Travel

2024 Deloitte holiday travel survey

On the surface, this year’s holiday travel season looks a lot like 2023. Our 2024 Deloitte holiday travel survey found that just under half of Americans plan to travel between Thanksgiving and mid-January, with 19% visiting friends and relatives only, and 30% planning to stay in paid lodging.

But a closer look at the findings reveals a surge in enthusiasm: The average number of trips is set to climb, and more Americans are planning vacations of a week or longer (33% versus 25% in 2023). With more and longer trips, budgets are up as well.

Bolstering these more ambitious plans is an optimistic financial outlook: Nearly half (46%) of Americans say their finances improved over the past year, up from 31% in 2023.An elevated prioritization of travel also appears to be at play: Among Americans with increased budgets, four in 10 say it is because “Travel has become more important to me.” And as they look to spend more, travelers are increasingly leaning into the experience of travel. The share splurging on upgraded airfare or more luxurious lodging climbed significantly. This spend looks likely to find its way to a variety of travel providers, as intent rises across hotels, private rental, air, car rental, and cruise.

While positive trends exist across income levels, higher-income Americans are expected to account for an outsized jump in travel spend: Their share of the traveling public has increased significantly, and 35% plan to take three or more trips, compared with 19% in 2023. And international trips are in high demand—the share of higher-income Americans going abroad for their longest trip of the season has risen to 42% from 29% in 2023.

Young travelers also are showing high enthusiasm. Gen Zers account for 14% of Americans planning trips, up from 8% in 2023. And across generations, millennials have the biggest planned increase in trip spend and frequency, by a significant margin.

As the season approaches, travel suppliers would be wise to remember that with big budgets come big expectations. Ensuring that staff and systems are well-prepared to keep up with demand—even as the season brings its tradition of intense peak travel days—will be as crucial as ever.

Read on for key takeaways and download the full survey findings.

Travel incidence is similar, but other metrics indicate substantial growth

Feeling better about their finances, and placing a high priority on travel, Americans have big plans to be on the go this holiday season. About half plan to travel, similar to 2023. But the average number of intended trips has increased from 1.88 to 2.14. And 64% say they will travel more than once, up from 57% in 2023.

High-income and young Americans are the biggest drivers of travel this season, with 14% of holiday travelers coming from the Gen Z group, versus 8% in 2023 and 45% having household income of $100K or above, up from 38% in 2023.

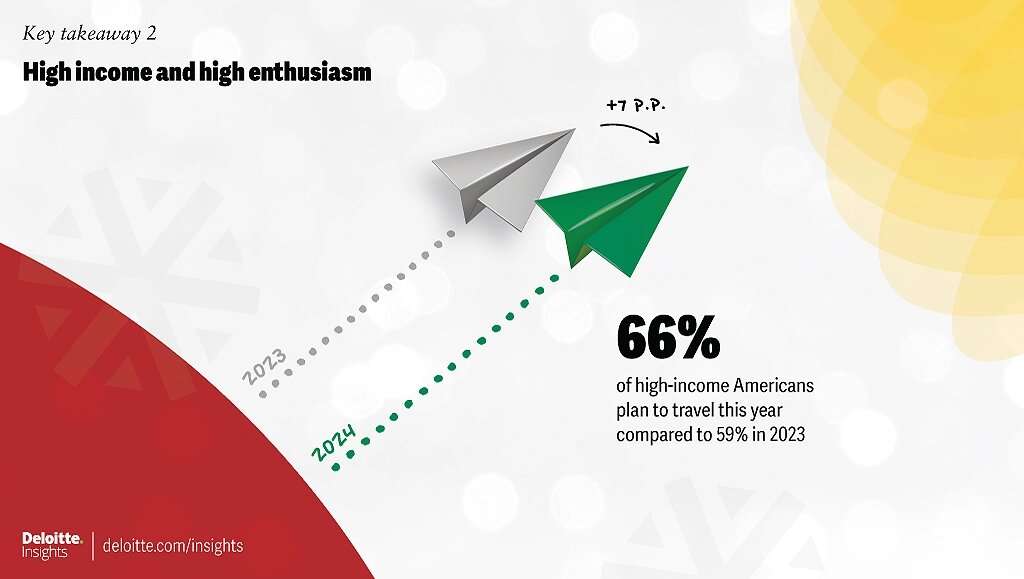

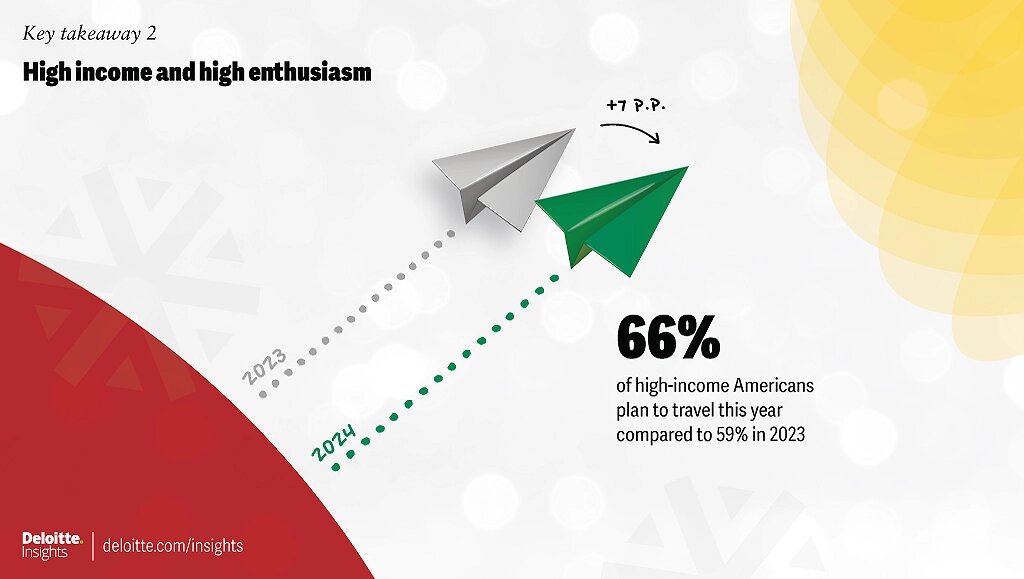

High income and high enthusiasm

High-income Americans continue to expand their travel ambitions. In 2023, 59% of those with household income of $100K or above planned to travel; this year, that number is up to 66%. They are expected to make up over half of paid lodging travelers (52%), up from 43% in 2023.

These wealthier travelers are also ratcheting up their travel behavior compared to 2023, jumping from an average 1.9 trips planned to 2.5, and spending more per trip. Half of those increasing spend cite the growing importance of travel to them personally.

Spend trends up as travel grows as a priority

Spend sentiment is up sharply for the holiday season. The percentage of respondents who plan to significantly increase the budget for their longest trip compared to the previous year jumped to 28% from 18% in 2023. The biggest groups planning increases are millennials (39%) and high-income (35%).

Travelers will spread the extra dollars across their trips, as more plan to book international vacations and upgraded airfare, in addition to upgraded and better-located lodging.

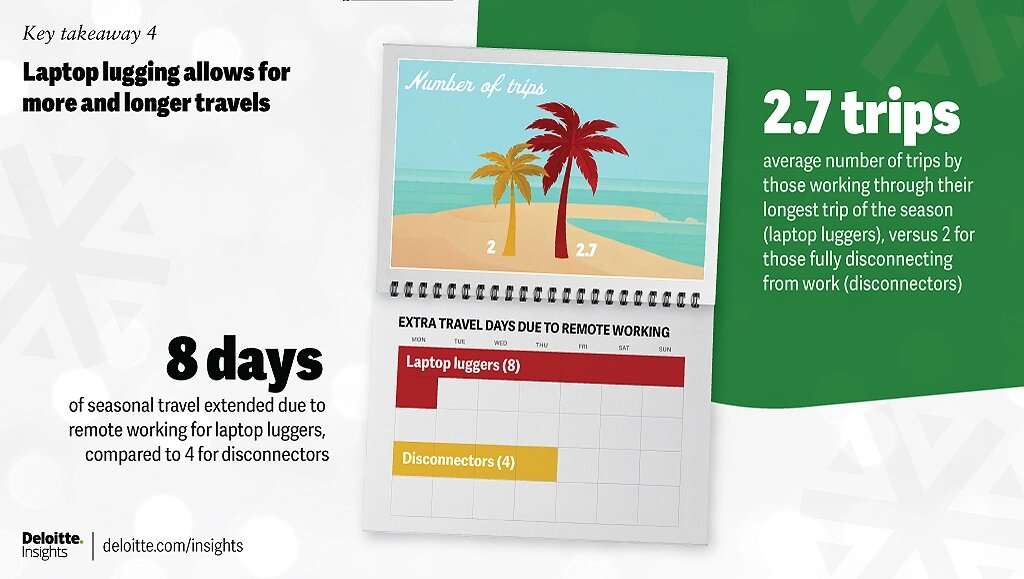

Laptop lugging gets a lift

More than four years after remote work became a widespread reality, the share of travelers laptop lugging—working during their longest trip of the season—rose sharply, to half from one-third. While the high percentage of young and high-income Americans in the traveler pool helps boost that number, this behavior is up across all ages and income groups.

Laptop lugging has big bottom-line benefits for travel providers. These travelers plan an average of 2.7 trips over the holidays, versus 2.0 for those disconnecting. Their trips are also longer, and their budgets are higher.