Bussiness

GoodRx Cuts New Deal with Kroger; Stock Sees Upgrades

Has GoodRx Holdings Inc. finally regained its mojo?

Two years ago, the Santa Monica-based prescription drug discounter was in a world of hurt. It had just been slammed by Cincinnati-based grocery chain giant Kroger Co.’s decision to stop accepting GoodRx prescription discounts for several months as part of a dispute between the two parties. This move prompted GoodRx to lower revenue guidance by tens of millions of dollars for all of 2022.

That disruption came at a time when the stock price was already plummeting due to earnings losses and increased competition from Amazon.com and other prescription drug discounters. And it may have helped speed up a leadership transition that saw co-founders and co-chief executives Trevor Bezdek and Doug Hirsch kicked upstairs and GoDaddy.com executive Scott Wagner come on board last year as interim chief executive.

Fast-forward two years.

Last month, GoodRx announced a new deal with Kroger where patients can present a GoodRx and receive major discounts on most generic drugs at Kroger’s 2,200 retail pharmacies. In Southern California, Kroger is the parent of Ralphs Grocery Co. and Food4Less.

But that’s not all. As part of Wagner’s pledge to make GoodRx more public-facing to the investor community, the 13-year-old company held its first-ever “investor day” presentation the same day as the Kroger announcement.

GoodRx executives outlined their growth expectations for the company and its various market segments over the next three years.

The response from the analyst community was immediate: Within days, two analyst firms – St. Petersburg, Fla.-based Raymond James & Associates and Toronto, Canada-based RBC Capital Markets – raised their ratings on GoodRx to “outperform” from the equivalent of “hold.”

“We leave (the investor day presentation) incrementally positive on the stock given GDRX’s reaccelerating revenue, improving margins, more focused business strategy, and attractive valuation,” Raymond James analyst James Ransom wrote in his upgrade bulletin.

The Raymond James upgrade and Kroger news pushed GoodRx shares up 21% over two days to a mini-peak of $8.06 on May 16 before falling back to close at $7.14 on May 24.

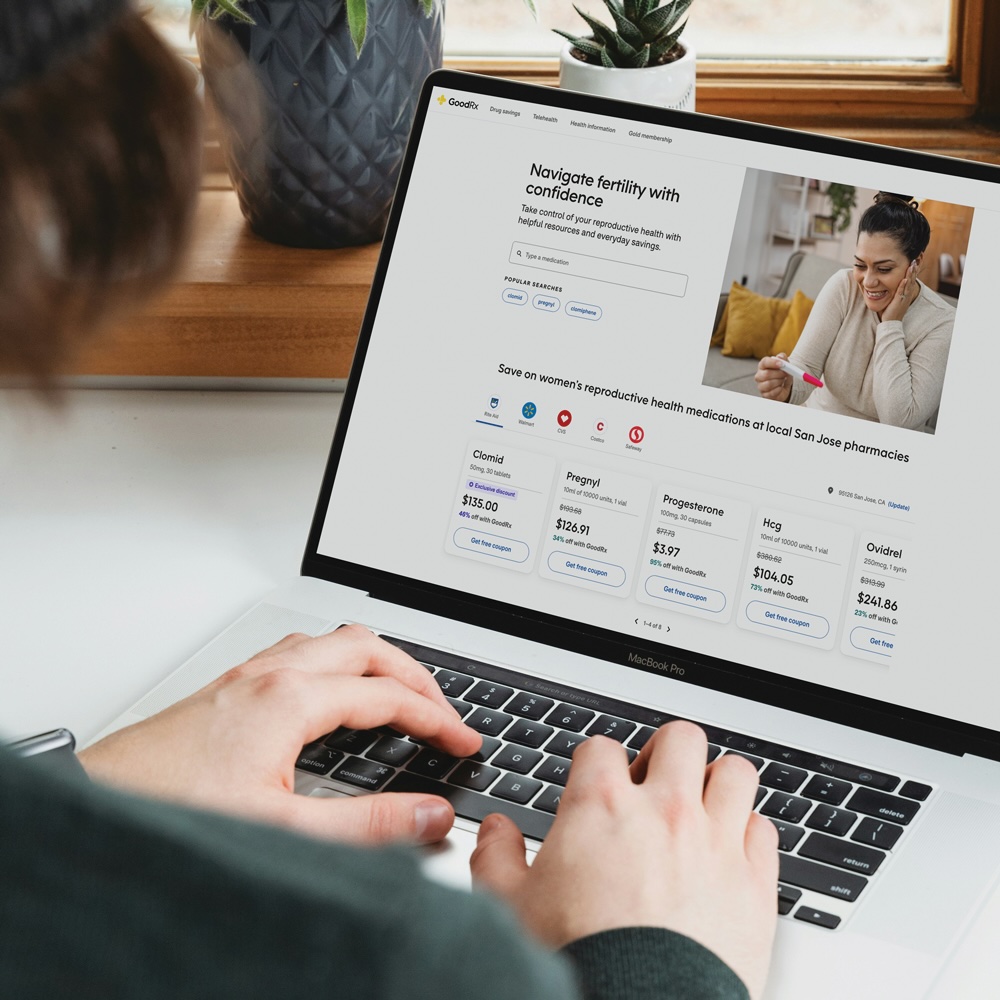

Last week, in a separate announcement, GoodRx unveiled an initiative to aggregate in a single portal its discounts for the multitude of prescription drugs used in the in-vitro fertilization process.

New Kroger deal

GoodRx burst on the prescription drug scene in 2011 with its comparison-price shopping platform, allowing customers to locate the pharmacy in their region with the lowest prices for commonly used prescription drugs. Eventually the platform was able to scour the prices at more than 70,000 retail pharmacies that had signed up to participate.

To supplement that model and to keep up with other prescription drug discounters that had begun to enter the market, GoodRx also cut deals with major retail pharmacies to offer its customers discounts with those pharmacy chains. One of the largest of these direct-contracting deals was with Kroger and its 2,200-plus pharmacies located within Kroger stores.

But throughout much of 2022, GoodRx was embroiled in a dispute with Kroger. The dispute became public in the spring of that year when Kroger suddenly stopped accepting GoodRx discounts. Neither company elaborated on the points of the dispute.

The impasse was resolved at some point in late summer of 2022 and the previous contract was reinstated, but not before the company was forced to reduce its revenue guidance by $30 million for the third quarter. Prescription revenue remained lower year-over-year for the fourth quarter.

Under the new deal announced May 15 and taking effect this week, patients can present a GoodRx coupon at Kroger pharmacies to receive almost 50% more savings on the expected patient price for most generics, compared to previously available prices on their prescription medications.

“We are excited to renew our relationship with Kroger,” said Wagner, GoodRx’s interim chief executive. “Kroger has been a valuable participant in the GoodRx marketplace over the years and an innovator in health care, nutrition and wellness. We’ve leveraged our direct contracting model to reach an agreement that we believe supports Kroger’s business goals and helps patients get the prescriptions they need at affordable prices.”

Beyond the additional revenue potential of this deal for both Kroger and GoodRx, it held significant symbolism since the suspension of the earlier Kroger deal contributed to the aforementioned turmoil for GoodRx.

“Today’s announcement that GDRX has signed a new direct contract deal with Kroger, a chain that once kicked GDRX out of its network, while this likely isn’t a huge needle mover, it symbolizes the turnaround at GDRX,” Raymond James analyst Ransom wrote in his upgrade report.

Growth outlook

At its investor day conference on May 15, GoodRx executives made their case to both investors and Wall Street analysts about the company’s growth potential. They outlined continued growth in the single digit percentage range for the core business of prescription drug pricing through 2026. The presentation projected compound annual growth rates of up to 30% over the next three years for a newer business line: deals with pharmaceutical companies to allow access to GoodRx’s platform and provide discounts on their medications directly to customers.

GoodRx is also growing its discount card market, where customers present a discount card to reap even more savings on the prescription drugs they purchase. The company noted that it now has a 44% market share of the prescription drug discount card market while its next closest competitor has roughly 14%.

“GDRX is an evolving growth story with inflecting revenue growth, and expanding EBITDA (earnings before interest, tax, depreciation and amortization) margins driven by their new direct contracting retail pharmacy model, and evolving pharma manufacturer solutions business,” analyst Ransom wrote in his upgrade bulletin.

“The stock has struggled over the last two years due to operational shortfalls, but the new management team has revamped the business and paved a path to (approximately) $1 billion of revenue and $350 million of EBITDA in 2026,” he added. (GoodRx posted $750 million in revenue last year.)

One area that received very little attention during the presentation was telehealth. Back in 2021, GoodRx acquired the telehealth service Hey Doctor and rebranded it GoodRx Care with big ambitions to turn it into a major part of the company’s consumer-oriented health care platform. But since Wagner took the helm, there have been few announcements coming from this part of the GoodRx’ business, though it’s still an offering.

Package of discounts for in-vitro fertilization drugs

On May 22, GoodRx announced it was packaging its discounts for in vitro fertilization drug treatments into one portal on its platform. The impetus for this move was the realization that patients undergoing IVF treatments have to take a raft of drugs over the four phases of treatment – and in many cases, patients have to go through repeat cycles of treatment. Up until now, patients had to search for discounts for each drug individually on the GoodRx website.

The announcement noted that while employer-based insurance plans do cover portions of this treatment cycle, they rarely cover in full all the drugs used. And it is very burdensome for the patient to track down discounts for all of the drugs on their own.

“This is a start of a concerted effort to bring all of our available savings on IVF treatments together in one place,” said GoodRx spokeswoman Lauren Casparis.