Entertainment

Dave & Buster’s Entertainment: Challenged But Cheap (NASDAQ:PLAY)

tupungato

Shares of ‘eatertainment’ concern Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) have essentially round-tripped after a 109% five-month rally to a seven-year high in April 2024. Profit taking followed by a poor 1QFY24 financial report and tepid 2QFY24 update were the culprits, with the quarter blamed on several non-recurring events and a complex macro picture. With a multipronged approach to achieve Adj. EBITDA of $1 billion in the coming years, discounted valuations, and robust share repurchases, the recent insider buying merited a deeper dive. An analysis follows below.

The company recently acquired 52 Main Event sites (June 2022) at nine times Adj. EBITDA, with expectations for $25 million in synergies. Since that time, the new C-Suite embarked on multiple programs to drive Adj. EBITDA significantly higher, which has produced encouraging results until the company’s 1QFY24 financial report.

As a reminder, Dave & Buster’s Entertainment, Inc. is a Coppell, Texas based owner-operator of venues that combine entertainment and dining for adults and families with 224 locations, consisting of 165 namesake properties and 59 Main Event stores in 42 states, Canada, and Puerto Rico. D&B (for founders David Corriveau and James “Buster” Corley) opened its first entertainment and dining center in 1982 and initially went public in 1995. It was subsequently purchased by private equity shop Wellspring Capital Management in 2006, sold to PE firm Oak Hill Capital in 2012, and taken public again in 2014, raising net proceeds of $98.6 million at $16 per share. The stock currently trades for just under $33 a share, translating to a market cap of $1.3 billion.

The company operates on a 52- or 53-week fiscal year (FY) ending the Sunday after the Saturday closest to January 31st. For the avoidance of doubt, FY23 refers to the 53-week year ending Sunday, February 4, 2024.

Revenue Disaggregation

D&B derived 65% ($1.43 billion) of its FY23 top line from entertainment, including bowling, arcade games, billiards, karaoke, laser tag, virtual reality, mini-golf, and sports viewing, amongst others. Most of these games are activated by play credits loaded onto cards or D&B’s mobile app from an automated kiosk. Gross margin from this revenue stream was 90.7%. High entertainment revenue versus a traditional restaurant translates into less exposure to food costs. Food and non-alcoholic beverages represented a $517.1 million (23%) contribution to D&B’s FY23 top line, with alcohol revenue ($253.4 million) constituting the other 12%.

Main Event Acquisition

Those percentages more or less held true before D&B acquired Main Event from Ardent Leisure Group for a cash consideration of $835 million in 2022. Main Event’s concept is similar to D&B’s, although it primarily targets families versus young adults for the latter. As part of the transaction, most of the acquiree’s management team (five members) were moved into D&B’s c-suite.

New Management’s Imprimatur

The new management team did not sit idly by, instituting a multi-year overhaul of the company that included a revamped marketing approach, higher game prices, a new food and beverage menu, more domestic locations (to 250 by FY25), expansion of its franchise model internationally, and identification of several areas for expense savings. It also embarked on remodeling the entire D&B system by FY26. Initiated in June 2023, these (and other) modifications are expected to add $680 million to $915 million to the Adj. EBITDA line upon completion. In short, management expects to deliver Adj. EBITDA of $1 billion in the coming years. To put its ambitions in context, the company generated FY21 Adj. EBITDA of $343.6 million and FY22 Adj. EBITDA of $480.4 million after struggling to survive during the pandemic, when the closure of all its locations compelled it to dilute existing shareholders by 56% to stay in business. With partial help from its initiatives in FY23, D&B achieved Adj. EBITDA of $555.6 million, representing a 16% improvement over the previous year.

Share Price Performance

The market was pleased with D&B’s progress. After trading more or less between the low 30s and mid-40s over the prior 30 months, shares of PLAY finally caught a bid after showing up on a few quant screens in November 2023, further bolstered by better than expected 3QFY23 earnings that were posted in December 2023. By the time D&B was scheduled to report 4QFY23 financials, its shares were on a tear and the initial reaction to those results was positive, with its stock up 10% in the subsequent trading session, closing at $68.29 a share on April 3, 2024. On an intraday basis, the move culminated a 109%, five-month surge to $69.82, representing a seven-year-high.

Since then, shares of PLAY have essentially round-tripped to their November 2023 levels. Initially, a healthy bout of profit taking ensued, triggered by a Piper Sandler downgrade on price, citing valuations (immediately after its 4QFY23 report) that were in line with the company’s five-year historical average pre-pandemic.

1QFY24 Financials & Outlook

The last move down was actuated by D&B’s 1QFY24 financial report of June 12, 2024, on which it posted earnings of $1.12 a share (non-GAAP) and Adj. EBITDA of $159.1 million on revenue of $588.1 million, versus earnings of $1.52 a share (non-GAAP) and Adj. EBITDA of $182.1 million on revenue of $597.3 million in 1QFY23, representing declines of 26%, 13%, and 2%, respectively. Comp store sales were down 5.6% year-over-year. Relative to expectations, the bottom line missed by an eye-popping $0.58 and the top line was $27.8 million shy.

The rather surprising report was partially blamed on $11 million ($0.26) of expenses related to the rollout of its new menu and service model, IT deployments, and a failed test marketing campaign, all of which should not recur. The poor showing was also attributed a “complex macro environment” featuring weakening patronage from its lower income consumers.

On a positive note, management stated that its fully programmed remodels were delivering double-digit growth in sales. D&B did open four properties in the quarter, with expectations to add a total of 15 in FY24.

As for the start to 2QFY24, D&B stated the sales were trending at a low single-digit negative comp.

The market did not take kindly to the miss, selling shares of PLAY down 11% in the subsequent trading session. The trend has continued, with D&B’s stock now down 24% since the report.

Balance Sheet & Analyst Commentary:

That said, the company continues to kick off a solid amount of cash, a large portion of which has been earmarked to repurchase shares. In 1QFY24, D&B generated $108.8 million of operating cash flow, of which $50 million was spent on stock buybacks totaling 2.4% of the amount outstanding. Likely due to the elevated share price in the quarter relative to FY23, this activity was a slowdown from the $300 million expended on repurchases in FY23. The company has $150.0 million remaining on its authorization, cash of $32.1 million and debt of $1.3 billion for net leverage of 2.3 as defined by its revolving credit facility. It has access to $484 million of additional liquidity.

After being predominantly bullish entering calendar 2024, the Street is slightly less enthusiastic on D&B’s prospects, featuring six buy or outperform ratings against three holds, with Raymond James downgrading its stock before Piper in March 2024. That said, analysts’ median price objective of $64 represents 68% upside from its July 23, 2024 close. On average, they expect the company to earn $2.80 a share (non-GAAP) on revenue of $2.24 billion in FY24, followed by $4.18 a share (non-GAAP) on revenue of $2.42 billion in FY25.

Clearly excited about D&B’s upside potential is CFO Darin Harper, who purchased 13,578 shares at an average price of $38.77 on July 3-5, 2024.

Verdict:

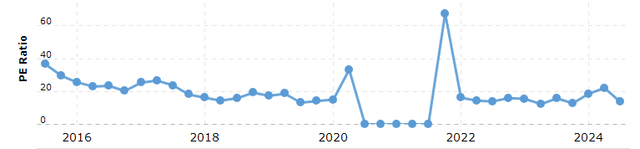

PLAY Trailing P/E (Macrotrends)

Despite an abysmal quarter versus expectations, the company has a detailed plan to achieve $1 billion in Adj. EBITDA in the coming years. Even if it doesn’t get there in short order, it generates plenty of cash flow to service and (if it chooses to) retire debt and repurchase shares. Trading at a P/E of around eight times FY25E EPS and an EV/TTM Adj. EBITDA of less than 5, its risk/reward is asymmetrical to the upside. On a trailing P/E basis, the stock is trading at/near its lowest level for the last decade, outside of the Covid pandemic. Therefore, this is a name I have accumulated via covered call orders.