Shopping

Beyond Shopping: Malls Seek New Life as Dynamic Destinations | PYMNTS.com

Paco Underhill is a name synonymous with the evolution of retail spaces, particularly malls. As an environmental psychologist, retail consultant and the author of “Why We Buy,” Underhill has dedicated his career to understanding the behavior of consumers and how the retail world responds to those behaviors.

In 1986, he founded Envirosell, a company that has conducted consumer behavior research in more than 50 countries. As Envirosell’s clients span industries from technology and healthcare to global mall developers and Fortune 100 companies, Underhill has a front-row seat to the shifts in retail environments.

Underhill, who spoke to PYMNTS, has observed the rise and decline of malls globally, as they face challenges from eCommerce growth, changing consumer behavior and shifting expectations. Malls in the U.S. must adapt creatively to remain relevant, he noted, moving away from traditional retail spaces to more experiential destinations.

In this interview, Underhill discussed trends shaping the future of malls, including the decline of department stores, the rise of experiential retail and how malls are evolving to meet the needs of modern consumers.

The Changing Landscape of U.S. Malls

Underhill noted the expansion of U.S. malls in the 1970s and 1980s was driven by favorable financing, with banks supporting mall projects that secured anchor tenants like department stores. By the mid-1990s, however, retailers in categories such as bookstores, sporting goods and home goods began moving away from the traditional mall model, marking a change in the retail landscape.

“In the 70s and 80s, if a mall company could secure anchor tenants, banks were willing to fund them,” Underhill said. “Old malls were about department store chains. Many of those large tenants, particularly department store tenants, would dictate what their terms were before signing a lease, like what other stores would be allowed in the shopping mall. They said no supermarkets and no drug stores. By the mid-90s, various segments of retail kissed malls goodbye and focused on fashion and gifting.”

For many, Underhill said, malls became climate-controlled, safe and clean environments, offering amenities such as good bathrooms and well-maintained spaces. Globally, however, malls took on different forms. In places like Australia, malls began incorporating residential spaces, public libraries and even universities into their designs. In South Africa, sports stadiums were placed adjacent to mall food courts, capitalizing on the synergy between shopping and live events. These international adaptations, he added, have continued to push the envelope on what malls can offer their customers.

Major Trends in U.S. Malls Today

Today, U.S. malls are facing challenges with vacancies, declining foot traffic and more competition from eCommerce, Underhill said. As the importance of anchor stores has dwindled and as more retailers shift online, malls must rethink their offerings to stay competitive.

“One of the challenges U.S. malls face is: are they answerable to Wall Street or to their customers?” Underhill said. “To be a successful mall takes both money and time. Many of these malls were put up quickly, and many haven’t aged particularly well.”

There is a divide in the current U.S. mall landscape, Underhill said.

“There are A malls doing just fine and B and C malls virtually empty,” he noted. “Ten percent of shopping malls in the U.S. are doing fine, 20% are holding on, and a good 60%-70% are not doing well at all. Many were built in a hurry and are destined to be torn down.”

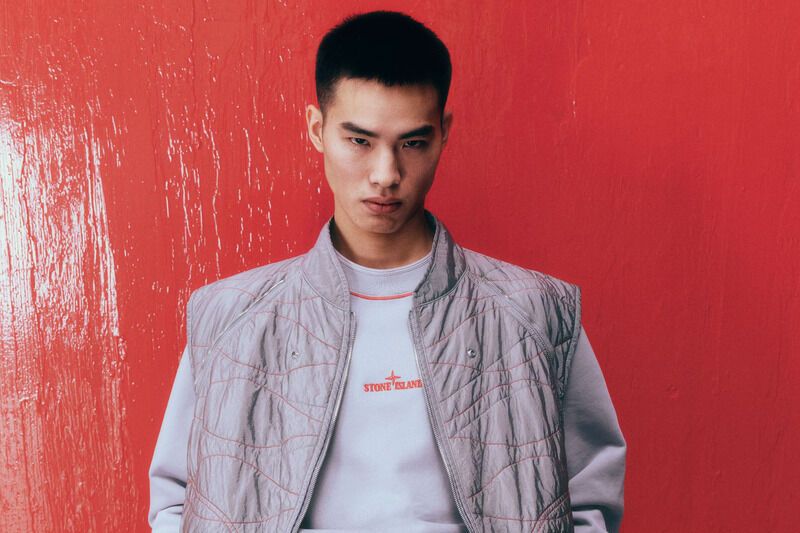

Meanwhile, Underhill noted one major trend is the crossover between the physical and digital retail worlds. While eCommerce continues to dominate, many brands are realizing the importance of having a physical presence. Whether it’s a mattress retailer opening brick-and-mortar locations for customers to try before they buy, or a clothing brand establishing a pop-up store to create in-person experiences, the boundaries between the physical and digital worlds are blurring.

Malls that adapt to this new reality by offering flexible leases and incorporating temporary, pop-up stores are finding success, Underhill said, advocating for short-term leases that allow brands to occupy space for seasons or events, making malls more dynamic and adaptable. By hosting temporary stores and offering more varied, experiential options, malls can cater to changing consumer desires and create fresh reasons for shoppers to return.

Shifting Consumer Behavior and Changing Tenant Mix

As women purchase more for themselves and their families, Underhill said, malls must adapt their offerings to meet these needs. This includes creating environments that are more female-friendly, with spaces that promote comfort and encourage longer visits. Additionally, he said generational shifts are influencing mall culture and tenant mixes, with younger shoppers valuing convenience and experiences over traditional retail options.

Malls are also experimenting with different types of tenants to stay relevant, he added. Entertainment venues, food courts and experiential retail are thriving in ways unlike traditional retail anchor stores. Malls are becoming destinations for more than just shopping, Underhill pointed out. In some parts of the world, such as Brazil, malls have taken it a step further, with unique entrances and special services, creating an immersive experience for visitors.

The Future of Malls: Mixed-Use Developments

As the role of malls continues to shift, Underhill believes there will be more mixed-use developments where malls serve as hubs for various activities beyond shopping. This could include incorporating housing, offices, healthcare facilities and even government buildings into mall spaces.

Underhill envisions the future of malls as being highly localized, with each mall tailoring its offerings to the specific needs and preferences of its surrounding communities.

“There will be more active control and more creative leasing,” he told PYMNTS. “They have to give people a reason to come back.”

Ultimately, Underhill thinks malls will change from being retail-centric to becoming more community-centric, with a focus on creating spaces that are flexible, adaptable and relevant to the needs of modern consumers. Whether it’s through integrating technology, offering more dynamic tenant mixes or evolving into mixed-use centers, the mall of the future will be more than just a place to shop — it will be a place to connect, engage and experience life in new ways.

Consider South America, where consumers view malls as valued, social experiences, Underhill said.

“Everybody going to an American mall wears rubber-soled shoes,” he said. “In South America, the sound you hear in a mall is of fashionable footwear.”

While many malls across the U.S. may be on a path to obsolescence, he added, those that embrace change will survive and thrive in the future.