Shopping

Digital Stagnation Pressures UAE Merchant Growth

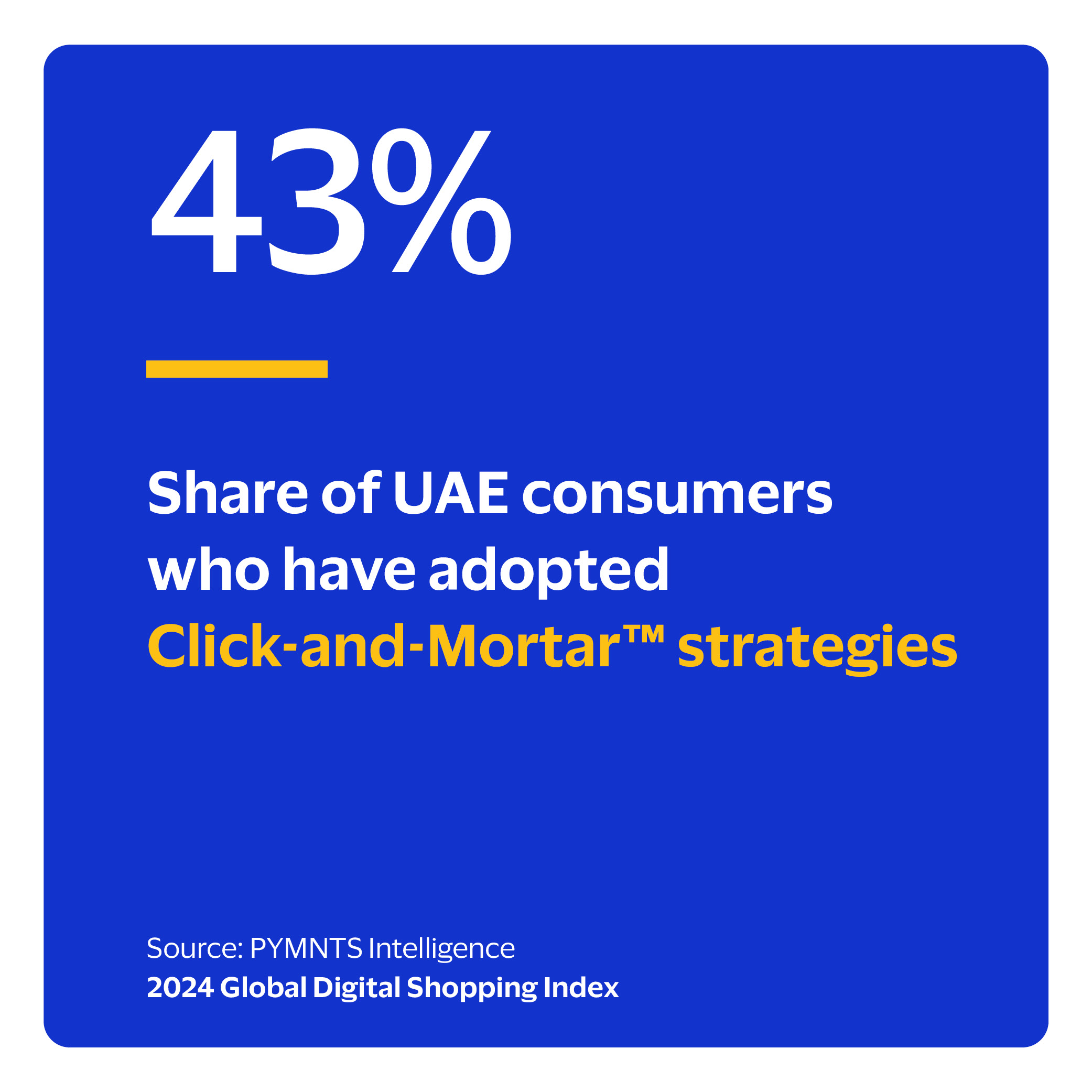

In the United Arab Emirates, 71% of consumers actively use digital features to enhance their shopping experiences. Yet valuable opportunities to build on this robust foundation remain in play. The UAE has the second-highest consumer satisfaction rate of the markets surveyed. Click-and-Mortar™ shopping — including digital tools with in-person shopping — is a factor.

In a retail landscape increasingly driven by digital innovation, ongoing development can help ensure the UAE stays ahead. If leaders fall short, digital features can quickly become stale table stakes. To maintain their competitive edge, local merchants must meet current needs and set new benchmarks for digital retail innovation.

These are just some of the findings in the “2024 Global Digital Shopping Index: UAE Edition,” a PYMNTS Intelligence report commissioned by Visa Acceptance Solutions. For this edition, we surveyed 1,392 consumers and 212 merchants in the UAE to capture recent trends in consumer behavior and document the rise of Click-and-Mortar™ shopping experiences. It also draws data from a larger survey of 13,904 consumers and 3,512 merchants across seven countries held from Sept. 27, 2023, to Dec. 1, 2023.

Other key findings from the report include:

The broad use of digital features in the UAE largely explains high consumer satisfaction.

Consumers’ high satisfaction rate is mainly due to the extensive integration of digital features into the shopping experience. Nearly three-quarters of shoppers in the UAE embrace online-only or Click-and-Mortar™ methods. Moreover, the savvy consumer base uses 14 digital features, on average, a share similar to Saudi Arabia. It is just four features shy of India, whose consumers use the most features.

Despite their reliance on digital features, the share of Click-and-Mortar™ shoppers here has stagnated.

Because so many UAE consumers use digital features for better shopping experiences, the base is particularly sensitive a lack of offerings by merchants. In the past year, the number of features consumers use, on average, has risen, even as the average variety offered has fallen by one feature. This mismatch in supply and demand suggests that retailers are failing to fully seize the opportunities Click-and-Mortar™ shoppers present.

Though UAE merchants are number one in consumer satisfaction, they can still improve.

Grocery shoppers have different digital needs compared to those buying other retail items. In fact, less than half of grocery shoppers used digital aids when they last shopped, mainly due to insufficient offerings from grocers. Grocer shoppers in the UAE usually use 10 features, compared to the 14 features the average UAE shopper uses. The data is clear: To maintain their leading position in customer satisfaction and reach a greater variety of consumers, UAE merchants, especially grocers, must innovate.

By focusing on the Click-and-Mortar™ experiences most popular among active users, merchants in the UAE can improve the customer experience. Prioritizing features such as family-friendly pickup options and engaging online experiences would meet the specific needs of busy households.

Download the report to learn more about how UAE consumers are using digital shopping features.