Sports

Academy Sports (NASDAQ:ASO) Misses Q2 Sales Targets

Sporting goods retailer Academy Sports & Outdoor (NASDAQ:ASO) missed analysts’ expectations in Q2 CY2024, with revenue down 2.2% year on year to $1.55 billion. The company’s full-year revenue guidance of $5.99 billion at the midpoint also came in 2.3% below analysts’ estimates. It made a non-GAAP profit of $2.03 per share, down from its profit of $2.09 per share in the same quarter last year.

Is now the time to buy Academy Sports? Find out in our full research report.

Academy Sports (ASO) Q2 CY2024 Highlights:

-

Revenue: $1.55 billion vs analyst estimates of $1.58 billion (1.8% miss)

-

EPS (non-GAAP): $2.03 vs analyst expectations of $2.02 (in line)

-

The company dropped its revenue guidance for the full year to $5.99 billion at the midpoint from $6.21 billion, a 3.6% decrease

-

EPS (non-GAAP) guidance for the full year is $6.13 at the midpoint, missing analyst estimates by 4.9%

-

Gross Margin (GAAP): 36.1%, in line with the same quarter last year

-

EBITDA Margin: 15%, in line with the same quarter last year

-

Free Cash Flow Margin: 3.2%, down from 7.7% in the same quarter last year

-

Locations: 285 at quarter end, up from 270 in the same quarter last year

-

Same-Store Sales fell 6.9% year on year, in line with the same quarter last year

-

Market Capitalization: $3.80 billion

“Academy continues to make progress against our strategic initiatives demonstrated by the opening of nine new stores this upcoming quarter, new omni-channel enhancements, such as Door Dash, and leveraging customer excitement around the launch of our new loyalty program. In addition, our inventory discipline drove gross margin expansion of 50 basis points and a 5% reduction in units per store,” said Steve Lawrence, Chief Executive Officer.

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

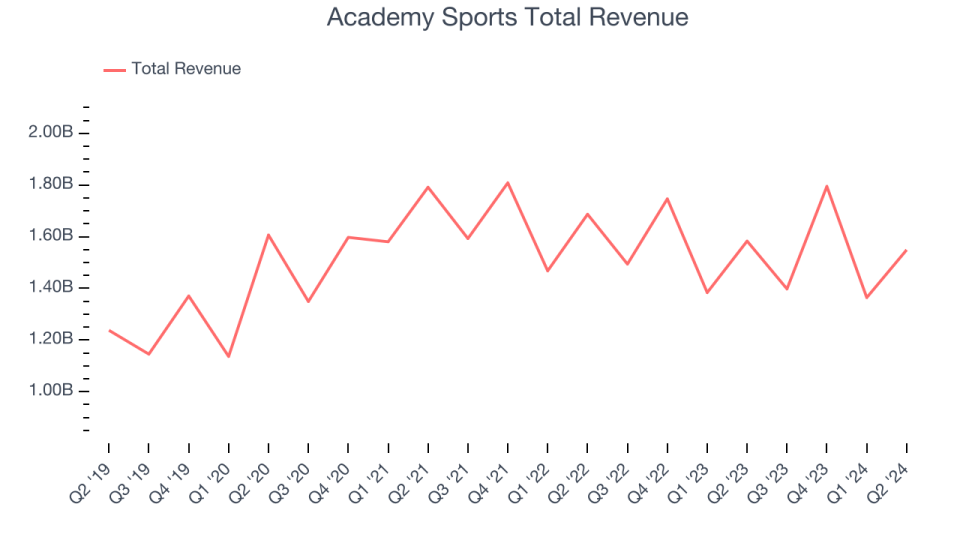

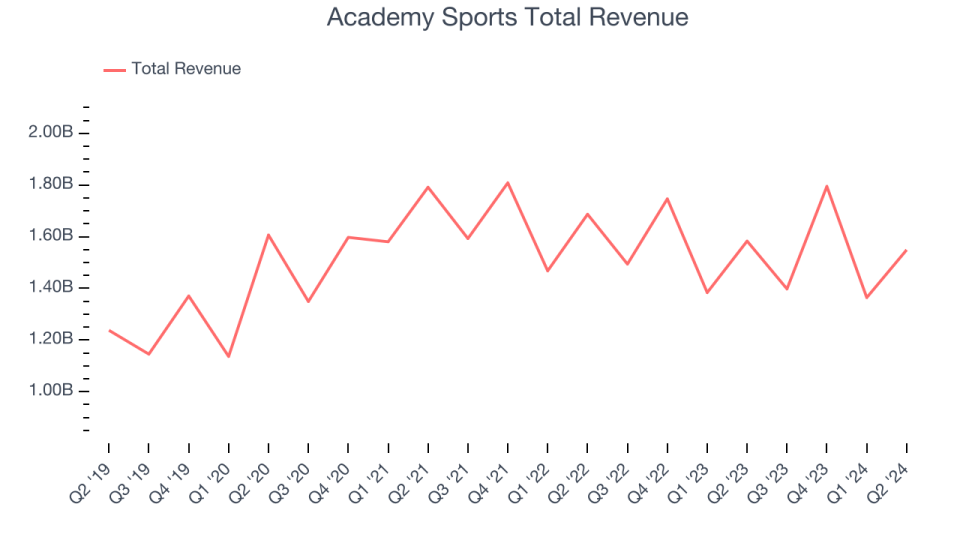

Sales Growth

Academy Sports is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company’s annualized revenue growth rate of 5.3% over the last five years was sluggish , but to its credit, it opened new stores and expanded its reach.

This quarter, Academy Sports missed Wall Street’s estimates and reported a rather uninspiring 2.2% year-on-year revenue decline, generating $1.55 billion in revenue. Looking ahead, Wall Street expects sales to grow 3.6% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

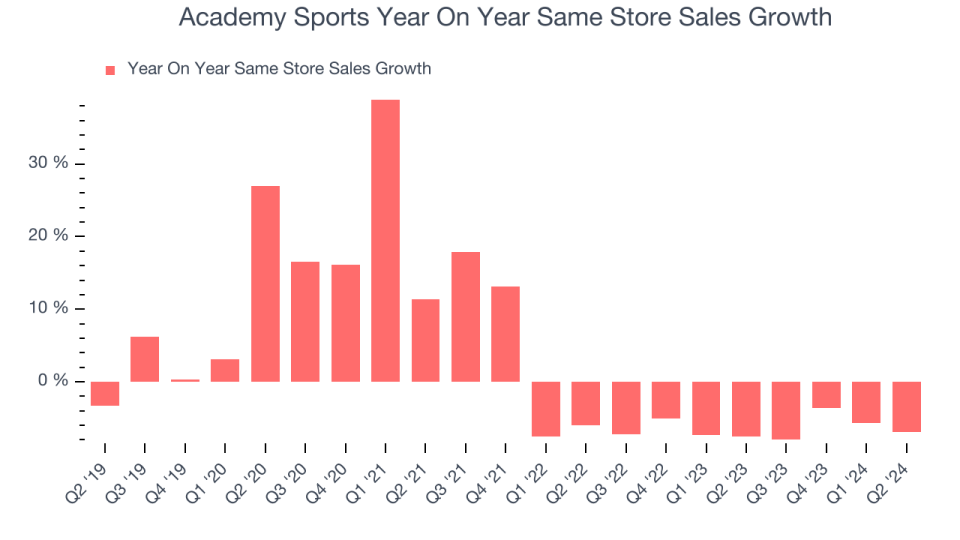

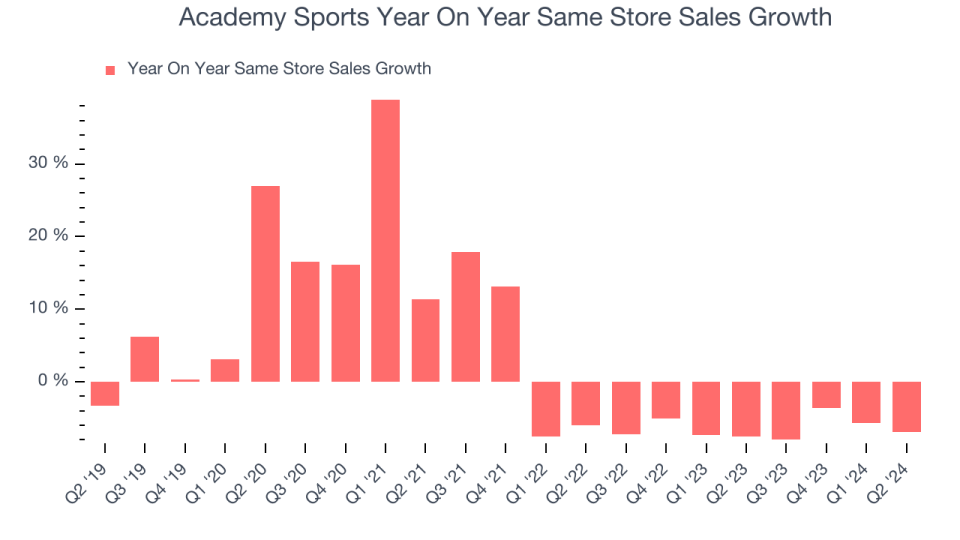

Same-Store Sales

A company’s same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Academy Sports’s demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 6.4% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Academy Sports’s same-store sales fell 6.9% year on year. This performance was more or less in line with the same quarter last year.

Key Takeaways from Academy Sports’s Q2 Results

It was good to see Academy Sports beat analysts’ gross margin expectations this quarter. On the other hand, its sales missed and it lowered its full-year revenue and earnings guidance. Overall, this was a weaker quarter. The stock traded down 2.2% to $51.49 immediately following the results.

Academy Sports may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

.jpg)