Entertainment

Accel Entertainment Will Not Accelerate Your Return (NYSE:ACEL)

Nikola Stojadinovic/E+ via Getty Images

Investment Thesis

Accel Entertainment (NYSE:ACEL) is a founder-led company with a consistent growth in revenue in recent years. Since 2021, Accel has repurchased more than 12 million of its shares outstanding. The current acquisition of Fairmount Holdings will further accelerate its growth by entering into the casino and horse racing businesses.

While all of these factors are persuasive to invest in Accel, I see limited upside for Accel’s shareholders. Accel issued a lot of shares during 2019 to 2021 that has not yet been offset by the recent share buybacks. The owner earnings per share have been decreasing since 2021 that shows the notable growth in revenue has not really increased shareholder returns. The current strategy to enter the horse racing and casino businesses may create opportunities for shareholders, but I believe it is too soon to bet on that.

Introduction

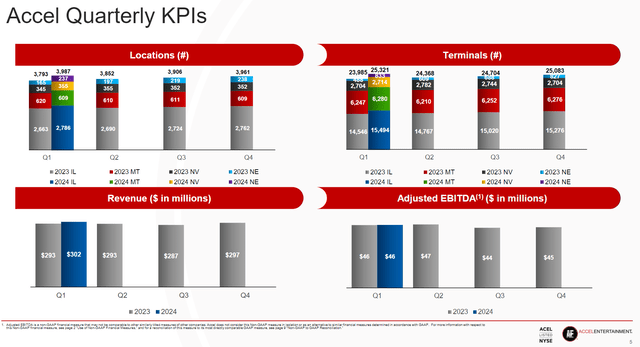

Accel designs, manufactures, and operates gaming terminals, ATMs, and amusement devices for non-casino locations. They have more than 25 thousand gaming terminals across 4 thousand locations in Illinois, Montana, Nevada, and Nebraska. In Q1/2024, Accel generated more than $300 million in revenue and $46 million in adjusted EBITDA.

Quarterly Key Performance Indicators (Q1/2024 Presentation)

The main reasons I started looking deeper into Accel were its recent share buybacks, consistent growth in revenue, and current acquisition. I will dive into each of these factors in more detail in the rest of this article.

Share buyback

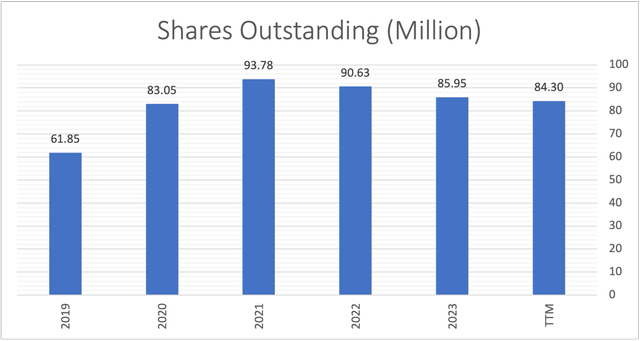

Accel allocated $200 million for its share buyback program in 2021, of which it has already spent approximately $124 million to repurchase 12 million of its shares outstanding. While these numbers seem promising, comparing the current number of shares outstanding to that of 2019 shows that the number of shares increased by more than 20 million in total.

Number of shares outstanding (Wisesheet)

The most significant factors contributed to the overall increase in the number of shares outstanding since 2019 are:

- The reverse recapitalization in 2019 that resulted in significant share issuance.

- Delisting of previously issued warrants in 2020 and the subsequent warrants’ redemption to Class A-1 common stock.

- Conversion of 1.7 million Class A-2 common stock to Class A-1 common stock in 2020.

- Using equity for some of the previous acquisitions. For instance, Accel issued around 0.5 million of shares for Century Gaming acquisition.

Accel still has 3.3 million Class A-2 shares that are convertible to Class A-1. Additionally, it will issue more shares for its future acquisitions, including 3.5 million shares for the Fairmont acquisition. For these reasons, I think looking at the 12 million share buybacks alone is misleading, and it is necessary to include a per share comparison to evaluate shareholder returns and Accel’s growth.

Growth

Accel was able to increase its revenue from $429 million in 2019 to around $1.2 billion in 2023. The main driver of this growth has been more than 10 new acquisitions in recent years including the acquisition of Grand River in 2019, American Video Gaming in 2020, and Century Gaming in 2022. Through these acquisitions, Accel was able to expand its footprint from Illinois to 3 additional states.

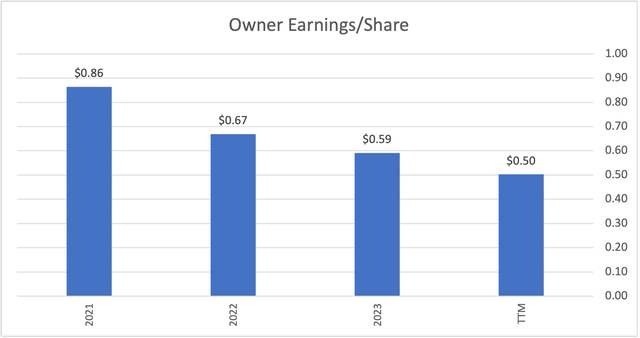

To evaluate revenue growth on shareholder returns, owner earnings were calculated as follows:

Owner earnings = operating cash flow – capex

Then they were divided by the weighted average of outstanding shares to calculate owner earnings per share after 2021. As shown in the figure, owner earnings decreased from $0.86 per share in 2021 to $0.50 per share over the last 12 months. Furthermore, while revenue has increased more than 60% since 2021, owner earnings/revenue decreased from 11% to less than 4%. Therefore, I believe the current acquisitions have not actually increased shareholder returns.

Owner earnings per share (Author’s calculation using data from Wisesheet)

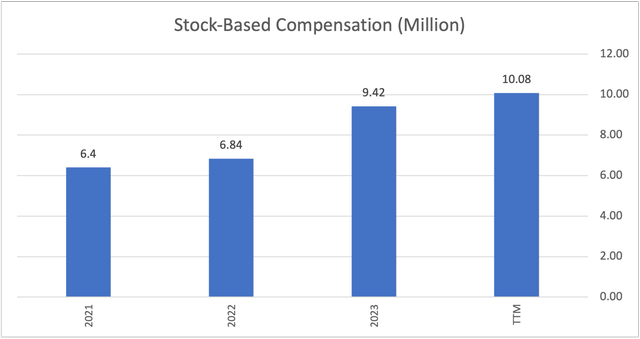

To calculate the owner earnings in the above figure, stock-based compensation was included in operating cash flow and added back to net income as a non-cash charge. However, I think it is more appropriate not to include it in owner earnings, especially for companies like Accel with substantial stock-based compensation. Accel had $6.4 million of stock-based compensation in 2021 that increased to more than $10 million in the last 12 months.

Stock-based compensation (Author’s compilation using data from TIKR)

Excluding stock-based compensation, the owner earnings per share will be $0.80 in 2021, $0.59 in 2022, $0.48 in 2023, and $0.38 for the last 12 months. This shows that owner earnings per share have decreased by more than 50% compared to 2021 levels. Therefore, I believe Accel has been value destructive for shareholders since 2021, despite the substantial increase in revenue.

Current Acquisition

Accel’s current acquisition, Fairmont Holdings, seems compelling since it will broaden Accel’s footprint into the horse racing market and give the company an opportunity to develop a casino within the property. The plan is to open a temporary casino in 2025 and a permanent casino by the end of 2027. According to management’s estimates, Accel needs to invest $85-95 million for the temporary and permanent casinos.

The main reasons I see this acquisition as a potential opportunity for Accel’s shareholders are:

- According to the Illinois Gaming Board, the gross profit from each route location must be distributed based on a state-determined sharing system, in which the terminal operator only keeps 32.5% of profit. The rest of the profit goes to the establishment, state of Illinois, local municipality, and Light & Wonder. However, Accel will keep more than 32.5% of the gross profit from the established casinos and hence will have a higher profit margin compared to that from the non-casino locations.

- There is limited number of terminals in each non-casino location due to state regulations. Currently, each establishment is limited to having 6 terminals. However, Accel will have 200 slot machines in the temporary casino and 500 slot machines in the permanent casino. This will further increase their profit margin due to economies of scale.

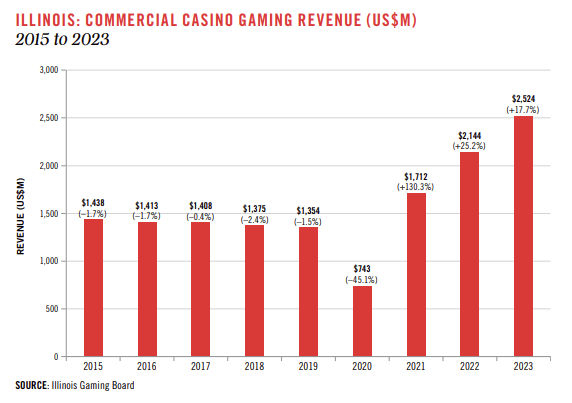

- The commercial casino gaming revenue in Illinois has increased from $1.7 billion in 2021 to $2.5 billion in 2023, which offers an opportunity for Accel to benefit from the increasing revenue in the casino gaming market.

Illinois commercial casino gaming revenue (American Gaming Association)

I think given the required $85-95 million of investment and based on the poor performance of management to increase owner earnings in previous acquisitions, it is too soon to evaluate the Fairmount acquisition and its possible opportunities for shareholders. However, I believe the shift towards casino operations can potentially be a game changer for Accel since this segment has notably higher margins and profitability compared to their core business.

Valuation

For valuation, I am going to compare Accel’s expected EV/EBITDA to its historical levels, sector median, and the multiple used by J&J Ventures Gaming for the acquisition of Golden Entertainment’s (GDEN) distributing gaming operations in Nevada and Montana. Before that, let’s start by estimating the expected additional revenue and EBITDA from Fairmount acquisition.

- Estimation of Additional EBITDA from Fairmount

To roughly estimate the expected revenue from the casinos, I divided Accel’s generated revenue from Illinois operations in 2023 ($867.2 million) by the average number of terminals located in Illinois (14,900 terminals). This translated to $58,000 of generated revenue per terminal. However, this estimate is related to non-casino locations and I expect higher revenue for casinos. Therefore, I think assuming $70,000 of generated revenue per terminal is appropriate, if not conservative. Additionally, to be conservative, I am not considering revenue from the casino tables.

Multiplying the generated revenue per terminal by 200 slot machines for the temporary casino and 500 slot machines for the permanent casino, the expected revenue from the slot machines is $14 million from the temporary casino and $35 million from the permanent casino.

For the food and beverage, I assumed Accel will generate around 25% of the gaming revenue. This estimate is based on the proportion of food and beverage revenue to gaming revenue for Golden Entertainment, which has been 20-30% in recent years. Based on this, the expected food and beverage revenue would be around $3.5 million for the temporary casino and $9 million for the permanent casino. Therefore, Accel is expected to generate an additional $17.5 million of revenue in 2025 and $44 million of revenue by the end of 2027.

For the EBITDA margin, management expects something in the high 20s. However, as I showed in my previous article, that is something currently Golden Entertainment is achieving for its operations in Nevada. I believe Accel’s casinos in Illinois will have relatively lower margins, and that is why I will use 25% for the EBITDA margin. Therefore, Accel is expected to generate an additional $11 million of EBITDA by the end of 2027. Adding this number to around $4 million of EBITDA for the sportsbook and horse racing, the Fairmount acquisition can generate an additional $15 million of EBITDA for Accel.

Adding $15 million to around $165 million of the generated EBITDA in 2023, the expected EBITDA would be $180 million. This translates to a forward EV/EBITDA of around 6.7.

Since the start of 2022, Accel’s EV/EBITDA has been fluctuating around 7-8. Therefore, an EV/EBITDA of 6.7 seems modestly lower than the average of the last 3 years. However, the sector median is around 9-10, which is consistent with the multiple (9) used for the acquisition of Golden’s distributed gaming operations. This does not necessarily mean Accel’s fair multiple is 9, especially given the relative quality of the businesses and the difference between the locations of the core operations. Overall, I think Accel is slightly undervalued, with a fair multiple at around 7-8 and an optimistic multiple of around 9.

EV/EBITDA for the last 3 years (Seeking Alpha)

To calculate Accel’s share price, I assumed a net debt of around $280 million (similar to the last 3 years) and added 3.5 million to the number of shares outstanding due to the acquisition of Fairmount (84.3 + 3.5 = 87.8 million). Using the fair (7.5) and optimistic (9) EV/EBITDA multiples, the estimation of Accel’s share price can be summarized as follows:

| Fair Valuation | Optimistic Valuation | |

|---|---|---|

| EV/EBITDA | 7.5 | 9 |

| Estimated EBITDA (M) | $180 | $180 |

| EV (M) | $1,350 | $1,620 |

| Market Cap (M) | $1,070 | $1,340 |

| Share Price | $12.2 | $15.3 |

| Potential Upside (from $11) | 11% | 39% |

Summary of Accel’s Valuation (Author’s calculations)

Risks

I think the most important risk for Accel’s shareholders is further dilution and a decrease in owner earnings per share. At the end of 2023, Accel had around 1.2 million of outstanding options with weighted average exercised price of $11.6. Additionally, there are 3.3 million shares of Class A-2 common stock that will be converted to Class A-1 as explained in the Accel’s latest quarterly filing (Q1/2024):

• Tranche II, equal to 1,666,667 shares of Class A-2 common stock, will be exchanged for Class A-1 common stock if the closing sale price of Class A-1 common stock on the New York Stock Exchange (“NYSE”) equals or exceeds $14.00 for at least twenty trading days in any consecutive thirty trading day period; and

• Tranche III, equal to 1,666,667 shares of Class A-2 common stock, will be exchanged for Class A-1 common stock if either (i) the LTM EBITDA threshold as of March 31, 2024 or June 30, 2024 is $198.6 million or (ii) the closing sale price of Class A-1 common stock on the NYSE equals or exceeds $16.00 for at least twenty trading days in any consecutive thirty trading day period.

I think the conversion conditions can limit the upside for Accel’s shareholders to $14 per share in the near future. Additionally, Accel’s president and CEO, Andrew Rubenstein, has revealed plans to sell approximately 0.6 million of his shares. Looking at insider transactions over the past two years, insiders have consistently sold their shares at prices above $10. Although insider selling does not necessarily mean something is wrong, it is hard to believe there is a great opportunity here that I can see better than the insiders.

Conclusion

Based on what I explained in the previous sections, I don’t see a compelling opportunity in Accel given the decreasing owner earnings per share and limited upside with the risk of more dilution. However, I believe there are some possible opportunities for Accel’s shareholders in the future, including: 1) taking advantage of the likely legalization of local gaming in other states; and 2) entering into the casino business with higher profitability compared to the current core business. Therefore, I suggest a “Hold” rating for Accel.

)