Entertainment

AMC Entertainment: The Bullish Case Hinges On The Fed (NYSE:AMC)

BCFC

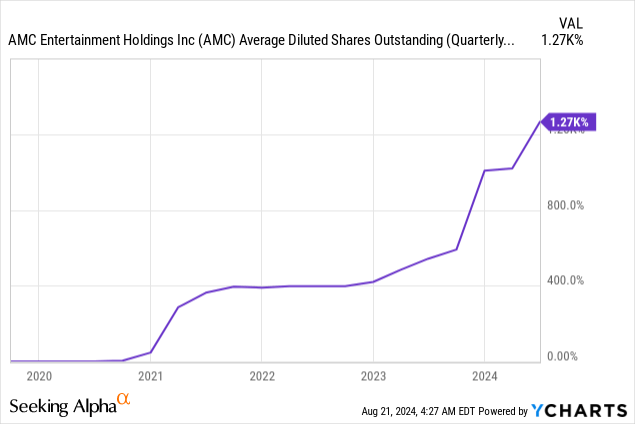

The woes facing AMC Entertainment (NYSE:AMC) range from a high debt burden that has seen quarterly interest payments paid by the largest theatre operator in the US swell, to flagging box office revenues following the 2023 Hollywood labor disputes. The operator had 321,581,000 shares outstanding at the end of its recent fiscal 2024 second quarter, a substantial rise from 151,347,000 shares a year ago. AMC, at $5 per share, has an $1.61 billion market cap. While AMC Apes can’t window-dress the remarkable levels of dilution over the last half-decade, the alternative was a bankruptcy filing that could have likely handed the entire company to its creditors and wiped out shareholder value.

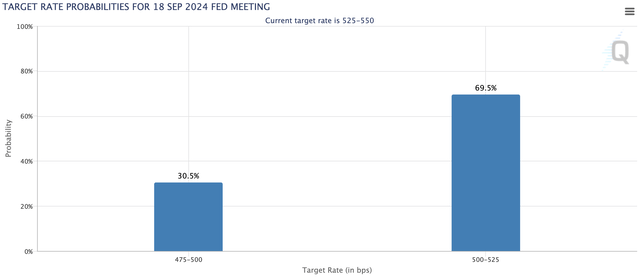

However, with the commons dropping 82% over the last 1 year and with the Fed set to lighten the burden of AMC’s debt loan, there is a case for short to medium-term outperformance. The most salient catalyst will come on the 18th of September, when the Federal Open Market Committee (“FOMC”) meets to reduce rates for the first time since 2020. The CME FedWatch Tool has placed the probability of this happening at 100% with a sole consumer inflation reading the week before the meeting being the main data point that could defer this. I last covered AMC in January.

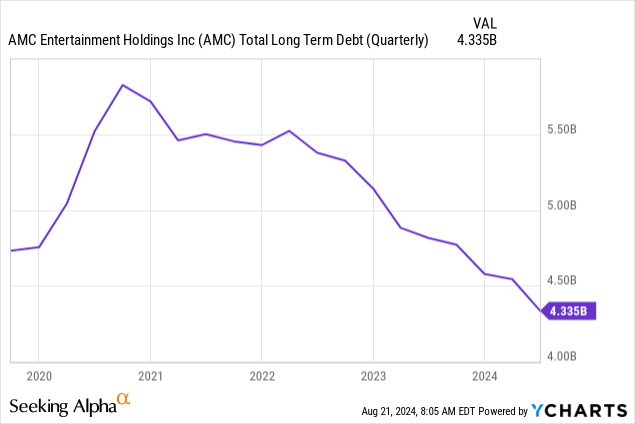

Debt, Income, And Cash Flow

AMC’s total long-term debt stood at $4.33 billion at the end of its second quarter, maintaining a downward trend in place since the pandemic forced the operator to shut its assets and take on debt to remain a going concern. Total long-term debt was down roughly 12% over its year-ago comp and had dropped materially from a peak well north of $5.5 billion in 2020. Further, AMC recently announced a deal with its creditors to refinance $2.5 billion of existing debt and extend its maturities to 2029.

The largest tranche of the post-period end deal will see AMC issue $1.2 billion of new term loans due 2029, swapping these for the 2026 Senior Secured Term Loans. There will also be a potential to extend another $800 million of 2026 maturities. The deal adds strength to AMC’s balance sheet but comes with dilution as there is an option to reduce debt by another $464 million through the conversion of exchangeable notes into equity. AMC recorded second-quarter revenue of $1.03 billion, down 23.7% over its year-ago comp but in line with consensus estimates.

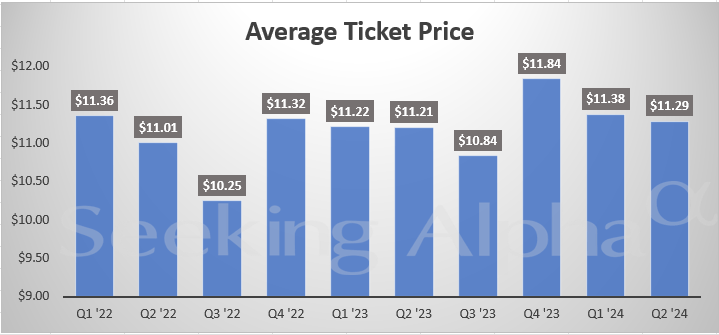

Seeking Alpha

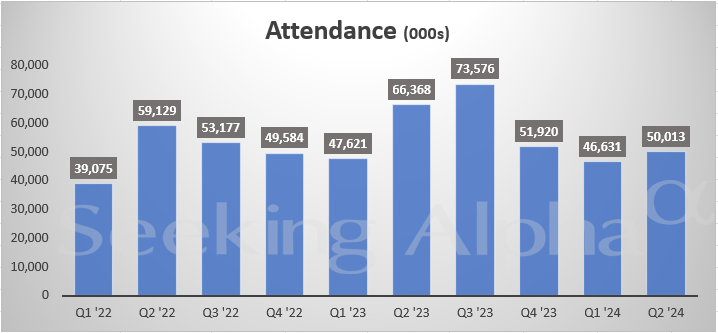

The dip was due to what AMC’s management flagged as a slower box office in the shadow of the 2023 Hollywood writers and actors strikes. The company recorded a net loss of $32.8 million, down from a profit of $8.6 million a year ago, with adjusted EBITDA dropping to $29.4 million. This was from $182.5 million a year ago for an 84% decline in adjusted EBITDA. Attendance fell quite markedly versus its year-ago quarter on the back of a comparatively weaker box office slate despite the second-quarter release of Inside Out 2, the highest-grossing animated movie of all time.

Seeking Alpha

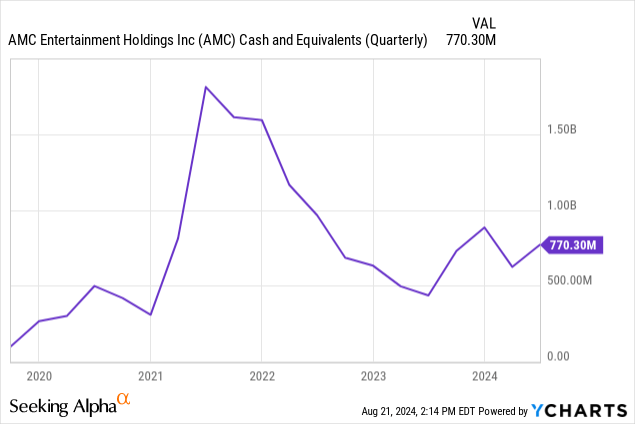

Critically, the success of Deadpool & Wolverine, the stickiness of Inside Out 2 into the third quarter, and the release of Alien: Romulus should help buffer third quarter box office receipts and should support a more competitive year ago comp for AMC. The company also ended the second quarter with cash and equivalents of $770.3 million, up sequentially from $624.2 million, even as cash used in operations rose to $34.6 million from $13.4 million a year ago. Negative free cash flow during the quarter was $79.2 million.

Everything Changes Once The Fed Cuts Rates

The Fed cutting rates would form a pivotal moment for AMC’s story, which for years has been defined by back-to-back disruptions that have aggregated together to form an intense headwind. The pandemic which forced up debt was immediately followed by record inflation and a Fed funds rate which had to be hiked to its highest level in a generation. The 2023 labor disputes only compounded this conundrum. While we won’t see an immediate return to the zero-interest rate policy era, the outlook on AMC’s commons should dramatically change on a lightening of its debt burden in response to rate cuts slotted to begin from September. The underlying dynamics of movie going in the US remain healthy. Future dilution is expected to remain elevated, and AMC has made it clear it intends to tap its equity to continue to strengthen its balance sheet. The rest of the 2024 movie slate is set to see Joker: Folie a Deux, Transformers One, Venom: The Last Dance, and Gladiator 2 release. With 2025 set to see an even healthier box office slate as recovery from 2023 Labor disputes completes. Do I think AMC is a buy? No. But the short case is less clear.