Travel

APAC Travel Trends: Why They Book and Where ‘Cash’ Is Still King

Price is the ultimate travel dealbreaker in the Asia Pacific region (APAC), according to a new survey from Indonesia-based travel platform Traveloka. Affordability ranks as a critical factor for travelers across the region when making decisions.

Nearly half of travelers across the region put cost above all else when booking accommodations, with promotions playing a pivotal role in swaying decisions. In markets like Singapore, Indonesia, and Malaysia, budget-conscious travelers are making price the deciding factor, and they’re ready to jump on discounts to explore new destinations.

Australians lead this trend, with 48% putting affordability first, well ahead of considerations like comfort or amenities.

Cost of travel was also pointed out as the primary barrier to selling outbound travel from China, according to Dragon Trail’s Chinese Outbound Travel Trade Survey released in July this year.

Promotions also wield significant influence and are often the top-ranked factor influencing travel decisions in several key markets: 47% of Singaporeans and 39% of Malaysians said they would visit destinations they wouldn’t normally consider if discounts were available.

Conducted with nearly 12,000 respondents across nine countries: Singapore, Indonesia, Malaysia, Thailand, Indonesia, India, Japan, Vietnam and Australia; the survey, in partnership with YouGov, reveals how budget-conscious behavior is shaping travel choices.

The study highlights the challenges and opportunities that price sensitivity presents for travel brands. Domestic travel remains dominant in cost-conscious markets like Thailand and Indonesia, where 70% said they prefer to stay local. Affordable and accessible domestic packages appeal to these travelers, many of whom cite cost and convenience as top priorities.

Digging into Digital Deals

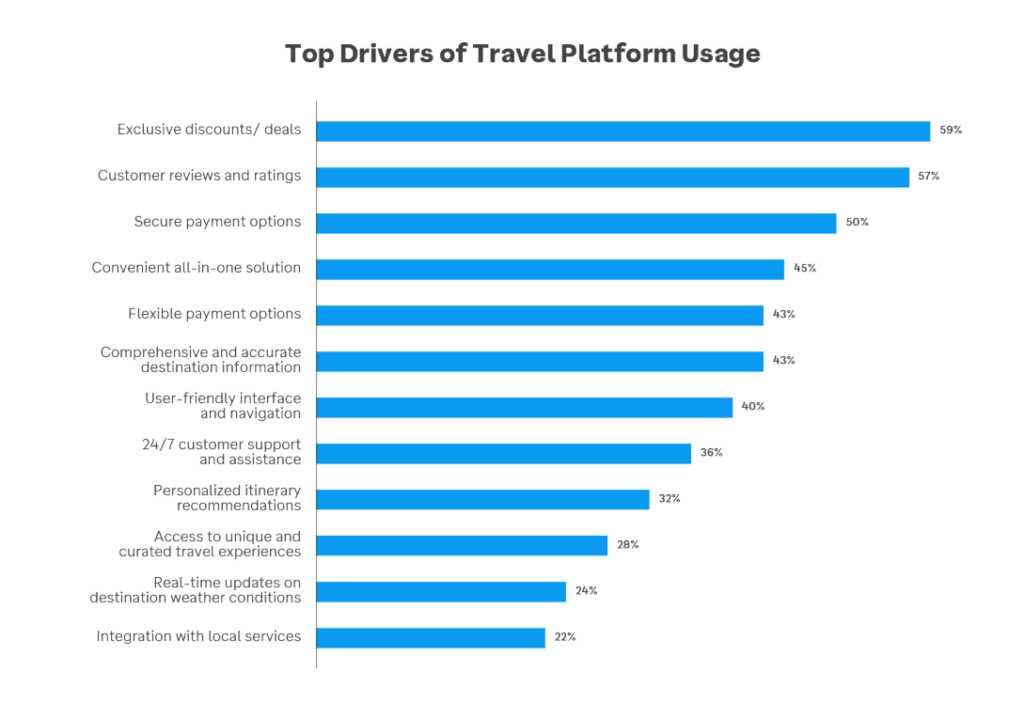

Digital platforms are also emerging as key tools for stretching budgets. In countries like Indonesia and Singapore, 53% of respondents use travel platforms to find deals and compare prices. Trust in technology emerged as a recurring theme, with 83% of respondents across the region expressing confidence in their security and reliability.

However, Japan remains cautious, with only 18% relying on such platforms, instead turning to blogs and navigation apps.

Price sensitivity also clashes with sustainability efforts, as high costs remain a barrier to eco-friendly travel. While travelers in India and Indonesia show enthusiasm for sustainable options, many across the region shy away from them due to perceived expenses.

Across the region, travelers are open to sustainable choices when they are affordable and accessible. According to Traveloka, this presents an opportunity for travel brands to help bridge the gap.

A Trip.com survey released in October had also highlighted that while travelers do think of sustainability they are not too sure of how to act on it.

How Diverse Is the APAC Market?

The findings challenge the long-standing assumption of APAC as a monolithic travel market, instead painting a complex picture of diverse preferences and motivations.

“APAC is bursting with opportunities, but its diversity demands creativity and nuance. Understanding the unique needs of this diverse market is critical for travel providers seeking to thrive in this dynamic travel landscape,” said Caesar Indra, president of Traveloka.

The region’s diversity is evident in the differences in travel motivations. While Singaporeans seek rest, Indonesians prioritize adventurous experiences, and Japanese travelers gravitate toward cultural exploration and wellness. This variance is evident in destination choices: Singaporeans lean toward urban and natural attractions, Indonesians favor mountains and beaches, and the Japanese show a preference for historical sites and spa retreats.

Payment Preferences and Predictions

Payment preferences further revealed the diversity within APAC. Cash reigns in Thailand and Indonesia, where it is used by over two-thirds of travelers. Meanwhile, countries like South Korea and Australia have embraced credit and debit cards, with 84% and 81% usage rates, respectively. The rise of mobile wallets, such as OVO in Indonesia and VNPAY in Vietnam, signals a growing shift toward digital payments in emerging markets.

Traveloka predicts three key trends that will define the future of travel in APAC: the continued rise of domestic tourism, growing demand for sustainable travel, and an expanding reliance on digital tools.

How Brands Can Make the Most of This

As the travel landscape rebounds, brands that understand the budget-conscious mindset of APAC travelers stand to benefit the most. The survey also aims to offer a roadmap for industry players to help them remain competitive while focusing on:

- Personalization: Leverage AI to tailor experiences and target offers.

- Sustainability: Make green options affordable and visible to drive adoption.

- Payment Flexibility: Expand local payment methods to meet varied preferences.

- Promotions: Use data to craft timely and compelling offers for budget-conscious travelers.