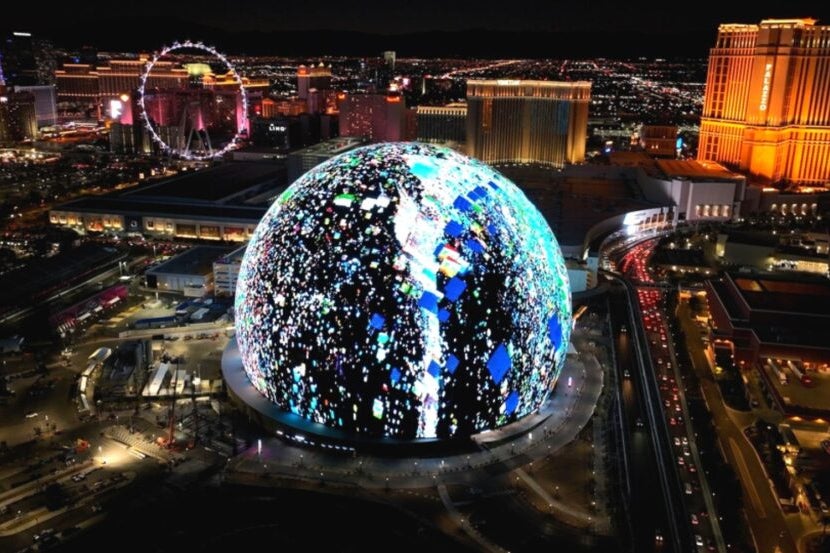

Sphere Entertainment Co SPHR, the company behind the Las Vegas Sphere, has high production costs and scalability issues.

Despite the company’s penchant for novelty events, like last month’s “Wizard of Oz” screening, the profitability outlook is “underwhelming,” according to Benchmark analyst Mike Hickey.

Hickey downgraded the rating for Sphere to Sell, while setting the price target to $40.

The Sphere Entertainment Thesis: Creating content for Las Vegas Sphere is expensive. Plus, not all productions resonate with audiences, the analyst noted.

There is only one screen to recover these massive investments, which translates to substantial financial risk, Hickey said in the downgrade note.

Check out other analyst stock ratings.

“Replicating the Las Vegas model in other markets appears challenging,” given the huge investment required, issues with gaining approvals (as most communities are averse to any “sound-emitting structure” in their neighborhoods) and few places having the “consistent tourist traffic needed to support long-running content or concert residencies,” the analyst stated.

“We are concerned that a weakening consumer environment could negatively impact non-gaming entertainment in Las Vegas, including their advertising business and ticket pricing for films, live shows, and concessions,” he further wrote.

SPHR Price Action: Shares of Sphere Entertainment had declined by 3.2% to $45 at the time of publication on Tuesday.

Now Read:

Image:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.