Infra

Amazon Could Be A Dominant Leader In AI Infrastructure Alongside Nvidia (NASDAQ:AMZN)

gorodenkoff

I analyzed Amazon (NASDAQ:AMZN) on Seeking Alpha in January, and since then, my research into the company has deepened, and my overall thesis has developed significantly. I still believe Amazon is a fantastic long-term Buy. A large part of why I consider it to be so is its focus on artificial intelligence infrastructure, which will be the focus of this analysis.

Amazon’s AI Trifecta

I believe a lot of investors are putting too much emphasis on large language models in understanding the market value of AI and not enough weight into AI infrastructure. It is my opinion that as the market for AI expands and evolves, there will be multiple highly differentiated and advanced models that cater to specific needs. However, it is companies like Amazon who are positioning themselves most astutely with a full-stack approach to AI, which CEO Andy Jassy outlined in his recent interview on Squawk Box. He broke down Amazon’s value in AI into three core elements:

- Chips: Amazon has developed a chip designed for training machine learning models, particularly deep learning and other high computational tasks, called Trainium. It is optimized for high performance and cost efficiency. It has also developed Inferentia, which is a chip designed for machine learning inference tasks, with a focus on high throughput and low latency at a lower cost. Inferentia enhances the performance of inference tasks and is suited for deploying LLMs and generative AI at scale.

- Services: Amazon has developed a comprehensive AI services platform called Bedrock, which presents a range of foundation models for use through a unified API. Users can customize the models with their own data, and the system is integrated with various AWS services, simplifying the deployment and management of AI tasks. It is also designed for developing unique and task-specific AI systems.

- Applications: In many respects, these will be the third parties that are dependent on Amazon’s infrastructure for the development, integration, and usability of designed AI software, offering their applications to the public, with Amazon taking a significant rake.

If we were to discuss this in poker terms, in some respects Amazon’s growing position is akin to playing the role of a casino in AI, and the AI application developers are the players at the tables. If one thing is for certain, it is that the casino is at far less risk than the players. In many respects, this is foundational to why I consider Amazon to be such a worthwhile long-term investment in AI, and it follows on from its historical record of being relentlessly focused on infrastructure to enable third-party success. However, Amazon cleverly never positions itself to be damaged at the expense of smaller contributors to its ecosystem. For many years, it has offered the infrastructure to enable digitally-listed retail, with high levels of physical infrastructure in warehousing and delivery, and with AWS, it began to offer the same in internet services, with a significant focus on cloud operations. Amazon has been in the AI game for a very long time, beginning to gain traction internally around 2014 with Alexa. With such a high level of financing, it has now positioned itself as one of the businesses with durable and highly unassailable moats in AI infrastructure provision. As such, I consider Amazon to continue to be a compelling long-term investment.

Mr. Jassy mentioned in his recent interview that I linked above that “customers want choice” when it comes to AI. I believe this will be foundational to how the AI markets evolve. I think that the model that we see with ChatGPT offering ‘GPTs’ by third-party developers will become much more sophisticated. I believe much more complex ecosystems will be developed primarily offered by Google (GOOG) (GOOGL), Microsoft (MSFT), Meta (META) and who I deem will be the leaders in the field, Nvidia (NVDA) and Amazon. Of course, this is already happening, but we are nowhere near the full level of sophistication that could be expected over the next 50-100 years. If we consider AI to be in nascent stages, then the reality is Nvidia and Amazon could have a very, very strong future ahead of them. Both companies are providing the building blocks, and I believe AI is going to be a very lucrative industry for engineers and software developers to enter. As such, they will go to AWS and Nvidia first to access the tools they need.

Over the next year, AWS will likely continue to edge toward 20% of Amazon’s total revenue (it is currently around 16%, up from nearly 12% in 2020), but I also think that over the long term, this could reach 25% or more. It is highly unlikely that AWS and its associated AI services will overtake its online stores and third-party seller services. However, as it integrates its AI and its partnerships in AI more thoroughly into its business operations, I believe Amazon is likely to lead the way in advanced automated retail, and the synergy between AWS and Amazon Retail is going to become much more pronounced.

Valuation & Growth Analysis

Its developments have not been easy on the short-term financials of Amazon. In 2021 and 2022, it reported negative free cash flow, a result of its high capital expenditures, which included technology infrastructure related to AWS, such as data center capabilities for AI computations.

I believe this is indicative of a general trend for big tech at the moment, and investors are now well aware of the capex and R&D spending Meta recently announced, as discussed on the All-In Podcast’s latest episode. I believe investors are quite right to be skeptical of Meta’s valuation following the projected total expenses for full-year 2024 of between $96-99 billion, largely a result of infrastructure costs, with its capital expenditures for full-year 2024 estimated to be $35-40 billion. The company stated the reason for its high capex in its Q1 2024 earnings release, with a warning of more to come:

…we continue to accelerate our infrastructure investments to support our artificial intelligence (‘AI’) roadmap. While we are not providing guidance for years beyond 2024, we expect capital expenditures will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.

I believe Meta and Amazon’s approaches show a significant similarity in that both companies are sacrificing short-term value through higher expenses for long-term growth. Amazon is well renowned for a long-term mindset instilled in it by the ultra-long-term ethos of Jeff Bezos, and I believe Meta is similar in this regard. There is some truth to the saying here that ‘good things take time.’ Amazon, Nvidia, Meta, Google, Microsoft, and other major AI players may look to be slightly weaker in the short term as expenses mount to meet growing demand and competitive pressures, but over the long term, the moat that these companies will command will mean they continue to dominate in the realm of big tech.

Consider the following table, which I have constructed to show each of the five peers assessed on growth and value metrics alongside expenses relative to market cap, which relate to their investments in AI infrastructure:

| AMZN | NVDA | META | GOOGL | MSFT | |

| Market Cap | $1.88T | $2.16T | $1.10T | $2.06T | $2.99T |

| P/E GAAP FWD | 43.65 | 38.32 | 21.44 | 22.01 | 34.05 |

| PEG Non-GAAP FWD | 1.82 | 1.04 | 1.03 | 1.17 | 2.48 |

| EPS FWD Long-Term Growth (3-5Y CAGR) | 23.8% | 33.86% | 21.13% | 18.91% | 13.72% |

| TTM R&D Expenses | ($85,622 million) | ($8,675 million) | ($36,606 million) | ($43,897 million) | ($28,193 million) |

| TTM Net Capital Expenditure | ($48,133 million) | ($1,069 million) | ($26,622 million) | ($37,974 million) | ($39,547 million) |

| TTM R&D as % of Market Cap | 4.55% | 0.40% | 3.33% | 2.13% | 0.94% |

| TTM Net Capital Expenditure as % of Market Cap | 2.56% | 0.05% | 2.42% | 1.84% | 1.32% |

The above table clearly shows that Amazon has the highest development expenses at this time, both nominally and relative to its market cap. I believe this reiterates my above point and is absolutely in line with Amazon’s founding ethos, which is to sacrifice short-term profits for long-term cash flows. I believe Amazon is proving time and time again that it is a company for long-term investors. I have read many of Jeff Bezos’ shareholder letters from when he was CEO of Amazon, and I must say that it looks like Andy Jassy is doing a good job of carrying forward the values that Bezos instilled in the company from day one.

It is also no surprise, then, that Amazon is the highest-valued firm by P/E GAAP ratio standards of the firms listed in my table, as the company is clearly not looking to please investors in the short term, in my opinion. I believe Amazon is focused on genuine business excellence. By focusing on building substantial moats in infrastructure, now including more advanced AI, the company is positioning itself to have durability in varying future economic conditions. This is what carried Amazon shrewdly through the internet bubble of the 1990s. It is what I believe will make Amazon a durable AI foundry during the coming scaling of automation, robotics and AI across the world. Where many other applications may rise and fall, Amazon will be one of the infrastructures that support many novel AI systems and is protected by the high-capex barrier to entry in chip and services provision.

I believe we can see Meta, Google, and Microsoft taking a similar approach and now navigating an important transition toward being useful and relevant in AI infrastructure. However, what is surprising is that Nvidia has notably low R&D and capex expenses relative to its market cap compared to the other five peers. This is likely a result of its stringent focus on compute provision, rather than being more largely diversified across various sectors like retail and entertainment in the case of Amazon or a family of social media apps in the case of Meta. It is arguably quite clever for Nvidia to be directly focused on compute, and it places it in a favorable position to be a big tech company that focuses on ‘behind the hood’ products and services.

From my analysis of Amazon’s durable moat in AI and technology services through AWS and its well-established moat in retail operations, I believe, with a very long-term mindset, Amazon could be accurately deemed fairly valued at the time of this writing. This assessment holds if investors are willing to accept some periods of price volatility as the cost for a high-quality, long-term-focused company that should continue to trade at high valuation multiples, significantly above a meaningful discounted earnings intrinsic value—a phenomenon typical in big tech. I believe investing in companies like this always comes with some risk, primarily based on investor sentiment, independent of business results. However, I also believe it is a mistake to discredit highly valued technology companies like Amazon based on an established market value above the typical intrinsic value from discounted earnings or cash flow methods if the market has proven willing to sustain its valuation multiples for extended periods of time. For Amazon, its current P/E GAAP ratio of around 60 is a significant reduction from its 10-year median on the metric of around 115. In many respects, this is due to its recently lower growth prospects compared to historical rates, but with a company the size of Amazon, it is reasonable to assess that the market has been efficient in valuing the stock with relative accuracy. Amazon is certainly not a value investment in the traditional sense, but I think it could be considered a value investment from a qualitative standpoint, as the fair value elicited in my analysis is supported by an immense operational moat and business excellence instilled by decades of exceptional management and strategy.

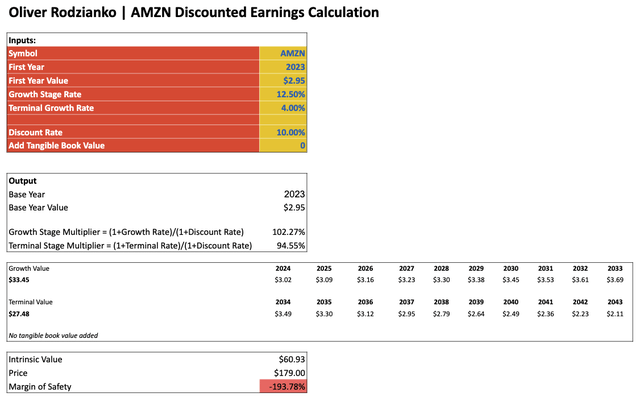

My discounted earnings model for Amazon below is by no means stating that Amazon is overvalued at the time of this writing. However, it acts as a reference point for the purposes of risk analysis to show how far above intrinsic value the market is currently accepting Amazon shares to trade at. I have used basic EPS and a 12.5% CAGR forecast for my 10-year growth stage, as I believe this is reasonable and conservative. Additionally, I have used a 4% CAGR for my terminal stage, as this is roughly in line with U.S. inflation. I have used a 10% discount rate because this is my low-end total annual portfolio return expectation. Finally, I have used a discounted earnings model as opposed to a discounted cash flow model, as there is more meaningful data on Amazon’s earnings compared to cash flow to work from.

AMZN Intrinsic Value Through My Discounted Earnings Model (Author’s Own Model)

Risk Analysis

I believe there is some risk here that the market for AI over the long term is not as pronounced as it currently appears that it will be. I, for one, am very optimistic about the future of artificial intelligence in the world economy, and I think that its present utility at such early stages has proven long-term effectiveness. However, due to regulatory pressures surrounding the use of certain autonomous systems, as well as potentially having to navigate a change in job markets, I believe there could be some overspending related to AI at tech companies at present to keep up with competitive pressures in big tech that could later be seen as money spent too soon as the wider economy has a slower uphill climb to dominant acceptance of regulated AI systems in all walks of life. After all, it will require the support of the full global economy at large to allow the AI application market to really flourish, which is what Amazon’s Bedrock depends on for the potential outsized success it could achieve.

With that in mind, the valuation at this time of Amazon is very high, and I believe that the market is expecting long-term outsized success in AI infrastructure as a core part of why it deems Amazon a continued long-term growth investment. However, I believe that investors should be cautious if my analysis related to moderated AI market growth comes to fruition. I believe the current mix of elements related to technology stock valuations, high expenses related to AI, and government regulations could cause volatility in the stock price alongside management and strategy redirections to arrive at long-term success.

Key Elements

Amazon has three distinct advantages in AI infrastructure provision at the moment, namely in chip design, in AI services, and in providing its infrastructure to capitalize off of third-party AI application developers.

Amazon has high R&D and capex expenses relative to its market cap versus peers, but this is arguably well justified, as the company’s strategy has famously been hinged on sacrificing short-term profits for long-term cash flows and a real business moat.

To my mind, Amazon is a very secure business with a remarkable strategic direction. I believe, alongside Nvidia, it will continue to be one of the most dominant compute providers as it relates to AI and other advanced technology services for a wide range of use cases.