World

Nvidia’s CEO Could Be the World’s Richest Man Sooner Than You Think

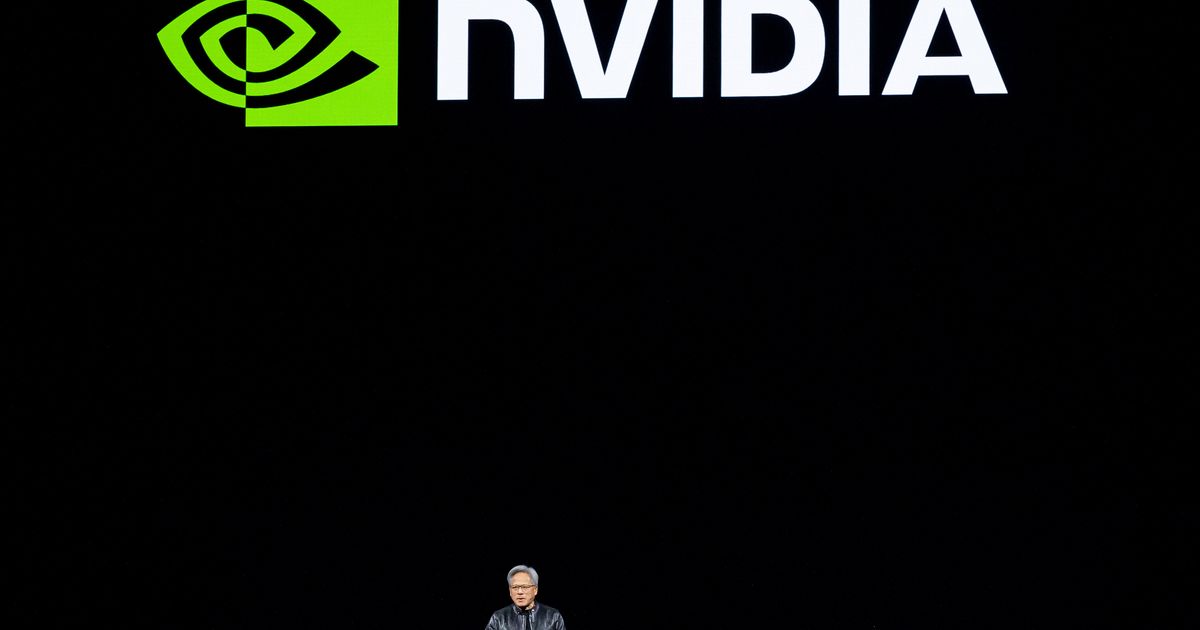

Photo: David Paul Morris/Bloomberg via Getty Images

Jensen Huang, the founder and CEO of Nvidia, has been rich for about three decades, but it’s only in the past few months that his wealth has grown to GDP–of–an–Eastern European–country levels. His company, founded in 1993 in a California Denny’s, manufactures a type of hypercomplex microprocessor that was once the domain of video-game systems but now makes artificial-intelligence technology, with its extreme demands on computer power, possible.

Nvidia is worth $2.6 trillion — larger than two Metas, three Berkshire Hathaways, or five ExxonMobils. Goldman Sachs called it “the most important stock on planet Earth” for its centrality in the booming AI industry, and his company will likely be worth more than Apple in a few months. As of Friday, Huang is the 17th-richest person in the world, with an estimated $91 billion to his name, according to Bloomberg. That’s more than double what he was worth on Christmas. At this rate, Huang — whose public image is far from the flamboyant edgelord tech bro who has become so common among the Silicon Valley’s C-suites — could become richer than Elon Musk by 2025 and his company more valuable than any other in the world. (Or, of course, the stock could stop going straight up, as it did a few weeks ago, since lots of people seem to think it’s gotten way overvalued.)

AI, as a technology, is still pretty uneven. OpenAI’s most advanced public version can pick stocks better than humans, while Google’s new AI-powered chatbot, Gemini, thinks you should eat rocks. (You should not eat rocks.) Huang, though, doesn’t really care very much about that, at least as far as his own personal fortune is concerned. AI software requires a huge amount of processing power, regardless of how right or wrong the actual program’s answers may be, and Huang’s company more or less has the market cornered on making the kinds of computer chips that can handle that. Even the stupidest AI is going to need a lot of Nvidia’s chips, called graphics-processing units.

Since there is such a fervent belief among the Silicon Valley set that AI will one day achieve superhuman intelligence, there’s a tremendous incentive for just about every tech company to make that technology a core part of its operations. Huang’s business, though, is today’s equivalent of selling shovels during a gold rush. Many, if not most, of the companies vying to be the next big thing in A.I. will go bust — and Nvidia will have long pocketed their money.

Huang, a naturalized U.S. citizen born in Taipei, is, in many ways, a lot like other tech CEOs. He has something of a signature look that he trots out during TED Talks and Wall Street presentations and spends his time among his many homes in California and Hawaii. He has also been known to say the kinds of off-putting things that tech CEOs sometimes say, like, “The entertainment value of pain and suffering can’t be understated.” But Nvidia is a truly hard-core technology company — not, say, an advertising business in disguise — and Huang’s engineering expertise is in physical hardware, not code. He is also the product of a Baptist reform school in Kentucky (his uncle reportedly sent him there thinking it was a prestigious academy; his roommate was illiterate and showed off his stab wounds) as well as Oregon State University, where he went to college. (It’s not as if he’s without an elite pedigree, though, since he received a master’s degree in electrical engineering from Stanford University.)

Of course, Huang is not some Silicon Valley outsider, especially now that he is so rich and so many companies rely on his chips. He has touted Musk’s plans to transform Tesla with self-driving technology — a kind of artificial intelligence, after all. Still, it’s been decades since a hardware manufacturer like Nvidia was within spitting distance of being the world’s most valuable company; the days when Intel dominated computing have long been replaced by companies that make splashier consumer-tech products. The reality is that there just aren’t many — perhaps any — competitors that can make the kinds of processors that the coming AI industry will need to operate.

.jpg)