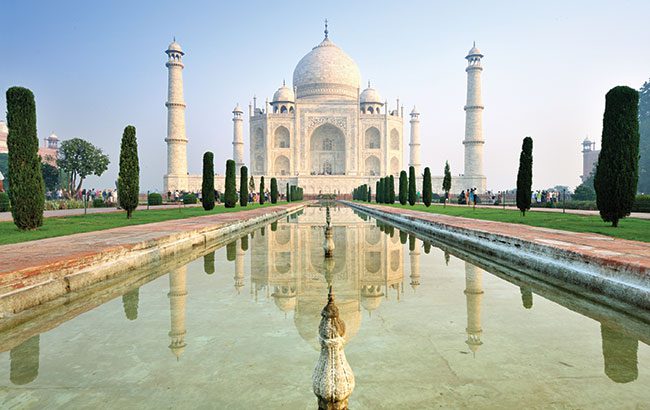

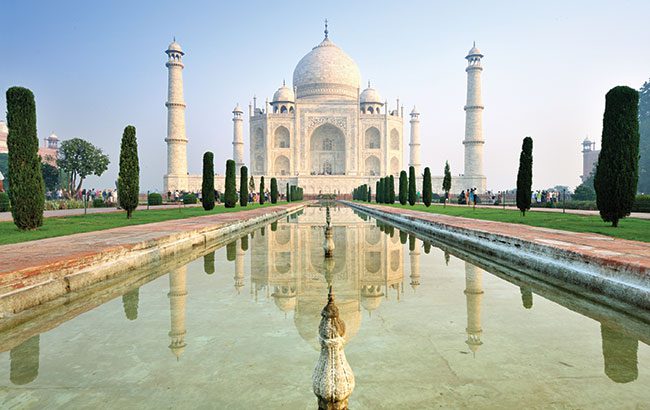

Travel

India to drive travel retail sales – The Spirits Business

The president of the Tax Free World Association (TFWA) believes India will drive travel retail sales in the future.

Speaking during his last TFWA Asia Pacific Exhibition & Conference (12-16 May) as president, Erik Juul-Mortensen discussed the state of the duty free and travel retail industry in Asia Pacific.

In his opening speech for the Singapore show, Juul-Mortensen said the rate of post-pandemic recovery has varied widely across the region.

“Last year, passenger traffic at both Hong Kong and Macau International Airports reached just 55% of its 2019 level,” he continued.

“In Malaysia, 2023 passenger volumes returned faster at 78% of their pre-Covid total. Changi Airport fared even better, seeing 86% of the 2019 passenger count pass through its terminals last year. Mumbai International Airport in India heads the pack however, serving 10% more passengers last year than in 2019.”

Juul-Mortensen believes that India will “drive duty free and travel retail sales across Asia Pacific and beyond for years to come”, and highlighted there were 149 civil airports in the country – double the number it had a decade ago.

“Nine more are approved or construction work has already started, while many others are planned,” he noted. “Delhi and Mumbai are both gaining second airports, and there is even talk of a third one for Mumbai.”

Citing data from consultancy CAPA India, Juul-Mortensen said outbound international departures by Indian residents were predicted to rise from 17.4 million in 2019 to more than 50m in 2030.

He also noted that the region’s passenger traffic would return to 2019 volumes by the end of this year, according to ACI World.

“Longer term, Airbus thinks Asian passenger flows will grow roughly twice as fast as the global average, and two to three times faster than Europe and North America, for the next 20 years,” Juul-Mortensen said. “The indications are for plenty of footfall in airport terminals.”

China remains ‘concern’

In regards to the China market, he said recovery has been slow due to cautious spending.

“Economic conditions today in China are a concern for many duty free and travel retail professionals, with a troubled property sector, weak consumer confidence and lower GDP growth than in recent years,” Juul-Mortensen explained. “The country’s shoppers are understandably cautious when it comes to spending.”

Despite the slower recovery, he cited a report by Bain & Company that said China would account for more than a third of global luxury spending by 2030, up from less than a quarter in 2023.

Juul-Mortensen also highlighted that Korea’s recent introduction of purchase limits and regulations on bulk shipments was an “important step in the right direction”.

Cruise boom

Speaking about the potential of the cruise channel, he said the sector had experienced “impressive growth” from a modest base.

Data from trade body the Cruise Lines International Association forecasts cruise passenger numbers will double between 2022 and 2027 to approximately 40m per year, Juul-Mortensen noted.

He continued: “Asia Pacific accounted for a quarter of those passengers in 2022. This is a sector worth watching in Asia Pacific, especially since cruise passengers spend more on average than air passengers.”

Regarding sustainability, the TFWA president said the sector needed an “industry-wide approach” as it tops the list of traveller preoccupations, and criticised the lack of “coherent labelling or in-store communication”.

He also called on the industry to adapt to consumer preferences and create “engaging activations” to reach travellers.

Juul-Mortensen concluded: “As an industry, we must get a tighter grip on our market through data sharing, and show travellers a more serious, coherent approach to sustainability.”

In the December 2023 issue of The Spirits Business, we explored whether 2024 could be the year the rum category booms in global travel retail.

The TFWA will host its annual flagship conference in Cannes, France, from 29 September to 3 October 2024.