Bussiness

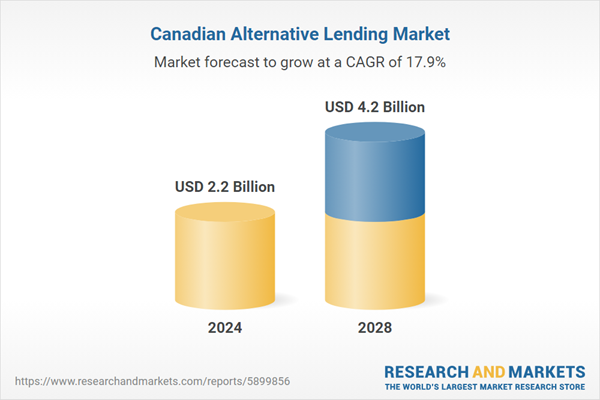

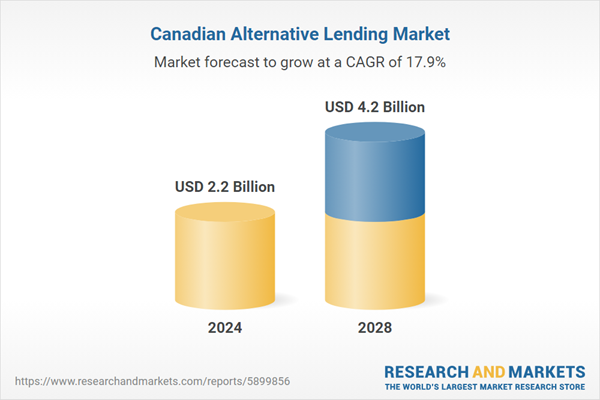

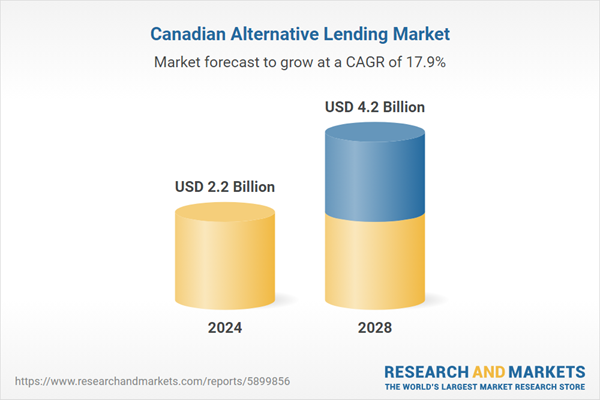

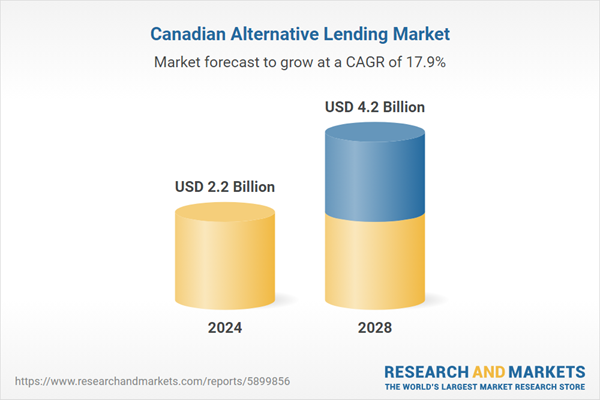

Canada Alternative Lending Business Report 2024: Market to Grow by 26% to reach $2.17 Billion this Year – Product Launches and Innovations, Regulatory Changes, Mergers and Acquisitions to 2029

Canadian Alternative Lending Market

Dublin, Sept. 27, 2024 (GLOBE NEWSWIRE) — The “Canada Alternative Lending Market Business and Investment Opportunities Databook – 75+ KPIs on Alternative Lending Market Size, By End User, By Finance Model, By Payment Instrument, By Loan Type and Demographics” report has been added to ResearchAndMarkets.com’s offering.

The alternative lending in this region is expected to grow by 26.0% on an annual basis to reach US$2.17 billion in 2024. Alternative lending adoption is expected to grow steadily over the forecast period, recording a CAGR of 17.9% during 2024-2028. The alternative lending market in the country will increase from US$1.72 billion in 2023 to reach US$4.20 billion by 2028.

This report provides a detailed data-centric analysis of the Alternative Lending industry, covering market opportunities and risks across a range of industry categories. With over 50 KPIs at the country level, this report provides a comprehensive understanding of Alternative Lending market dynamics, market size and forecast, and market share statistics.

Medium to long term growth story of alternative lending in Canada remains strong. The Canadian alternative lending sector is set for continued growth, driven by increased demand, innovative product offerings, strategic partnerships, and supportive regulatory changes, all contributing to enhanced access to credit and competition in the market.

Growth in the Alternative Lending Sector

Alternative lending in Canada has seen a mix of trends. While the largest alternative lenders experienced two consecutive quarters of asset decreases under management, the alternative lending segment continues to grow and fill gaps left by traditional lenders.

Alternative lenders in Canada can benefit from increased demand for debt capital. Private lenders can offer flexible debt capital to borrowers facing limited financing options from banks.

Key Developments in the Alternative Lending Sector

Product Launches and Innovations

Fig Financial’s Digital Personal Loan Service: Fig Financial has introduced a fully digital platform for personal loans, allowing Canadians to apply and receive approvals in under ten minutes. This service aims to simplify the borrowing process and provide an alternative to traditional banks, especially for those facing financial challenges due to inflation and job insecurity.

New Offerings from Various Fintechs: Several fintech companies have expanded their services, focusing on enhancing customer experience and accessibility. These innovations often include online platforms that streamline the application process and offer competitive rates compared to traditional lenders, catering to a growing demand for flexible lending solutions in the current economic climate.

Mergers and Acquisitions

On March 26, 2024, Fairstone Bank and Home Trust Company announced a merger to create the leading alternative lender in Canada, serving over 2 million customers through more than 250 branches nationwide. The combined entity will offer a diverse range of financial products, enhancing competition and access to financial services for historically underserved populations in Canada.

Regulatory Changes

Key regulatory and government policy developments in the Canadian alternative lending sector include:

Criminal Interest Rate Reduction: The Canadian government has lowered the criminal interest rate from approximately 48% APR to 35% APR, aimed at combating predatory lending practices. This change, part of the 2024 federal budget, also introduces stricter regulations for payday loans, capping the maximum cost of borrowing at $14 per $100 borrowed, designed to protect vulnerable consumers from high-cost loans.

Open Banking Initiatives: The 2024 federal budget proposed advancements in open banking, allowing consumers to share their banking data more securely with lenders. This initiative is expected to enhance consumer-driven banking practices, improve access to credit for underserved populations, and foster competition among lenders by enabling third-party financial service providers to access customer data through secure APIs.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

189 |

|

Forecast Period |

2024 – 2028 |

|

Estimated Market Value (USD) in 2024 |

$2.2 Billion |

|

Forecasted Market Value (USD) by 2028 |

$4.2 Billion |

|

Compound Annual Growth Rate |

17.9% |

|

Regions Covered |

Canada |

Scope

Canada Economic Indicators

Canada Alternative Lending Market Size and Forecast

Canada Alternative Lending Market Size and Forecast by End User

-

End User – Business

-

End User – Consumer

Canada Alternative Lending Market Size and Forecast by Finance Models

-

P2P Marketplace Consumer Lending

-

P2P Marketplace Business Lending

-

P2P Marketplace Property Lending

-

Balance Sheet Consumer Lending

-

Balance Sheet Business Lending

-

Balance Sheet Property Lending

-

Invoice Trading

-

Debt Based Securities

-

Equity Based Crowd Funding

-

Real Estate Crowd funding

Canada Alternative Lending Market Size and Forecast by Payment Instrument – Transaction Value, Volume and Average Value

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Canada Alternative Lending Market Size and Forecast by Payment Instrument to Model

Alternative Lending Market Size and Forecast by Payment Instrument to P2P Marketplace Consumer Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to P2P Marketplace Business Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to P2P Marketplace Property Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Balance Sheet Consumer Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Balance Sheet Business Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Balance Sheet Property Lending

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Invoice Trading

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Debt Based Securities

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Equity Based Crowd Funding

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Alternative Lending Market Size and Forecast by Payment Instrument to Real Estate Crowd funding

-

Cash

-

Cheques

-

Credit Transfer

-

Direct Debits

-

Debit Card

-

Credit Card

-

E- Money

Canada Alternative Lending Market Size and Forecast by Loan Types

-

B2C Loans

-

Personal Loan

-

Payroll Advance

-

Home Improvement

-

Education/Student Loans

-

Point of Sale

-

Auto Loans

-

Medical Loans

-

B2B Loans

-

Lines of Credit

-

Merchant Cash Advance

-

Invoice Factoring

-

Revenue Financing

Canada Alternative Lending Analysis by Consumer Attitude and Behaviour

For more information about this report visit https://www.researchandmarkets.com/r/vt0rwq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900