Gambling

Sports gambling exceeds projections, hauls in $3.5m – Mountain Times

While the July 26 figures from the state of Vermont on tax and fee revenues for the General Fund, Transportation Fund and Education were $143.6 million — above projections— and the General Fund contributed nearly $140 million of that with the personal income tax leading the way, as it has done for several years, another much-anticipated, but much more modest contributor, was revenues from sports wagering.

Gambling on sports only became legal in Vermont in January. So, the data is only for the last half of fiscal year 2024 (January-June), as provided by the Division of Liquor & Lottery.

Charts courtesy Vermont Division of Liquor & Lottery

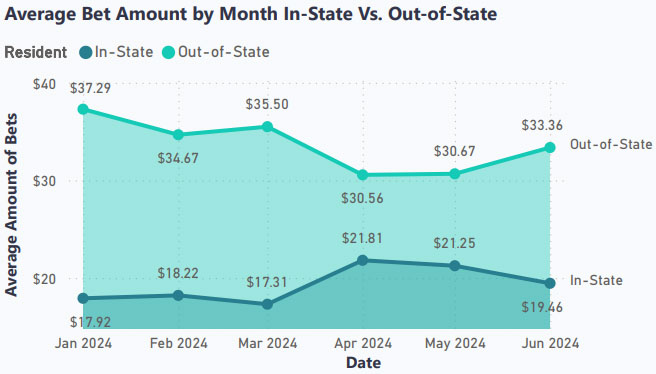

Top chart shows betting percentage by sport; bottom chart show in-state vs out-of-state spend.

With no history to draw from, state officials projected that revenues to the state would be about $1.2 million for the first six months. Revenues came in nearly three times higher at $3.5 million. With the NFL football playoffs concluding and basketball in full swing revenues got off to a hot start, then revenues drifted off in the spring. College students also went home in May.

Another notable data point is that nearly a third of the money came from out-of-state bettors, who also bet an average amount nearly double those registered in-state ($34.22 to $19.05).

The total handle (amount bet in gambling parlance) was $101.1 million from 232,884 users.

Basketball boasted the largest share (39.8%) with $40.2 million. “All other” came in at $23.4 million (23.2%) with baseball, tennis and football all representing just over 9% each.

)