Fashion

Macerich sells Biltmore Fashion Park in Phoenix to Red Development

Legacy Southern California mall developer and investor Macerich Company might still be working out details of a refinance of a Victor Valley property and something more complicated at the Santa Monica Place, but it’s definitely out of a major retail center in Phoenix.

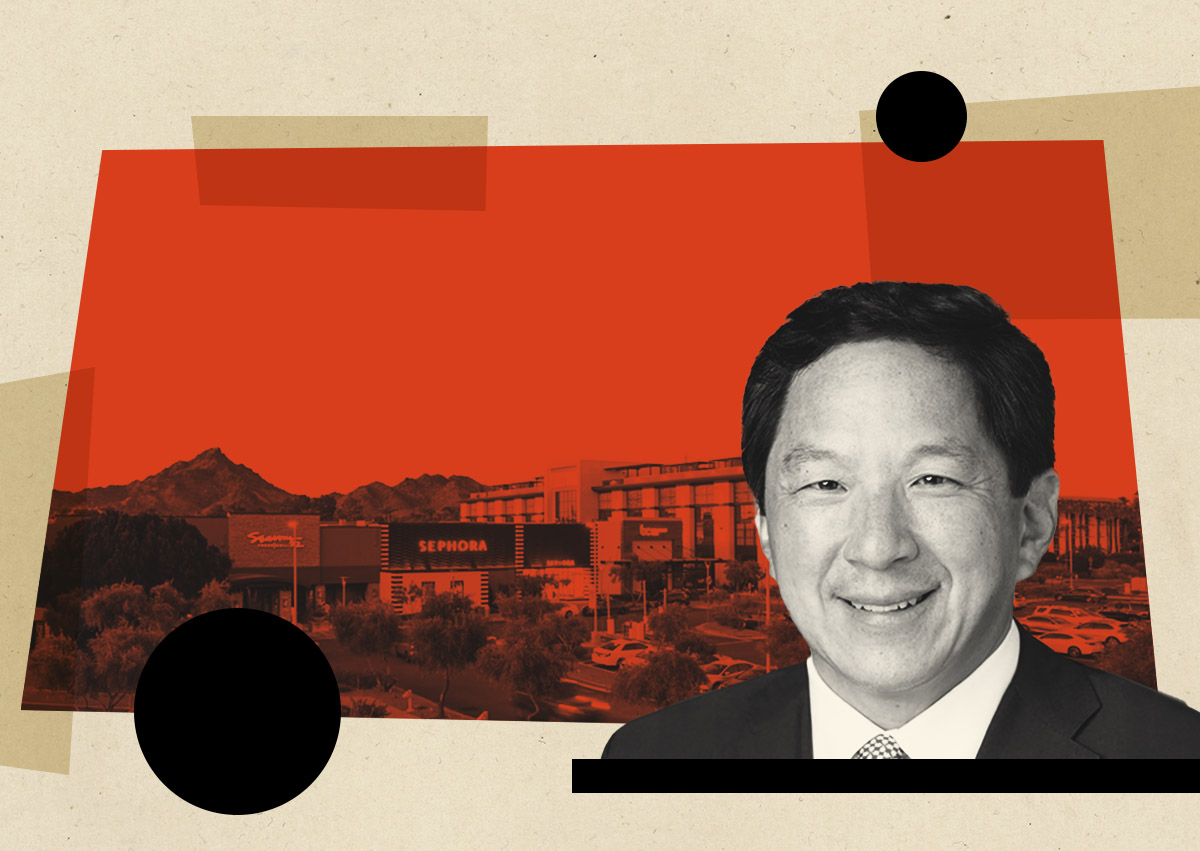

The Santa Monica-based retail REIT tapped Red Development, a regular partner on several developments, to buy out its 50 percent stake in Biltmore Fashion Park, the Phoenix Business Journal reported.

Publicly traded Macerich announced the deal on its recent quarterly earnings call, suggesting a $110 million price and estimating that much would go toward paying down debt. Macerich has earlier said it plans to trim $2 billion in overall debt as it seeks to regain a solid footing on its finances.

Mike Ebert, a managing partner in Red Development, said the investor plans to renovate Biltmore Fashion Park, calling it “one of the state’s most important and historical” developments and crowing that it’s now “a locally owned and operated landmark.”

The shopping center’s tenant roster at 2502 East Camelback Road includes Saks Fifth Avenue, Anthropologie, Macy’s and Life Time Fitness, among others. Plans are in the works to add an office tower on the site. Jack Hsieh, recently appointed CEO of Macerich, said the company took advantage of recent strategic planning for the Arizona property.

“That project had entitlements to increase office density on the project. As you know, we added a new Life Time Fitness into that location. Over time that was going to have a more balanced retail mixed use component to that overall project,” Hsieh said on the earnings call. “In our judgment, we felt like that was a good way to raise liquidity. It’s good for our partner.”

Hsieh said Macerich now expects to lower its outstanding debt to somewhere between $1.2 billion and $1.4 billion by the end of the year.

Macerich recently indicated it plans to hold onto a mid-market retail center in the Inland Empire region of Southern California, while the outlook for Santa Monica Place in the real estate investment trust’s hometown coastal resort remains uncertain.