Entertainment

AMC Entertainment: It’s Going To Get Worse Before It (Hopefully) Gets Better (NYSE:AMC)

Anne Czichos

As a child and teenager, one of my favorite things to do was going to the movies. Sitting in a dark theater, watching the latest smash hit film, eating popcorn, and drinking soda, was a great way to pass the time. So it pains me the stance that I have to take when it comes to AMC Entertainment Holdings (NYSE:AMC), a massive global operator of movie theaters. For some time now, I have been bearish on the business. Its troubles really began with the COVID-19 pandemic. And even though that is now long over, the firm continues to struggle from low attendance rates driven in large part by the delayed impact of worker strikes in Hollywood last year.

In my last article about the company, published in May of this year, I ended up downgrading the stock from a ‘sell’ to a ‘strong sell’. This came after shares had skyrocketed 180.7% since my prior article on the firm in what many have considered to be the second meme stock rally. My conclusion at the time was that this move higher tremendously overvalued the business given the troubles that it is facing. And so far, that call has proven to be correct. Since my most recent article, shares are down 17.9% while the S&P 500 is up 6.6%. And since I first rated the company a ’sell’ back in January of 2021, shares are down 93% while the S&P 500 is up 51%.

Interesting developments

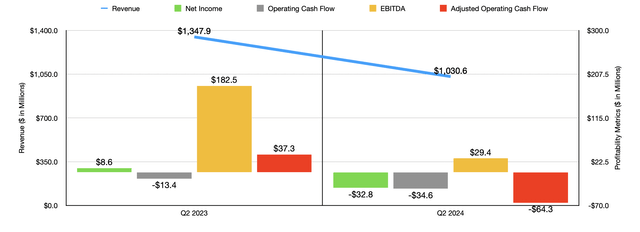

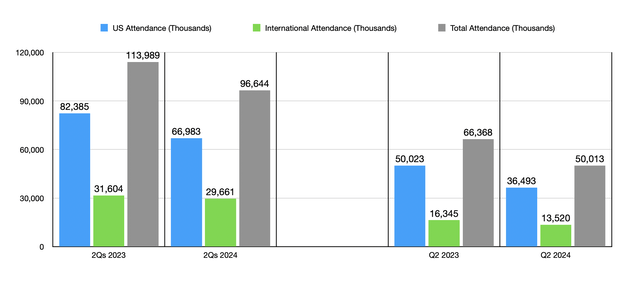

Fundamentally speaking, AMC Entertainment is suffering a great deal. As an example, we need only look at the most recent data provided by management, which would cover the second quarter of the 2024 fiscal year. Revenue during that time was $1.03 billion. That’s a drop of 23.5% compared to the $1.35 billion the company generated just one year earlier. This was driven by a plunge in attendance. In the US, attendance at its theaters totaled 36.49 million in the second quarter. That was down precipitously from the 50.02 million reported the same time last year. International attendance, meanwhile, dropped from 16.35 million to 13.52 million. All told, global attendance for the company declined 24.6% year over year.

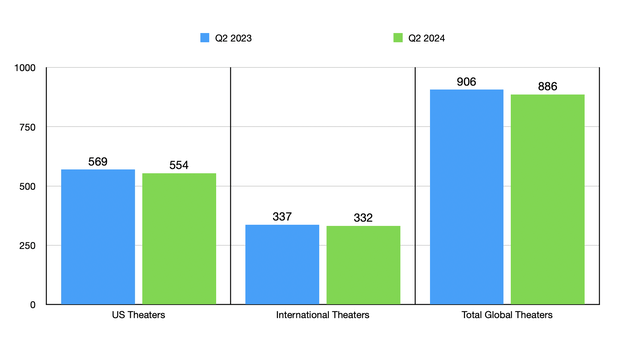

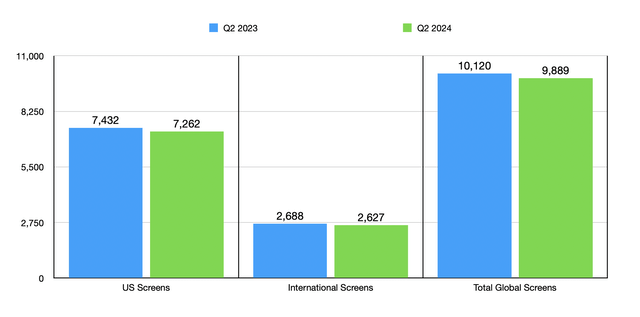

Part of this can be attributed to a decline in the number of theaters and, by extension, screens that the company has in operation. In the US, the number of theaters dropped from 569 to 554. And internationally, the number dropped from 337 to 332. Collectively, this brought the number of theaters down globally from 906 to 886, with the number of screens falling from 10,120 to 9,889. For some time now, management has been closing down underperforming locations. This makes sense when you consider the problems the industry has gone through and the fact that the company has had issues regarding profits and cash flows. I mean, between 2021 and 2023, the company saw net operating cash outflows of $1.66 billion. This picture had improved from one year to the next, largely because of a recovery following the COVID-19 pandemic. But it has not improved enough in order to make the company healthy again.

Another problem for the company this year has been a reduction in the number of major films released by studios. As I detailed in my most recent article about the firm, the number of films planned for the 2024 box office was lower than what was seen in the prior year. Worker strikes were responsible for this, with a forecast for the number of films coming from all production studios expected to decline from 150 last year to 128 this year. I do actually think that there is some glimmer of hope here. I say this because there have been a couple of major box office hits lately. Both of the films that come to mind are courtesy of The Walt Disney Company (DIS). Globally, Inside Out 2 has grossed $1.63 billion, making it the highest grossing animated film in history. The total domestic box office for it was $642.5 million. And then, there was the third installment of the Deadpool series, Deadpool & Wolverine, which is currently at $1.14 billion globally, with $546.8 million of that coming from the domestic box office. This makes it the highest grossing R-rated film ever.

Author – SEC EDGAR Data Author – SEC EDGAR Data

These successes will likely encourage production studios to start investing more in theatrical content. And I would imagine that, by sometime next year, this should allow a more meaningful and sustained recovery for the industry. That doesn’t mean, of course, that there can’t be some benefit this year. In a press release issued on July 29th, AMC Entertainment stated that over 6 million moviegoers watched a film at one of its theaters in the US between July 26th and July 28th. This made it the company’s highest weekend of attendance and admissions revenue so far this year. Furthermore, it was the highest weekend for food and beverage revenue that the company had seen since 2019.

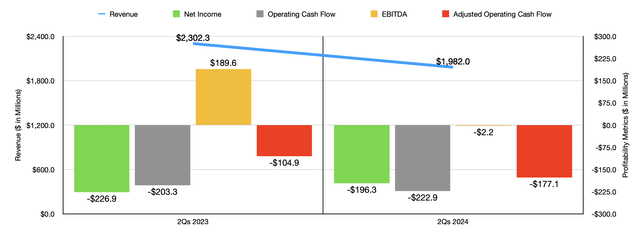

On the bottom line, performance achieved by AMC Entertainment has been pretty dismal. In the most recent quarter, the company generated a net loss of $32.8 million. That’s far worse than the $8.6 million gain reported one year earlier. Operating cash flow worsened from negative $13.4 million to negative $34.6 million. If we adjust for changes in working capital, it worsened from $37.3 million to negative $64.3 million. And finally, EBITDA for the company plummeted from $182.5 million to $29.4 million. In the chart above, you can also see financial results for the first half of this year relative to the same time last year. The second quarter weakness was part of a larger trend, not a worn off.

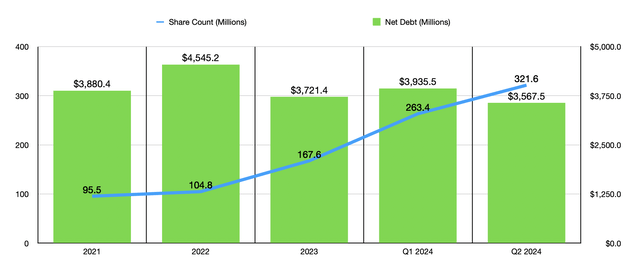

If AMC Entertainment had little to no debt, I wouldn’t be as concerned as I currently am. But the fact of the matter is that, as of the most recent quarter, the company had $3.57 billion of net debt on its books. Interestingly, debt has remained in a fairly narrow range between 2021 and the most recent quarter of this year. And in fact, the current level of debt is actually lower than what the company had in the first quarter of this year and it’s lower than it had at the end of any of the last three fiscal years. Management has done well in that regard. However, this has come at a cost. And that cost has been significant shareholder dilution. From the end of 2021 through the present day, stock issuances made by the company resulted in shareholder dilution of 70.3%. This is not sustainable in the long run. And in fact, with the company’s market capitalization at $1.80 billion as of this writing, there’s not much more that the company could raise to handle debt without spooking markets.

Management has been making other efforts to get the company through these difficult times. Earlier this year, in late July to be precise, management engaged in some refinancing transactions. They essentially were able to swap out $1.1 billion worth of existing term loans that were supposed to come due in 2026, as well as $100 million of second lien subordinated secured notes due in 2026 for $1.2 billion worth of new term loans that will now come due in 2029. The company also issued just over $414 million of exchangeable notes for cash, with which it repurchased an equal amount of second lien notes. These notes are exchangeable for 82.6 million shares of the company, but the company also has the ability to issue up to another $100 million worth for the purpose of debt reduction. Plus it has the ability to issue up to another $800 million of new term loans in order to repurchase existing term loans.

There are all sorts of different hypothetical scenarios that we could look at regarding these transactions and the impact they will have on the company’s bottom line. The picture is especially complicated when you consider the ability for the company to pay some of its interest in-kind (in the form of new notes as opposed to cash) if it so desires. But if we keep things simple and use only the initial amounts that the company said that they would tap into and we assume that all interest from existing notes and new notes are paid in cash, then according to my estimate, and factoring in current interest rates, the firm might only have to pay an extra $6.5 million in interest expense annually, while simultaneously getting the ability to push off some of its debt for multiple years.

As I mentioned already, the initial exchangeable notes issuance can result in the issuance of up to 82.6 million shares. But that’s only what we might have to deal with out of the gate. If the company taps into the full amount that it can and pays all of the interest in-kind, then we are looking at up to 128.8 million shares that can be put out. At the low end of this range, we would be looking at another 20.4% dilution. And at the high end, we would be looking at another 28.6%. This is better than letting the company collapse. But it’s certainly not an enviable position to be in.

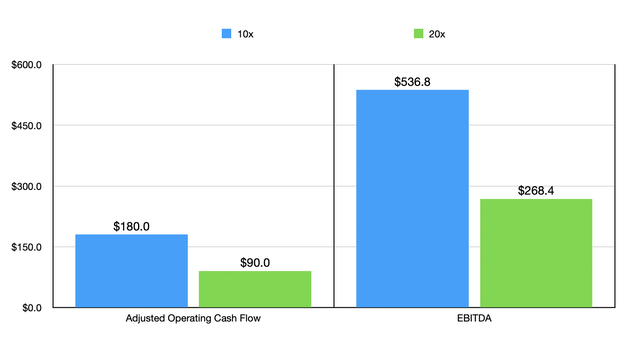

As for what shares might actually be worth, this is the magic question. We can’t really value a company that is consistently cash flow negative. So the best way to look at this is to see what kind of cash flows would be needed for the company to be fairly valued. In the chart above, you can see scenarios where the company would be trading at 10 times or 20 times on either a price to adjusted operating cash flow basis or on an EV to EBITDA basis. Even in the best case, the firm would need to have $90 million of adjusted operating cash flow and $268.4 million worth of EBITDA in order to be fairly valued at multiples of 20. But to put this in perspective, back in 2019, before the COVID-19 pandemic really had an impact on the firm, it was trading at a price to adjusted operating cash flow multiple of 1.4 and at an EV to EBITDA multiple of 8.5. So I find it very unlikely that it would trade much higher, if any higher, than this.

Takeaway

Fundamentally speaking, AMC Entertainment is currently a mess. Management has worked hard to prevent the ship from sinking. But this doesn’t mean that things are going well. The company will certainly continue struggling this year. The good news is that we are starting to see some true life again in the theatrical space. If the business can hold on long enough to get through that, it should be fine. But there’s a difference between being fine and being an attractive investment opportunity. With a tremendous amount of debt on its books, cash flow problems, declining revenue, and significant shareholder dilution in prior years, I have to say that the stock looks to be, still, a ‘strong sell’.