Shopping

BNPL use may rise this year for holiday shopping

Buy now, pay later financing may have increased appeal for consumers during the year-end holiday shopping season this year in light of credit card interest rates being higher than ever, industry consultants say.

Annual interest rates on credit cards rose to a historic high earlier this year and remain elevated compared to previous years, which has consumers looking for cheaper ways to spread out payments over time.

“Buy now, pay later is certainly very popular, especially among younger consumers, and it’s really appealing to consumers who are less established financially, and the reason it’s appealing is that it doesn’t require a credit check and doesn’t carry interest,” said Sara Rathner, a credit card specialist at the financial research and marketing firm NerdWallet.

While BNPL installment financing can be interest-free, the companies also provide loans that carry interest. Nonetheless, Rathner noted the predominant alternative payment tool, credit cards, can currently lead to “very high interest” debt.

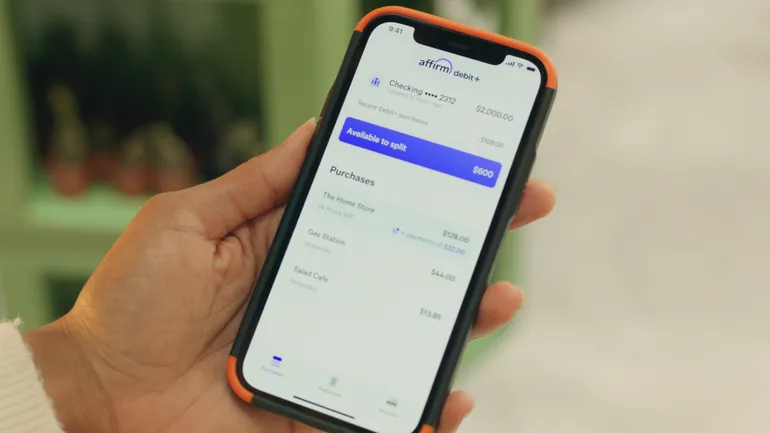

The biggest BNPL providers include Affirm and Block’s Afterpay as well as the Swedish company Klarna. Smaller players are Sezzle and the Australian company Zip. BNPL executives have expressed optimism about more consumer use of such installment payment tools this holiday season.

“We are expecting it to be a strong holiday season,” Joe Heck, CEO of Zip’s U.S. arm, said by email.

On a Nov. 7 Affirm earnings call, CEO Max Levchin was also upbeat, though vague. “We don’t want to give any numerical guidelines here, but suffice to say, we feel very good about it,” he said. “We’re seeing a lot of demand.”

With more awareness of BNPL options, companies offering the services expect use of the installment payment option to climb during the holiday shopping season.

“Anytime interest rates go up, [BNPL] becomes even more valuable to consumers and merchants,” said Ian Moloney, senior vice president for regulatory affairs at the American Fintech Council, which represents Affirm, among other companies. “The cost of getting a loan or using a credit card is much higher.”

Rising interest rates for credit cards

The average annual interest rate on a credit card rose to a record high of 20.79% in August, and it remains elevated at 20.42% as of this month, according to Bankrate. Before the average crossed the 20% threshold in March 2023 and it had been in the mid and high teen percentages from 2020 through 2022, according to data from Bankrate.

An annual report from Adobe Analytics earlier this year projected U.S. shoppers will tap BNPL financing for a record $18.5 billion in holiday spending, up 11% from 2023.

Consumer surveys have also shown the use of BNPL ticking upward. About 40% of consumers have tried buy now, pay later at least once in the previous year and 8% said they use it “frequently,” according to an October poll of about 1,000 consumers by the Electronic Transactions Association and the consulting firm The Strawhecker Group. Those figures were up from 36% and 6%, respectively, in the 2023 survey.

BNPL “has matured, and is now broadly accepted by merchants,” said Erin McCune, a partner at the consulting firm Bain and Co. who focuses on payments and fintech. “Now, it is no longer a new-fangled thing, and if you’re selling into a younger generation, you’ve got to have it.”

Klarna’s Nov. 12 IPO announcement suggests consumer demand will continue to grow, said Ben Lourie, a professor of accounting at the University of California at Irvine.

Klarna believes it can “go public because BNPL keeps growing, especially in this period because of the high interest rates,” said Lourie, who is part of the university’s Paul Merage School of Business.

Tailoring payment methods to the purchase

BNPL spending won’t overtake credit card spending any time soon, said Ted Rossman, a senior analyst at Bankrate.

“But banks are taking notice,” he said.

Traditional financial institutions are offering their own version of buy now, pay later, Rossman also noted. Citi Bank, for example, also offers financing that lets shoppers split a payment into installments.

A survey of more than 1,000 U.S. consumers conducted in September by the credit reporting agency Experian found that 46% planned to use a major credit card to make a holiday purchase this year, and 42% said they planned to use a debit card. Respondents could pick more than one payment method. Buy now, pay later was not one of the options. An Experian spokesperson did not respond to a message asking why BNPL was not included.

Consumers tend to use BNPL for bigger expenses, according to a Zip holiday spending survey this month.

BNPL companies pitch their product as an interest-free alternative to credit cards that consumers can use to spread out the cost of big purchases, even though they also offer interest-based lending services.

Affirm offers loans that can be paid back over months and carry interest rates of up to 36%. Three-fourths of Affirm’s loans are longer-term and interest-bearing, rather than short-term and interest free, according to its Nov. 7 earnings forecast.

Block’s Afterpay has only one consumer lending product, a monthly installment loan that carries an interest rate between 0 and 36% depending on the consumer and the merchant, a spokesperson said by email.

About 1% of purchases made with Klarna carry interest, spokesperson John Craske said in an email. Those interest rates range from 0 to 34%, he said.

For consumers that don’t have access to credit, BNPL may be an alternative. “Over 119 million Americans don’t have easy access to traditional credit,” Heck explained. “These are often full-time working professionals who are good at managing their money, but may face higher interest rates or denials from traditional financial systems.”

Industry players tout statistics that show the majority of their customers pay back buy now, pay later financing in full and on time.

BNPL companies belonging to the Financial Technology Association, a trade group that represents fintech companies, report delinquency rates of less than 2%, Miranda Margowsky, head of communications for the association, said in an email. FTA members include Zip, Klarna and Marqeta, another company that recently began offering BNPL services.

However, about 47% of consumers who used buy now, pay later had made a late payment, a LendingTree survey conducted earlier this month found.

Concerns about rising BNPL debt emerge

Consumer advocates worry that BNPL loans encourage shoppers to stretch their budgets, pile on debt and put themselves in financial jeopardy.

“Credit cards are like power tools, they can be useful or dangerous, and BNPL is the same way,” Rossman said. “Sometimes it’s a good deal, but maybe you end up overspending.”

Not all buy now, pay later products are interest-free, noted Christine Hines, a senior policy director at the National Association of Consumer Advocates.

“There are other loan products for longer periods, and some of them now come with interest rates and other charges,” she said.

For that reason, it’s important for consumers to know the terms and ensure they are not taking on too much debt, Hines said