Entertainment

AMC Entertainment (AMC): A Must-Buy Before Q2 Earnings Premiere?

AMC Entertainment Holdings, Inc. AMC is slated to release results for second-quarter 2024 on Aug 2, after the closing bell.

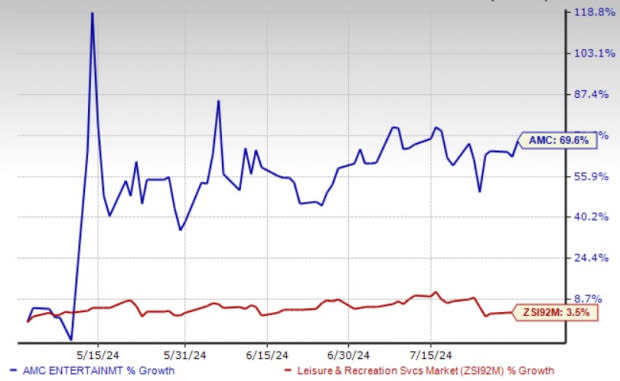

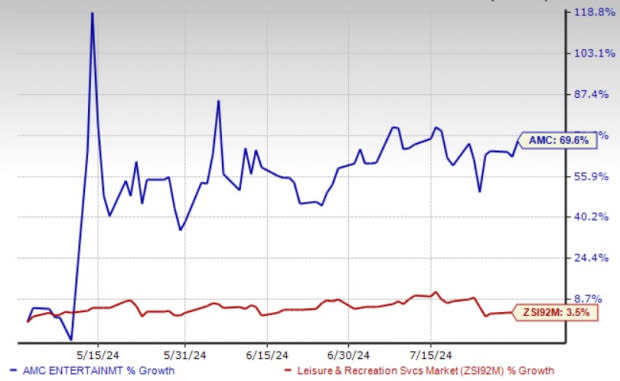

In the last reported quarter, the company’s earnings missed the Zacks Consensus Estimate by 25.8%. The company’s top line dropped 0.3% year over year. However, AMC’s loss per share narrowed to 78 cents from a loss of $1.31 reported in the prior-year quarter.

AMC surpassed the earnings in the trailing three out of four quarters. The average surprise over this period is 38%, as shown in the chart below.

Image Source: Zacks Investment Research

Trend in Estimate Revision

The Zacks Consensus Estimate for second-quarter loss is pegged at 10 cents per share against break-even earnings reported in the prior-year quarter. In the past seven days, loss estimates for the current quarter have narrowed by 27 cents. The consensus mark for revenues is pegged at $1.03 billion, indicating a 23.5% year-over-year decline.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for AMC Entertainment this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: AMC Entertainment has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #2 at present.

Factors Influencing Q2 Performance

AMC’s second-quarter 2024 performance is likely to have been hurt by prolonged actors and writer strikes in 2023. These strikes significantly reduced the number of new movies being released in theaters, which is likely to have negatively impacted the company’s earnings in the quarter to be reported.

The company reported preliminary second-quarter 2024 results. Total revenues in the quarter are likely to be nearly $1,030.6 million compared with $1,347.9 million in the quarter ended Jun 30, 2023.

Despite weak preliminary second-quarter 2024 results, AMC saw an encouraging trend of increasing daily revenues in June 2024, suggesting a recovery in moviegoing activity. The industry box office for June was nearly on par with the combined total for April and May, contributing to improved financial performance for AMC during that month. During the Jun 13-16, 2024 period, AMC reported the highest attendance and admissions revenues across its U.S. and international locations.

AMC’s focus on enhancing the guest experience and operational efficiency has been pivotal in its success. The company continues to innovate and diversify its offerings. Its retail popcorn initiative expanded to 6,500 points of distribution, including major retailers like Walmart, Amazon, Publix and Kroger. These efforts are likely to have aided the company’s performance in the quarter to be reported.

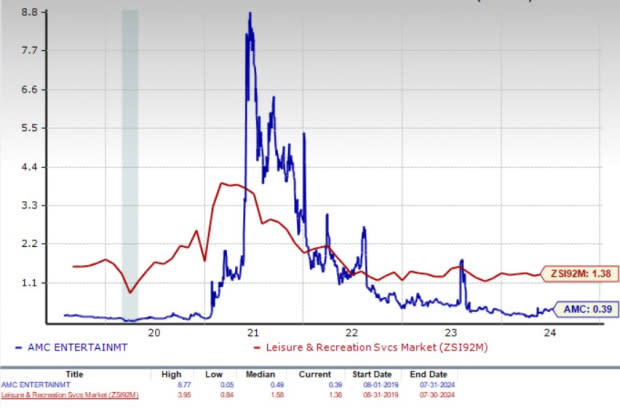

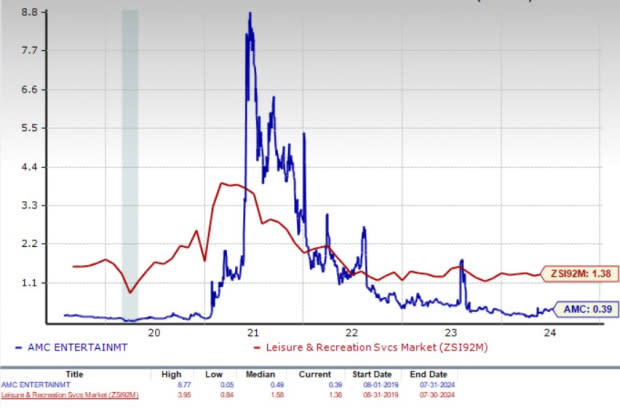

Price Performance & Valuation

In the past three months, AMC Entertainment’s stock has surged 69.6% compared with the industry’s increase of 3.5%. The company’s price performance outshined other industry players, including Cinemark Holdings, Inc. CNK, The Marcus Corporation MCS and Live Nation Entertainment, Inc. LYV.

Image Source: Zacks Investment Research

The company is currently trading at a forward 12-month price-to-sales ratio of 0.39X, well below the industry average of 1.38X, reflecting an attractive investment opportunity.

Image Source: Zacks Investment Research

Investment Thoughts

Although the company’s top and the bottom line are likely to have registered a decline in second-quarter 2024, the company’s prospects for the near-term future remain bright. AMC is benefiting from increased attendance from moviegoers, the availability of diverse film options and movie-themed merchandise offerings. Also, strong consumer spending on premium large-screen formats and innovative food and beverage options bode well.

Looking ahead, AMC is confident about the future of the movie theater industry. An extensive review of upcoming movie releases for 2024, 2025 and 2026 suggests a promising period ahead. AMC is also venturing into new revenue streams, such as concert films and special events. The company partnered with top musical artists to bring exclusive concert films and listening events to its theaters. Collaborations with stars like Taylor Swift, Beyoncé and Billie Eilish are opening new growth opportunities. These initiatives, alongside the launch of AMC Theaters Distribution, highlight AMC’s commitment to innovative programming and revenue diversification, reinforcing its competitive edge in the industry. The recent rise in AMC’s share price reflects growing investor confidence in the company’s prospects. Given this optimism, adding AMC stock to your portfolio could be a wise decision.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marcus Corporation (The) (MCS) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Cinemark Holdings Inc (CNK) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report