World

Barrick Gold: Being Number 3, In A First Place World (NYSE:GOLD)

Ryan McVay/DigitalVision via Getty Images

Contributed by Mark Malinowski, produced with Avi Gilburt.

Introduction

Many times, the media and pop culture lead us to believe that if you are not first, you might as well be in last place. Some people apply this idea to their investments by only selecting the best of the best of the best. While this isn’t a bad approach per se, how do they know they are the “best?” In the mining industry, producers with only a single mine can have geopolitical events overtake and tank their stock literally overnight. So putting all your eggs in one basket is definitely not the theory we subscribe to.

How do you know you are getting good value or a good price at the time you are ready to buy the best? What happens when the products these companies mine and produce change in value in a volatile way? Finding a good entry point for a stock or commodity is often the secret sauce that investors and traders don’t discuss. Combining Elliott Wave Theory and Fibonacci Pinball provides a way to find low risk, high reward opportunities.

What happens when you select companies that are great at what they do fundamentally, are geographically risk diverse, and have good technical indications on their side? When you do, you are talking about finding companies that sit at the intersection of fundamentals and sentiment, and today I am going to look at Barrick Gold (NYSE:GOLD).

Background

Barrick Gold is a very geographically diversified producer. They are firmly planted as the number 2 gold producer in the world in terms of Gold Equivalent Ounces (GEOs) produced. They produced 4.05 Moz of gold (plus ~ 800 k GEOs in copper) in 2023 with a combined AISC of 1350 to 1400 USD/ oz. They operate 13 gold mines, 6 of which are tier one gold operations, and 3 copper mines. These operations (plus projects) span 18 countries and 4 continents.

To say that Barrick has taken a different approach to growth compared with some of their peers is an understatement. Most of the big players have done all stock takeovers (NEM/Newcrest and AEM/Kirkland come to mind) to keep debt down in an elevated rate environment. Since the merger with Randgold 5 years ago, Barrick has been investing in their own projects and existing mines. They have also been actively seeking distressed assets for the right price. This has led to a slower pace of growth. It has also led to them putting more of their own cash flow to work, as there are several mega-projects being developed at the same time. If we follow the Warren Buffett school of investing, the best place for a company to put free cash flow is reinvestment by the company with a high rate of return opportunity.

CEO Mark Bristow is known for his ability to develop and repair relationships where trust has been lost. That doesn’t mean that Barrick hasn’t had their share of issues over the past couple of years. The worst being that one of their top-tier mines (the Porgera mine in Papua New Guinea) was on care and maintenance from April 2020 until December 2023. That was a LONG time with no production. Fortunately, Mark Bristow was able to renegotiate new terms to the deal with the government. That kind of patience is not something that many companies would be willing to handle financially. Barrick did it without going into negative earnings. Going into the future, Bristow will find another mine or distressed asset where his unique skills create value where others would destroy it.

Why we like this company from a fundamental viewpoint

What I like best about Barrick in the near term is their steady hand on operations. The following two statements from their 2023 Annual Report, speaking about the average price of gold and copper on an annual basis:

“For every $100/oz change in gold price, attributable operating cash flow generated by our operations increases by ~$1.6bn”

“For every $0.5/lb change in copper price, attributable operating cash flow generated by our operations increases by ~$0.9bn”

In the longer-term future, I like that they have a concrete play to grow their production by 40% over the next 7 years with projects that are currently well under development. Going from ~5 million GEOs to 7 million GEOs by 2030.

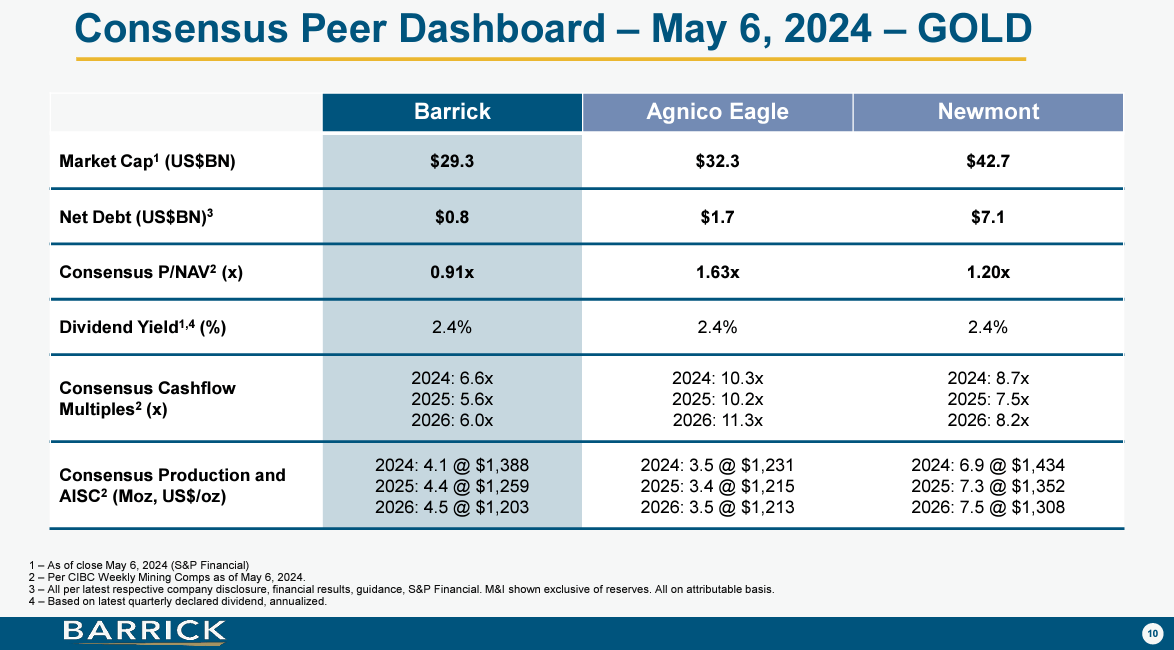

In their most recent earnings report presentation, they provided what I think is an excellent table comparing them with their two most obvious gold peers:

Consensus Peer Dashboard – Gold (Barrick)

The discount that they are trading at is significant, especially given their lower debt and their price per net asset value comparisons. If they can reduce their AISC costs as they are predicting, they will be a leader and at par with Agnico Eagle (AEM). What holds them back is the fact that they are mining in higher risk locations with some of their mines. What leads them continues to be Mark Bristow’s strong relationships, in my opinion.

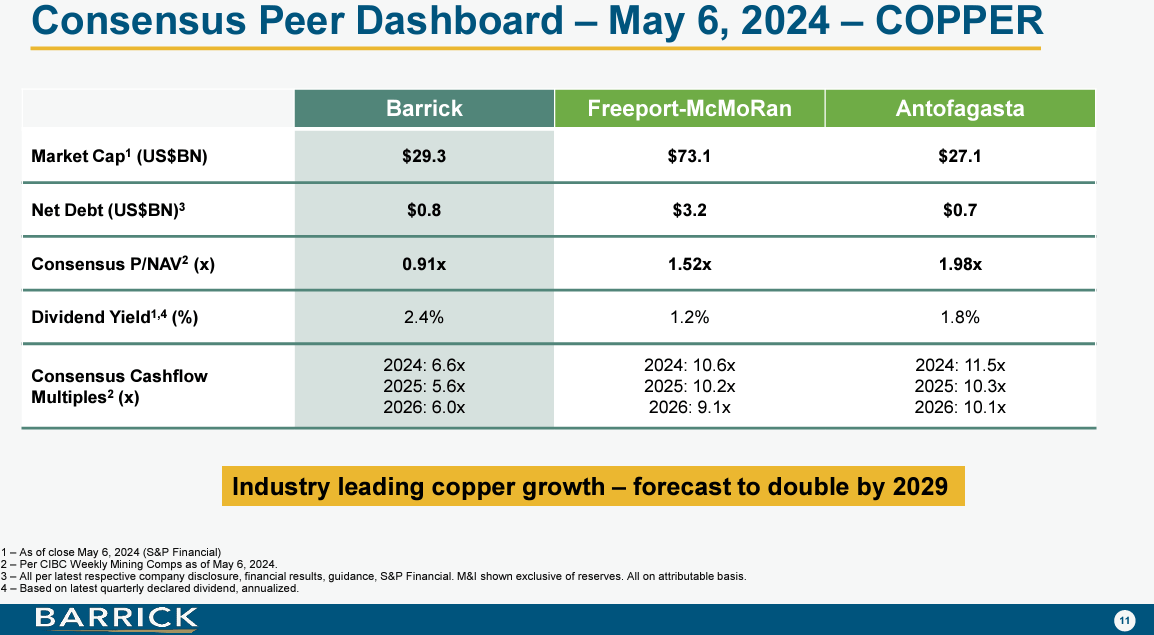

Considering their planned doubling of copper production in the next 6 years, comparison to the copper side of things also seems wise. Barrick also did that comparison for us in their May presentation.

Consensus Peer Dashboard – Copper (Barrick)

While this is not the focus of this article, copper is the future driver of growth at Barrick. Three things need to be achieved for that value to be unlocked. First, execution of new mine development on time and budget. Ramping up and holding steady state operations at these new facilities. Then, the expected growth in terms of copper demand (and therefore price per pound) over the next decade is what will increase their valuations on the 5 plus year time horizon.

Bottom line, the market is undervaluing Barrick compared with peers on a fundamental basis. The question now is how does that line up with sentiment.

Technical Elliott Wave theory view of Barrick Mining

Back in August 2020 was the last time that Barrick Gold was in an uptrend on the daily chart. It did that when the world was shutting down and a solid 4 months after the Porgera mine went on care and maintenance.

Fortunately for those long-term investors, Zac made the call with a clear stop out level in August 2021 that if the chart did not make 5 waves up or price sustained below the July low, that a larger and deeper correction was likely to occur on Barrick. At that time, Barrick was trading at ~21.53 USD.

Stock Waves GOLD chart Aug 2, 2021 (EWT)

It has subsequently struggled to stay above the 2022 low. First, with a ~17.50 target, and given the shape and proportion of the decline, the 13 -14 USD price range seemed to be a magnet.

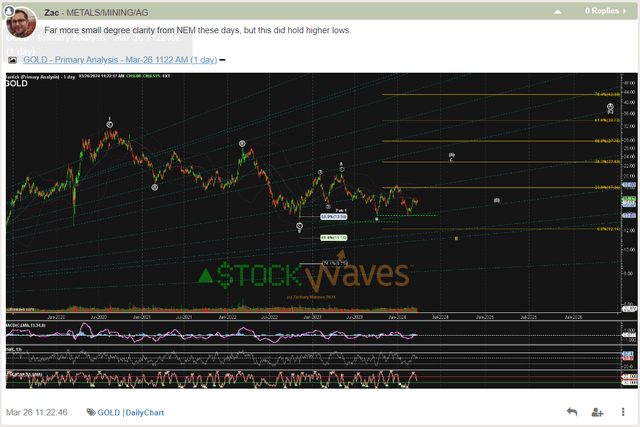

In March 2024, despite how challenging the chart looked, Zac posted this:

MMA post showing GOLD chart from 3/26/24 (EWT)

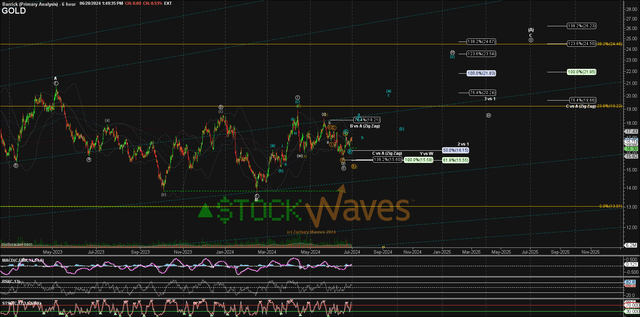

On June 28th, this was made an Active Wave setup with clear risk/reward parameters. Wave Setups are highlights of a clear Elliott Wave setup noting an ideal support level, an invalidation level where the setup ceases to be probable, a target and an initial resistance level. As resistance levels are reached for the smaller degree sub-wave “way-points” in the pattern, an official “update” is posted with favorable adjustments to the support & invalidation as well as a new resistance level. Of course, many charts are likely posted in between tracking the progress.

June 28, 2024 chart on GOLD used with WS (EWT)

GOLD has now reached that first blue a-wave inside the “(a)” wave of circle iii, it allows for some consolidation at a very small degree.

In discussing the Barrick chart with Zac, and its current impact on GDX, we agreed that this chart is very similar to the look of AEM back in late March. He shared this post with members on July 3rd.

MMA post from July 3 on GOLD (EWT)

This has been viewed by many as an ugly chart for some time, but with the price of gold and copper continuing to increase and Barrick quietly getting themselves invested in great expansion projects in the background, things are looking up. Like many charts in the precious metals miners sector, we see this working on a diagonal pattern, which has its challenges and its rewards. Having experienced guides can be invaluable.

We continue to identify high probability targets at the intersection of fundamentals and technicals. We continue to see a very bullish 2020s decade for commodities, but not all charts are the same. We relish the diverse patterns we see even among the precious metals mining stocks, as they present more opportunities for rotation than in an “all-the-same” market.

/static.texastribune.org/media/files/f5fdb1dff4d6fd788cba66ebaefe08d0/Paxton_GOP_Convention_2018_BD_TT.jpg)