Entertainment

Madison Square Garden Entertainment: Demand Remains Robust (NYSE:MSGE)

ChrisSteer/E+ via Getty Images

Summary

I gave Madison Square Garden Entertainment (NYSE:MSGE) a buy rating (21st June). My key thesis was that MSGE benefits from the strong demand for live events, and it is particularly well positioned to benefit from this because it operates popular venues in the US. I reiterate a buy rating for MSGE as various forward indicators of demand remain robust for the business, showing no major signs of slowdown like what peers are seeing.

Earnings results update

In the latest quarter (4Q24) reported last week, MSGE grew revenue by ~26%, leading to a total of $186 million, which beat consensus expectations of $173 million. This was driven primarily by an increase in the number of concerts held at The Garden vs. 4Q23. Adjusted Operating Income [AOI] also beat consensus expectations of $6 million by coming in at $13 million. Looking ahead into FY25, management guided AOI growth to be in the high-single-digits to low-double-digits percentage range, implying a mid-point of high-single-digits percentage AOI growth, in line with my model.

Forward-looking demand indicators remain robust

Over the past few weeks, there have been multiple companies mentioning that the discretionary spending environment has softened, and that has gotten me worried about demand for live concerts. Encouragingly, MSGE 4Q24 report dismissed this concern. To be specific, multiple leading indicators that I track for the company remain solid.

Firstly, MSGE is tracking flattish y/y growth in the number of events booked in FY25 vs. FY24. This may seem negative at face value, but remember that FY24 was a tough comp (FY24 hosted the most number of shows in MSGE history) and also that FY25 will not have Billy Joel’s residency. For the issue with Billy Joel residency, it is sad that MSGE did not manage to renew the exclusivity contract. But this should not come as a surprise to investors since management talked about it two quarters ago. The impact is quite sizeable since MSGE hosted 12 shows in FY24 but will only host 1 in FY25. We know that the show racked in around $3 million to $4 million per show. Assuming $3.5 million per show for FY24, this implies FY24 will see a ~$40 million headwind (~4% y/y growth headwind).

However, I would not be too worried about this because it would further highlight the strength of demand. Think of it this way: (1) without this popular show, MSGE is still able to track well against the FY24 number of events booked (which was a record, I reiterate); (2) management noted there is still a strong pipeline, and they sort of hinted that MSGE will eventually see positive y/y growth in its events book since they intend to increase the number of events at its venues in FY25 (vs. 962 in FY24). Besides, this could also be seen as a potential upside surprise if MSGE can find events that bring in higher revenue.

Secondly, the sale of Christmas Spectacular tickets remains extremely robust. While the y/y growth (FY25 vs. FY24) has stepped down from 35% reported last quarter to 18% as per 4Q24, this still represents a very robust demand strength. Importantly, this growth was driven by both growth in pricing and in volume. Given this demand backdrop, I see potential for overall ticket sales to come in much higher than 18%, as MSGE only started to actively promote the FY25 season in late July, and MSGE could further increase show count if demand comes in stronger than expected.

Lastly, the same “sold out” trend continued into 4Q24, which continues to convince me that the underlying demand is much better (if there is more capacity, more tickets are likely to be sold). Other indicators to point to strong demand include strong demand for premium hospitality suites, so much so that MSGE is increasing capacity to meet demand, and that F&B spending per capita and merchandise spend grew by a by a double-digit percentage in 4Q24.

One final thing to touch on that could end up being a stronger-than-expected growth driver is sponsorship. As I said previously, I believe brand marketers will allocate more resources to the live event space (given the strong consumer demand). MSGE is seeing positive traction here as some sponsors have already been approaching them to proactively renew agreements.

Valuation

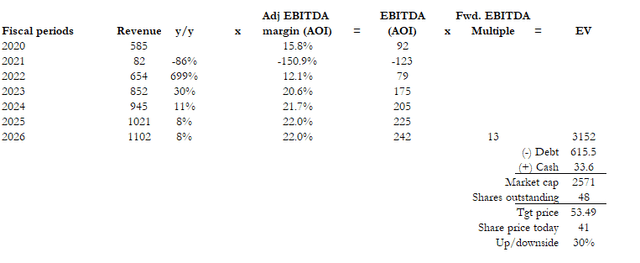

I revised my price target upwards from ~$48 to $54 as I shift my forward EBITDA multiple expectation from 12x to 13x to reflect better visibility into FY25 growth and also the underlying demand strength. I believe the data points provided in 4Q24 further validate that MSGE can continue to grow AOI at a high single-digit percentage easily. The market has also reacted very positively to the results (and since my last post about the stock), which shows that investors are recognizing MSGE growth potential (this is also an attractive space within the entire discretionary space that is showing solid growth). Previously, I valued MSGE at 12x forward EBITDA as I compared it against other peers in the entertainment industry (like Walt Disney (DIS), Six Flags Entertainment (SIX), Cedar Fair LP (FUN)). However, with the majority of these peers saying that demand is poor for them while MSGE is seeing solid growth, I think MSGE should trade at a larger premium. For comparison, these peers are trading at low-teens forward EBITDA multiples (same as MSGE).

Investment risk

The broader weakness in discretionary spending may eventually impact MSGE if it gets worse from here if the Fed decides to further delay cutting rates, which risks the US going into a recession. Aside from this additional risk, I think the biggest risk remains with MSGE losing its right to operate key venues (as I mentioned previously).

Last year, the NYC Council committee only extended MSGE to operate Madison Square Garden for five more years. The fear is that the rights are not extended

Conclusion

My positive view on MSGE is because it continues to see robust demand. For instance, MSGE is tracking well against FY24 events booked, seeing strong ticket sales for the Christmas Spectacular, increasing demand for premium hospitality suites, and positive traction in sponsorship deals. While the loss of Billy Joel’s residency is a temporary headwind, MSGE’s ability to maintain a strong pipeline of events suggests that it can mitigate this impact. Given the solid performance, I reiterate my buy rating for MSGE.