Travel

China’s Outbound Travel Rebound Is Slow-Going — But These Trends Are Worth Watching

Skift Take

The Chinese travel wave is slowly making a comeback, but travelers have new habits and expectations. Companies need to step up by offering more flexibility and personalized experiences with a focus on value.

Around 128 million Chinese travelers will venture abroad in 2024, according to the latest survey from digital marketing and research firm China Trading Desk.

That’s still far off the pre-pandemic peak of 155 million but the firm predicts gains, with China’s outbound travel hitting 200 million by 2028.

Dragon Trail in its latest survey had noted that China’s October Golden Week marks a major milestone in the recovery of outbound travel.

But you can’t just look at the headline numbers — several factors are shaping travel decisions in 2024. Budget remains a top priority. Health and safety concerns, lingering from the pandemic era, are still on the minds of almost one-fifth of respondents.

Government policies and travel restrictions also continue to play a role in the choice of destinations.

China Trading Desk’s survey pointed to three other important trends to watch:

1. Last-Minute Planning: Spontaneity and Flexibility on the Rise

One of the most significant shifts in travel behavior is the increased reliance on last-minute trip planning. The survey reveals that 73.1% of Chinese travelers are booking trips less than a month in advance. This trend is most pronounced among younger travelers, especially Gen Z, who are gravitating toward spontaneous and adventure-driven experiences.

Economic uncertainty and the flexibility afforded by travel platforms are driving the shift towards last-minute bookings among Chinese travelers, Subramania Bhatt, founder of China Trading Desk told Skift. “Many travelers are concerned about unpredictable conditions. Gen Z and millennials prefer quick getaways that can be organized with minimal notice.”

Bhatt said this trend is likely to continue into 2025, particularly as travel platforms offer personalized last-minute deals, and businesses continue to adapt to the on-demand culture.

“The growing demand for flexibility — both in terms of booking windows and travel experiences — will likely prompt travel providers to offer more real-time options and discounted deals for spontaneous bookings,” he said.

2. Gen Z: Adventurous, Digital, and Experience-Driven

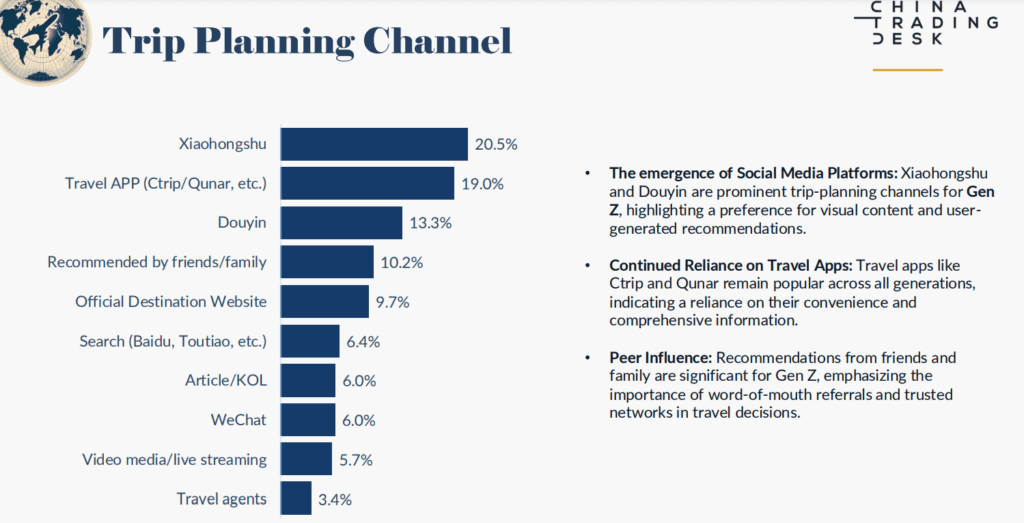

Gen Z is leading the gains in China’s outbound travel market, with around 54% of travelers in the 18-29 age group. Their preferences differ significantly from older generations — they want new experiences, with a particular interest in outdoor and remote destinations. They’re digital natives, relying heavily on platforms like Xiaohongshu (Little Red Book) and Douyin (TikTok) to inspire and plan their travels. These travelers are also budget-conscious, often seeking deals and promotions.

“Gen Z values experiences over material goods,” noted Bhatt. “They prioritize culinary exploration, historical experiences, and ‘Instagrammable’ landmarks. They are more likely to travel with friends or family, but solo travel remains significant.”

While the older generation appreciates experiences, they also demonstrate greater concern for health, safety, and economic factors. They rely more on travel apps like Ctrip and Qunar for planning and booking, while placing a higher value on recommendations from friends, family, and trusted sources.

3. The Shift to Luxury Travel for Affluent Tier 1 Travelers

At the other end of the spectrum, there’s a growing interest in luxury travel among high-net-worth individuals and travelers from China’s Tier 1 cities.

Nearly half of the respondents surveyed by China Trading Desk expect to spend at least RMB 25,000 ($3,565) per trip.

These affluent travelers prioritize premium experiences, from first-class flights to five-star accommodations, and are drawn to exclusive, high-end dining and shopping.

According to the survey, almost two-thirds of these travelers prefer staying in 4-star hotels or above. Travelers also said that competitive pricing and discounts are key motivators for purchasing luxury goods abroad, highlighting that even among wealthier travelers, value for money still matters.

One of the most interesting trends according to Bhatt is the reversal of first-time travelers. “Over the last few quarters more first time travelers have been outside of China and majority have been on at least a trip.”

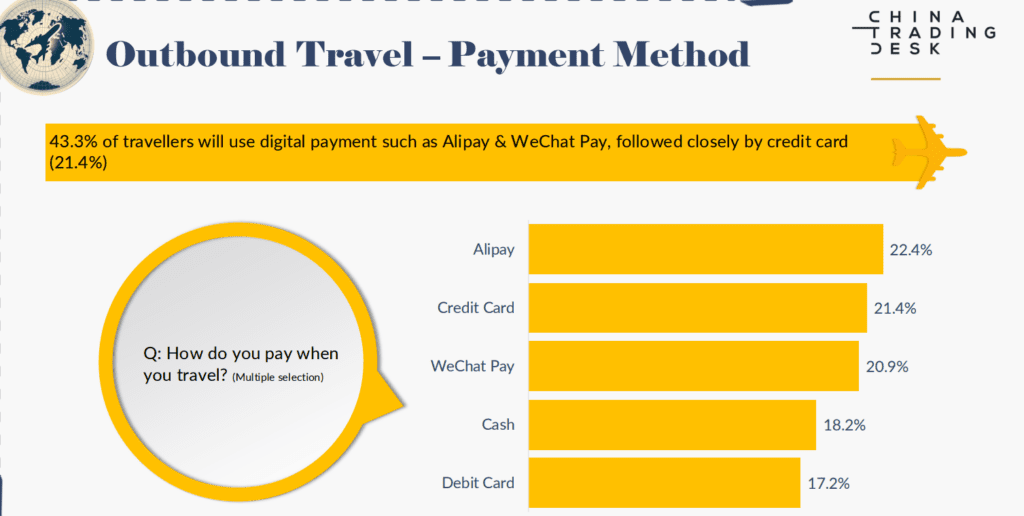

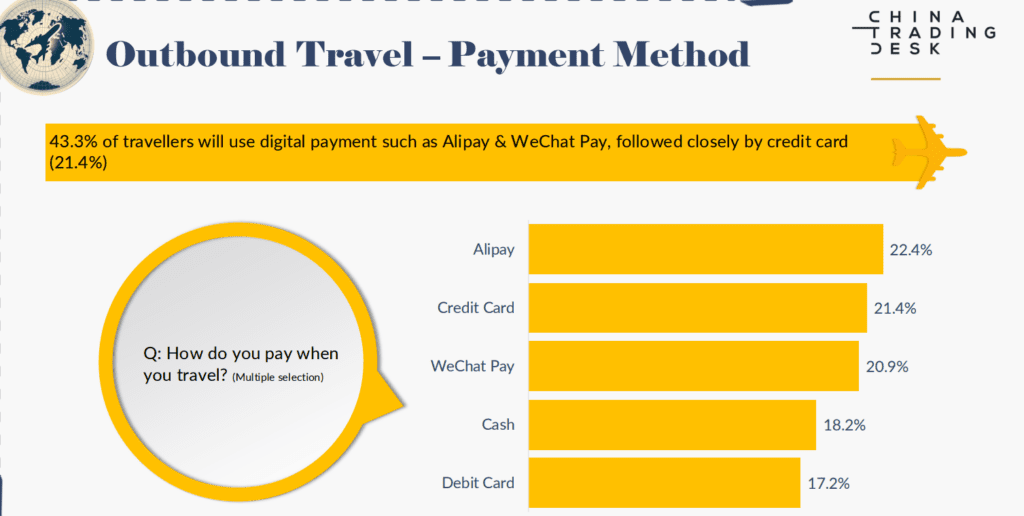

Another observation according to Bhatt is the continued importance of cash, especially for older generations, despite the rise of digital payments. “Businesses should ensure they cater to both cashless and cash-based transactions,” he said.