Travel

2003: Steep Travel Cuts, Web Dominance and Signs of Life

Setting the stage for business travel in 2003 is a complicated matter. The industry is getting buffeted by so many factors, even major announcements seem like run-of-the-mill occurrences.

Coming off a desperate year for business travel in struggling economy, the build up of military action in the Middle East that culminated in the U.S. entry into the Iraq War on March 19 pushed the industry into the direst of straits. Corporates, already in a minimalist mood regarding travel, held back even more, citing traveler safety and security concerns. Airline finances were reeling.

A U.S. Department of Transportation report showed Q1 operating losses for the major U.S. carriers reached $2.9 billion, with United which filed for bankruptcy in late 2002 accounting for $1.3 billion of that. Airlines managed to cut operating losses to about $450 million in Q2, and some signs of life began to revive business travel in the second half of the year.

While the war seems like it should have had deeper impact, it was little more than a blip in BTN reporting, with travel buyers reporting about a month after the Bush Administration’s initial “Shock and Awe” campaign, that companies were returning to normal business travel operations, even though they were at drastically reduced levels due to ongoing economic uncertainty. Hotel occupancy continued to struggle. Average daily rates were depressed, but all players were angling for whatever business travel volumes were available and supplier efforts to capture market share were fierce.

Of course, the competition wasn’t just with other suppliers. The big competition for managed travel in 2003 was the World Wide Web. The big “www.” continued its rampage into traditional managed travel structures. Hoteliers finally figured out that competing web fares were undercutting negotiated rates in a big way and began to proactively extend lower market rates when they were available. It was tough though. Making those available through the GDS proved an Herculean task, and buyers who had been promised “floating rates” found that they weren’t available in the channels they needed when they needed. Hoteliers pivoted to efforts that guaranteed business travelers woudl get the lowest unrestricted rates regardless of channel and/or enabled web bookings to be credited toward volume agreements. Lots of different strategies tried to bridge the gap.

In the meantime, airlines were grappling with similar issues. American Airlines EveryFare program that incentivized travel agencies to book direct on aa.com gained some traction in 2003. Maritz TQ3 showed 7 percent savings for such fares compared to negotiated rates through the GDS, but the productivity hit absorbed by the agencies to service such bookings and the volume hit to their GDS agreements also became an issue.

But all the distribution dynamics were in play in 2003.

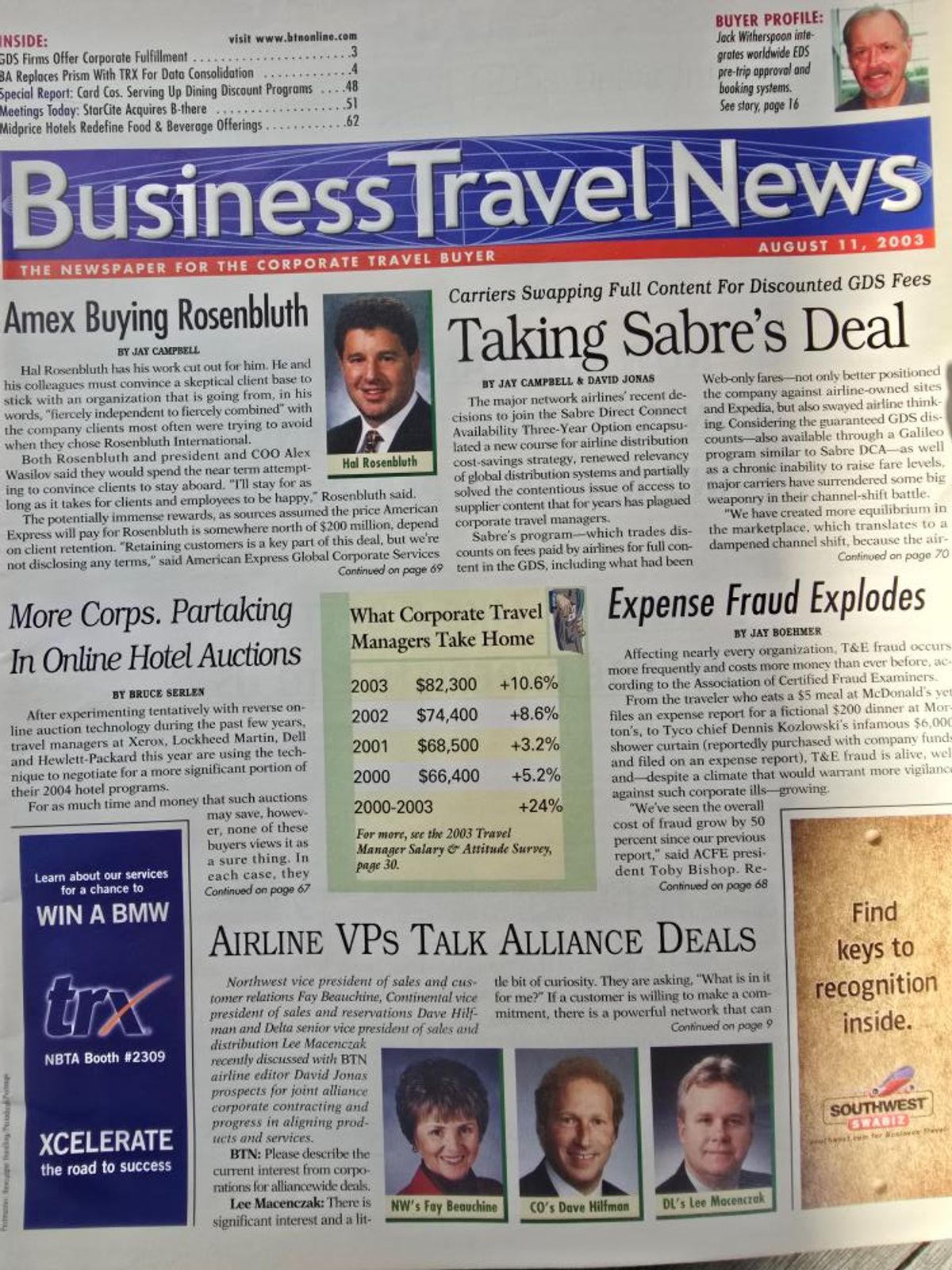

The largest global distribution player Sabre in mid-2002 had rolled out a discounted distribution rate for airlines that would commit to provide full content, including web fares, to the GDS. Only U.S. Airways had taken that deal at the time. Whether it was the desperate financial straits or some other influence that brought the airlines to this table in the first half of the year, I’m not sure, but by August all five of the other major U.S. airlines had taken Sabre up on the Direct Connect Availability Three-Year Option program for discounted distribution fees. The program went a long way to gathering content back into the GDS for a number of years. Though airline dissatisfaction with the configuration would continue and they would champ at the bit for more self determination.

Other agreements were changing as well. One, in particular, was the beginning of a reversal for agencies, and started to show how GDSs, which had suffered from lack of business travel bookings as well (both due to the general downturn but also siphoning of volume to the dot-coms), were eager to get those transactions volumes back through whatever means possible. According to a Sep 24 securities filing, Worldspan

and American Express adopted a new model in which the former pays the

latter for travel segments booked, instead of the other way around as per

standard industry practice. Check out this article from then-BTN distribution editor Jay Campbell.

Another wrinkle would enter the game in 2003 and that was agency technology that became GDS agnostic, enabling agencies to engage with multiple GDSs and not locking them into just one. That capability would increase GDS competition with one another, and it looked like that contest would play out with incentive structures.

BTN had a critical development in 2003 as well, with a young editor named Jay Boehmer joining the ranks. Jay is now the chief editor of The Beat, BTN Group’s subscription channel for distribution and technology news. Don’t forget, there’s an in-person component to The Beat as well. Hope to see you at The Beat Live conference on December 3.

_______________________________________________________________________

.png)

_______________________________________________________________________

U.S.

Department of Transportation OKs Continental-Delta-Northwest alliance but with

hefty conditions. The airlines push back, setting out concessions of their own

that they are willing to follow. Industry is divided on whether DOT should take

action.

Travel managers report that discounted online fares were

beginning to provide transparency into how low hoteliers were willing to go

with rates—informing corporate negotiations at least for key properties in key

markets.

Airlines continue to search for what the industry called

“fare rationalization.” United dropped walk-up coach fares by as much as

40 percent to, from and connecting through Chicago and Denver.

Online check-in processes debut for Delta, Northwest,American and US Airways—in that order. Continental and United were still assessing tech platforms. The tech advancement was an effort to stem

secondary screenings at security and not at the gate; boarding passed become

required.

Hilton and Marriott implement wireless

internet connectivity.

Sabre increases 2003 distribution fees; Worldspan and Galileo wait.

Delta Air Lines and United Airlines resurrect

the carrier-within-a-carrier concept for low-cost subsidiaries. The trend had

sputtered in the U.S. following the Sept. 11 attacks when Delta, United and US Airways each disbanded such strategies. At the same time, some

carriers accelerated service transitions to smaller jets operated by regional

partners in an effort to maintain hub dominance while competing with the likes

of Southwest, Air Tran and JetBlue.

Car rental companies slash non-negotiated rates,

but corporate rates stayed relatively firm, with car rental companies

looking to maximize margin to already-agreed upon pricing even as local and

state taxes—as well as surcharges imposed by airlines for frequent flier

partnerships—added to total daily rates.

While a half dozen vendors in Europe launch solutions for

integrating Web-only content with global distribution systems, General

Electric enables travelers to make direct website reservations with rail

providers and low-cost carriers for fares “not available through the

local GE Travel Centre or its customized Sabre solution GETRes.

InterContinental

Hotels Cancels 2003 Cancellation Fees for meetings booked at hotels in the

United States, Canada and Puerto Rico between Feb. 1 and April 30, 2003, and to

be held before Dec. 31, 2003. The chain said the move was meant to boost

confidence in booking meetings during uncertain economic times and as potential

military action looms in the Middle East. No other major chains follow the

move.

Airline

owners of Worldspan sell the smallest of the global distribution systems

to Travel Transaction Processing Corp. The sale will close in July

but will leave intact close ties to Delta and Northwest airlines.

Sabre’s

GetThere subsidiary shows clients a non-GDS content solution that, execs

said, improved on GetThere’s web fare offering and competitive solutions by

enhancing travel management control of self-booking.

Delta reorganizes its sales organization in the face

of slumping corporate travel in 2003, removing the “district sales” layer and

focusing field sales on regional accounts. At the same time, Southwest,

JetBlue and other low-cost carriers were bulking up sales organizations.

Qantas

joins British Airways in trying to eliminate card costs. It announces it

will impose a 1 percent fee on card payments in Australia.

U.S.

airline carriers are in the brink of disaster as corporates cut travel in a

protective stance against the war in Iraq. UAL corp. liquidation and AMR Corp

bankruptcy are both possible by summer. Several U.S. carriers announce they

will reduce international capacity and warn of domestic service cuts, which

would force travel buyers to find alternatives and modify volume contracts.

London-based Six Continents PLC spun off its hotel and

restaurant businesses. The

hotel portion became know as InterContinental Hotels Group, including InterContinental,

Crowne Plaza, Holiday Inn, Holiday Inn Express and Staybridge Suites extended

stay brands. The spinoff followed a failed hostile takeover bid in February

that would have resulted in the outright sale of the hotel business.

Sabre’sTravelocity and GetThere become

the highest-growth units of the company as revenues from transactions processed

by traditional travel agencies fall.

Northwest Airlines announced it will begin loading

negotiated corporate rates via ATPCO into Orbtiz for Business, if

requested by clients.

Continental-Delta-Northwest

raises eyebrows as it moves forward with domestic alliance while defying conditions

laid out by the DOT; meanwhile United and US Airways continued to align

services, sales, marketing and corporate contracts. DOT also granted American

limited code sharing with British Airways.

As merchant model internet sites eat into hotel

profitability as they undercut corporate and other GDS rates, Hilton,

Carlson and other hoteliers begin to put in safeguards around rates. Hilton

mandated rate parity to all owned and franchised hoteliers and Carlson signed

on to TravelWeb, which emulated merchant sites but was owned by hoteliers as a

clearinghouse for distressed inventory.

US Airways exits bankruptcy after seven months of

court-supervised restructuring.

Sabre adds business fare filing, allowing carriers to

feed negotiated rules and rate formulae directly to the GDS via ATPCO without agents. The process is called Fare by Rule, category 25. Galileo,

which had

offered the capability for over a year says it will enhance its category 25

capabilities.

E-booking providers, like TRX, GetThere and E-Travel among others, push room reservations with in attempt to foster booking for the

whole trip and not just air. Attachment rates for hotel still today in 2024

linger at about 50%

ARC announces a “significant volume” of American

Airlines online traffic shifted to its Direct Connections program,

encouraging what ARC called its “viable” ambition to “be recognized as the

industry’s data store.” Continental, Northwest and three other major U.S.

carriers were participating in the program that enabled settlement and credit

card billing on bookings made outside the GDS.

UAL and Air Canada report progress in

bankruptcy reorganizations as airlines see a

string of positive developments for

the industry, after a “horrific” first quarter, citing airport efficiencies,

reduced labor and increased demand for the upcoming summer months.

Hotels report a rise in occupancy, citing “pent up demand

from business travel” as a major primary factor in rising revenue per available

room, up 2.1% in Q1 and another 1.3% for Q2.

AA’s EveryFare offer, which incentivizes agencies to

book on aa.com, is met with some hesitancy as GDS contracts with incentives

based on volume thresholds deter agencies from fragmenting their booking

channels. Servicing issues also have become evident since the rollout in late

2002. Some

agencies using it, however, say they are saving as much as 7% on AA fares.

Maritz’s TQ3 takes on expense reporting for DaimlerChrysler with back-office responsibilities that include auditing, compliance checks and archiving.

DaimlerChrysler has automated expenses through SAP.

More than 6 months after the conventional end of the annual

hotel RFP cycle, many corporate travel managers were continuing to make

deals—signaling a new strategy for off-cycle negotiations that often included

muti-year deals and hotels eager to secure market share.

AA and Amex launch joint corporate card for midmarket

companies.

ANC

Rental Corp. agrees to sell Alamo and National to Cerberus Capital

Management LP, a private New York investment firm, for $290 million. The sale

culminates the restructuring effort ANC has undertaken since filing for

bankruptcy protection in November 2001.

General

Electric moves the vast majority of its $70

million in Europe-originating travel to a new Carlson Wagonlit service center in Warsaw. According

to a CWT exec, “it’s not for everybody,” citing requirements like streamlined

policy across European countries and at least 30 percent adoption rates for

online booking.

Marriott joins Starwood in displaying total

pricing in the GDS, including tax and surcharge information.

As corporates revive business travel, buyers reengage with

airlines and both sides get creative with deals, pursuing tiered discounts, shared-risk

arrangements and even reverse auctions.

Sabre enhancement enables zone fare loading for

meetings.

U.S. Department of Justice closes its anti-trust

inquiry into Orbtiz and owners United, American, Delta, Northwest and

Continental.

American

Express Global Corporate Services buys Rosenbluth

International for “somewhere north of $200M” according to sources quoted by BTN with Amex confirming that retaining

customers is a big part of the deal.

Five remaining U.S. airlines follow U.S. Airways to Sabre’s

Direct Connect Availability Three-Year Option. Constructed more than a year

earlier, the option trades discounts on fees paid by airlines for full content

in the GDS, including what had been web-only fares. American Airlines was the last to sign.

Seeking to serve the more than $30 billion market for

lightly managed corporate travel, according to its own analysis, Sabre

Holdings launched Travelocity Business after an April announcement of plans

for $5 touchless and $20 agent-assisted transactions

Cendant

Corp.’s Travel Distribution Services division unveiled Travelport a new

company to offer corporate clients ticketing and fulfillment bundled with or

separate from the Highwire online booking tool and the Galileo

International global distribution system.

Association of Certified Fraud Examiners determines

the cost of corporate T&E fraud has grown by 200% since its last report on

the issue in 1996, even in an environment of increased audits and automation.

Buyers continue to include rate loading in their hotel

contracts, with some auditing monthly and at least one demanding refunds for

overcharges at the hotels.

Orbitz again floats agent connectivity, but it’s

predicated on whether the Department of Transportation will let GDS

regulations expire. The company also announces plans for an IPO. (DOT lets GDS

regulations expire in early 2004).

British Airways reduces agency commissions to 1% and

plans an all-out assault on intermediary costs, with sources at the carrier

saying the airline will begin to charge for credit card payment on all fare

types and introducing surcharges for paper tickets. It also says it will unlock

an alternative distribution strategy should GDS negotiations stall.

Buyers revolt as they realize the “floating rates,” the rates

in certain markets that fell below negotiated rates, were not loaded accurately

into the GDS.

Akamai

Technologies sends a market signal as the midsize program shifts its entire program to Expedia Corporate Travel and accesses Expedia hotel rates instead of issuing an RFP.

Company names like Nike in the U.S. and Barclay’s, Pearson

and Telenor in Europe begin publishing

carbon emissions data for business travel; some begin carbon

off-setting projects with select suppliers.

GDS deregulation gets under the microscope as regulations

are set to expire in 2004. The

voice of the industry cites mounting competitive pressures from supplier

websites, merchant websites and newer multi-GDS enabled agency technologies

that have worked to mitigate any monopolistic power of the GDS.

According to a Sep 24 securities filing, Worldspan

and American Express have adopted a new model in which the former pays the

latter for travel segments booked, instead of the other way around as per

standard industry practice.

Negotiators from the United States and the European Union begin

the task of creating an open aviation area spanning the Atlantic and

integrating the world’s two largest commercial air markets. The liberalized

framework provided the beginning of the process that stretched

into 2007 (after a failed agreement in 2005) as the U.S. pushed for more

access to London Heathrow and Europe pushed for cabotage—the ability to fly

between U.S. cities.

Starwood

Hotels & Resorts introduces a new pricing

policy for corporates that guarantees contracted business accounts

the lowest internet rates as provided by retail channels “like starwood.com”

for Monday, Tuesday and Wednesday nights in North America. Buyers remain

concerned about how the company will execute on this and that lower “merchant

fares” still remain.

Hyatt begins crediting corporate clients for

volume purchased directly on Hyatt.com—if they can associate that booking with their

corporate identification number.

Cendant introduces “Corporate Select” program which offers a fixed percentage off the rack rate at 2,300 of Cendant’s 6,000+

properties globally that are selected by the parent company and not requested

by individual buyers.

Air France and KLM Royal Dutch Airline merger makes the joined up carrier the largest in Europe.

Travel management companies deploy multi-GDS interfaces. The

industry begins to see more competitive incentivizing across GDS contracts as TMCs

gain access to multiple channels from a single interfaces.

Sabre’s TMC incentive line item increased by $63Mto $400M in

2003; it estimates in 2004 it will increase by $50 million

again.

TMC

service off-shoring becomes a hot point after Amex began delivering

some standard 24-hour support through the Philippines and tests similar

operations in India. Other intermediaries like Orbitz and WorldTravel

BTI had overseas operations but seemed undecided about potential future servicing

strategies.

Orbitz continues to build on its “for Business”

brand, but buyers using some of the features aren’t yet sold on its

capabilities, called them “the icing but not the cake.”

PNC Financial Services Group radically converts its

travel program, ditching its TMC and moving to a GDS relationship. It enables

travelers to purchase travel the same way they do other commodities and moves

all travel management under procurement as cost pressures mount on travel

programs.

Proctor & Gamble on the other hand outsourced its

travel management to IBM, seeking to reduce costs through grouping up volume.

Over the long term, such strategies provided mixed results.

EU-U.S.

data impasse threatens U.S. Customs and Border Protection the ability to

access passenger name records of European travelers flying to and through the

U.S. Customs began receiving feeds in February 2003 from airlines, but the EU

said the process contradicted European data privacy laws and clearance was set

to expire at year’s end.

NOVEMBER – After delivering three issues in October,either

BTN did not publish in November 2003 or we no longer have a printed record of

those issues.

American Express Corporate Travel Services axes fixed

hotel rates in its consortia program replacing it with the hotel’s “best,

unrestricted rate.” TQ3 follows the move but says it also will retain the

fixed-rate program.

IATA

begins dismantling the numerous barriers it maintains against true pan-European

travel management, with change accelerated by the European Commission,

which surprised IATA by announcing that immunity from prosecution for acting as

a cartel is likely to end May 2004. Among changes are pan-European

accreditation for international travel agencies, scrapping restrictions on

storing ticket stock on corporate client premises and introducing a single bank

settlement plan.

EU

and U.S. come to agreement on passing customs and immigration data for European

travelers.

Orbitz and its airline owners sell nearly 12.2 million shares of the stock for $26 a

share in its long-awaited initial public offering, raking in $316M.

_______________________________________________________________________

Elizabeth West is the editorial director of the

BTN Group. She has reported on the business travel and meetings industries for

24 years. Beth was editor-in-chief of Meeting News from 2006 to 2008 and

director of content solutions for ProMedia Travel from 2008 to 2011, when

ProMedia was acquired by Northstar Travel Media and merged with BTN. She became

editor-in-chief of BTN in 2015 and editorial director of the BTN Group in

2019.

_______________________________________________________________________