Entertainment

Director Frederic Salerno Acquires Shares of Madison Square Garden Entertainment Corp (MSGE)

On August 20, 2024, Frederic Salerno, a Director at Madison Square Garden Entertainment Corp (NYSE:MSGE), purchased 5,000 shares of the company, as reported in a recent SEC Filing. This transaction increased the insider’s holdings to 17,348 shares.

Madison Square Garden Entertainment Corp is engaged in the entertainment business, primarily in the operations of live sports and entertainment events. The company’s portfolio includes renowned venues such as Madison Square Garden and The Chicago Theatre, among others.

The shares were bought at a price of $41.25 each, valuing the transaction at approximately $206,250. Following this purchase, the market cap of MSGE stands at $1.97 billion.

The company’s current price-earnings ratio is 13.40, which is below both the industry median of 18.265 and the historical median for the company. This valuation metric is a critical indicator often used by investors to determine the market’s perception of the stock’s growth and profitability prospects.

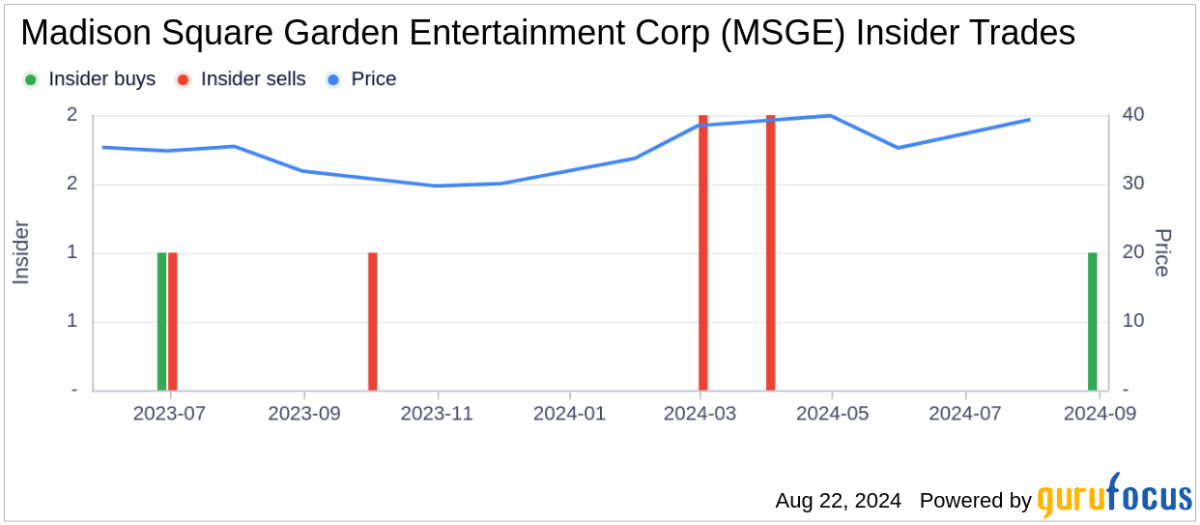

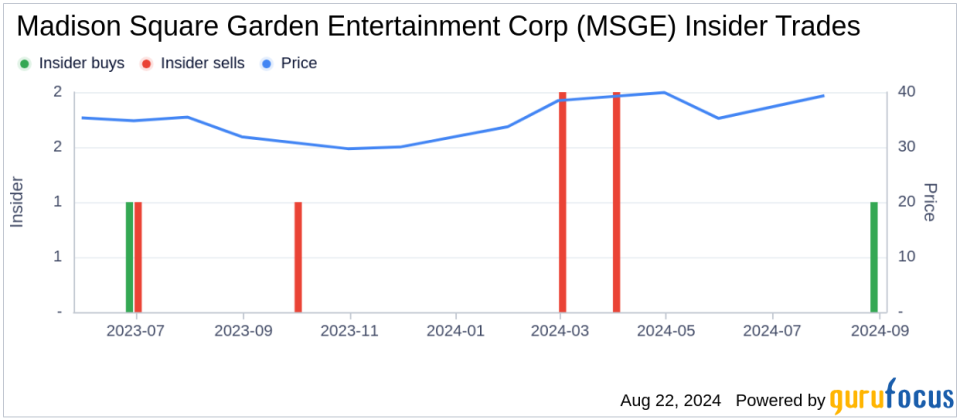

Insider transactions provide valuable insights into how the top executives and directors view the stock’s value. Over the past year, MSGE has seen 1 insider buy and 5 insider sells. The recent purchase by Director Frederic Salerno might signal a positive outlook on the stock’s future performance.

For more detailed information on MSGE’s stock performance and valuation metrics such as price-sales ratio, price-book ratio, and price-to-free cash flow, visit the GF Value page.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.