World

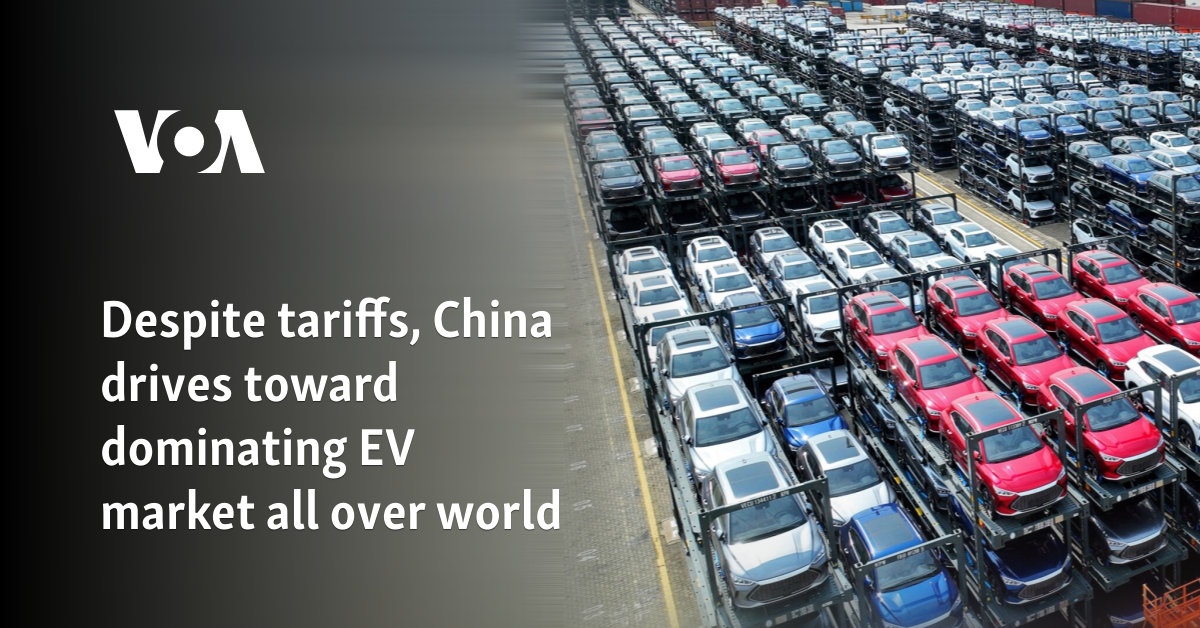

Despite tariffs, China drives toward dominating EV market all over world

As China pursues tit-for-tat actions against the European Union in response to tariffs on Chinese-made electric vehicles, Beijing’s drive for global dominance in the automotive sector continues unabated.

Over the past year, companies such as EV giant BYD and others have made inroads in markets from Southeast Asia to Latin America and Africa, even as they face tariffs of up to 100% in Canada and the United States, and up to 45% in the European Union.

Chinese EV companies have announced plans to invest millions to build new factories in Thailand and Brazil, and they have opened showrooms in Zambia, Kenya and South Africa.

And while most Chinese EV makers say they will continue to sell cars in Europe and not boost prices to offset the tariffs, analysts say it makes sense that they are equally focused, if not more so, on markets in the developing world as well.

Ryan Berg, director of the Americas program at the Center for Strategic and International Studies, said the EV market is like a balloon that is fully blown up.

“When countries like the U.S., the EU, Canada and others squeeze [the balloon], the air is going to go elsewhere. Well, the air right now is going to go to the developing world countries that haven’t put the tariffs on Chinese cars in the first place,” Berg said.

Bangkok, Brazil and Ethiopia

In Thailand, companies such as Great Wall and BYD are leading the way. BYD opened a production facility in Thailand in July and its company chairman, Wang Chuanfu, said BYD has already captured 40% of the market for EVs. Earlier this year, Great Wall became the first Chinese EV company to mass-produce electric vehicles overseas through its production facilities in Thailand.

In addition to Thailand, BYD has also captured a large market share in Singapore and Malaysia. According to government statistics, the EV behemoth ranked as Singapore’s second-most popular car brand by sales in the first half of 2024. BYD ranked among the top 10 car brands in Malaysia when compared with all registered vehicles, following BMW and Mercedes-Benz.

In Latin America, BYD plans to launch a partnership with Uber that aims to bring 100,000 Chinese-made EVs to Uber drivers globally. In addition, BYD is planning a new auto factory in eastern Brazil to come online in 2025. Both BYD and Great Wall have local R&D, production and sales centers in Brazil.

John Helveston, an assistant professor in engineering management at George Washington University, said from a business perspective, it makes sense for Chinese EV companies to move to markets where there is more room for profit.

“I mean, just like we have Toyota and GM and Ford and Volkswagen … these companies like BYD very much are also global companies,” Helveston told VOA. “They want to expand just like any other successful business.”

Paul Nantulya, a China specialist at the Africa Center for Strategic Studies at the National Defense University in Washington, said Africa provides huge market opportunities for Chinese EV companies.

That opportunity, however, comes with its challenges. As in other countries, there is still a lack of infrastructure for EVs in Africa such as charging stations.

Nantulya, who attended the Forum on China-Africa Cooperation (FOCAC), said Beijing and Africa are building long-term relationships, particularly when it comes to green energy and EV sectors.

About “122 green energy projects have been implemented since the last FOCAC, so between 2021 and 2024, 122 green energy projects have been implemented across the African continent across 40 countries. So, the demand is huge, and it is steady,” he told VOA.

“Chinese state-owned enterprises that are in this sector have been making a very, very aggressive push in developing economies … you know, the uptick of that technology in Africa is extremely high,” he said.

In March, China partnered with Ethiopia to announce an ambitious plan to shift toward electric mobility. The plan aims to introduce nearly half a million electric vehicles in Ethiopia over the next decade.

Mutual benefits

All three analysts said Beijing’s penetration of global markets is boosted by the economic benefits that China offers in exchange. For example, Helveston said, many countries are willing to “leverage market access” in exchange for improved infrastructure and technology.

Chinese companies have built roads, trains, schools and hospitals in some of the poorest countries in the world, and developing countries see “automotive trade [as] just building on top of those relationships that have already been there a while,” he said. “It’s a very transactional relationship.”

CSIS’s Berg said countries in Latin America “have been really keen to court Chinese investment in technological industries like the EV industry.” He noted that Latin American countries see the EV industry as “reliable” and “plentiful in terms of job opportunities.”

Nantulya added that Chinese technology is seen as a way to help African countries address energy challenges such as blackouts.

“When you look at it from the African perspective, [China’s presence] is helping them diversify their energy grids, which is a significant issue. It’s also contributing to improving their energy mix,” Nantulya said.

China has taken a proactive approach by building large infrastructure projects in developing countries, whereas the United States has not yet undertaken projects of similar scale, he said.

“I think that we’re looking at some pretty big shifts in, let’s say, 10 years from now with what the global situation might be. … A lot of these countries might be much more comfortable working with China than the U.S.,” Helveston said.

Washington, however, is not sitting back. At the U.S.-Africa Leaders Summit in 2022, the United States committed to $55 billion in pledges over three years that included investments in renewable energy infrastructure, clean energy and efforts to mitigate climate change.

Berg said geopolitics also is a motivating factor in Beijing’s push into developing countries in South America.

“They are in their geopolitical competition with [the United States], engaging in reciprocity … showing that they can be extremely active in some ways and especially in the economic domain in our neighborhood,” he said.