Jobs

Trump plans to gut EV policy: What it might mean for jobs, auto industry, made in America

- Trump promises stiff tariffs vs. China and Mexico, may nix federal funding behind U.S. EV plants

- Tens of thousands more U.S. auto jobs now vs. 2019, pre-COVID

- Anti-EV talk may be bluster, but the poison pill is whether it becomes part of MAGA platform

- First-term flashback: Coal lobbyist in charge of EPA, hobbled EV tax credit, mpg fines frozen

Former President Donald Trump once owned a Tesla Model S, and in the course of this year’s campaign has made plenty of disparaging comments about EVs at rallies in the run-up to the 2024 elections.

Yet he has a fan base inside the world of electric cars. Tesla CEO Elon Musk endorsed Trump for president in July. In turn, in August, Trump called Musk “a brilliant guy” and first said that he would consider naming him to an advisory role or cabinet job.

Trump may see Musk, who has been highly successful in creating a global automaker by making EVs, as an ally in a future administration—specifically as the leader of a commission on government efficiency.

Giga Texas opening – Elon Musk

Perhaps that’s been inspired by Musk’s massive job cuts at X (formerly Twitter), and at Tesla, where Musk nearly fired the entire Supercharger team earlier this year. Trump has called Musk “the greatest cutter.”

But it sows confusion among some who wonder how the former president stands on the future of the EV industry. With statements and actions often in conflict with one another, what will a second Trump presidency actually mean for EVs?

What Trump has said and done about EVs in the past

Trump’s first term corresponded with a time in which most U.S. and European automakers were pivoting from initial “compliance car” EV efforts to serious long-range EVs that cast a much wider net. Meanwhile many Chinese automakers were pivoting to EVs, and China made no secret about nurturing strong global automakers while building out a supporting clean-energy infrastructure.

Trump hasn’t had a well-defined platform—then or now—regarding clean energy, transportation, or the auto industry in the same way as President Joe Biden (or, by extension, Vice President and current presidential candidate Kamala Harris). Trump has insisted that there is a “much smaller market” for EVs and plug-in hybrids than what’s been projected, because of these vehicles’ cost and range. He’s been critical of legacy automakers pivoting to EVs—including sharp criticism of GM’s plan to go all-electric, with claims that going all-EV is “not going to work.”

GM CEO Mary Barra – Photo by Steve Fecht for General Motors

In late 2019 Trump effectively nixed an extension of the tax credit for Tesla and GM, which had already reached their 200,000-vehicle caps under the former framework. Trump also froze fines for fleet fuel-economy violators, after his administration lost a court battle to roll the fine amounts back—another move that indirectly likely suppressed the EV market.

There’s been no about-face to a clean-energy economy. In July, Trump reportedly asked oil and gas CEOs for a $1 billion campaign donation in exchange for scrapping EV policies, halting wind energy expansion, and derailing other clean-energy policies that the industry opposes.

The oil industry was reportedly not as excited about this as the campaign had anticipated. If Trump were seeing the industry as it were decades ago, he might have been startled to be reminded that today it’s complicated. Today’s diversified multinational energy companies have invested deeply in solar panels, energy storage, and charging networks, with wells and refineries and combustion only part of the business.

Uber and BYD

Trump promises tariffs on China and Mexico

One thing Trump stands for once again—and his administration is likely to follow through on—is tariffs. Trump in March promised a 100% tariff on Mexico-built Chinese cars, whether they were EVs or not, and he said that if Chinese automakers decide to build their vehicles in the U.S., “they can’t send Chinese workers over here.”

Since originally announcing that, the Biden administration has stepped up with sweeping tariff hikes to Chinese EVs, batteries, steel, and more—including a 100% tariff on EVs, although gasoline vehicles aren’t covered. Canada followed with a 100% tariff on Chinese-made EVs, calling them an “extraordinary threat.”

China aside, Trump has clearly reiterated that his administration will have policies that “punish” companies that ship jobs to Mexico—indicating he may seek a further dismantling of what was originally known as NAFTA. Under that policy signed into law by President Clinton and started by President George H.W. Bush with a push by the Reagan administration, automakers have over the past 30 years set up shop in Mexico to take advantage of lower labor costs to build vehicles and parts for the U.S. market.

BMW Group Plant San Luis Potosí in Mexico

Jobs: Would Trump maintain Biden gains?

First, let’s take a look at how Trump policy affected the auto industry in the previous term. According to Harvard University data, the U.S. lost about 75,000 manufacturing jobs during the Trump administration.

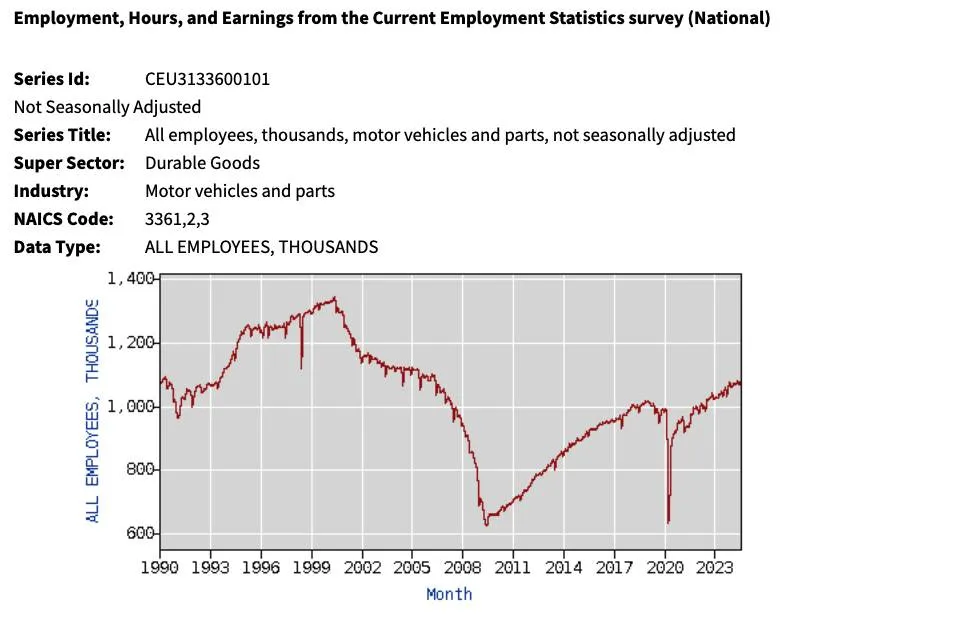

Trump has repeatedly claimed that during his term auto sales and manufacturing were at record levels. According to the U.S. Bureau of Labor Statistics (chart below), motor-vehicle-related manufacturing employment and earnings gained slightly during his administration, but in looking at the broader trendline they signaled a leveling-off after a steady, strong recovery that had persisted since the 2008-2010 auto industry financial crisis.

It’s not all bright and shiny for the Harris campaign. The same federal agency did, this past week, point to a sharp loss of manufacturing jobs, with 24,000 lost in August. But it’s unclear how many of those are related to the auto industry.

By annual averages, again according to the federal government itself, there were 993,500 people directly employed by the industry in 2019—the last full year before the arrival of what Trump termed in formal White House releases “the China Virus,” COVID-19. In 2023, that number was 1,040,500, and it’s set to be significantly higher in 2024.

Auto industry employment over time – federal government

China’s significant gains in the auto industry on the global stage, and especially the EV sector, happened during the Trump Presidency. But the Biden administration has acted to catch up; an analysis from EDF in March found that U.S. EV manufacturing investments are outpacing those made in China in the period of 2021 to present.

According to a new report from the Environmental Defense Fund (EDF) out last month to coincide with the second anniversary of Inflation Reduction Act passage, U.S. investments in EV manufacturing have reached $199 billion, with 63% of that coming since the 2022 law. That’s brought 201,900 EV-related U.S. jobs, with 931,000 more jobs for the broader economy.

The investment hasn’t entirely been for new plants either. The DOE in July announced that $1.7 billion is going “to support the conversion of 11 shuttered or at-risk auto manufacturing and assembly facilities across eight states.”

According to the political organization Climate Power, Biden administration policies have directly created tens of thousands of jobs beyond automakers and battery firms and includes $100 million for small- and medium-sized auto parts makers, as part of a grant program enabled by the Infrastructure Law.

![ExxonMobil oil refinery, Baton Rouge, Louisiana, by WClarke [CC BY-SA 4.0] ExxonMobil oil refinery, Baton Rouge, Louisiana, by WClarke [CC BY-SA 4.0]](https://images.hgmsites.net/lrg/exxonmobil-oil-refinery-baton-rouge-louisiana-by-wclarke-cc-by-sa-4-0_100641388_l.jpg)

ExxonMobil oil refinery, Baton Rouge, Louisiana, by WClarke [CC BY-SA 4.0]

Climate change: Drill, baby, drill

Trump made climate-change denial a core 2016 facet of many policy decisions. He made a pledge to “bring back coal,” and he has suggested that climate change itself is a hoax created by China to hurt U.S. businesses.

Once in office, Trump could appoint another coal lobbyist to head the EPA, and make decisions that make the EPA more vulnerable to a challenge of its ability to regulate EVs as part of fleet emissions rules.

That said, coal is no longer specifically one of Trump’s crusades in 2024. But as experts have recently summed, a Trump administration means rules and regulations that will keep coal plants online longer. Trump has recently ranted about how much land solar farms occupy, and has for years expressed a strong dislike of wind power, at some points participating in misinformation campaigns that appear to have been started by opposing interests. He claimed, for instance, that offshore wind farms kill whales and drive them “crazy”—which brought fisheries specialists at the federal government’s NOAA to issue a fact sheet stating there is “no scientific evidence” whatsoever behind this.

![Per capita global warming emissions by country [Global Climate Budget 2018] Per capita global warming emissions by country [Global Climate Budget 2018]](https://images.hgmsites.net/lrg/per-capita-global-warming-emissions-by-country-global-climate-budget-2018_100682095_l.jpg)

Per capita global warming emissions by country [Global Climate Budget 2018]

But opinions among the electorate are evolving. Trump is also going to need to listen to an electorate on climate-based policies, which are becoming increasingly popular—even with those in his own party. According to a December 2023 CNN poll, nearly two-thirds of U.S. adults say they’re worried about the threat of climate change and 73% favor climate policies. The same poll found that 50% of Republicans think the U.S. “should design federal policies to cut greenhouse gas emissions in half by 2030.”

That’s not how the Republican party has acted in Congress; but it may require some harsh recalibration, as Boomers continue to write policy while more EV-savvy Gen X and Millennials gain more buying power. Last year House Republicans made a symbolic vote to gut the Clean Air Act, while it supported several court cases challenging the EPA and the Department of Transportation over pollution rules. It’s likely yet another challenge to California policy is just around the corner.

A paper from the political organization Climate Power, updated on August 9, found that across the economy, 334,565 jobs were potentially at risk from Trump and an alliance with Big Oil interests.

According to the U.S. Energy and Employment report from the Department of Energy, released last week, clean energy jobs grew at double the rate of overall jobs in 2023. About 75% of these jobs don’t require a four-year degree and, according to data from the Brookings Institution, clean-energy-related jobs can bring an 8-19% income boost.

Climate Power says that about 134,000 of those jobs are in low-income communities and about 52,000 of them are in rural communities. Two-thirds of those jobs are related to batteries, wind, solar, and grids—potentially direct targets that wouldn’t see subsidies with another Trump term.

EV tax credit on shaky ground

Trump said on August 19 that he would consider ending the $7,500 EV tax credit for purchases, but is “not making any final decisions on it,” according to Reuters. Trump also at that time emphasized that “tax credits and tax incentives are not generally a very good thing.”

When he was in office as President, Trump attempted to repeal the EV tax credit or let it lapse, although he didn’t have the support of Congress—and it may take that even to pull back on the more controversial pieces like the EV leasing loophole that subsidizes imported vehicles and luxury EV leases.

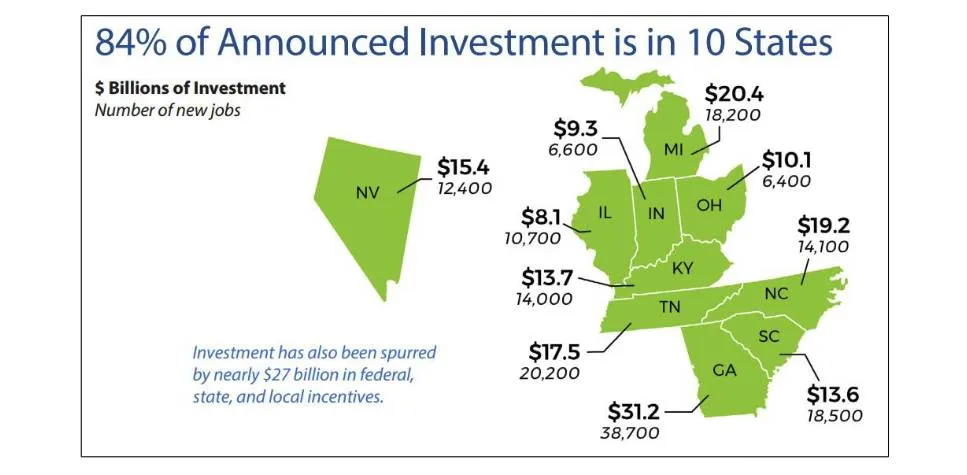

IRA EV investment focused in 10 states

Turning Red over the EV future

Trump’s plan to dismantle Biden’s EV-focused policy may be a hard pill to swallow for the Southeastern U.S., as the manufacturing push and corresponding buildout of the supply chain to create jobs making electric vehicles has especially benefited “red” states.

As EDF pointed out, 84% of the announced investment has been made in 10 states, from the traditional heart of the auto industry in Detroit down to the new one closer to Atlanta—including Georgia, North Carolina, South Carolina, Tennessee, Kentucky, Ohio, Illinois, Indiana, and Michigan, as well as Nevada. Climate Power also points to Texas as a hub for investment.

By 2027 U.S. facilities will be able to make 5.8 million new EVs annually, roughly equating to about 36% of all new vehicles made in 2023. Many of those can be exported, too.

What happens to America’s EV transformation if Trump wins?

If Trump wins, the IRA spigot won’t instantly get shut off, and Republican politicians in states that have gained billions from EV development and jobs won’t suddenly start playing along with everything Trump wants. They won’t refuse approved federal economic investment in their states. A second Trump term may instead become an antagonistic chipping-away of federal funding and programs that started with the infrastructure bill and IRA, rebranding what’s left and trying to save face with red-state governors.

Mike Murphy, a Republican political consultant who has studied attitudes toward EVs by political affiliation, is part of an effort to try to sway Republicans back toward EVs, and as a new campaign of his focusing on Michigan points out (below), it’s about jobs.

As Murphy points out, without help from Congress—which in this case would likely take a landslide toward Republicans with allegiance to Trump—there’s not anything the President could do to go after ongoing policy like tax credits, or to repeal the massive manufacturing spending that’s part of the infrastructure bill. But it likely would mean a slow dissolution of the most future-proof auto industry jobs.

“He could try to repeal some stuff, and that would be a big fight in Congress on party lines,” said Murphy. And even then, he says, some of the Republican governors in states that have benefitted big from the policy might stand up against dismantling it.

More likely, a Trump administration could simply stand in the way.

“While a lot of the money that’s been appropriated is already in the pipeline, one thing you can do when you’re the administration, you control personnel,” he said. “So there are people at the Department of Energy and the Department of Transportation who review and give grants…. He could not fill those jobs or fill them with hostiles so it sits there in a zombie state, which is not infrequent in the policy debate.”

In that case, state applications for National Electric Vehicle Infrastructure (NEVI) funding—toward Biden’s national EV charging network—might, for instance, stack up and not be acted on.

Murphy also points out that California in 2026 is the other wildcard, and California’s electric vehicle mandate, imposed since outgoing governor Gavin Newsom has been in office, might become a potential liability in a race.

Meanwhile, Trump’s eagerness to weaken EPA authority might effectively give automakers a “gift” they didn’t want, interfering with long-term competitiveness on a global stage and versus China.

President Donald Trump (Photo courtesy DoD)

The MAGA EV “poison pill”

Which brings the story back to Elon Musk, who has been mooted as a member of a future Trump administration.

Musk is the CEO of a company that has benefited handsomely from the EV tax credit, its domestic assembly requirements, and Biden EV policy. Trump has repeatedly said in the past that EVs “are all made in China,” omitting that Tesla makes hundreds of thousands of EVs in the U.S., including many for export.

Murphy called polling on Musk “fascinating,” and notes that while Musk leads an automaker that sells the most EVs in the world, he’s “well-liked by EV skeptics on the right.”

“So he could be Nixon to China and he could really open up Republican minds to EVs, which is the number you have to move more than any other if you want to get to 50% EVs.”

Elon Musk at Tesla Model 3 reveal

Musk has in several different contexts, in recent years, questioned the role of EV subsidies, and more recently said that he doesn’t want them.

Murphy sees that as clever and likens it a bit to when Philip Morris had the majority of the market share and argued to Congress in favor of a ban on tobacco advertising. Tesla still had more than 55% of the U.S. EV market in 2023, although it’s been losing ground each year. Meanwhile, Tesla does rely on subsidies for revenue, especially in Europe, in the form of traded carbon credits.

Musk, too, has sullied his reputation as an EV innovator with often ill-advised statements—particularly on X, which has become a gathering place for the far right and a megaphone for Musk’s own theories about citizenship, reproductive rights, gender, and gender equality. Sales of EVs in California have dropped markedly in the period since Musk took over X, and it is clear from posts on his own social media site that many former Tesla fans have dumped the brand because of his politics.

Earlier this year, the marketing analysis firm Caliber noted that Tesla’s “consideration score” had fallen to less than half its November 2021 high, citing Musk’s reputation as having a significant impact. July polling results from CivicScience suggested that consumers’ opinion of Musk was directly affecting vehicle purchases, with significantly more within the EV base choosing not to buy a Tesla as a result—versus those who decided to buy one because of Musk.

Despite those indicators piling up, in June, Tesla shareholders solidly approved a pay package for Musk expected to amount to $56 billion.

Given Musk’s involvement in the industry and social-media chumminess with the candidate, Trump might choose to tone it down. Or he may not.

Teaser for Trumpchi GA4 debuting at 2018 North American International Auto Show

Because of that and how transactional Trump is, Murphy argues, the rhetoric isn’t always going to be the policy and Murphy does suspect Trump is bluffing with some of the EV bluster.

“The other thing is Trump could keep railing about EVs and have copycat Republican politicians rail about them, and that has a poisoning effect on the market—if you convince that plurality of the market that electric vehicles are never to be bought,” Murphy said. At that point, Musk might have little recourse for signing on.

Murphy recently did a poll of American voters with a household income of $50,000 a year or higher—representing about 99% of potential new-car shoppers and two-thirds of the Presidential year electorate. Of those, 40% identified as Republican; 36% identified as Democrat, and more than 20% independent.

“So Trump could keep fanning that fire,” he summed. “That’s bad news for people who want to make EVs and sell them in North America.”

Factory Zero – GM Detroit-Hamtramck revamped for EVs

A choice: The EV economy or the ICE one?

If Trump follows anywhere close to the same playbook, he will eliminate or obscure policy that incentivizes EVs while providing talking points that dissuade and disincentivize.

Despite all the talk about imports, exports, and making products in the U.S., that may lead to more EV production being pushed elsewhere.

Green Car Reports has attempted to get executives to comment on whether such Trump policy may actually lower vehicle prices, as the campaign has claimed in the past, but multiple executives we’ve spoken with on the matter in recent weeks have summed, off the record, that it amounts to wild speculation and there isn’t currently a Plan B if manufacturing locations suddenly need to be shifted again.

2025 Polestar 3 production at Volvo plant near Charleston, South Carolina – Aug. 2024

Meanwhile, there are few if any auto industry executives who will argue that the ICE market is anything but a legacy business—and that it’s not a matter of if new gasoline vehicle sales will be phased out, but when. If states are no longer sitting on piles of IRA cash and plants ready to ramp up EVs are shuttered, what incentive is there for automakers to spend hundreds of millions each to repurpose them for ICE production for only a few years?

So effectively, under Trump, companies might get caught in an inefficient, unproductive, frustrating space—in which it would be too expensive and impractical to revamp plants to make internal combustion models again for a few years, and too expensive to import many types of vehicles from elsewhere.

Will Trump policies lead to lower-priced vehicles and more choices, or will it lead to an uneasy state of the industry with higher price fluctuations?

Partly, with Trump, it may be a matter of seeing through the screen, in delivering what he thinks his base wants to hear versus what he will choose under advisors and a cabinet who wish not to be “fired.”

Although it’s still unconfirmed how deeply Vice President Harris plans to stand behind Biden’s manufacturing-focused clean energy policy, Americans have a choice, and that choice is increasingly looking like two different economies that couldn’t be more different.