Travel

Allegiant Travel Company Stock Fails To Impress: Is There Upside? (NASDAQ:ALGT)

Angel Di Bilio/iStock Editorial via Getty Images

In December 2023, Allegiant Travel Company (NASDAQ:ALGT) opened its much awaited Sunseeker Resort, diversifying Allegiant’s business, which prior to the opening was primarily focused on passenger transport and, to a lesser extent, resort related revenues.

The Company provided its first quarter results on the May 7, 2024, providing some insights in the performance and expectations for the Sunseeker Resort. Results beat analyst estimates by $11.18 million on the top line and beat EPS estimates by $0.12. While results beat analyst estimates, I found the earnings somewhat underwhelming. In this report, I discuss why I was not quite satisfied with the results and update my price target for the stock.

Allegiant Travel Company Is Stuck In A Cost Trap

Total revenues increased by 1% where a $17.2 million decline in airline revenues was more than offset by Sunseeker revenue growth. The new resort, however, is having a challenging start as its opening in December was far from an ideal time to open. While the Sunseeker Resort has potential for Allegiant Travel Company, there is obviously some learning curve involved to find the right ways to market, price, and promote. For the full year, the company is now expected a $15 million EBITDA loss for the resort.

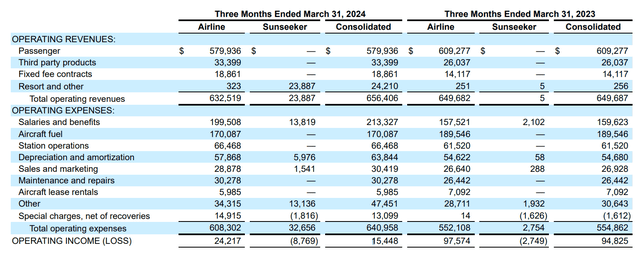

The reason why the results failed to impress me is primarily the performance in the airline segment. While revenues declined $17.2 million, we saw cost increasing $56.2 million despite a lower fuel bill. That was primarily driven by a $42 million increase in salaries. Capacity increased by just 2%, so we are seeing that modest increases in capacity are not quite allowing Allegiant Air to stabilize costs or revenues. Total passenger revenue per available seat mile decreased 4.8% while unit costs excluding fuel increased 18.5%. So, what we are seeing is that due to attrition, Allegiant Travel Company was not quite able to grow its capacity and the company has now increased pay, but it is increasing the cost basis more than Allegiant can seemingly expand capacity without compromising unit revenues and yield.

What Is Allegiant Stock Price Forecast?

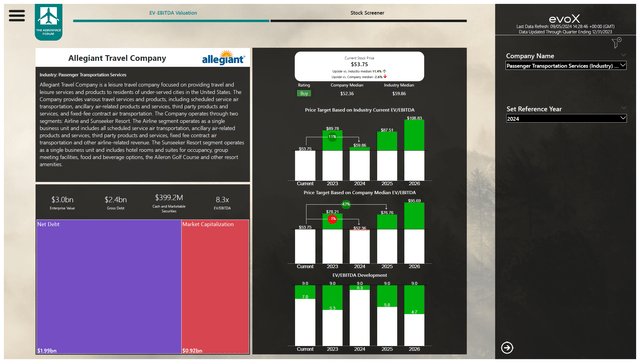

Much of the year will be focused on Allegiant to reducing unit costs, which it hopes to achieve by the fourth quarter, as modest growth in capacity will layer on top of an easier comp. The Sunseeker Resort will be in a ramp up mode this year, and I expect that it will take until 2025-2026 before we will see pricing and occupancy at targeted levels. Based on my expectations that Allegiant will continue to add debt in the years to come to hold a minimum of $400 million in cash and cash equivalents and a wider time range than normal to assess its performance against the benchmark, I am rating the stock a buy with $76.76 price target representing 43% upside. However, the risky nature of the investment opportunity should also be highlighted given the cost challenges faced in the passenger airline operations as well as the learning curve and ramp up for the Sunseeker Resort, making this a speculative buy.

Conclusion: A Challenging Year For Allegiant Travel Company But With Prospects

I believe that 2024 will be all about controlling cost at the airline business while attempting to ramp up the results at the Sunseeker Resort. The Sunseeker Resort does have a lot of potential, but it will take a while before full run rates are achieved. With all risks considered, I believe that Allegiant Travel Company is a speculative buy opportunity with significant upside.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.