World

Copper and the Need to Meet the World’s Rewiring Demand for Energy Transition

Avoiding a climate catastrophe and reducing carbon emissions poses significant technical and societal challenges. Transitioning power and transportation systems, in particular, to rely on renewable energy sources will necessitate a considerable increase in copper use, far beyond what current production levels can accommodate.

But the critical question remains: Is the traditionally cautious mining industry committed to producing more copper to meet the world’s rewiring needs?

Copper’s Crucial Role in the Energy Transition

Copper plays a pivotal role in the energy transition due to its exceptional conductivity, second only to silver. While more cost-effective alternatives like aluminum exist, they come with efficiency compromises.

Copper is found in a diverse array of products, from toasters and air conditioners to microchips. The average car contains around 65 pounds (29 kilograms) of copper, and the typical home boasts over 400 pounds.

The construction of more complex grids capable of managing electricity generated by decentralized renewable sources and stabilizing their intermittent supply requires millions of feet of copper wiring. Solar and wind farms, often covering expansive areas, demand more copper per unit of power generated than centralized coal- and gas-fired power stations.

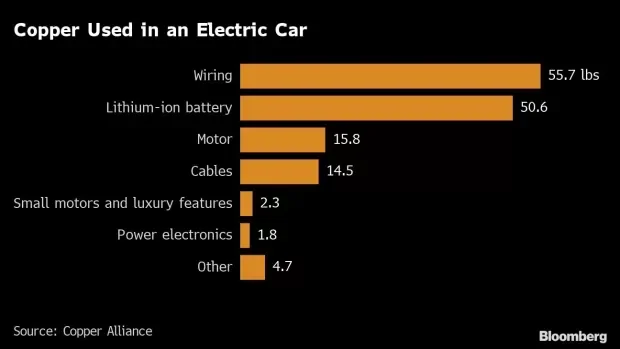

Electric vehicles (EVs) use over twice as much copper as traditional gasoline-powered cars, as per the Copper Alliance.

This electric metal is ideal for making various decarbonizing technologies. Taken together, these clean energy technologies can potentially abate around 2/3 of global GHG emissions by 2050.

Meeting net zero carbon emission targets by 2035 would likely require doubling annual copper demand to 50 million metric tons, as estimated by an industry-backed study by S&P Global.

Even more conservative projections foresee a one-third increase in demand over the next decade, driven by increased investments in decarbonization by governments and businesses. It could grow to almost double by 2035, however, the availability of such significant quantities of copper remains uncertain.

While there is an increase in copper recycling, it’s unlikely to meet the rising demand, leaving mining as the primary source. Although there’s an ample supply underground, boosting output significantly faces several challenges.

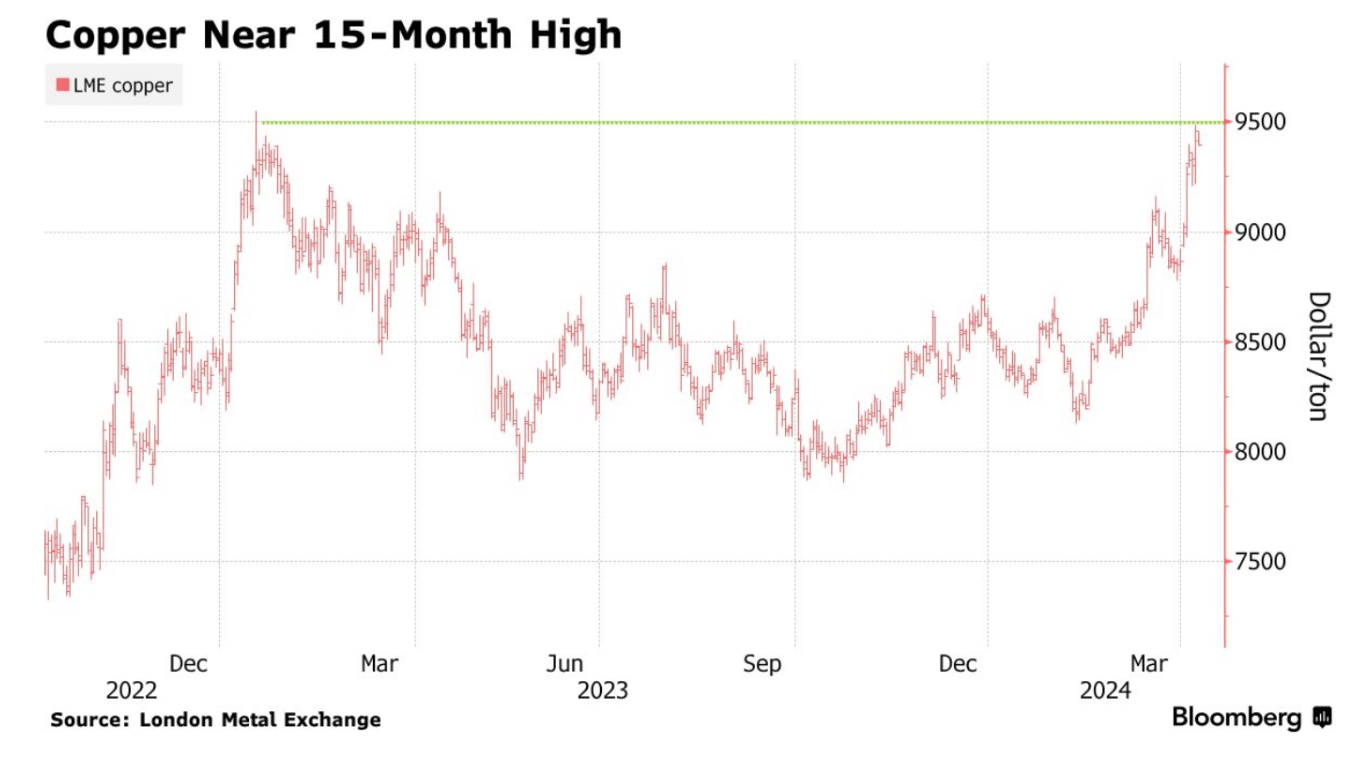

Copper’s fluctuations mirror those of the global economy, rising and falling with industrial production. This makes miners cautious about expanding capacity, fearing a downturn in demand.

Additionally, there’s a fundamental challenge: extracting copper from new deposits is becoming more difficult and costly as ore grades decline, requiring more mining to yield the same amount of metal. Heightened scrutiny of the environmental impacts of copper mining further dampens investment enthusiasm.

Supply Crunch Looms as Demand Soars

A recent copper price rally has sparked speculation among traders and executives about a potential supply crunch. Goldman Sachs Group Inc. estimates that addressing an expected annual supply shortfall of 8 million tons over the next decade would require the industry to invest $150 billion.

However, reaching this level of investment would necessitate copper prices reaching record highs, as noted by Trafigura Group and BlackRock Inc.

Just as oil shaped geopolitics in the last century, access to copper is becoming a crucial economic concern in the present one, prompting governments to vie for limited future supplies. The majority of copper ore is mined in Latin America and Africa, processed locally into a more concentrated form, and then exported to other nations for smelting into pure copper.

China, lacking sufficient domestic reserves, has compensated by acquiring mines abroad and expanding its smelting capacity domestically. While China’s surplus capacity has driven smelting fees to historic lows, the US and its allies are uneasy about Beijing’s influence over such a critical industry.

Consequently, they seek to increase sourcing and refining of essential metals for the energy transition domestically or in friendly nations.

Trends Shaping Copper’s Demand and Future Market

In the event of severe copper shortages, prices would soar, potentially jeopardizing the economics of EVs, smart grids, and renewable energy, thereby impeding their adoption. Clean energy technology manufacturers could mitigate this risk by finding ways to reduce copper use in their products.

Higher prices would incentivize miners to increase production, but developing a new mine takes several years. Even if a surge in demand prompted miners to invest heavily in new projects, it would take about a decade to significantly impact output projections.