Bussiness

Modine Manufacturing: Great Business Added To My Watch List (NYSE:MOD)

Oselote/iStock via Getty Images

Investment Thesis

Modine Manufacturing (NYSE:MOD) stock has caught fire, rising roughly 270% over the last twelve months. The company is well-positioned to capitalize on the growth in data centers and the need for advanced cooling technologies driven by accelerated computing demands. The AI market is still in its infancy, and I believe that the data center cooling runway is long for Modine. Strategic acquisitions that have doubled the company’s data center cooling capacity and improved its R&D capabilities have me bullish on the business outlook. Modine’s 80/20 strategy, which has the company focused on higher-growth and higher-margin business lines and has improved efficiency and margins in recent years, provides a compelling argument for increased free cash flow margins in the years ahead. With its enhanced operating leverage and high-growth opportunities ahead, Modine’s business looks as solid as ever. However, the stock price may suggest that investors should be hesitant to jump in.

After reviewing Modine’s latest earnings report and several years of reports and transcripts, I see that the company is on the right track. However, I can only add the stock to my investigation list and consider it a hold, pending a more in-depth analysis of its potential free cash flow generation in the years ahead.

Fiscal 2024 Results

Overall Annual Financial Results

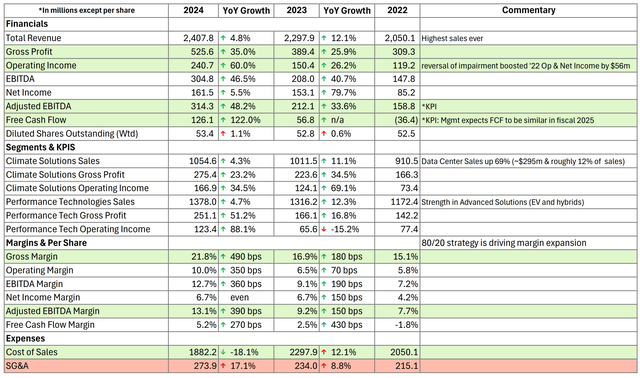

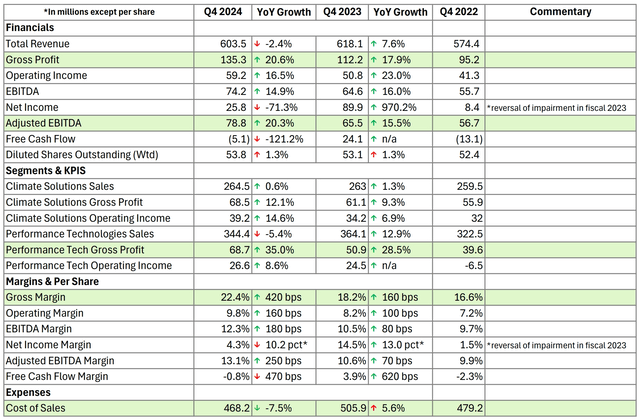

Annual Results – Modine (with key items highlighted) (Author-generated from SEC filings and transcripts)

Modine achieved record revenue in fiscal 2024, but the $2.4 billion in sales is not what impresses me about the company’s execution. Expanding margins is the key to the company’s performance and investment thesis. As we will discuss in more detail later, Modine’s 80/20 strategy is paying off. Adjusted EBITDA increased by 48% to $314.3 million, which amounted to a 390 basis point improvement in adjusted EBITDA margin to 13.1%. Free cash flow improved by 122%, FCF margin expanded by 270 bps, while operating margin expanded by 350 basis points.

Anyone new to Modine should keep in mind that net income and EPS are flawed measures for this company due to the reversal of an impairment charge in fiscal 2022 and a subsequent tax benefit in fiscal 2023. Therefore, pay attention to adjusted numbers if you are looking at the bottom line or EPS. In my opinion, the most important KPIs to follow are its expanding EBITDA margins, operating income margins, and free cash flow margins.

Full-Year Segment Results

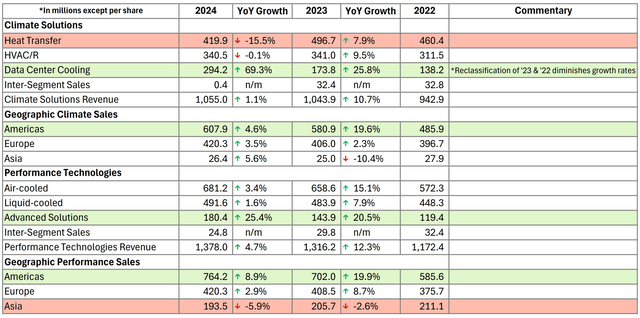

Annual Segment results – Modine (with key items highlighted) (Author-generated from SEC filings and transcripts)

Turning to the segment breakdown, data center cooling sales were the key driver of the 1.1% increase in Climate Solutions revenue. A 69.3% increase in data center sales may be a continued sign of great things to come. Later, we will see the potential market opportunity in this space. The company saw weakness in heat transfer unit sales and stagnant HVAC/R sales. In the Performance Technologies segment, Modine saw a 4.7% increase in sales, driven by its advanced solutions. Americas was the strongest region for Modine, with Europe and Asia somewhat mixed.

Q4 Financial Results

Q4 Results – Modine (with key items highlighted) (Author-generated from SEC filings and transcripts)

Q4 revenue declined 2.4% and missed analysts estimates by $1.9 million. However, the company’s focus on improving operational efficiencies and cost management showed through as adjusted EBITDA increased 20.3% YoY and operating income in both the Climate Solutions and Performance Technologies segments increased 14.6% and 8.6%, respectively. This was accomplished despite a decline in sales Performance Tech sales due to a significant decline in the cost of sales and subsequent gross margin expansion.

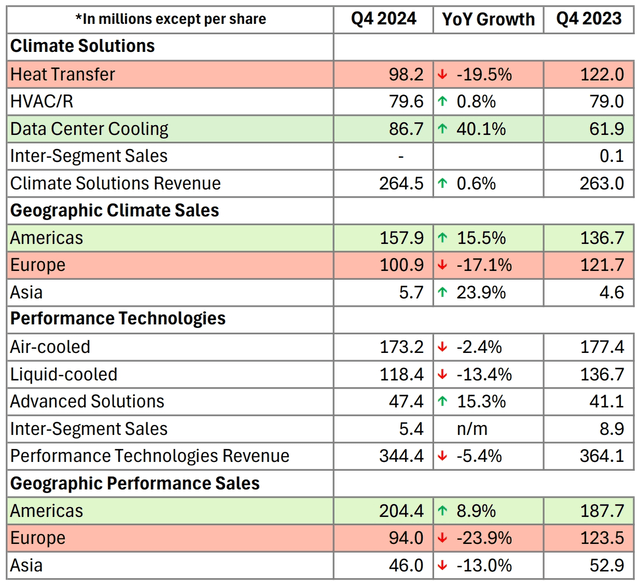

Q4 Segment Results

Q4 Segment Results (with key items highlighted) (Author-generated from SEC filings and transcripts)

Data center cooling was the key driver of the Climate Solutions segment. The Americas segment was very strong, while Europe showed weakness, attributed to weak heat transfer sales.

In the Performance Technologies segment, the advanced solutions were the strong point, with a 15.3% increase in sales, but sales declined 5.4% overall, Europe and Asia dragging down results, while Americas grew 8.9%.

Guidance

Modine expects revenue to grow in the range of 5% to 10%, and adjusted EBITDA in a range of 16% to 22%. This would put sales between $2.53 billion and $2.65 billion, and adjusted EBITDA at $365 to $385 million. This exhibits Modine’s operating leverage and improved efficiency. Free cash flow is expected to be at a similar level when compared to fiscal 2024, which came in at $126 million for the year.

Turning to the Climate Solutions segment, CFO, Mick Lucareli, told analysts that the company expects roughly 60% to 70% data center sales growth in this coming fiscal year. That would bring the data center cooling business to roughly $500 million for fiscal 2025. HVAC/R sales are expected to grow in a range of 20% to 25%, and heat transfer products are expected to grow 3% to 5%.

With a return to significant growth in HVAC/R, continued explosive growth in data center cooling and an eventual turnaround from a significant decline in heat transfer sales, Modine’s Climate Solutions segment appears primed for an incredible fiscal 2025.

In the Performance technologies segment, sales are expected to decline slightly. Modine expects 20% to 30% growth in advanced solutions, a decline in liquid-cooling products (the company has divested from three businesses and sees low-growth in this business going forward), and flattish growth in its air-cooled segment, which is subdued by divestitures with offsetting growth from power generation and off-highway vehicle products.

The company announced an accounting change during the earnings call. Its coatings business will be moved into its Climate Solutions segment. Sales in coatings were $53 million in fiscal 2024, and could be less given divestitures; therefore, this is expected to have a minimal impact on the financials.

Modine Is In Demand

Going To Where Demand Is Strong

Modine has restructured its company around the 80/20 principle. The idea is to pivot towards the most profitable verticals that the company serves and eliminate those that are low-margin or in contracting industries.

Since incorporating 80/20, Modine has emphasized its data center, commercial HVAC, and EV products categories while jettisoning its internal combustion engine (ICE) vehicle units. Through acquisition and reorganization, the company has more than doubled its data center cooling manufacturing and servicing capabilities and bolstered its HVAC portfolio.

Modine has exited some businesses in recent years, divesting from three underperforming German ICE vehicle components businesses and two coatings businesses in California and Florida. The focus is now on strengthening its more profitable air and liquid cooling vehicle components and its advanced thermal management components geared to hybrids and EVs.

These realignments show how serious the company has been at improving margins and moving towards higher growth opportunities.

Data Centers Are A Huge Opportunity

As high-performance computing (HPC) and AI use cases grow exponentially in the short term, the need to cool servers within data centers is expected to grow at a high and steady rate. The data center cooling market is ripe for innovation, and companies unable to pivot from one technology to another could get left behind. Modine is ensuring that it will have the optionality to serve its data center customers, no matter what technology dominates, or if several technologies share the gains.

With the acquisition of TMGcore (TMG), Modine gains liquid immersion cooling exposure for its Airdale brand. TMG not only gains Modine access to new I.P. and technology, but it gained them a hyperscale customer and opened a seat at the table with other hyperscalers. Now that they have made it through the process of gaining approval to work with one, the company believes that it will have a much easier time gaining other hyperscale customers.

In acquiring Scott Springfield Manufacturing, a Canadian-based company, Modine expanded its air-cooling products to serve both its data center and commercial and residential HVAC businesses. Management likes the potential that it gets from Scott Springfield, as it provides it with evaporative cooling technology that could support or augment its liquid cooling technology.

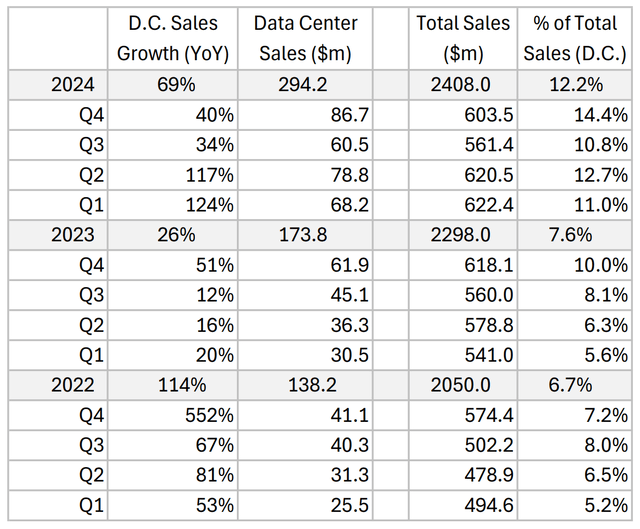

Below, you can see the trend in data center cooling sales for the last twelve quarters.

Modine data center sales growth by quarter (Author-Generated from SEC filings and transcripts)

During the Q4 earnings call, Modine’s management reiterated its medium-term goal to grow its data center cooling business at a 35% CAGR and turn it from a $295 million business in fiscal 2024 into a $1 billion business, implying that Modine is more than tripling what already makes up 12.2% of net sales in just four calendar years.

With a 69% data center cooling CAGR in fiscal 2024, I think it’s safe to say that Modine has been capturing a larger share of data center cooling growth than the overall market. The market growth outlook appears to support Modine’s ambitious goals of doubling its business.

In my opinion, Modine’s data center cooling diversity push appears to be the right strategy. This is a dynamic situation with a wide range of growth possibilities, and Modine itself is unclear as to what specific technologies will dominate the industry, if any. With a global footprint, Modine has geographic diversity to help weather regional downturns. Research has supported Modine’s idea that optionality is important, as the data center market shows potential growth in different technologies, as shown in the table below.

|

Data Center Cooling Market Growth By Region – Grand View Research Report |

CAGR 2024-2030 |

|

North America |

12.0% |

|

China |

21.9% |

|

Japan |

18.7% |

|

India |

20.2% |

|

Europe |

15.1% |

|

United Kingdom |

13.2% |

|

Germany |

14.3% |

|

Middle East & Africa |

17.4% |

|

Data Center Cooling Market Growth By Segment – Grand View Research Report |

CAGR 2024-2030 |

|

Precision A/C Units |

18.0% |

|

Hot Aisle Containment |

15.0% |

|

Room-Based Cooling |

15.0% |

|

Row-Based Cooling |

18.0% |

I believe that the data center cooling segment is a huge part of Modine’s future, and that the company has positioned itself well to have enough capacity to capture market share as the demand for expanded cooling technologies for the market grows. The stock price appears to indicate that the market agrees with this sentiment.

Traditional HVAC, A Great Long-Term Play

Combined with the assets of Scott Springfield, the Napps Technology acquisition, in Q2 of fiscal 2024, allows Modine to expand its manufacturing capabilities of HVAC products, and increase its geographic diversity by adding a plant in Texas. Modine has had success in growing its HVAC/R business in recent years, but the company expects fiscal 2025 to be a year of growth, as mentioned earlier.

The market growth potential in HVAC/R remains strong.

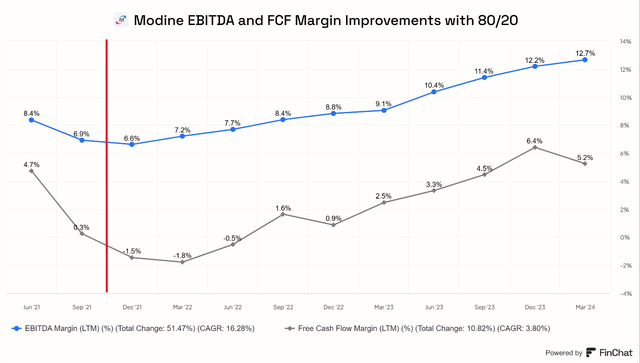

Margins and Profitability

In late 2021, Modine incorporated its 80/20 strategy for reorganizing the business following the Pareto principle, which states that 80% of the outcomes or results come from roughly 20% of the causes or actions. Modine’s intention was to focus its company resources on the products that the company had sustainable competitive advantages and that would support its profitability targets. Modine initiated cost-cutting measures and began shifting its capital expenditures towards higher-margin and high-growth areas that it could excel in. This meant divesting from slower-growth businesses, like some of its ICE vehicle segments, and expanding those that would drive shareholder value, such as the HVAC/R and data center cooling businesses.

Modine appears to be following through on both its financial targets outlined in this change and in expanding margins and cash flow generation. Since the announcement of 80/20, Modine has nearly doubled its TTM EBITDA margin, and improved from negative free cash flow generation to a TTM FCF margin of 5.2%.

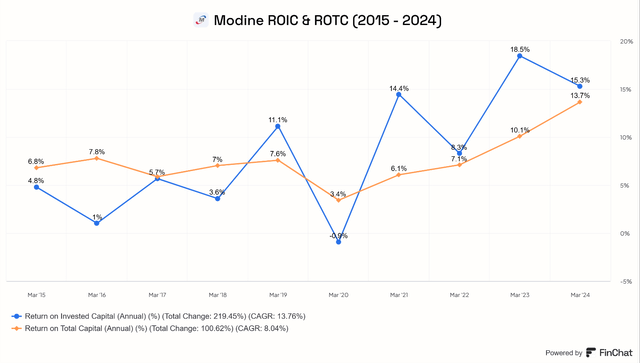

Modine’s efficiency improvements since 80/20 (www.FinChat.io)

Looking Ahead

Modine has steadily improved its capital efficiency ratios. For a manufacturing company in steady or fast-growing industries, this is important to monitor. The trend clearly shows that Modine’s reinvestment into its business has been contributing to its margin expansion and growth and are likely to pay off going forward, as long as this remains.

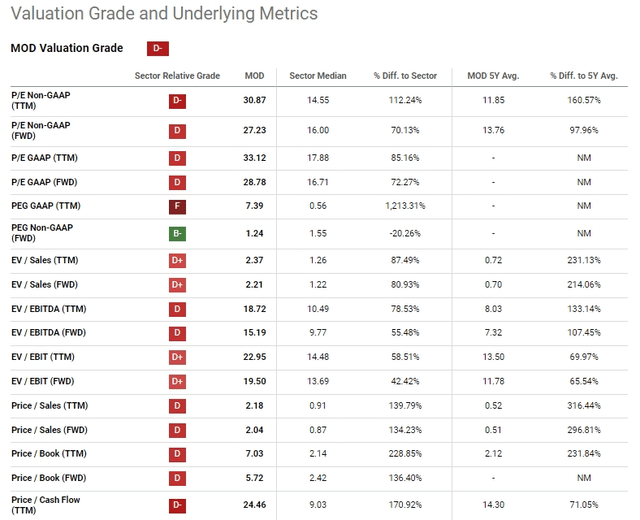

Valuation

Modine might be challenging to value using multiples, the company is at an inflection point and the potential growth outlook is hard to pin down. If we were to use Seeking Alpha’s valuation grades, we would see an incredibly overvalued stock. However, the non-GAAP PEG ratio appears to show a decent valuation. I see this as a potential indicator that if the company continues to improve its non-GAAP efficiency metrics, such as Adjusted EBITDA and Free Cash Flow margin, the company could hold hidden value unseen in traditional metrics. If this plays out, the stock could be a decent investment idea for those willing to accept some volatility or absolute risk in the data center cooling market.

Reverse DCF

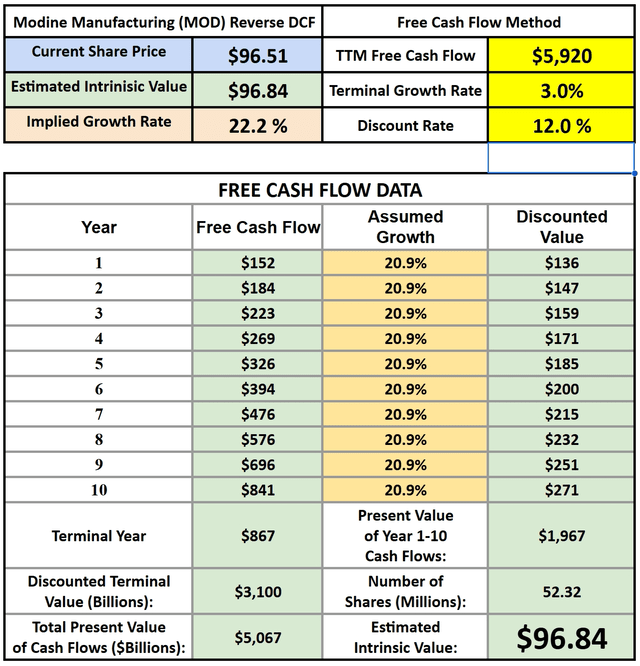

Because the data center and data center cooling markets are at an inflection point and potentially in the very early stages of growth, it is difficult to properly frame the opportunity ahead for companies like Modine. I suspect that even a thorough cash flow projection analysis will reveal a wide range of outcomes. For this reason, I am using a reverse DCF model to determine a hurdle rate for Modine’s free cash growth.

In my DCFs, I tend to utilize higher discount rates because I only want to invest in individual stocks that, I think, can beat the returns of the S&P 500. A 12% discount rate should do. I think a 3.0% terminal rate is appropriate for a company with secular tailwinds behind its business model. Between the HVAC/R segment, advanced thermal management for EVs and hybrids segment, and the data center cooling segment, Modine serves markets that should have long runways of global growth.

My simple reverse DCF model shows that Modine would need to grow Free Cash Flow at a CAGR of 20.9% over the next ten years to gain a 12% annual rate of return given the current stock price.

Note: This model represents a growth hurdle, not an assumption or projection (Author-Generated Reverse DCF)

This might be an aggressive assumption for the company. However, if it can grow near 8%-10% on the top line and the data center business grows much higher, Modine could find itself much more heavily weighted to data center cooling than the 12.2% it is right now. In this case, a sustained data center cooling technology growth rate could propel Modine into this valuation. The company has enough operating leverage to drive FCF growth rates well above revenue growth rates; the question is whether the operating leverage and the market opportunity are enough.

Risks And Conclusion

The competition to be a winner in liquid cooling and direct-to-chip cooling for data centers will be intense, and it’s certain that not everyone will capture enough share or even survive and provide great shareholder returns. Modine may be well-positioned organically and through acquisition to win in this segment, but if the company cannot, then we may see poor stock returns in the years ahead, as the company will be valued more like an HVAC stock.

At first glance, it appears that Modine has many aggressive assumptions built into the stock price. I think the potential is immense, but the wide range of outcomes regarding data center growth and who the winners will be makes me hesitate to buy the stock.

Given the business’s strength and market potential, I have initiated a deeper investigation into Modine, essentially adding the stock to what most people call their watch list. I need to do a deeper analysis into the potential for the company to generate expanding free cash flow margins or accelerating top-line growth in the years ahead in order to feel comfortable buying the stock or recommending it as a buy.

Modine could be a worthwhile investment for aggressive investors who are bullish on the AI market and data center growth; I just need more evidence of this potential before jumping in. Please let me know what you think in the comments.