Bussiness

Airbnb: A High-Quality Business At A Reasonable Price (NASDAQ:ABNB)

stockcam

Introduction

On its IPO day in December 2020, vacation rentals marketplace – Airbnb, Inc. (NASDAQ:ABNB) stock opened for trading at $146 per share, roughly 114% above its IPO price of $68 per share. Since this stellar debut, Airbnb’s stock has swung as high as ~$220 and as low as ~$80, as you can see on the chart below.

Airbnb Stock Chart (WeBull Desktop)

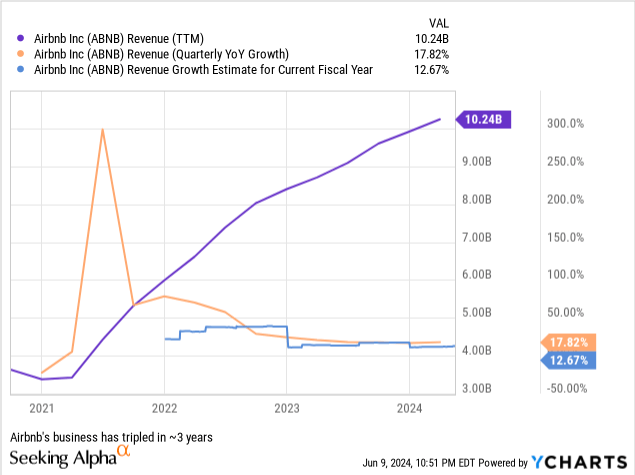

Despite tripling its business over the past 3.5 years, Airbnb’s stock has virtually gone nowhere! Is ABNB stock a buy, sell, or hold? Let’s find out.

Airbnb: By The Numbers

Airbnb was a “verb” well before the COVID-19 pandemic came along; however, the confluence of lockdowns and excessive money printing provided the perfect storm for Airbnb’s business. During 2021-22, Airbnb experienced hypergrowth due to a combination of pent-up travel demand following COVID-19 lockdowns, the rise of remote work allowing for longer stays, a shift in travel preferences towards private and isolated accommodations, and a boom in domestic travel (with consumers preferring unique/differentiated stays).

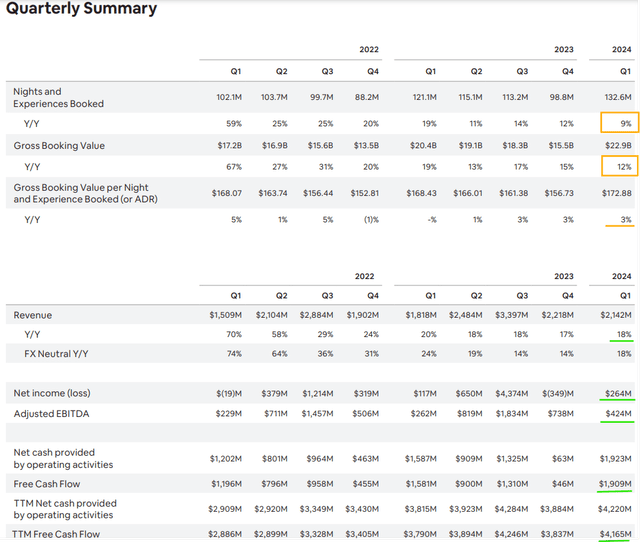

While Airbnb’s growth rates have normalized in recent quarters, the vacation rentals marketplace company is still growing at a healthy clip:

YCharts Airbnb Investor Relations

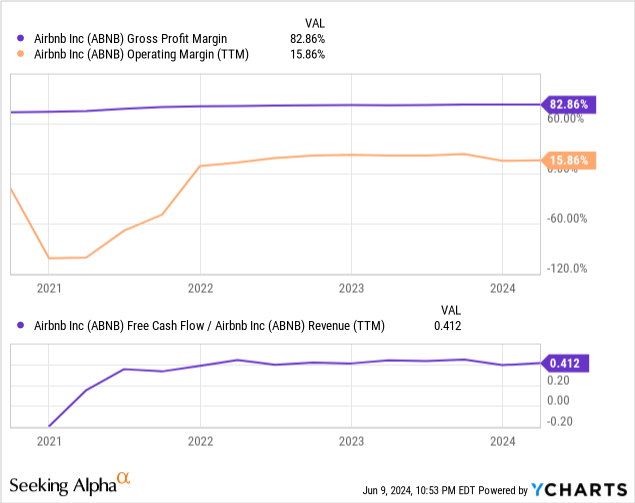

With increased scale, Airbnb is delivering higher gross margins and tons of operating leverage. In Q1, Airbnb’s gross profit margin hit ~83%! Over the last twelve months, Airbnb has generated roughly $4.2B in free cash flow at a TTM FCF margin of 41%. Such a robust margin profile is a clear indication of an economic moat. While Airbnb’s brand and scale moat are obvious, innovations like “Group trips” highlight the powerful network effects possessed by Airbnb.

YCharts

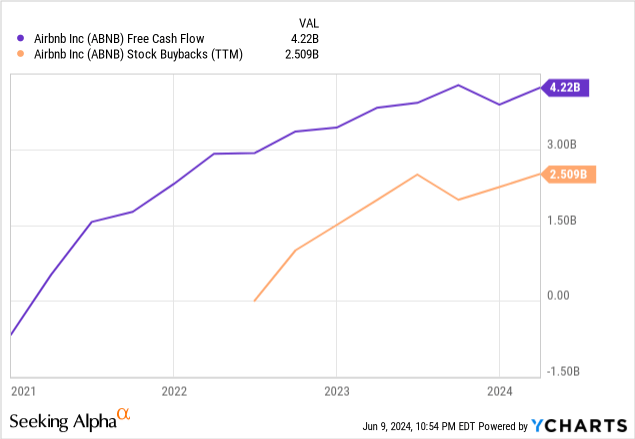

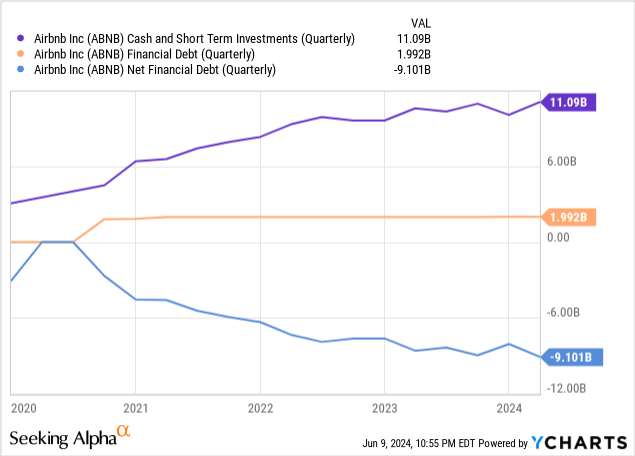

While Airbnb is far from hitting terminal growth rates, the business is already generating boatloads of cash and returning a good chunk of it to shareholders. Over the last twelve months, Airbnb has spent ~$2.5B on stock buybacks, yet its net cash balance has expanded to +$9.1B.

YCharts YCharts

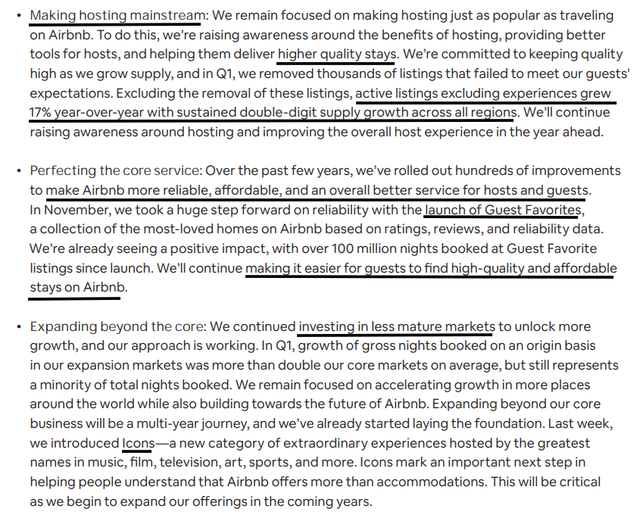

Today, Airbnb empowers 5M+ hosts and hundreds of millions of consumers through its marketplace. With supply growing at 17% y/y, Airbnb’s affordability (relative to hotels) is improving once again. Given the improved balance between supply and demand, Airbnb is now prioritizing the quality of stays through initiatives such as “Guest Favorites”:

In addition to optimizing its core offerings, Airbnb is investing in geographical expansion and the development of new, innovative offerings such as Icons – a fresh iteration of experiences.

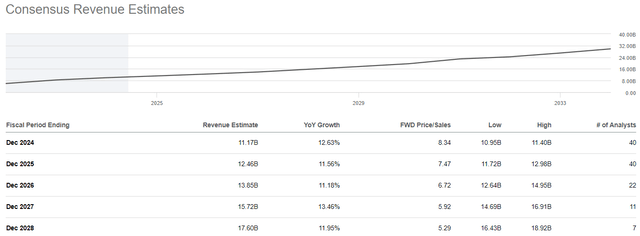

According to consensus street estimates, Airbnb is set to deliver low double-digit sales growth rates through the rest of this decade:

Despite holding a cautious view of the economy, I think Airbnb has a bright future ahead of itself. For every booking on Airbnb, hotels get ~10 bookings – and this means Airbnb has a lot of room to grow within its core offering.

As big as Airbnb is, and we’re approaching 0.5 billion room nights a year. For everyone who stays in an Airbnb, somewhere around eight or nine people stay in hotels. And when you ask people, why are you staying in a hotel? An Airbnb is typically more affordable. It’s a more local experience, it’s much better for groups and families. People say yes, but hotels are historically a more consistent experience. And so if we can just get one of those travelers from hotels to stay in an Airbnb, that would double our size of our business to 1 billion nights a year. And so we think quality and reliability is a multiyear roadmap. So you’re going to be hearing every year major updates from us on quality and reliability.

As I see it, Airbnb is a cash cow with a long runway for growth. However, is ABNB stock a good investment at current levels?

ABNB Stock Fair Value And Expected Return

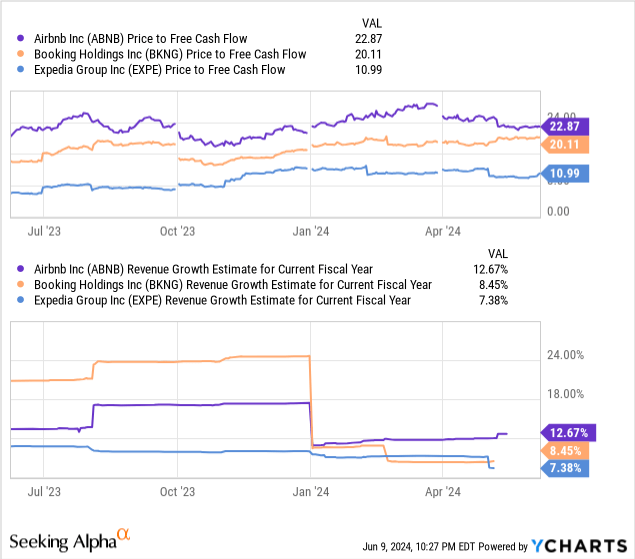

On a relative basis, Airbnb trades at a premium to travel marketplaces such as Booking Holdings Inc. (BKNG) and Expedia Group (EXPE); however, this premium seems more than justified, given Airbnb’s higher growth rates.

YCharts

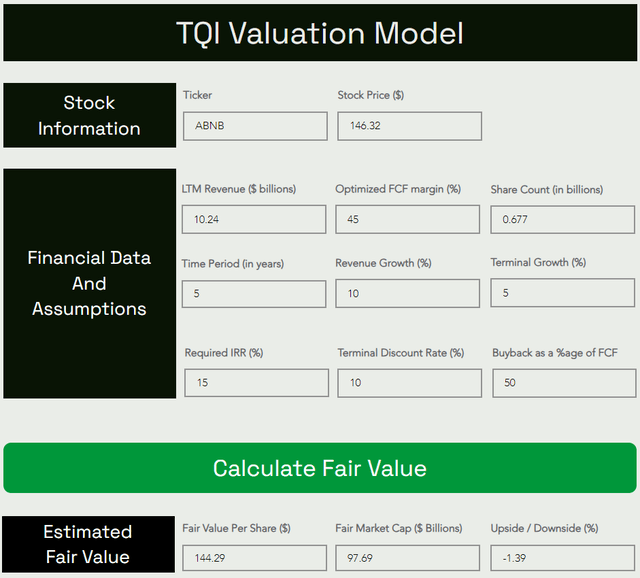

Based on conservative assumptions for future top-line growth and steady-state free cash flow margins, I peg Airbnb’s fair value estimate at ~$144 per share (or $97.7B in market cap). For my model, I have assumed a below-consensus 5-year CAGR revenue growth rate of 10% and a terminal growth rate of 5%. Furthermore, we are modeling Airbnb’s long-term steady-state FCF margins at 45%, which is pretty much where ABNB’s margins are right now.

All other assumptions are straightforward, but feel free to share any questions that you may have in the comments section below.

TQI Valuation Model (Free to use at TQIG.org) TQI Valuation Model (Free to use at TQIG.org)

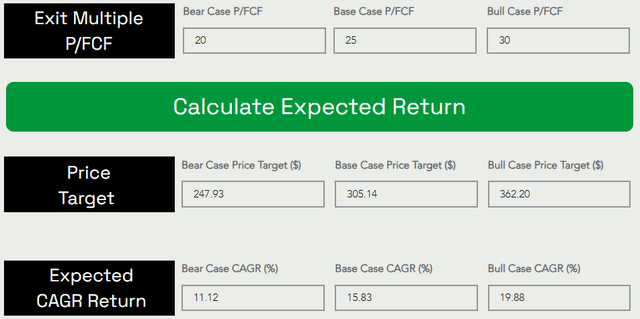

Applying an exit multiple of ~25x P/FCF for 2029, Airbnb’s 5-year expected CAGR comes out to be 15.83% – slightly higher than our investment hurdle rate of 15%.

Final Thoughts

In the event of a hard landing, consumer spending will likely take a hit (early signs are already visible), and travel is discretionary. Hence, Airbnb’s near-to-medium-term business outlook remains uncertain.

That said, from a fundamental standpoint, Airbnb’s business is stronger than ever. Trading at ~$148 per share, Airbnb is fairly valued, and its long-term risk/reward is attractive enough to warrant a “Buy” rating under our valuation methodology. At TQI, we have started a long position in ABNB stock within our GARP portfolio strategy, and I plan to build on this position in the coming weeks and months.

Key Takeaway: I rate Airbnb a “Buy” in the $140s, with a strong preference for staggered accumulation via 6-12 month DCA plan.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below.