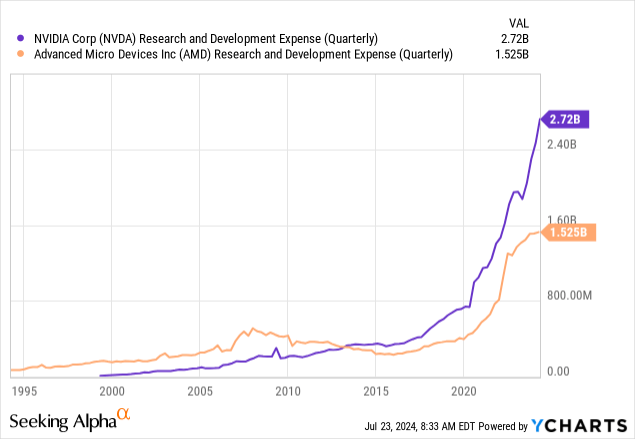

Nvidia’s closest rival in GPUs is AMD. Blackwell chips’ direct competitors from AMD are Instinct MI300 Series Accelerators. While AMD’s accelerators are also positively assessed by experts, it is older as it was released in late 2023. Since we live in a rapidly evolving world, and the fact that Blackwell is a newer product positions Nvidia better in this battle, in my opinion. Another factor that supports Nvidia’s advantage over AMD is its R&D budget, which is two times higher.

To summarize my stock analysis, I am extremely bullish about Nvidia because it dominates in a thriving industry and high demand for its new Blackwell family of chips suggests that the company is still leading in the technological race. Chances to sustain leadership are high due to historical dominance and the fact that Nvidia spends twice as much as its closest rival does.

Intrinsic value calculation

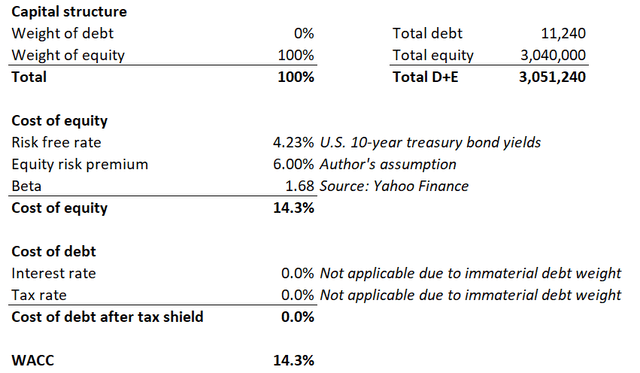

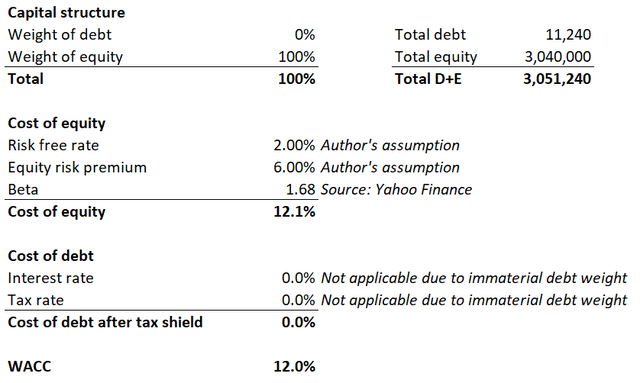

The discount rate for my discounted cash flow (DCF) model will be derived using the CAPM model. The below working demonstrates why NVDA’s weighted average cost of capital (WACC) is 14.3%.

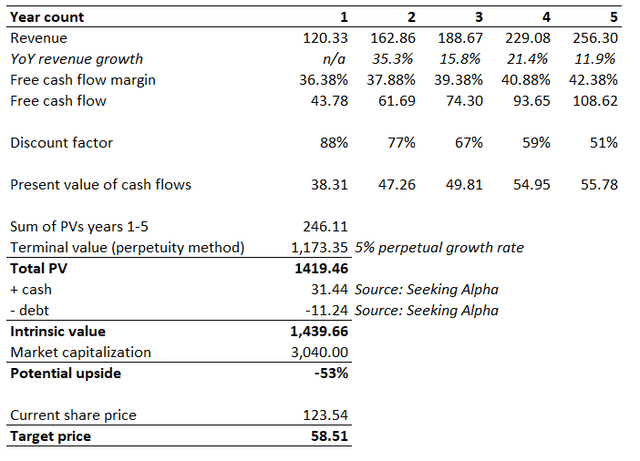

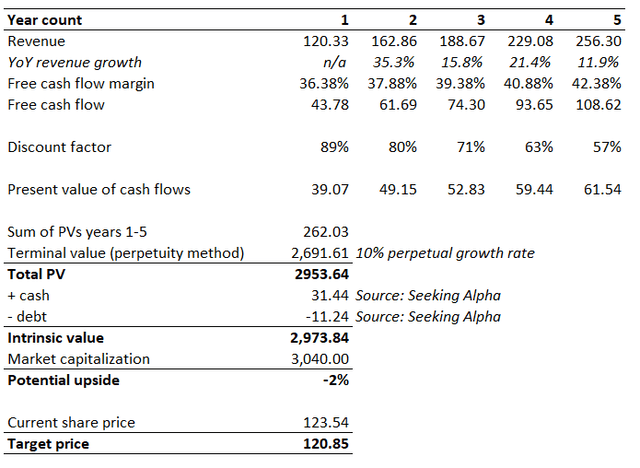

I think that using consensus estimates as my revenue assumptions is a prudent choice. Nvidia’s TTM levered FCF margin is 36.38%, expecting this position to improve with revenue growth is reasonable. Moreover, Nvidia has a solid record of the EBITDA margin expanding in line with revenue growth. Therefore, expanding the FCF margin by 150 basis points per year looks realistic enough to use this assumption for the DCF.

Perpetual growth rate is a crucial assumption, and it significantly affects the intrinsic value. Implementing a 2-3% perpetual growth rate for a semiconductor company looks too low, especially for a company with strong past revenue growth. Therefore, I am implementing a 5% perpetual growth rate, considering that the industry is thriving and Nvidia is almost a monopolist in it.

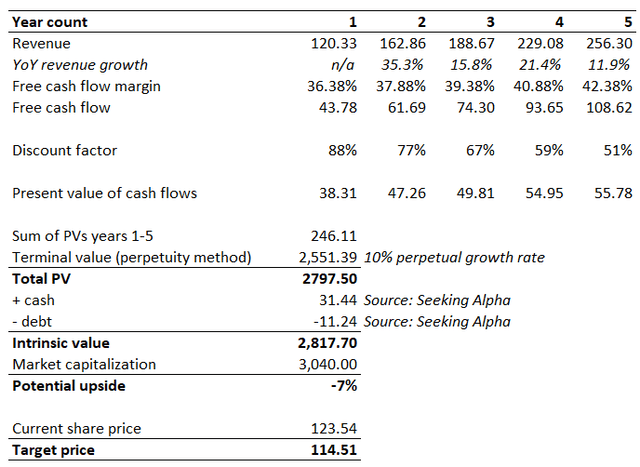

My first scenario with a 5% perpetual growth rate shows that Nvidia’s intrinsic value is significantly lower than the current market cap. The overvaluation is so wide that the spreadsheet suggests that there is a 53% downside potential. Moreover, the difference between the intrinsic value and market cap is so big that even upgrading the perpetual growth rate to an unrealistic 10% does not make NVDA undervalued.

NVDA’s valuation is not attractive. It appears that the current share price incorporates an above 10% perpetual growth rate, which is unrealistically high. Nvidia’s fundamentals are wonderful, but even wonderful companies are extremely unlikely to maintain a double-digit perpetual growth rate.

What can go wrong with my thesis?

My thesis is mixed because the company’s fundamentals look extremely strong, but it appears that unrealistic optimism is already incorporated into the share price. Therefore, I do not recommend to buying this stock at the current price and if the stock rallies further it will mean that my thesis went wrong.

My base-case DCF scenario suggests that NVDA’s intrinsic value is around $1.4 trillion. Nevertheless, the stock rallied to a $3 trillion market cap, which might mean that my assumptions are too pessimistic. I think that a 14.3% discount rate might be too aggressive for DCF. The uncertainty around the Fed’s next monetary policy moves is very high. I will try to simulate another scenario with a 2% risk-free rate for my WACC working. With the lower risk-free rate implemented, the WACC softens to 12%.

With a 12% WACC, we need to implement an 8% perpetual growth rate to justify current valuation. An 8% growth rate is also very aggressive, but at least it looks more or less realistic compared to the above 10% rate. What I am trying to convey with this exercise is that NVDA investors might react very positively to first interest rates cuts, as it significantly improves the valuation and might fuel further rally.

Summary

Nvidia is a wonderful company, which dominates the hottest industry of the modern era. The stock is on my “wish list”, but I am not buying because massive and even unrealistic expectations are incorporated into the current share price. Paying a 50% premium over its intrinsic value looks like a gamble to me.