Bussiness

Arista Networks: Downgrading The Business On Valuation And Growth Concerns (NYSE:ANET)

Erik Isakson

One of the most important traits that makes for a good investor is acknowledging when you have made a mistake. Last October, for instance, I did just that when it came to a company called Arista Networks (NYSE:ANET). For those not familiar with the institution, it focuses on providing customers with cloud networking capabilities, primarily through its Arista Extensible Operating System. The platform that the company has helps to establish workflow automation for its clients. It does this while providing tools and applications that help users in things like monitoring, detecting, and reporting on, network issues if and when they arise. It also provides security as part of its business as well.

Prior to that October article, I had the company rated a ‘hold’. While I acknowledged that the institution was growing rapidly and that cash flows were robust, the stock looked very expensive to me. But the more that I watched the company and the more I acknowledged how quickly the enterprise had been growing, the more it dawned on me that, instead of being overvalued, the institution was what one might call a GARP (growth at a reasonable price) play. Ultimately, this led me to upgrade the stock to a ‘buy’.

The results since then have proven miraculous. While the S&P 500 has jumped 26.9% since the time that article was published, shares of Arista Networks have jumped 58.2%. And since I reiterated my ‘buy’ rating in February of this year, the stock is up 8.3% compared to the 5.9% move seen by the broader market. However, looking at the picture again, I am starting to see some worrying signs. The stock is getting more expensive, and we are starting to see concerns of growth slowing down. On top of this, add management’s unwise decision to buy back even more shares, and I think that it’s finally time to downgrade the firm yet again to a ‘hold’.

A look at recent developments

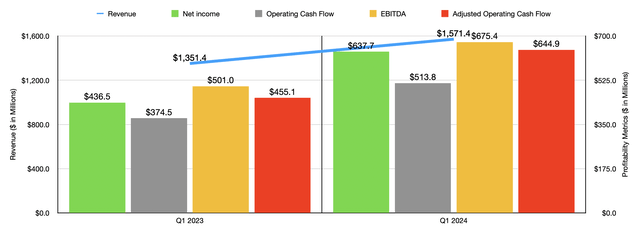

If your emphasis as an investor is on growth, even at the expense of valuation, then Arista Networks is a stellar company to examine. Consider financial performance achieved during the first quarter of the 2024 fiscal year compared to the same time one year earlier. Revenue came in at $1.57 billion. That’s up 16.3% from the $1.35 billion generated in the first quarter of 2023. This growth in revenue was attributable mostly to the product side of things, which includes the sale of the firm’s switching and routing products, as well as similar network applications. Revenue during that time jumped 13.4%, or $156.8 million. Management attributed this to strong demand that resulted in increased shipments of its products. Service revenue, meanwhile, skyrocketed 35.3%, or $63.3 million, year over year. This side of the business largely focuses on PCS contracts that are usually purchased in conjunction with the products that the company provides to customers. This move higher was driven not only by the increase in product sales, but also by the renewal of support contracts.

With revenue moving up, profitability and cash flows moved higher as well. Net income shot up 46.1% from $436.5 million to $637.7 million. Operating cash flow expanded from $374.5 million to $513.8 million. Even if we adjust for changes in working capital, we get a nice move higher from $455.1 million to $644.9 million. And lastly, EBITDA for the company expanded from $501 million to $675.4 million. Obviously, the increase in revenue for the company aided on this front. However, there has been help from a margin perspective as well. The gross profit margin for the company, for instance, grew from 59.5% to 63.1%. While this may not seem like much, when applied to the revenue generated in the most recent quarter alone, that’s an extra $66 million added to the firm’s bottom line on a pretax basis. Management attributed this to a decrease in logistics costs and a reduction in excess or obsolete inventory, as well as of supplier liability charges. The firm’s ability to better leverage fixed overhead costs because of the higher revenue base, on top of a lower mix of revenue coming from its larger customers who receive better terms than smaller customers do, all played a role in this margin expansion as well.

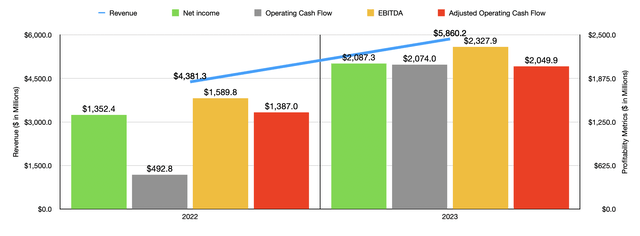

The first quarter of 2024 was not some miracle quarter. The fact of the matter is that Arista Networks has a long history of margin expansion. In the chart above, for instance, you can see financial results covering the 2022 and 2023 fiscal years. While revenue jumped 33.8% year over year, net income grew by 54.3%. Adjusted operating cash flow skyrocketed 47.8%, while EBITDA jumped by 46.4%. Clearly, management is doing a fine job at keeping costs down as revenue scales higher. This is definitely a recipe for success in the long run.

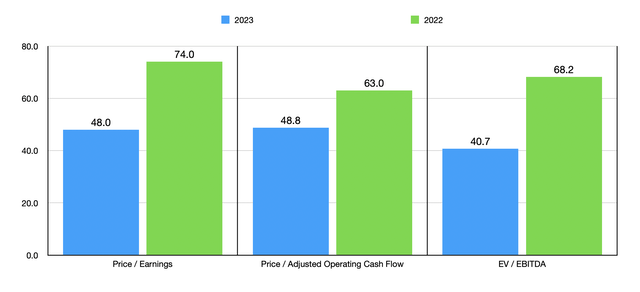

The bad thing about success is that it often breeds desirability. Investors want a high-quality company that is growing at a rapid pace. But that leads to essentially a bidding war on the market that pushes the stock higher. In the chart above, you can see how shares are priced relative to results from both 2022 and 2023. All those shares are much cheaper using the most recent data, they are still priced at astronomical levels. In the table below, I compared the enterprise to five firms that have some similarities to it. On a price to earnings basis, four of the five companies ended up being cheaper than our candidate. However, when using the other two profitability metrics, Arista Networks ended up being the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Arista Networks | 48.0 | 48.8 | 40.7 |

| Motorola Solutions (MSI) | 45.7 | 25.9 | 28.8 |

| Nokia (NOK) | 25.2 | 8.6 | 5.0 |

| Ericsson (ERIC) | 14.2 | 11.2 | 9.0 |

| Juniper Networks (JNPR) | 50.2 | 11.1 | 24.0 |

| F5 (FFIV) | 20.8 | 14.0 | 12.3 |

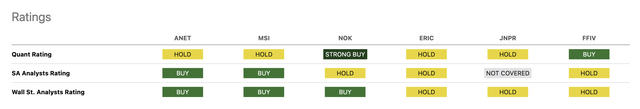

Seeking Alpha has a fantastic ratings system that looks not only at what analysts like myself think of firms, but also what Wall Street analysts believe. Most interestingly, it also has a Quant Rating system that has a solid track record of success. In the image below, you can see how these different groups in action, and what I noticed was that the Quant Rating system has a fundamentally different view than what analysts like myself and Wall Street analysts have. The ‘hold’ rating given by the Quant Rating system aligns with my own view of the company now.

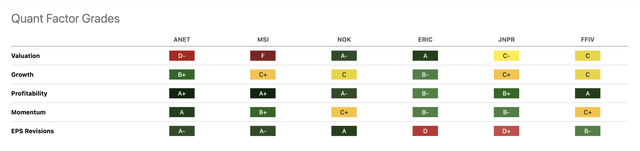

In the next image below, you can see the different criteria the Quant Rating system uses and how Arista Networks stacks up against similar firms. Not surprisingly, it’s the valuation that significantly impairs the attractiveness of the company. This, as well as how Arista Networks looks when it comes to the other metrics like growth and profitability, aligns with my own view of the business quite nicely.

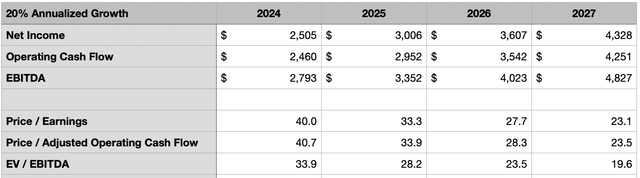

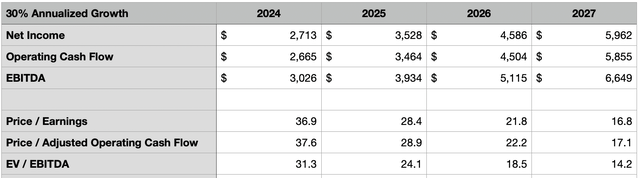

Of course, there is the potential for the company to grow into its valuation. And that is precisely what investors are hoping to see occur. But at some point, even that becomes difficult. In the first table below, you can see how shares are priced under the assumption that profits and cash flows continue to expand at a 20% rate per annum. I then, in the subsequent table, did the same thing with a 30% annualized growth rate. Even in these cases, shares look rather pricey. Each person has their own definition of what’s considered attractive. But to me, the stock does not become even close to a really solid opportunity until around 2026.

Author – SEC EDGAR Data Author – SEC EDGAR Data

There’s also concern about what the future might hold. For the second quarter of the 2024 fiscal year, management expects a slowdown in profit growth. Revenue should be between $1.62 billion and $1.65 billion. At the midpoint, that should be a roughly 12.1% increase year over year. That’s well below the 16.3% increase in sales seen from the first quarter of 2023 to the first quarter of last year. Even though the firm expects its adjusted operating margin to expand to 44% compared to the 41.6% the company saw one year earlier, that translates to an adjusted operating profit expansion of only 18.6% from $606.5 million to $719.4 million. For the first quarter of this year, this metric was 33.6% above what it was the same time one year earlier.

Another issue for me is that management continues to buy back stock. In the first quarter alone, the company allocated $62.7 million toward share buybacks. That allowed the company to complete its $2 billion share buyback program. Because that was completed, management, in the first quarter of this year, decided to initiate another $1.2 billion share buyback plan. Even though the company has no debt on its books and enjoys net cash of $5.45 billion, you never want to buy back expensive stock if it can be avoided. If anything, management should be leveraging this opportunity to issue additional shares in order to grow more rapidly.

Takeaway

It has been a fantastic ride over the past several months that I have been bullish on Arista Networks. I do believe that, in the long run, the company will continue to grow and will create additional value for its investors. However, shares have risen tremendously, and the stock looks more expensive now than it did in the recent past. I continue to be unimpressed with the share buybacks, and the weakness expected for the second quarter of this year is disappointing. Add on top of this how shares are priced relative to similar firms, and I think that it would be appropriate to downgrade the stock to a ‘hold’ at this time.