Travel

Top Challenges for Chinese Travel – and the Latest Booking Trends

Skift Take

While the Chinese are spending big once again, they are doing so with a keen eye on their wallets, seeking the best value for their money.

In 2023, China reclaimed its position as the world’s top spender on international tourism, spending $196.5 billion abroad and surpassing the U.S., Germany, UK and France. Closer to home, Chinese tourists are projected to inject a record RMB 6.8 trillion ($940 billion) into the mainland economy this year, marking the first time spending has topped pre-pandemic levels, according to a report by the World Travel and Tourism Council and Oxford Economics.

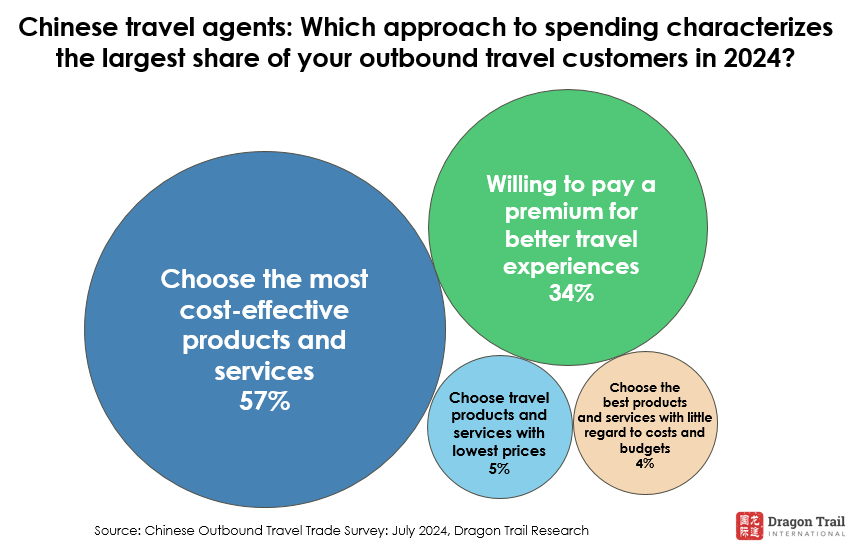

Despite this robust spending, a new trend has emerged: Chinese travelers have become more focused on seeking value. Cost of travel has become the primary barrier to selling outbound travel this year, according to Dragon Trail’s Chinese Outbound Travel Trade Survey releasing on Tuesday.

From June 24 to July 7, Dragon Trail Research surveyed 295 Chinese travel agents selling outbound travel for mainland Chinese travel agencies.

Rising Travel Costs and Economic Concerns

While the Chinese have returned to their status as top spenders, the economic stagnation post-pandemic continues to hinder the full recovery of China’s outbound travel market. The economic landscape and rising travel costs have made Chinese consumers more cautious about their spending.

Travel agents report significant variation in the cost of trips by destination. Long-haul trips to places like Antarctica can exceed RMB 20,000 ($2,755), while trips to Europe, the Americas, and Oceania typically cost over RMB 10,000 ($1,377) per person. Trips to Africa and the Middle East generally fall within the RMB 5,000-20,000 ($689-2,755) range, whereas Asian destinations are relatively cheaper, mostly between RMB 5,000-10,000 ($689–1,377).

Despite the preference for cost-effective travel, one-third of respondents noted that some travelers are still willing to pay a premium for better experiences.

Other Barriers and Booking Patterns

Visa policy changes have emerged as the second major barrier, with new requirements complicating travel plans. Despite some destinations relaxing visa requirements, the application processes for many popular countries remain cumbersome.

Safety concerns have also become more prominent. Increased competition, communication barriers, customer acquisition challenges, flight capacity issues, and geopolitical factors further complicate the market. The post-pandemic Chinese traveler focuses on personal property, health, hygiene, and environmental safety. Travel agents suggest that overseas destinations and businesses could boost sales by developing customized, personalized, and diverse travel products that address these safety concerns.

As a result of these growing concerns, booking lead times have become even shorter. Travelers now book visas, tours, flights, hotels, and car rentals roughly one month in advance. Interestingly, a quarter of travelers book their international flights just a week before departure, with similar trends observed for hotels and car rentals.

Small Group Tours and Millennial Influence

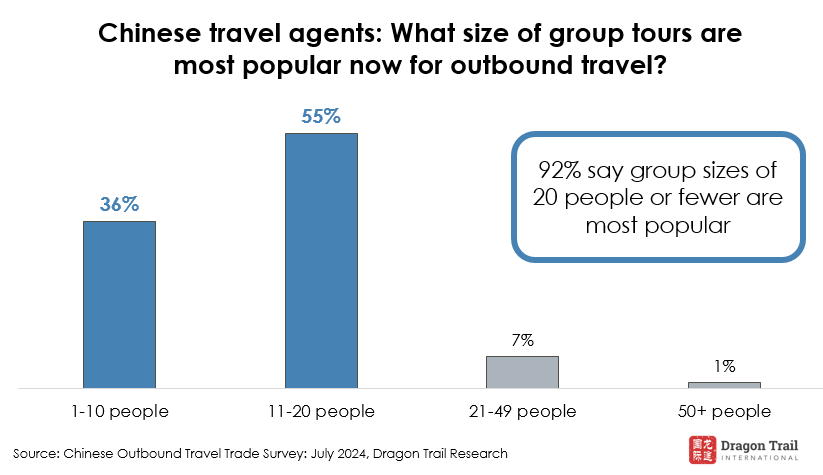

As Chinese travelers move from traditional sightseeing to seeking in-depth, personalized, and flexible travel experiences, small group tours and customized tours have gained popularity.

Although Chinese travel agents can now sell group tours to more than 130 countries and regions, up from just 60 at this time last year, the popularity of group travel has declined. About 92% of travel agents report that groups of 20 or fewer are the most popular choice.

The age demographic has also shifted, with younger generations, particularly those born in the 1990s and 2000s, increasingly driving the market. Travel agents identify travel with friends, family travel, and couples as the most promising segments. This correlates with their customer demographics, with agents focusing on younger clients seeing more potential in friend and family travel segments.

Other Insights from the Report

- Southeast Asia has emerged as the top region for outbound travel from China in 2024, noted for its growth potential. Northeast Asia, particularly Japan and South Korea, follows closely, with Europe also ranking high. The Middle East, though sixth in travel sales, ranks fifth for growth potential.

- Online travel agencies (OTAs) and platforms like Ctrip and Qunar remain the dominant sales channels for outbound travel, with WeChat, the instant messaging and social media channel, also playing a significant role.

- Live streaming has emerged as a new booking channel, with platforms like Douyin (Chinese TikTok) and Xiaohongshu (Chinese Instagram) gaining traction.

- Despite the rise of online channels, offline sales at in-person events or shops still hold significance.