Entertainment

Six Flags Entertainment: Merger Should Aid Legacy Six Flags’ Weakness (NYSE:FUN)

skynesher

Six Flags Entertainment Corporation (NYSE:FUN) has now merged, being a combination of the legacy Six Flags and Cedar Fair businesses. After the successful merger, Six Flags has now also reported the company’s Q2 results on a pre-merger basis.

In my earlier article, “Six Flags And Cedar Fair: Synergies Pose Great Upside,” I initiated both pre-merger stocks at a Buy rating as the merger’s anticipated synergies created an attractive valuation for the merged Six Flags. As I previously estimated with the merger terms, legacy Cedar Fair shareholders’ 15% return has since outperformed legacy Six Flags shareholders’ 8% return after the article was published on the 10th of April. In the same period, the S&P 500 (SP500) has returned 9%.

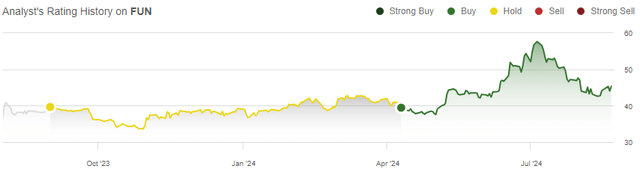

My Rating History on FUN (Seeking Alpha)

Q2 Results

Six Flags reported the pre-merger legacy companies’ Q2 results on the 8th of August. The combined revenues of $1.01 billion beat Wall Street estimates by $45 million, and the adjusted EPS of $1.72 beat by a great $0.65 margin; the combined Six Flags showed great traffic trends year-on-year, surprising analysts to the upside.

Legacy Cedar Fair’s Traffic & Earnings Improved Considerably in Q2

Legacy Cedar Fair’s revenues increased 14% year-on-year to $572 million in Q2. It showed good growth in the underlying performance, despite a part of the growth being caused by the shift in Cedar Fair’s fiscal quarter and operating days in certain parks. This increased the total operating days by 7.2% into 789 in Q2 for a better base to generate revenues from.

Underneath, Cedar Fair’s amusement parks seem to be seeing greatly normalizing traffic after the lingering effects of the COVID-19 pandemic. Cedar Fair’s attendance per operating day increased by 8.9% year-on-year, showing strong comparable traffic growth and ultimately pushing Cedar Fair’s adjusted EBITDA up by 36% to $205 million through good operating leverage. The total attendance of 8635 thousand in Q2 was now slightly above the 8500 thousand Q2/2019 level already, but was still -6.5% below the Q2/2019 level on an attendance per operating day -basis. The decline is understandable with increased operating days that spread out traffic more. The company communicated in the Q2 earnings call to not be seeing significant pressure from macroeconomic headwinds, but has seen some effects from adverse weather and the timing of Easter in 2024 that shifted into Q1.

Per-capita spending in Cedar Fair’s parks decreased by $1.92 to $59.54 due to lower season pass pricing to drive the improved traffic.

Overall, Cedar Fair showed solid financials with attendance normalizing through pricing initiatives and a post-Covid traffic normalization. The earnings momentum shows the improving traffic’s importance to the company’s bottom line.

Legacy Six Flags’ Weaker Growth Performance Continued, But the Trend Should Improve From the Merger

The legacy Six Flags business showed a considerably worse performance in Q2 — revenues declined -1% to $438 million as some of Six Flags’ parks were opened for fewer days, creating 58 less operating days in Q2 for the business. Attendance decreased -2% due to the fewer operating days, but also due to the mentioned weak weather conditions in April and the Easter timing shift to Q1 in 2024. Adjusted EBITDA declined by $23 million into $131 million, showing dramatically worse momentum than Cedar Fair.

The Easter’s timing shift was related to be the cause of nearly half of Six Flags’ attendance decline, but with Cedar Fair still showing continued momentum despite the timing shift, I believe that Six Flags’ performance was very notably weak. The weaker Q2 follows legacy Six Flags’ already lower longer-term revenue growth, as I already outlined the legacy companies’ differing growth trends in my previous article.

The weaker performance could start to slowly shift in the midterm — the now-completed merger should aid the legacy Six Flag business in improving attendance over the long term, as has been planned with the merger’s synergies.

The Q2 earnings call also highlighted the merger’s positive impact on legacy Six Flags to improve its weaker traffic trends; with CEO Richard Zimmerman’s and others’ management expertise from Cedar Fair carried onto the Six Flags business, the company plans to leverage the great business expertise and business data to revitalize Six Flags’ customer experience. Advertising and sales synergies should also improve Six Flags’ traffic.

Since the success of the legacy Six Flags initiatives still unknown, I believe that cautious optimism is in place; Richard Zimmerman should have great credentials to drive the improvements, even though turning around traffic trends could still be challenging. Six Flags has already announced seven new roller coasters for 2025 under Zimmerman along with improved food and beverage menus, showing good initial signs of operational changes in my opinion. As told in the earnings call, Six Flags has now also removed its in-part purchase surcharge, which was very poorly received by customers.

Other synergies should also elevate Six Flags’ legacy business, but the merged Six Flags company as well; the $200 million in run-rate synergies are now being implemented. Corporate cost decreases should start to show quite fast, with cost synergies in advertising, IT costs, procurement, and other costs likely taking some more time to be implemented. With the synergies and Cedar Fair’s momentum, the company’s earnings growth outlook over the midterm stands very good.

July Traffic Was Disturbed by Hurricane Beryl & Weather Conditions

After Six Flags’ Q2, Hurricane Beryl and weather conditions have caused Six Flags’ operations turbulence in July, as was updated in the Q2 report. During the five weeks ending August 4th, attendance declined -3% year-on-year, mainly caused by declines in four of the company’s locations.

As such, investors shouldn’t expect a good Q3 from the company. I don’t believe that the hurricane’s effects are likely to have too much persisting negative effects, only pushing short-term attendance down and likely requiring a moderate amount of additional capital expenditures for repairments.

Updated Valuation: FUN Is Still Attractively Priced

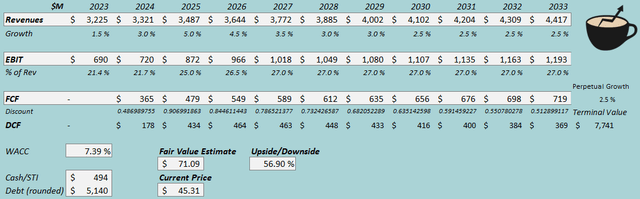

I now estimate a fair value for the merged Six Flags stock. From my previous discounted cash flow [DCF] model estimates, I have now slightly lowered my 2024 revenue growth estimate due to the July disruptions and quite poor Six Flags momentum. Afterward, I estimate similar, elevated growth from revenue upside caused from the merger.

I now estimate margins slightly more conservatively at an eventual 27.0% EBIT margin level, as Six Flags’ earnings have moved quite adversely still in Q2. The estimated level still anticipates great earnings growth momentum from implemented cost synergies in the midterm at a 5.3 percentage point expansion into 2027. I again estimate a moderately good cash flow conversion, slightly worsened by short to midterm investments to fuel the moderate growth.

For more thorough explanations of the financial estimates, I refer to my previous article.

DCF Model (Author’s Calculation)

The estimates put Six Flags’ (FUN stock’s) fair value estimate at $71.09, 57% above the stock price at the time of writing – the implemented synergies still represent good upside for the stock. I believe that some margin of safety is healthy with uncertainty around the total amount of earnings growth achieved through synergies, but still, but the undervaluation shows a very attractive gap to fair value.

I previously estimated the FUN stock’s fair value to be $65.17, with the new estimate up due to a lower used WACC.

CAPM

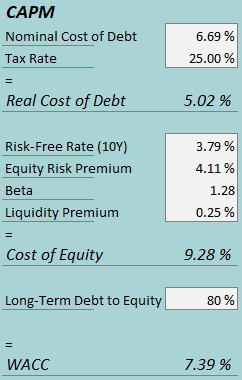

A weighted average cost of capital of 7.39% is used in the discounted cash flow (“DCF”) model, down from 8.03% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, legacy Cedar Fair had $40 million in interest expenses, making the company’s interest rate 6.69% with the current amount of interest-bearing debt. I again estimate a long-term debt-to-equity ratio of 80%.

To estimate the cost of equity, I use the 10-year bond yield of 3.79% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at 1.28. With a liquidity premium of 0.25%, the cost of equity stands at 9.28% and the WACC at 7.39%.

Takeaway

Six Flags and Cedar Fair have now merged, creating the new Six Flags company. The Q2 report showed great continued momentum with Cedar Fair, but worsening traffic at the legacy Six Flags, in line with already previously worse traffic trends. I still see a positive future ahead despite legacy Six Flags weakness, as the merger brings operational expertise to drive improvements in the Six Flags customer experience. Synergy implementations are already on their way, creating good midterm earnings growth momentum going ahead. The short-term earnings outlook is disturbed by a hurricane and adverse weather effects, but shouldn’t affect the longer-term investment case. As the merged stock’s valuation remains attractive, I remain with a Buy rating for Six Flags.