Travel

AXA Travel Insurance Review — Is it Worth It? [2024]

![AXA Travel Insurance Review — Is it Worth It? [2024] AXA Travel Insurance Review — Is it Worth It? [2024]](https://upgradedpoints.com/wp-content/uploads/2023/09/Family-Jeep-ride.jpeg)

Whether you’re traveling the world or crossing state lines, travel insurance such as the policies offered by AXA Travel Insurance can offer a safety net in case you have to cancel or interrupt your trip or need support along the way for medical emergencies, lost bags, or missed connections.

For more than 60 years, AXA Travel Insurance has provided peace of mind and financial stability to travelers. With solid ratings and underwriting by Nationwide Mutual Insurance, travel insurance plans sold by AXA are backed by an A.M. Best Excellent financial strength rating. AXA offers travel insurance with trip interruption and cancellation coverage, medical emergency and evacuation benefits, lost or delayed baggage, and more.

Let’s examine AXA’s travel insurance coverage options, benefits, and service and compare it to alternatives such as credit card travel coverage and other travel insurance providers.

Why Get Travel Insurance?

Travel insurance can protect what you’ve invested in an upcoming trip. When the unexpected occurs, such as a trip cancellation or medical need, travel insurance can offer the benefits you need to cover it.

You might choose travel insurance for these reasons:

- Your trip has deposits or payments that you can’t get refunded if you need to cancel your trip.

- The health insurance you use at home doesn’t work at your destination.

- You’re planning activities that aren’t covered by your health insurance.

- Medical care is subpar at your destination and you may need to be evacuated to another location with adequate medical facilities.

- You’re concerned about the possibility of lost bags, delays, or missed connections, especially if you have multiple flights or transfers.

Bottom Line:

Travel insurance isn’t necessary for every trip, such as if you’re traveling domestically where your health insurance works and you don’t have major nonrefundable expenses. But travel insurance is worth it if you’ve got a lot of nonrefundable expenses invested in your trip or you’ll need medical coverage at your destination.

Travel Insurance and COVID-19

COVID-19 can interrupt your travel plans, whether you get sick and have to cancel a trip, need to quarantine or get medical treatment while traveling, or plan to visit a destination with high COVID-19 numbers. While some travel insurance companies exclude COVID-19 from insurance coverage, AXA offers COVID-19 coverage as part of its travel protection plans, including trip cancellation and trip interruption and emergency medical and evacuation coverage.

Why Purchase Travel Insurance From AXA?

Any travel insurance company you purchase a policy from should be reputable, reliable, and stable. After all, you’re relying on the company to be there for you when you need it most. It pays to verify reviews and ratings — AXA offers good reassurance in this area.

With 64 years in business, AXA has an A- Better Business Bureau rating. On the travel insurance website Squaremouth, AXA has an overall 4.22/5 rating, with 0.1% negative reviews among more than 69,000 policies sold. AXA’s travel insurance plans are backed by Nationwide Mutual Insurance, which has an A (Excellent) financial strength rating from financial rating company A.M. Best. With 6 decades in business and solid ratings, AXA is a travel insurance company you can trust.

AXA offers travel insurance with medical and emergency evacuation benefits, trip cancellation and interruption, baggage loss, and Cancel for Any Reason (CFAR) options. Let’s look at the details of AXA travel insurance policies.

Types of Policies Available With AXA

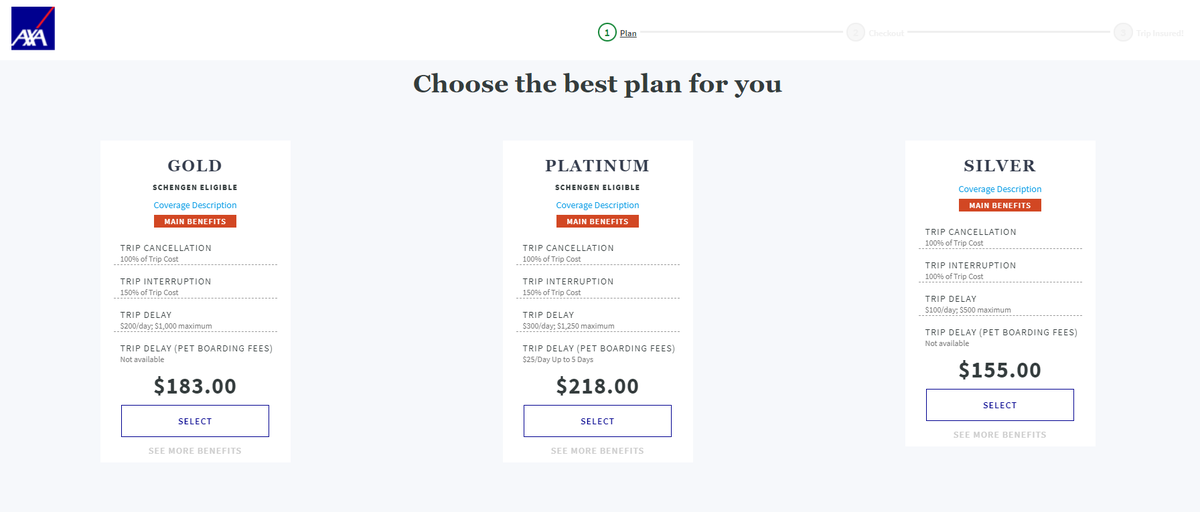

AXA offers 3 levels of travel insurance: Silver, Gold, and Platinum. Each level offers different limits, but all of AXA’s policies have 100% trip cancellation coverage, emergency medical coverage and medical evacuation, baggage delay and loss, and missed connection coverage.

Let’s compare what you get with each policy:

SCROLL FOR MORE

Silver

With plans as low as $16 and minimal coverage, AXA recommends the Silver plan for domestic travel. You can cover 100% of your trip cost for trip cancellation and interruption coverage. If your travel is delayed, you can get up to $100 per day for expenses, up to $500 total, and $200 for delayed baggage.

There’s also $500 in missed connection coverage. The $25,000 in emergency medical expense coverage isn’t much, but it might be adequate for domestic travel if you’re using your primary health insurance first.

Gold

Gold plans start at $36 but add more coverage and are appropriate for cruises or Schengen travel. Like the Silver plan, the Gold plan offers up to 100% trip cancellation coverage but bumps trip interruption to 150% of your trip cost. Limits for all coverages are higher, with $200 per day and $1,000 maximum in trip delay coverage and $1,000 for missed connections. Baggage delays offer up to $300, and you can get up to $1,500 for lost baggage and personal effects.

The health coverage is also much higher at $100,000, and it adds a $50,000 non-medical emergency evacuation option on top of the $500,000 medical emergency evacuation benefit. This plan also offers an optional $35,000 collision damage waiver.

Platinum

The Platinum plan, starting at $52, steps up coverage and offers additional options. You’ll get 100% trip cost coverage for trip cancellation and 150% for trip interruption. Trip delay coverage offers up to $300 per day and a $1,250 maximum, plus $600 for baggage delays and $3,000 for lost baggage and personal effects.

Emergency medical treatment is also higher at $250,000, and you’re covered for $1 million in emergency medical evacuation — $100,000 for non-medical evacuation.

The Platinum plan also offers additional coverage for sports, with $25 per day for lost skier days, $500 for lost golf rounds, and $1,000 for sports equipment rental. It also offers optional coverage for up to 75% of trip cost with Cancel for Any Reason coverage and a $50,000 collision damage waiver.

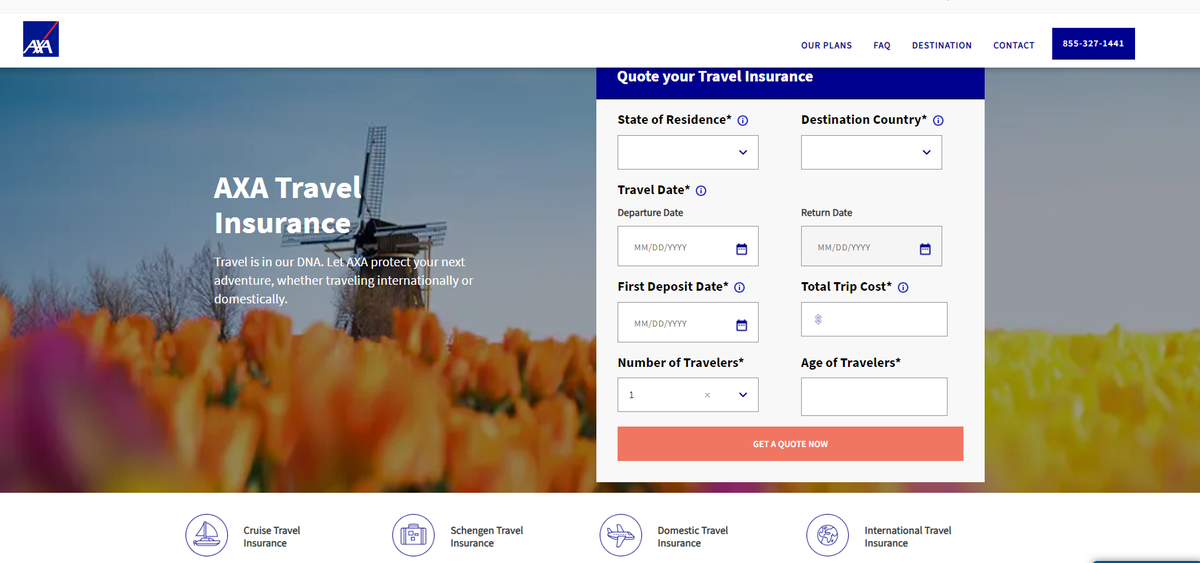

How To Get a Quote

You can get a quote directly from AXA by visiting the AXA Travel Insurance website. The quote form is the first thing you’ll see on the homepage.

To start your quote, you’ll fill out the quote form, including your state of residence, destination country, travel dates, first deposit date, total trip cost, number of travelers (up to 10), and the age of travelers.

Once you fill out the form, you’ll be presented with plan options. For a 60-year-old visiting Japan and spending $2,500, we were offered a Silver ($155), Gold ($183), or Platinum ($218) plan.

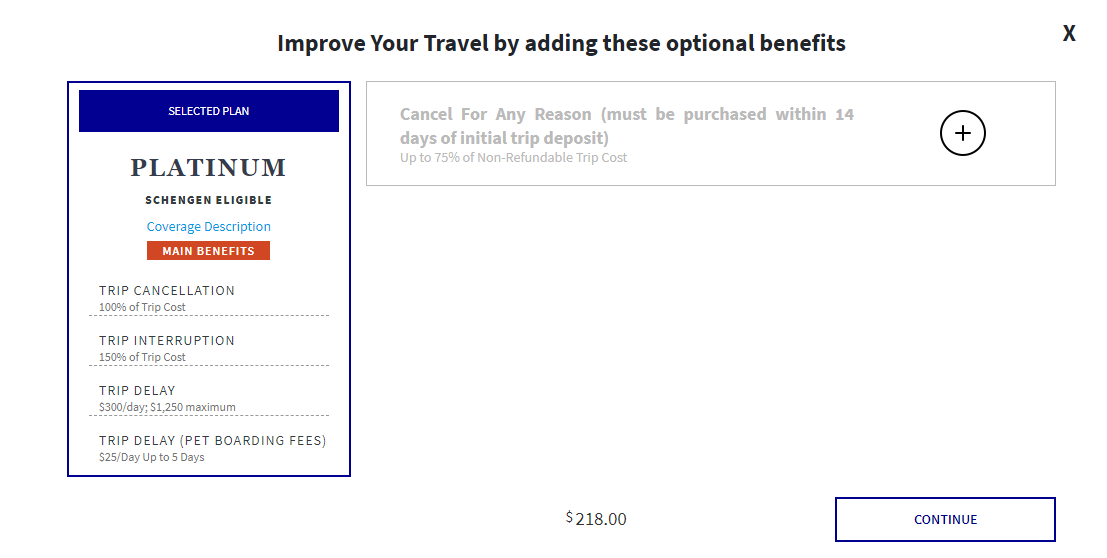

If you select a Platinum plan, you will be able to add CFAR optional coverage for up to 75% of your trip cost.

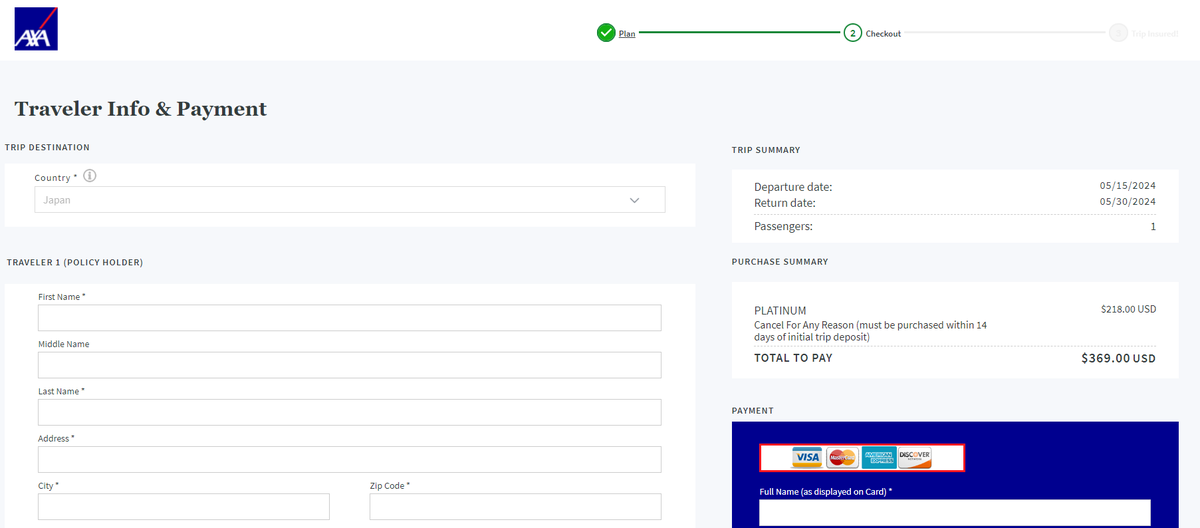

With your plan and options selected, the next and final step to secure coverage is entering your traveler information including your name and contact information, then making your payment for the policy.

How AXA Compares — Summary

AXA is a good option for travel insurance, but it’s not your only option. Let’s see how AXA compares to the coverage you can get from popular travel credit cards and travel insurance competitors.

AXA vs. Credit Card Travel Insurance

Many travel credit cards offer travel insurance as a complimentary benefit, whether it’s car rental collision waivers, trip cancellation coverage, or emergency medical and evacuation benefits. This coverage can be helpful if you’re using your card to pay for your travel expenses, but it’s often not as comprehensive as the coverage you can get from a travel insurance policy like what AXA offers.

Let’s compare AXA’s best travel insurance policy against The Platinum Card® from American Express and the Chase Sapphire Reserve®, which both offer some of the best travel protections available with credit card benefits.

SCROLL FOR MORE

Unless you’re taking a trip with expenses higher than $10,000, the trip cancellation coverage should be about the same whether you’re using an Amex Platinum card, Chase Sapphire Reserve card, or the AXA Platinum plan. However, the AXA Platinum plan comes out ahead with 150% of your trip cost for trip interruption.

We see a major difference in coverage for emergency medical treatment and evacuation. The Amex Platinum card doesn’t offer emergency medical coverage, but you can arrange an emergency medical evacuation using the Premium Global Assist Hotline. The Chase Sapphire Reserve card offers up to $2,500 in emergency medical coverage and $100,000 for emergency evacuation. Neither of these offerings compares to the $250,000 in emergency medical coverage and $1 million in emergency medical evacuation coverage you can get from AXA Platinum.

Bottom Line:

Credit card travel insurance coverage is complimentary if you already have the card, but it is lacking in some areas. It’s a good idea to use your card’s travel insurance as a backup for trip cancellation, interruption, travel delays, or lost baggage, but use the AXA Platinum plan for its superior emergency medical and evacuation coverage.

AXA vs. Other Travel Insurance Companies

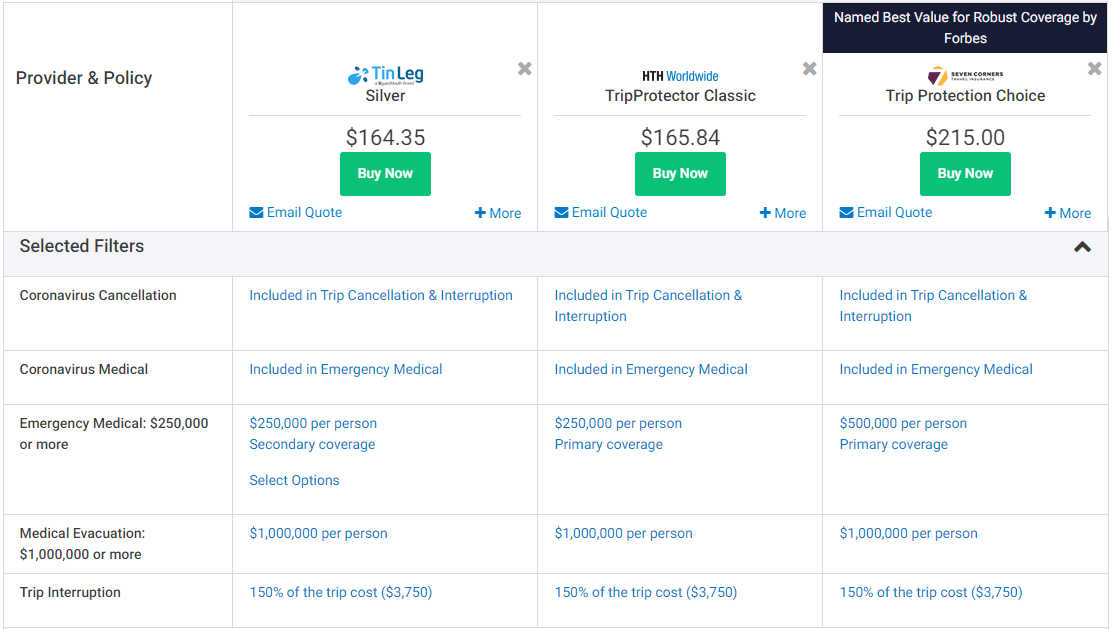

It’s always a good idea to compare travel insurance quotes across multiple providers so you can find the best price and coverage. We used Squaremouth, a travel insurance comparison website, to see how AXA’s policies compare to those of other companies.

As with the initial price quotes we pulled from AXA’s website, our sample trip on Squaremouth had:

- 1 traveler

- Age 60

- Traveling to Japan a month from now

- Trip cost: $2,500

- Initial trip deposit paid within the last 24 hours

- State of residence: Texas

We limited results to policies that offer at least as much coverage as the AXA Platinum policy does on major benefits:

- COVID-19 coverage

- Minimum $250,000 emergency medical benefit

- Minimum $1 million emergency medical benefit

- 100% trip cancellation

- 150% trip interruption

Each policy offered nearly identical coverage for these major benefits, and Tin Leg‘s Silver plan had the lowest cost at $164.35, followed closely by $165.84 from HTH Worldwide‘s TripProtector Classic plan.

If you’re mainly concerned with full coverage for trip cancellation and interruption along with $250,000 in emergency medical and $1 million for emergency medical evacuation, you can save if you go with Tin Leg.

However, the higher-priced policies offer additional coverage and options. For example, AXA Platinum offers the option to add Cancel for Any Reason coverage and includes sports equipment rentals and missed ski days or golf rounds. Tin Leg doesn’t have missed connection coverage, but Seven Corners Trip Protection Choice and AXA Platinum offer up to $1,500 for missed connections on cruises or tours.

All of the policies we quoted except for Tin Leg Silver offer employment layoff as a covered cancellation reason, and AXA Platinum allows you to cancel your trip for work reasons, though none of the other policies do. AXA Platinum also offers $100,000 in non-medical evacuation, which Tin Leg Silver and HTH Worldwide TripProtector Classic policies do not, and is much higher than the $20,000 benefit offered by the Seven Corners Trip Protection Choice policy.

Bottom Line:

AXA Platinum has a higher cost than competitors but offers more robust coverage. If you’re mainly concerned with major coverage for trip cancellation and interruption, emergency medical, and emergency evacuation, other travel insurance companies may offer a better quote. But if you want additional coverage and options such as non-medical evacuation and expanded cancellation reasons, check out the details on what AXA Platinum offers.

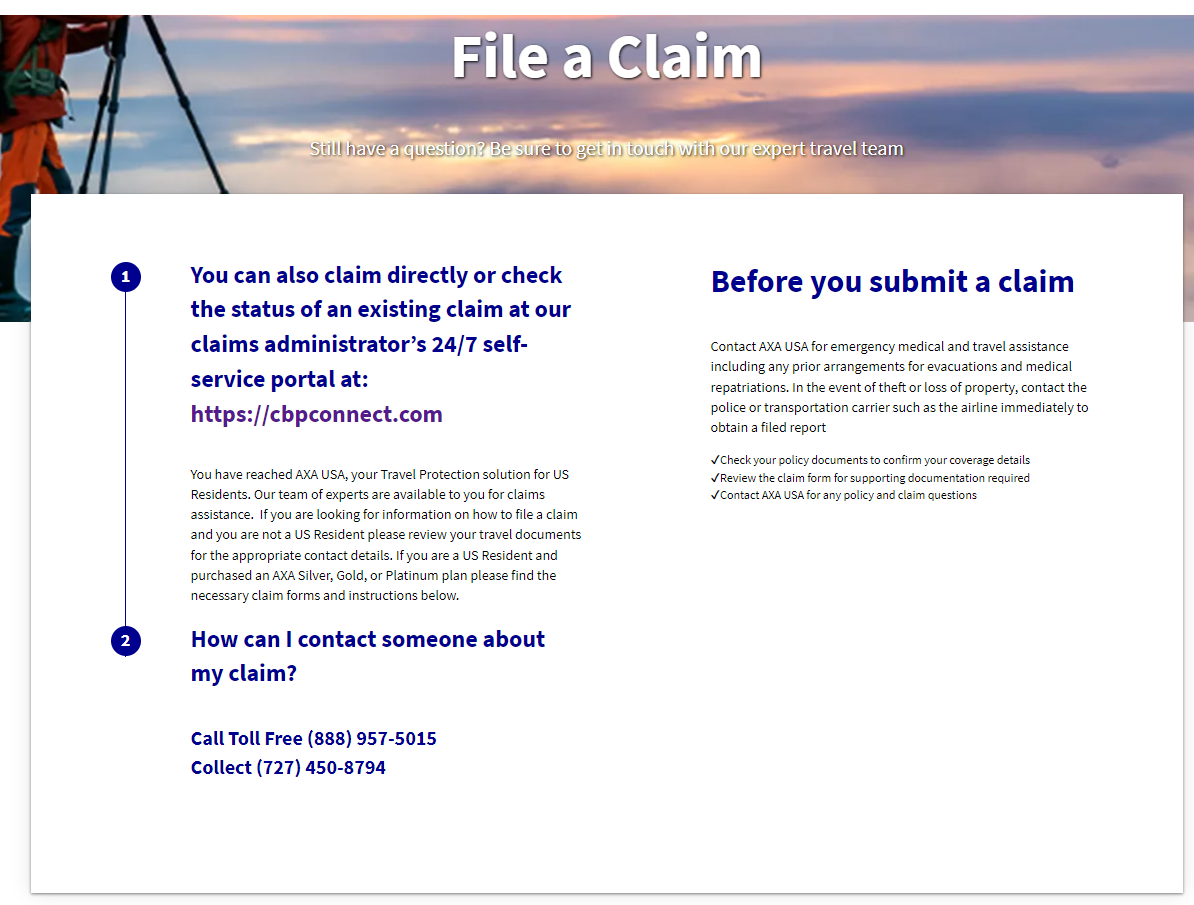

How To File a Claim With AXA Travel Insurance

You can file a claim with AXA in a few ways:

- Using the claim administrator portal

- By phone

- By email

- By mail

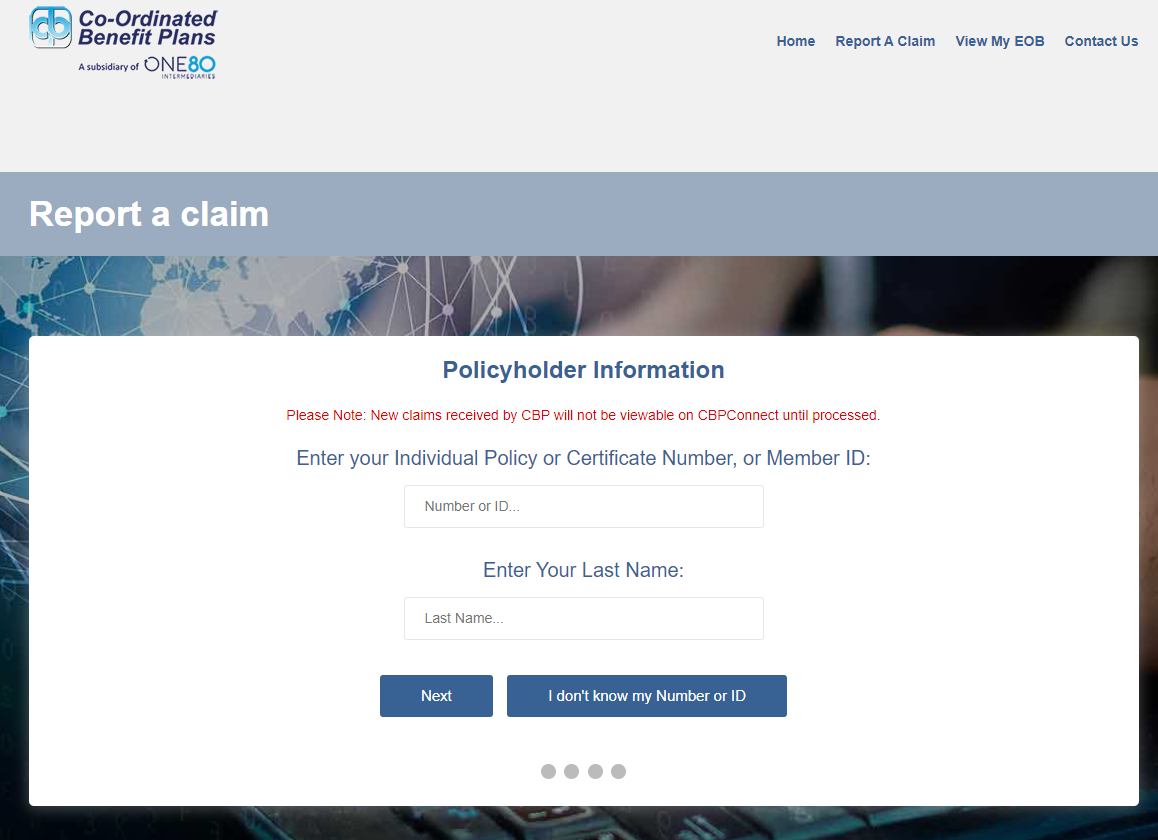

If you’d like to file your claim online, you can visit the portal for Co-Ordinated Benefit Plans and enter your policy number and last name to get started.

Alternatively, you can call AXA toll-free at 888-957-5015 or collect at 727-450-8794.

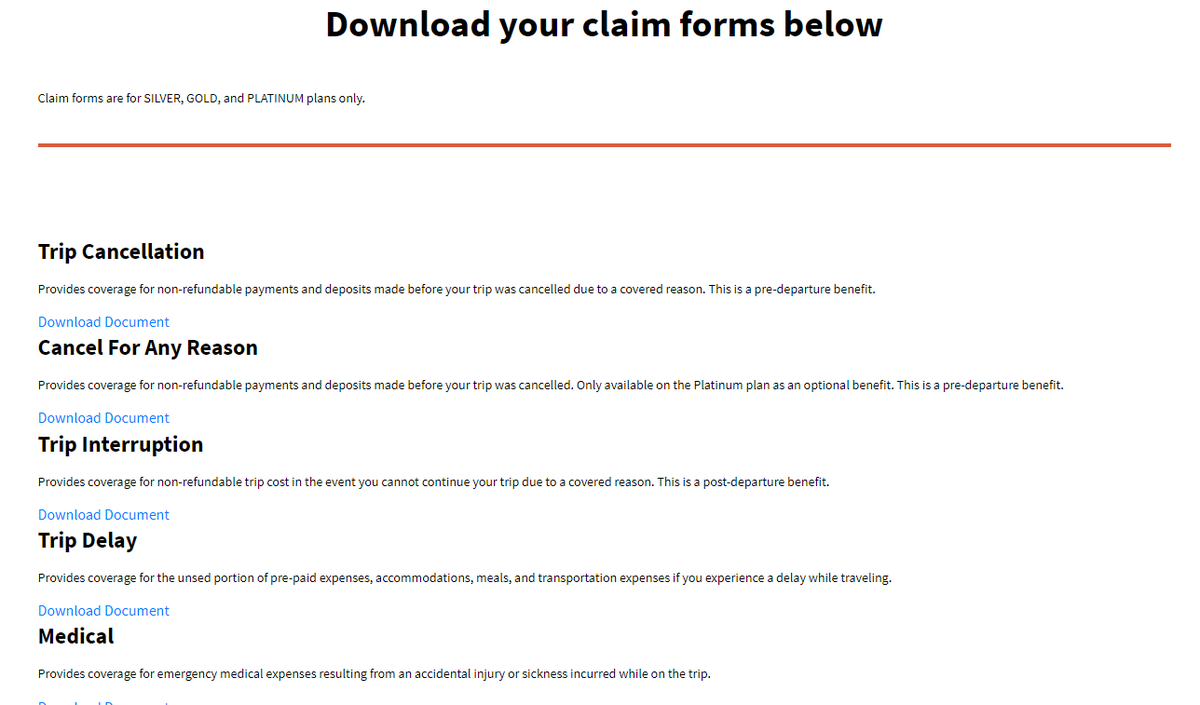

If you’d like to submit your claim via email or mail, you can download claim forms on the AXA website.

Once you download the claim form, you’ll get a list of documents required for submitting your travel insurance claim, along with mail or email info. For example, on a trip interruption claim form, AXA requires you to send in:

- Completed claim form

- Policy verification

- Booking confirmation, such as a ticket or proof of purchase

- Your original unused, nonrefundable tickets

- Your new ticket with confirmation of early return

- A cancellation statement from travel suppliers

- A medical report or physician statement if you interrupted the trip due to medical necessity

- Death certificate, if applicable

- Documentation of circumstances that led to trip interruption

- Documentation of reimbursement request expenses, such as receipts or credit card statements

You can email the form and other required documents to AXAClaims@cbpinsure.com or mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

Final Thoughts

AXA Travel Insurance is a reliable option with more than 6 decades of experience and solid ratings. There are 3 levels of coverage to choose from — Silver, Gold, and Platinum — that offer varying levels of coverage and options. AXA Travel Insurance isn’t the cheapest option, but it offers robust coverage options and reputable service, so it can be a good choice if you’re looking for enhanced travel protection.

For the premium global assist hotline benefit of The Platinum Card® from American Express, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the car rental loss and damage insurance benefit of The Platinum Card® from American Express, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the baggage insurance plan benefit of The Platinum Card® from American Express, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the trip delay insurance benefit of The Platinum Card® from American Express, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of The Platinum Card® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card® from American Express, click here.