Bussiness

Real-Time Payments Help Cure Small Business Healthcare Provider Finances

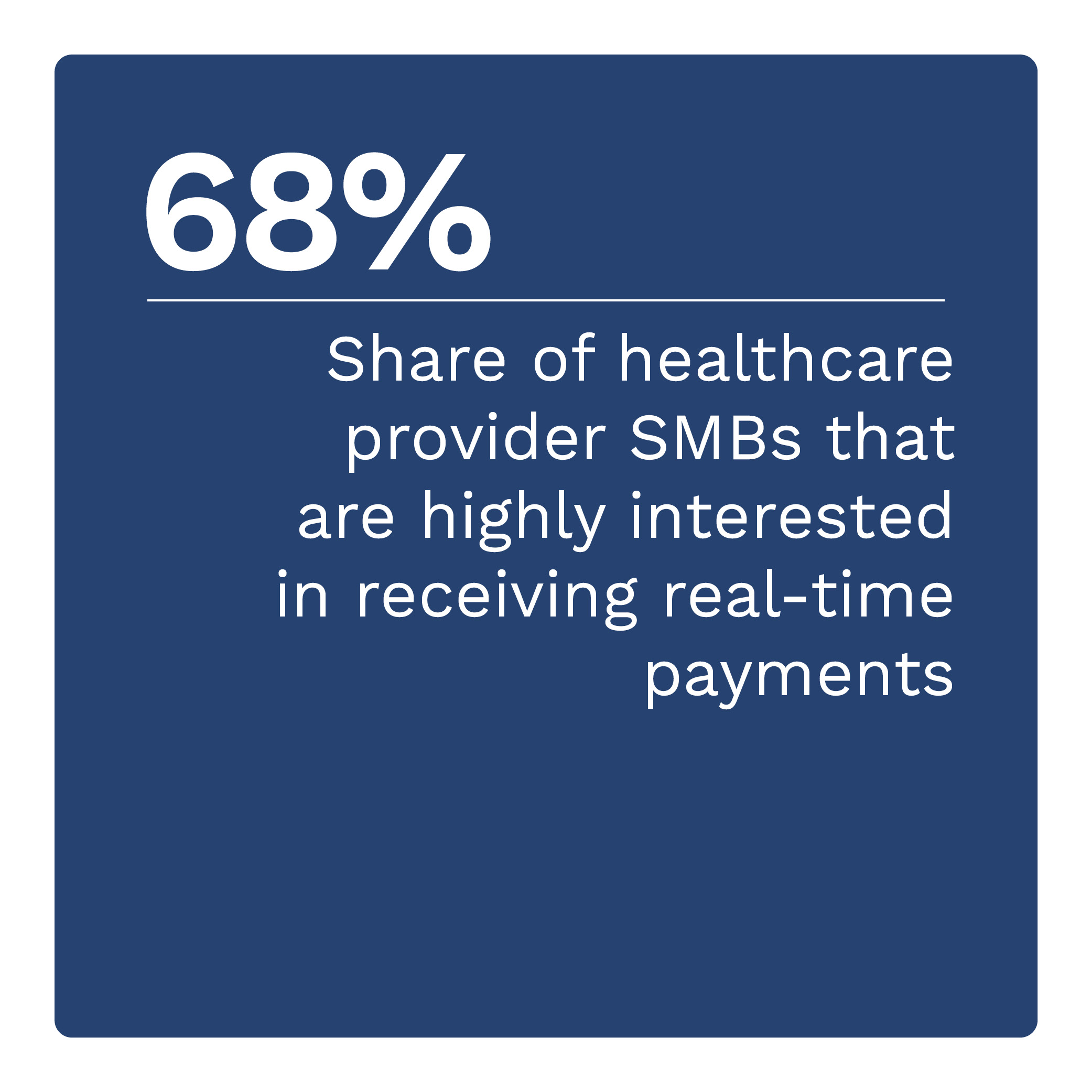

Small to mid-sized businesses (SMBs) in the healthcare provider segment now use real-time payments more widely than other payment rails. PYMNTS Intelligence finds that in the last year, 83% of businesses surveyed either sent or received real-time payments and 57% used real-time rails in both directions.

Moreover, 38% of healthcare provider SMBs identify a real-time payment rail as their most used form of payment. This is more than twice the share that said credit cards or checks were their top method. This usage highlighting a definite preference for instant settlement in the healthcare space.

These are just some of the findings detailed in “Small Business Real-Time Payments Barometer: Healthcare Edition,” a PYMNTS Intelligence and The Clearing House collaboration. This edition examines the use of real-time payments among healthcare provider SMBs, including key factors behind payment preferences. It draws on insights from a survey of 646 healthcare providers annually generating $10 million or less in revenue, conducted from Jan. 31 to March 4.

Other key findings from the report include:

Healthcare provider SMBs that use real-time payments report healthier balance sheets.

The key benefits of real-time payments, including speed, reliability and transparency, appear to lead to healthier balance sheets. Ninety-one percent of healthcare provider SMBs that cite instant PayPal as their most-used payment rail for receiving payments report having very or extremely healthy balance sheets. The same is true for 82% of those primarily receiving instant bank-to-bank payments. Roughly two-thirds of other healthcare provider SMBs say the same.

Firms’ perceived risk of fraud is the top deterrent to adopting real-time rails.

Roughly one-third of healthcare SMBs that did not send real-time payments in the last year cite a perceived increased risk of fraud as a main concern. Nineteen percent name this their top deterrent. The data shows that SMBs in this sector tend to weigh this concern differently depending on their financial scale. The report explores which businesses are most likely to have this misperception.

Roughly one-third of healthcare SMBs that did not send real-time payments in the last year cite a perceived increased risk of fraud as a main concern. Nineteen percent name this their top deterrent. The data shows that SMBs in this sector tend to weigh this concern differently depending on their financial scale. The report explores which businesses are most likely to have this misperception.

A healthcare provider SMB’s primary bank has an outsized influence on using real-time payments.

Healthcare provider SMBs are much more likely to cite a real-time payment rail as their most used rail to receive payments if their primary FI is a national or regional bank rather than a local bank or credit union. This trend is strongest for those using national banks. Fifty-five percent of these healthcare provider SMBs report using a real-time rail. The report details the instant payment rails preferences among this sectors’ SMBs using different types of financial institutions.

Real-time payments can provide many benefits beyond speed. Download the report to learn how healthcare SMBs use real-time rails, including the key drivers surrounding their payment method choice.

:quality(70):focal(958x822:968x832)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/JAEFIIKPTVFAPKJ55WWVVO7HAY.jpg)