Fitness

Basic-Fit: A Fitness Chain With A Unique Moat (OTCMKTS:BSFFF)

onurdongel/E+ via Getty Images

Investment Thesis

In my view, Basic-Fit (OTCPK:BSFFF) presents a compelling investment opportunity primarily due to its significant competitive moat: their ability to operate clubs at extraordinarily low costs. This cost-efficiency is driven by their scale and strategic use of technology. Basic-Fit’s fitness club breakeven point seems to be notably lower than competitors, allowing them to maintain profitability with far fewer members than competitors. Their advanced technological solutions, such as automated entrance systems and remote monitoring, drastically reduce staffing needs and thereby operational expenses. This unique cost structure not only enables Basic-Fit to outcompete other fitness chains but could also support aggressive expansion like they have been able to do the last two years. Given these factors, I think Basic-Fit is well-positioned for sustained growth and increased market share.

Introduction

Basic-Fit is a leading European fitness chain that operates over 1,500 clubs across multiple countries, including the Netherlands, Belgium, France, Spain, and Germany. Renowned for its budget-friendly approach, Basic-Fit has rapidly expanded its membership base, leveraging a standardized and very scalable model. In the following paragraphs, I will analyze what I think Basic-Fit’s moat is. Also, by comparing their numbers to other chains’ numbers. After that, I will look into the valuation and dive into the reasons why I think the valuation is really low at the moment.

Basic-Fit’s Moat

To begin with the elephant in the room, I think Basic-Fit has a very wide and quantifiable moat. That is, they can operate a club cash flow breakeven on just 1,400 members. This, by all means, is a very low number. To my knowledge, none of the other fitness chains disclose this information publicly. But, according to Basic-Fit themselves, their US competitor Planet Fitness (PLNT) needs between 5,000 and 6,000 members to reach cash flow break-even status. As Basic-Fit’s CEO René Moos stated during Q4 2023 earnings call:

If you talk about Planet Fitness in Spain and you look at the Spanish market, I would say that, there is still a lot of growth possible in Spain. I think competition is good. We can still double the penetration in Spain. It’s around 11%. So less than half what it is in the U.S. We think there is a room for competition. It cannot only be orange in Spain where people work out, but we’re very comfortable that with our model, we will compete with them. I think the model is similar both low cost. The only big difference, we are cash flow breakeven on 1400 members and they are cash flow breakeven on 5000 or 6000 members.

As you can see, the gap is immense. However, comparing these numbers is not apples to apples because Planet Fitness runs a franchise model while Basic-Fit operates their clubs themselves. The fact remains that if these numbers are even somewhat accurate, Basic-Fit can operate a club profitably much more easily (at least more than three times), enabling them to outcompete a Planet Fitness club in any given situation.

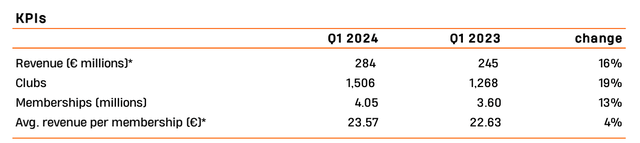

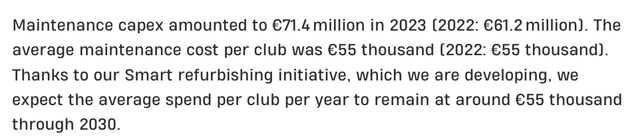

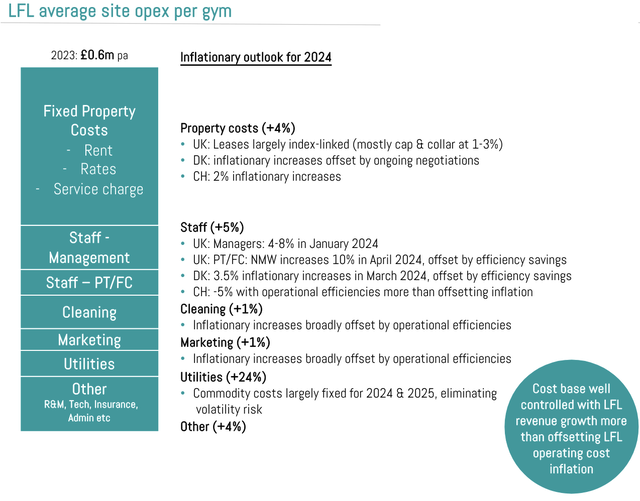

To look for a somewhat more apples-to-apples comparison, we can examine the PureGym Group (currently not publicly listed, but they do report extensive numbers). This is a non-franchise budget chain operating in the UK, Denmark and Switzerland and Basic-Fit’s largest competitor in Europe. Although Basic-Fit is not (yet) active in these regions, we can still analyze the numbers. For example, the capex required for opening new clubs is somewhat similar, with a slight advantage to Basic-Fit; PureGym needs 1.2M pounds and Basic-Fit just shy of 1.2M euros. While they go head-to-head regarding capex, we can see in both their 2023 annual reports that the costs of operating their clubs tell a completely different story. While Basic-Fit’s average maintenance capex per club is 55,000 euros, PureGym needs 600,000 pounds.

Average maintenance cost per club (Basic-Fit) |

Average site opex per gym (PureGym) |

As can be seen above, this is more than a tenfold the costs for PureGym. Just as with Planet Fitness, the difference is immense, and if they were active in the same regions, the competition would seem completely unfair. Therefore, in this instance again, Basic-Fit’s moat of operating clubs at far lower costs appears unbridgeable.

Furthermore, to consider a non-franchise operator in a region where Basic-Fit is actively expanding, we can look at McFit. McFit is part of a business group with different fitness related brands called RSG Group. RSG Group is not publicly traded, and they also don’t disclose specific financial data, we can glean insights from recent events. That is to say, Basic-Fit acquired all 47 Spanish clubs of the RSG group last April (42 under the McFit brand and 5 under the Holmes Place brand). The fact that RSG Group sold all their Spanish McFit clubs since Basic-Fit seriously grew the number of clubs in Spain from 56 to 139 clubs in the last two years, tells me that they couldn’t make the economics work for those McFit clubs. Either because low-budget fitness concepts don’t work in that region or, and this is more realistic because RSG Group recognized their inability to compete with Basic-Fit’s extraordinarily low operating costs. I believe they chose to cut their losses and focus on other markets, such as Germany. However, this decision may not be without risk, especially considering that Germany is Basic-Fit’s next biggest growth market, where a similar scenario could unfold.

To wrap things together, on the basis of these three illustrations, I think it’s undeniable that Basic-Fit has a special sauce with regard to operating their clubs on extremely low costs. Or, in other words, they can run their clubs far more efficiently than other operators. Which, if you ask me, is their moat.

Operational Efficiency

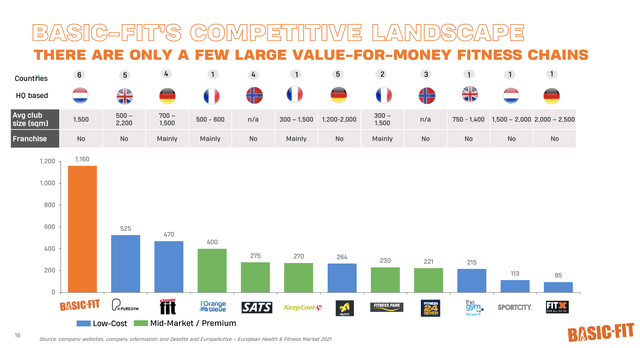

Basic-Fit’s recipe for cost-effectiveness hinges on two critical factors. Firstly, their sheer size plays a pivotal role. With an extensive network of over 1500 clubs, expanding with 200+ clubs in the last two years, Basic-Fit commands considerable bargaining power in negotiations. This leverage allows them to secure favorable terms not only for setting up new clubs and ongoing maintenance contracts, but also for essential aspects like rent leases, which can significantly impact operational costs. In comparison, in 2023 PureGym paid 108M pounds in rental costs on the basis of 581 clubs at the end of 2023, which roughly comes down to 168K pounds per club per year. Basic-Fit, on the other hand, paid 223M euros in rental costs on the basis of 1402 clubs at the end of 2023, which equals to 159K euros per club per year. If we convert PureGym’s rental costs to euros, it would be around 197K euros per club per year. As you can see, Basic-Fit pays around 20% less rent per club. Additionally, Basic-Fit seems to be operating slightly bigger clubs, see the slide from their investor presentation below:

Investor presentation 2023 (Basic-Fit)

As you can see, Basic-Fit only operates large clubs of around 1500 square meters while PureGym also operates smaller clubs (less than 1000 sqm) which drags their average size down. If this is the case, Basic-Fit’s rent discount would be even bigger than the 20% on a square meter basis. Although Basic-Fit and PureGym are not active in the same regions and region-specific rent prices may differ, the substantial discount of at least 20% provides an insight into how Basic-Fit is able to negotiate the best prices on their club rents.

Secondly, Basic-Fit stays ahead of the curve by embracing technology. The company has made substantial investments in developing and implementing cutting-edge digital solutions aimed at streamlining operations in their clubs. From automated gym attendance processes to offering a platform of digital services like virtual workouts and personalized lifestyle advice, with these technological developments Basic-Fit significantly reduces reliance on manual labor. But, if you ask me, I find it the most incredible that Basic-Fit is, thanks to their technological advancements, able to run their clubs with no or little to no staff. They’re able to do this thanks to their automated entrance system and remote security monitoring with smart cameras. The result is that Basic-Fit needs to hire 1 to 1.5 FTE on average per club, while other chains need to hire a significant multiple of that. Although Basic-Fit and other non-franchise public fitness chains – to my understanding – do not publish their per club staff cost, I think this is one of the most important reasons why they can run their clubs on such low costs as described in the previous paragraph. If you ask me, this level of automation and efficiency is truly impressive and is the distinguishing factor that sets Basic-Fit apart from their competitors.

Valuation

Basic-Fit, at the last reported date of the 31st of January 2023, had just a bit more than 850M euros in long-term debt. With a current market cap of around 1.4B euros (23rd of May) and 70M of cash on the 31st of January, the company has an enterprise value of 2.18B euros. The company expects to make between 305M and 330M EBITDA in 2024. This means that the company currently trades below 7 times EV to 2024 expected EBITDA. If you ask me, this is an insanely low valuation for a company with significant growth ahead. The company expects to double its number of clubs in the regions they are currently active in by 2030. I see this as possible because this is similar to the pace they have been growing in the last two years. A company that can double its size in less than six years and has such a significant moat should trade at a minimum of 15 times EV to EBITDA, if you ask me.

If you compare this with their competitors, Planet Fitness trades at a EV to forward EBITDA just shy of 16. PureGym did not give a 2024 EBITDA outlook, but their current 2024 EBITDA run-rate is 159M pounds. And since, to my knowledge, PureGym’s current valuation is not publicly known, we have to make an estimation of their market cap in another way. What we do know is that the company was valued at an excess of 1.5B pounds on the 14th of December 2021. On the 14th of December 2021, Basic-Fit had a market cap of 2.9B, which makes the current market cap down around 47%. On that same date, Planet Fitness had a market cap of 7.41B, currently the market cap is down 23% from these levels. If we take the average from these market cap declines we get 35%, and if we detract that from PureGym’s 2021 valuation we can make a very rough estimation that the current market cap of PureGym would be around 975M pounds. We do know that the company had 104M of cash and 799M pounds in debt at the end of 2023 which, if we go out from the rough estimation, comes down to an enterprise value of 1.67B pounds. If you hold this against the 159M EBITDA run-rate, you get a rough EV to EBITDA valuation for PureGym just above 10.

| Basic-Fit | Planet Fitness | PureGym Group | |

| EV / EBITDA (fwd) | 6.87 | 15.98 | 10.5 |

While these comparisons are difficult because, on the one hand, Planet Fitness runs a franchise model and is mostly active in the US and, on the other hand, PureGym’s numbers are not all that accurate. It does give a rough insight into the fact that Basic-Fit is not trading at a rich valuation at all, especially given its considerable moat.

Slowdown

One of the reasons for the low valuation could be found in the slowdown in growth of new members.

As you can see in the image above, during the last quarter the clubs grew at a higher pace than the memberships (19 and 13% respectively). This is something that could be troubling. The management addresses this to the situation in France, as said during the full year 2023 earnings call:

Our performance in France was somewhat impacted by the social unrest that affected consumer behavior in the first half of the year. Although, we observed a trend towards normalization in the second half, results still fell somewhat below expectations, due to a generally weaker consumer environment. In the first couple of months of 2024, the membership development in France continued to be slightly behind expectations. To support our French membership development, we are implementing initiatives that have been very successful in the Benelux countries. This should improve our performance as from the second half of 2024. Visible initiatives include longer opening hours of our clubs, and selectively also having clubs open 24/7. Another visible element is the installation of massage chairs in all our French clubs.

Since France is their largest market, comprising 54% of their open clubs at the end of Q1 2024, any difficulties in that region will significantly impact the company’s numbers. In their Q1 2024 report, they still observed some weakness in the French market and consequently implemented a management change, separating the responsibilities for the expansion of new clubs from the management of the existing club network. Given that this region has grown so rapidly to become their largest, I believe the need for such changes is a natural part of a growing company’s evolution. It’s important to keep track of the growth in membership numbers in the following quarters to determine if management’s actions are effective and find out if this is just a short-term hiccup or a larger issue.

Funding Of Growth

Another reason for the low valuation, could be some worries about the funding of their growth. The company has, for a large part, funded their recent growth on the basis of debt. Resulting in a current debt load of 850M, expecting to grow to at least 1B euros in the next two years. From 2025 onwards, they’re confident that they should be able to fund their entire growth capex through their generated free cash flow. While taking on new debt always brings risks (especially in a macroeconomic environment like this), I do think that they’re managing their debt in a reasonable manner. Assuming the low end (305M) of their 2024 EBITDA guidance, they’re currently around 2.5 times net leverage. My estimation is that they will stay in or below this range until 2025, as their EBITDA and debt will grow at the same pace, with a slight advantage to the former since more clubs opened in the last two years will reach mature status. I will closely monitor their debt development over the next two years, but for now, I don’t see any red flags both regarding their ability to fund growth and their current debt profile.

Risks

On top of the current reasons for the low valuation described in the previous two paragraphs, there are also some more general risks associated with Basic-Fit’s moat and the budget fitness chain model as a whole. A company-specific risk is that competitors catch up with their low operating costs. A competitor-though requiring a very large cash injection-could possibly reach the same scale, thereby leveraging their size to negotiate similar favorable terms regarding rent and purchasing equipment, and thus erode part of Basic-Fit’s cost leadership. In line with this, if the technological advancements that currently allow Basic-Fit to operate clubs with such low staff numbers and thus saving a lot of costs become outdated, or if competitors adopt similar or better technologies, Basic-Fit’s cost advantage could diminish. A broader risk could be the trend of people opting not to go to gyms altogether. With the access to home fitness technology, virtual trainers, and on-demand workout programs, more individuals might choose the convenience of exercising at home. This shift in consumer behavior could lead to a significant decline in gym memberships and foot traffic, ultimately impacting Basic-Fit’s-business model and profitability. Although I think all the risks in this paragraph are not currently acute, I am of the opinion that it is important to monitor them in the following years to see if Basic-Fit’s business model and moat withstands.

Conclusion

In summary, Basic-Fit has dug a large moat between them and their competitors thanks to its impressive operational efficiency. With their scale and smart use of technology, Basic-Fit manages to keep per club operating costs lower than its competitors, which makes it hard for the latter to be operating in the same regions as them. Comparing Basic-Fit to competitors like Planet Fitness, PureGym Group, and McFit quantifies their unique efficiency. They run clubs at much lower costs, which helps them stay profitable with fewer members.

Although they face challenges, like the recent slowdown in membership growth specifically in France and concerns about rising debt levels, I still think Basic-Fit’s management is up to the task. They’re confident they can fund future growth through their own cash flows starting in 2025, which is a good sign if you ask me. Despite the risks of taking on debt, their current debt situation and growth plans look manageable to me. Overall, Basic-Fit’s extreme focus on keeping their operational costs down and their scalable business model put them in a strong position for continued growth and market leadership in the European fitness scene.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.