Travel

The State of Travel in 2024: Top 3 Charts

Skift Take

The travel industry is rapidly evolving, and the State of Travel 2024 report provides comprehensive insights into the key trends and shifts shaping its future.

The travel industry has continued to thrive in 2024, with businesses experiencing healthy growth and strong profit margins. However, as the industry evolves, it faces new challenges and opportunities that will shape its future. The Skift Research team has released a comprehensive report featuring over 350 slides, detailing industry performance, consumer trends, and business shifts that will impact the travel landscape for years to come.

While the report covers a wide range of topics, I’ve selected three standout charts that showcase some of the most exciting trends and developments in travel today.

1. The Rise of Experiential Travel

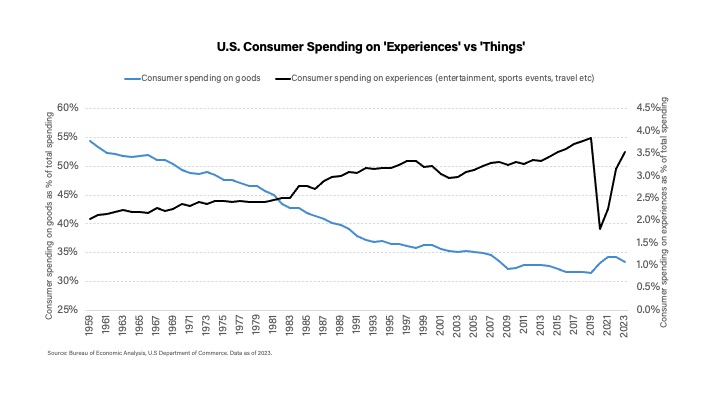

One of the most significant shifts we’ve observed is the growing focus on experiences over material goods. As consumers increasingly prioritize unique, memorable encounters over traditional travel consumption, the demand for experiential travel is skyrocketing. This shift is not just a passing trend—it’s transforming the global tourism landscape. According to McKinsey, the experiential travel market is projected to exceed $3 trillion by 2025.

The chart highlights the growing share of consumer spending on experiences such as entertainment, adventure travel, and personalized excursions. While spending on basic goods remains essential, the proportion spent on enriching experiences continues to rise, reflecting a fundamental change in traveler preferences. Travel companies must embrace this shift by offering more curated, personalized experiences to capture this growing demand.

Our recent report Direct Bookings vs. OTAs: Analyzing the Shift in U.S. Travel Booking Trends highlights a notable shift towards direct bookings, especially during and after the COVID-19 pandemic. Our U.S. Travel Trends survey shows that before the pandemic, bookings through Online Travel Agencies (OTAs) and direct channels (supplier websites or apps) were nearly equal. However, post-pandemic, travelers have shown a clear preference for direct bookings. About 51% of respondents reported an increase in direct bookings, driven by factors like better prices, exclusive deals, greater control, and more reliable customer service.

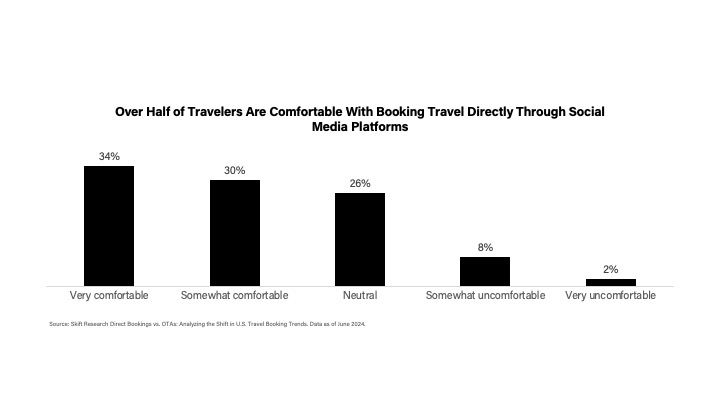

At the same time, social media platforms are becoming an increasingly influential tool not just for inspiration but for actual travel bookings. Our data shows that 34% of travelers feel very comfortable booking directly through social platforms like Instagram, Facebook, and YouTube, particularly younger travelers. Comfort with booking high-priced services, such as flights and hotels, through social media platforms is steadily increasing, reflecting a growing trust in these channels as viable booking options.

This creates an interesting dynamic: while many travelers still prefer the control and benefits of booking directly with suppliers, the convenience and seamless experience offered by social media is becoming a compelling alternative. For OTAs and suppliers alike, this presents both a challenge and an opportunity. By integrating “Book Now” buttons or using targeted ads on these platforms, both OTAs and direct suppliers can tap into the growing trend of social commerce, while continuing to emphasize the pricing, trust, and customer service advantages that make direct bookings appealing.

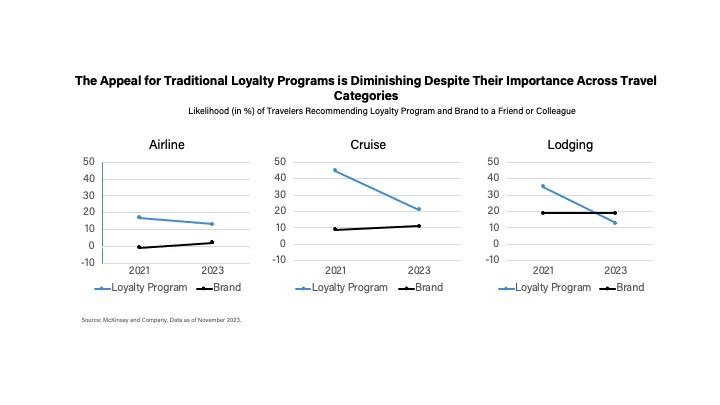

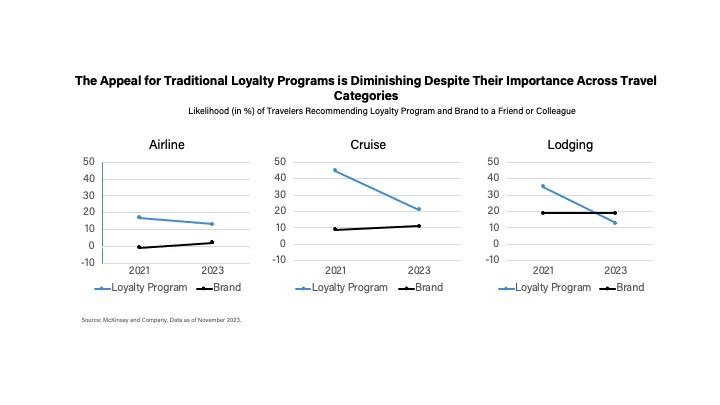

3. Shifting Dynamics in Travel Loyalty Programs

Loyalty in the travel industry is changing, particularly among younger travelers. A study by McKinsey & Company shows a steep decline in the likelihood of customers recommending airline loyalty programs, contrasting with the relatively stable likelihood of recommending the airlines themselves. This suggests that while service quality remains appreciated, loyalty programs no longer hold the same appeal as they once did.

Skift Research’s report Exploring Gen Z and Millennial Travel Habits found that only 9% of travelers join loyalty programs out of brand loyalty, with most opting in for discounted travel instead. This suggests that loyalty is no longer solely about brand allegiance.

This shift is creating new opportunities for travel companies to innovate. The chart on travel loyalty highlights how diverse brand interactions and personalized offers are becoming increasingly important to today’s travelers. Flexibility and value in loyalty programs are now key to retaining customers, and brands that adapt will reap the rewards.

Stay Ahead of the Trends with Skift’s State of Travel 2024 Report

These are just a few of the trends covered in Skift’s State of Travel 2024 report. Download the State of Travel 2024 report for free today.