Travel

Amtrak still falling short in capturing U.S. travel demand: Analysis – Trains

As summer transitions to fall, travelers seeking to use Amtrak are faced with a continuation of periodic sellouts and high fares on long-distance routes and many corridors. In the face of growing year-round demand, the company has yet to expedite restoration efforts that would capture additional ridership and revenue.

Transportation Security Administration officials have projected Labor Day holiday air passenger counts will rise 8.5% from 2023, making it the busiest holiday weekend this summer, in part because air fares are down 5% from last year and 17% from pre-pandemic 2019. The reason: airlines added many additional flights and lowered fares where needed to make travel more affordable. According to AAA, nationwide gas prices have ticked down to at $3.50 per gallon from $3.81, fueling more highway trips.

Holiday-crush news accounts rarely mention Amtrak’s mobility contribution; trains have every right to be included as a viable travel option where there are few public transportation alternatives or in corridors where multiple frequencies are offered.

Seat shortage

In the Northeast, management was able to boost frequencies by improving equipment utilization through push-pull operation [see “Amtrak adds eight weekday, four weekend Northeast Corridor trains,” Trains News Wire, March 4, 2024].

Reduced capacity in some regional corridors and for customers who depend on long-distance service is on full display this holiday weekend with the usual sellouts, as expected. However, sold-out trains are a regular occurrence periodically all year.

Four Horizon coaches and one Horizon business class/cafe in each of six sets usually protect 10 daily assignments on the Seattle-Portland, Ore., segment of the Pacific Northwest Cascades, for instance. Sellouts have been more prevalent on the Horizon-equipped trains than four departures usually covered by a pair of higher-capacity Series 8 Talgos. The Oregon-owned trainsets are sometimes shuffled from their regularly assigned trains to meet demand.

In the Midwest, a stretched-thin fleet has resulted in shortened Chicago-based consists on Milwaukee-bound Hiawathas as well as trains to Michigan and Missouri when mechanical failures occur.

Meanwhile, in the long-distance category, sellouts continue to turn away Coast Starlight, California Zephyr, Southwest Chief, and Capitol Limited coach passengers. Amtrak has attempted to address some deficiencies by implementing a series of consist changes, some beginning next week [see “Amtrak adds Texas Eagle capacity …,” News Wire, July 29, 2024]. However, the alterations generally involve redeploying rolling stock from one train to another. Over the summer, substantially delayed cross-country trains triggered a series of outright cancellations because substitute cars and locomotives weren’t available [see “Lack of equipment leads to cancellation …,” News Wire, July 16, 2024].

A total of 14 Superliners continue to be assigned to two Chicago-Carbondale, Ill., Illini and Saluki round trips because Canadian National insists single-level equipment does not sufficiently shunt track circuits that trigger signals and highway warning devices [see “The quest to counteract ‘loss of shunt’ …,” News Wire, Sept. 5, 2023]. Yet maintaining those trains if the bilevels were redistributed would be virtually impossible with the current lack of sufficient serviceable Venture, Horizon, or Amfleet rolling stock.

Limited overhaul plans

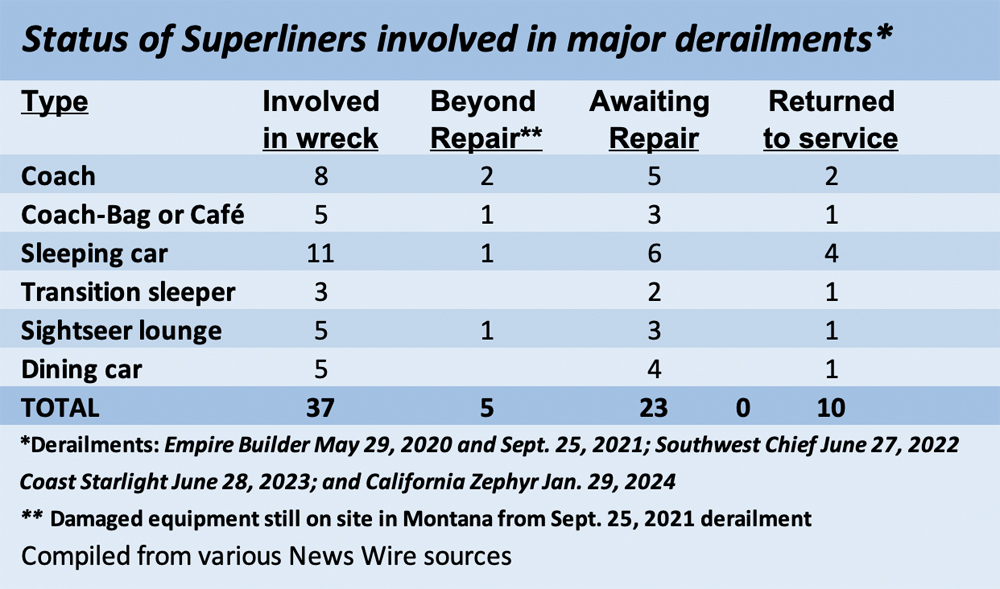

Rail Passenger Association CEO Jim Mathews reported recently that Amtrak has so far overhauled 41 of 50 stored cars designated for restoration in the fiscal year ending in September. Most cars returned to service have been Horizon coaches and cafes that have augmented regional service such as the Cascades and the Chicago-St. Paul, Minn., Borealis. Mathews says seven Superliners involved in wrecks are currently being worked on. Five serious derailments dating from May 2020 sidelined a total of 37 Superliners, according to information obtained by News Wire.

Restoring heavily damaged vehicles to service involves far more time, skilled labor, and financial resources than brake and operating component overhauls of equipment stored when management dropped most long-distance trains to triweekly departures in October 2020.

Restoring heavily damaged vehicles to service involves far more time, skilled labor, and financial resources than brake and operating component overhauls of equipment stored when management dropped most long-distance trains to triweekly departures in October 2020.

Long lead times required to make this many wrecked cars operational are clearly a significant reason for capacity shortfalls. On the other hand, Mathews confirmed that at least eight stored Viewliner I sleeping cars — none involved in derailments — won’t undergo overhauls until the next fiscal year, which begins Oct. 1. Rather than being available to add roomette and bedroom inventory on existing single-level trains as Viewliner II sleepers arrived, News Wire learned these cars were sidelined as their four-year brake rebuild dates came due and no overhauls for them were in the 2024 fiscal plan.

Recently released year-to-date revenue and ridership data summarized by the Rail Passengers Association shows that where Amtrak had the seats to capture travel demand, ridership was up nearly 18% for both Northeast Corridor and state-supported trains for the first 10 months of fiscal 2024 compared with 2023, but gained only 9% for long-distance trains. Travel demand is clearly pervasive; the challenge for Amtrak management is to invest in sufficient capacity to capture it.