Travel

China’s Golden Week Holiday: What’s Driving Outbound Travel

Skift Take

Understanding what Chinese travelers want is crucial for stakeholders in the tourism industry to tailor offerings and experiences that match these changing preferences.

Destinations in the Middle East are emerging as favorites for China’s upcoming May Day holiday, commonly known as Golden Week.

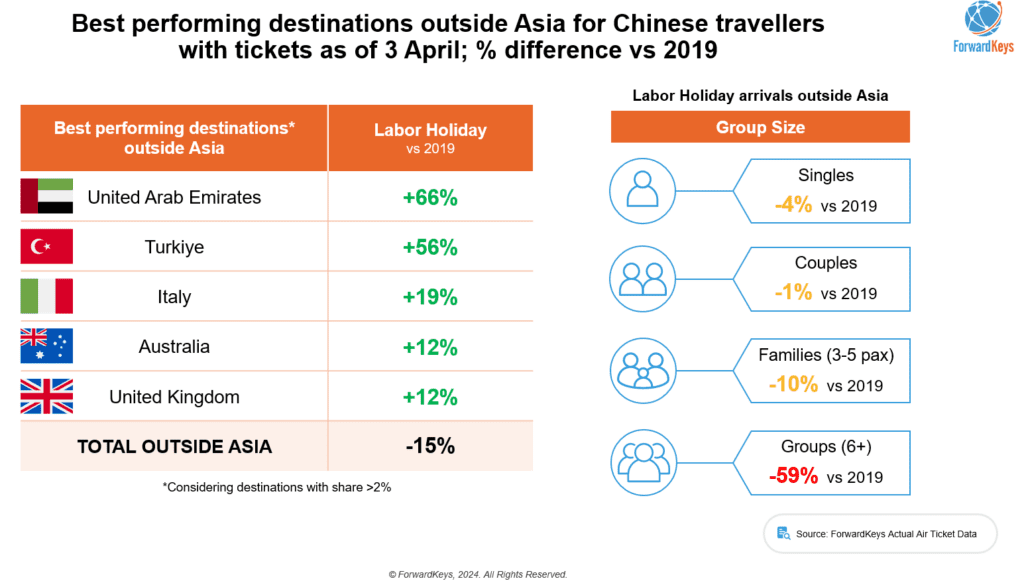

Overall outbound travel from China during this year’s holiday is still lagging behind 2019 levels by 13%. But travel to the United Arab Emirates (UAE) has surged by 66%, and Turkey has experienced a significant growth of 56%, according to ticket sales data from ForwardKeys.

Increased seat capacity from Africa and the Middle East, which is set to expand by 75% in the second quarter, has led to this surge in travel.

Corresponding increases in seat capacity to China have backed the travel growth rates of 56% to Turkey, 19% to Italy, and 12% to the UK.

Last month, Trip.com, China’s biggest online travel agency, announced record bookings in Abu Dhabi, exceeding 57,000 room nights over the past 12 months. From 2022 to 2023, outbound travel orders across all products from Chinese travelers to the UAE surged by more than threefold.

Chinese outbound travel to Middle East had already reached pre-pandemic levels during the Chinese New Year period in February.

Pre-Pandemic Travel Patterns

ForwardKeys anticipates that the May holiday will witness notable travel peaks around April 27 and May 1, closely resembling pre-pandemic travel patterns.

In the Asian region, Malaysia has emerged as the top-performing destination for Chinese travelers, with flight bookings currently 42% ahead of 2019 levels. Because of more lenient visa policies, including visa-free travel to Malaysia and Singapore, and streamlined procedures for South Korea, travel to these destinations is expected to surpass 2019 levels in May.

These findings align with insights from Dragon Trail’s Chinese Traveler Sentiment Report, releasing later on Wednesday. According to the report, visa-free policies, direct flights, and simplified application procedures are also making outbound travel more appealing and accessible.

According to ForwardKeys, a notable shift in passenger profiles is the decrease in group travellers, which has dropped by 53% compared to 2019 levels. In contrast, solo travellers are showing a strong interest in exploring Asian destinations, with a 9% increase.

The Dragon Trail report also highlights growing preference for independent travel among Chinese tourists. Travelers also prefer, semi-self-guided travel and boutique groups of 6-10 people, which offer flexibility and convenience.

Value-Oriented Approach

Along with flexibility and convenience, Chinese travelers are also seeking relaxation and comfort in their trips.

Amidst the challenges posed by the Covid-19 pandemic and China’s economic downturn in 2023, Chinese travelers are prioritizing relaxation and comfort in their trips.

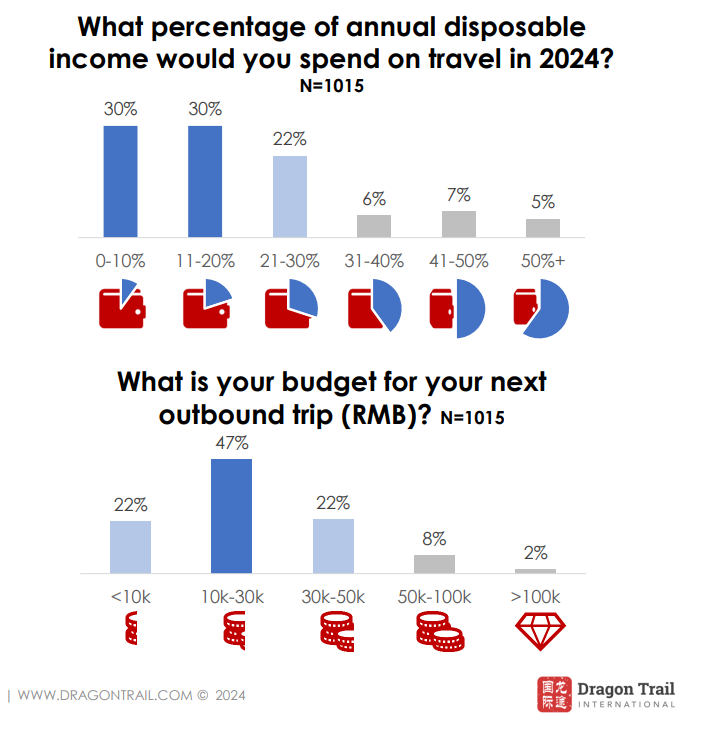

The economic pressures have led to a value-oriented approach to travel planning, with a majority carefully considering their spending to maximize value and opting for affordable travel options.

Around 20% of respondents who said they would not travel outbound in 2024 cite limited income as a barrier. Only a small percentage (11%) are willing to pay a premium for superior products and services.

Most travelers allocate less than 20% of their income for travel, with budgets typically ranging from RMB10,000 to RMB30,000 for upcoming trips.

Despite budget-consciousness, shopping remains an integral part of outbound travel, with more than two-thirds of travelers spending a minimum of RMB2,000 (US$276) per trip. Local foods and souvenirs are the primary shopping categories, followed by cosmetics, clothing, shoes and bags.