Jobs

Chart Of The Moment: Not All Jobs Are Equal

JARAMA

The U.S. Bureau of Labor Statistics (BLS) nonfarm payrolls has averaged monthly gains of over 233k over the past year. By all standards, that is a healthy number, especially considering the federal funds rate has been above 5% over that same time period.

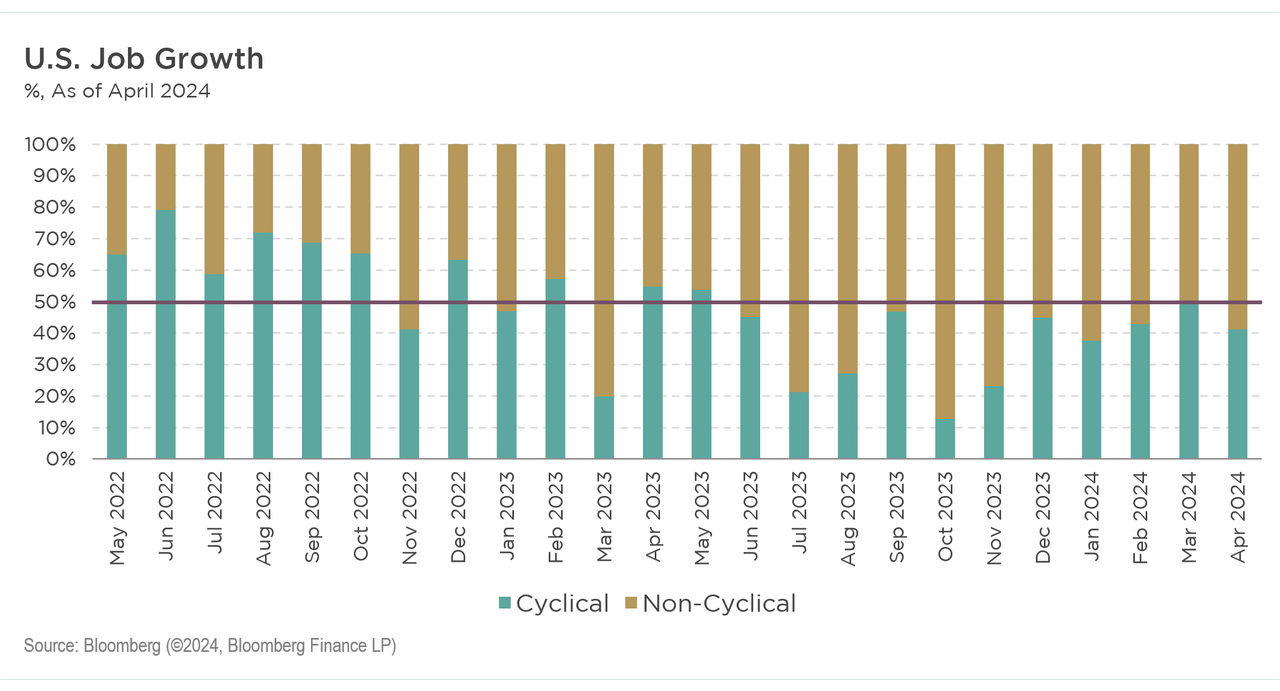

However, a deeper look into the numbers may reveal the impact of higher rates. The chart below decomposes the composition of monthly job additions into two categories, cyclical and non-cyclical, based on the underlying industry. The non-cyclical component consists of Education, Health Services, and Government, with the remaining industries defined as cyclical.

What becomes evident over the past two years is the dramatic shift in the type of jobs that the U.S. has added. Initially, strong job growth was supported by the cyclical components of the U.S. economy.

However, since November 2022, those strong job additions have come from non-cyclical industries. The primary conclusion one could draw from this shift is that the higher financial cost of elevated interest rates is potentially causing firms in cyclical industries to scale back on their hiring.

Companies that are more closely aligned with economic growth are cutting back their hiring as the hurdle rate for positive return on investment (ROI) has increased.

Meanwhile, those industries with less interest rate sensitivity, typically sectors that are non-cyclical, likely will continue to pursue their hiring needs, regardless of interest rates, based on the structural or enduring nature of the businesses.

The same pattern is also reflected in aggregate credit growth across the U.S., where firms are hesitant to expand their balance sheets at current interest rate levels. These metrics give credence to the view that current policy rates are, in fact, restrictive and economic growth should slow in the coming quarters.

On multiple occasions, Federal Reserve Chair Jay Powell has made comments that robust job growth, on a stand-alone basis, would not prohibit the committee’s future rate cutting.

On the surface, this position seems incongruent. Can strong hiring and rate cuts coexist? However, I believe the Fed’s stance is further supported by the type of jobs being added. Not all jobs are created equal in the eyes of the economy, and the recent drop-off in cyclical hiring may hint at slowing growth.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.