Travel

Ducommun: Robust Air Travel Demand And Defence Backlog (NYSE:DCO)

Ilija Erceg

Synopsis

Ducommun (NYSE:DCO) specialises in providing engineering and manufacturing services for high-performance products and high-failure-cost applications, mostly used in the industrial, medical, and aerospace and defence industries. DCO’s historical financial results have shown consistent top-line growth. However, its margins were contracting slightly due to the acquisition of BLR and its restructuring plans. For 1Q24, its net revenue continued to grow. On a positive note, its margins started to improve when compared to the previous period.

Currently, DCO’s defence backlog is growing, signalling growth in its defence business. In addition, DCO also revised the run rate of the SPY-6 and other defence programmes upward, implying higher revenue. For its commercial aerospace business, the growing air travel demand is expected to strengthen the outlook but will be slightly pulled back by headwinds created by Boeing and Spirit AeroSystems regarding the 737 MAX quality. Given the positive outlook for DCO and upside potential, I am recommending a buy rating.

Historical Financial Analysis

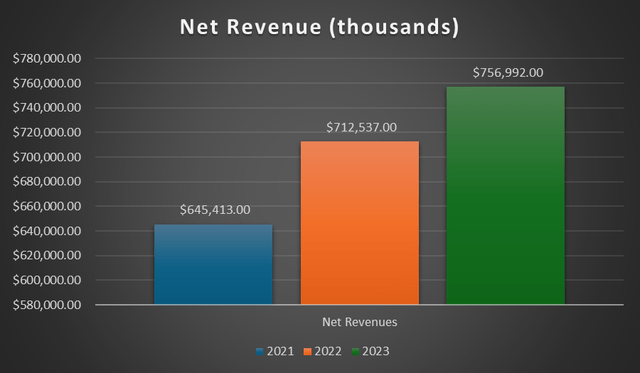

Author’s Chart

Over the last three years, DCO’s top line has shown consistent and robust growth. In 2023, its reported net sales were $756.9 million, up from the previous year’s $712.5 million. The main growth driver was higher revenues in DCO’s commercial aerospace markets. For that year, commercial aerospace revenue grew $61.8 million, driven by higher build rates on large aircraft and other commercial aerospace platforms.

However, do take note that lower revenue in its military and space markets partially offsets some of the growth. Although rotary-wing aircraft platforms’ build rates increased, it was offset by softness in fixed-wing aircraft and missile platforms. In 2023, DCO’s military and space revenue declined $16.9 million.

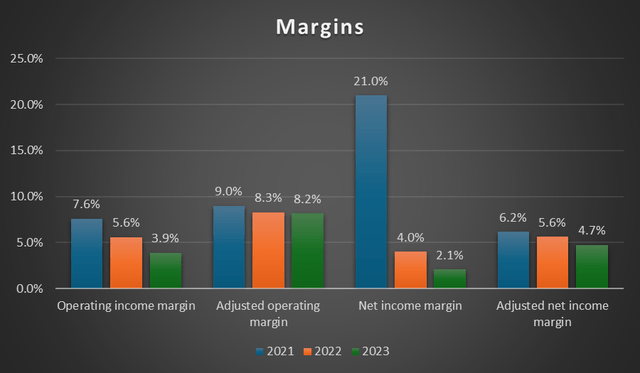

Author’s Chart

Moving onto margins, they are showing signs of compression. For 2023, all four margins contracted year-over-year. DCO’s operating income margin contracted from 5.6% to 3.9%. The reason behind the contraction was due to higher SG&A and restructuring charges, which more than offset the increase in gross profit margin. On an adjusted basis, the operating income margin contraction was less pronounced, as it fell by 0.1% to 8.2%.

In 2023, the net income margin fell from 4% to 2.1%. The decrease was due to higher SG&A, interest expense, and restructuring charges but was partially offset by gross profit margin expansion. On an adjusted basis, the adjusted net income margin contraction is slightly less, as it contracted from 5.6% to 4.7%. Lastly, the reason behind the much higher net income margin of 21% in 2021 was due to a gain on sale-leaseback of $132.5 million. On an adjusted basis, adjusted net income is lower at 6.2%.

First Quarter 2024 Earnings Analysis

For 1Q24, DCO reported net revenue of approximately $190.8 million, which increased 5.3% year-over-year. This growth was mainly attributed to growth in both the commercial aerospace and military and space end markets. DCO’s commercial aerospace revenue increased $8.1 million year-over-year, driven by higher rates on single-aisle and twin-aisle aircraft platforms. Additionally, the higher rates on rotary-wing aircraft also contributed to the growth.

For its military and space market, revenue increased $1.3 million year-over-year. Growth was modest as higher rates on rotary-wing aircraft and naval platforms were partially offset by the lower rates on legacy aircraft platforms.

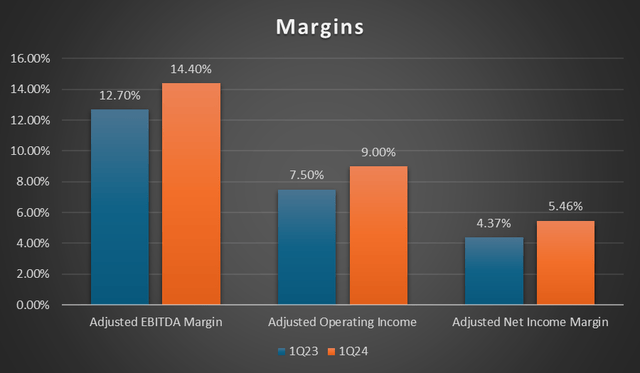

Author’s Chart

Moving onto margins, its adjusted margins performed well year-over-year. DCO’s adjusted operating income increased 25.7% year-over-year to $17.1 million. The growth was driven by DCO’s pricing actions, favourable product mix, higher volume, and benefits from its restructuring programme. However, it was partially offset by increased SG&A costs due to the acquisition of BLR. DCO’s adjusted operating income margin expanded from 7.50% to 9%.

As a result, both its adjusted net income margin and adjusted EBITDA margin expanded year-over-year. DCO’s adjusted net income margin expanded from 4.37% to 5.46%, while its adjusted EBITDA margin expanded from 12.70% to 14.40%. DCO’s adjusted EPS increased from $0.63 to $0.70, which represents an increase of 11.11% year-over-year.

Military and Space Segment Outlook

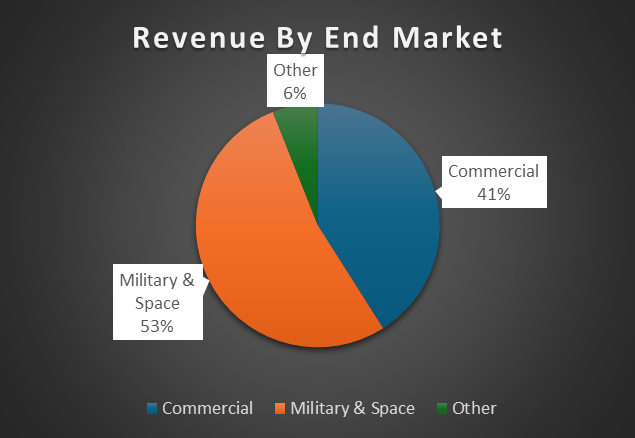

Author’s Chart

DCO’s end market can be segmented into military and space, commercial, and others. Based on the last twelve months of 1Q24 revenue, the military and space end market accounts for 53% of total revenue. Commercial end market accounts for 41%, while other accounts for the remaining 6%.

DCO supplies products for military aircraft such as joint strike fighters, Apache, F/A-18, and CH-53K. It also supplies products for missiles and radars such as the Patriot, Tomahawk, SPY-6, and SM3/6.

For 1Q24, DCO’s military and space revenue accounted for 52% of total revenue. For context, in 2021, it accounted for 70%, and in 2022, it decreased to 59%. Currently, its revenue mix is much more balanced, and DCO anticipates this trend to continue moving forward.

Currently, DCO’s military helicopter product demand is still robust. For the Blackhawk programme, demand is still strong, as revenue increased by more than 70%. The demand for Apache tail rotor blades is also strong, as it increased by more than 50%.

In addition to military helicopter products, its naval business is also performing strongly. DCO reported robust growth in the Phalanx close-in weapon system and also weapon systems for use in submarines.

However, on the other hand, this growth was being offset by weakness in F-18 programmes and a halt in the manufacture of TOW missiles. On a brighter note, DCO forecasts that the TOW missile shipment will resume in 2025. Although the legacy F-18 programmes experienced declines, the saving grace is that the newer F-35 platform reported strong demand.

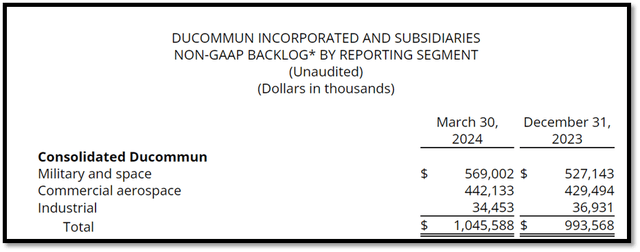

Defence Backlog

For the quarter, DCO’s defence backlog increased approximately $125 million year-over-year and about $42 million sequentially. Currently, the total defence backlog is approximately $569 million.

The driver behind the increase in defence backlog is attributed to DCO’s wins with RTX Corporation (RTX) on the SPY-6 programme in April 2024. For context, SPY-6 is a radar system that does air and missile defence. This win with RTX shows that DCO’s radar business is growing and has the potential to grow further. Additionally, the growing radar business will be a good complement to its missile business. According to DCO, the new card award deliveries are anticipated to start in 2025. Overall, the growing backlog is showing that DCO’s defence business is growing.

Looking ahead, DCO forecasts that the run rate of the SPY-6 and other defence programmes will be approximately $135 million in 2025. For context, DCO’s previous run rate forecast was approximately $125, $10 million lower than the current estimate. Looking ahead, the revised run rate forecast and growing backlog are expected to bolster DCO’s defence business.

10Q

Commercial Aerospace Business

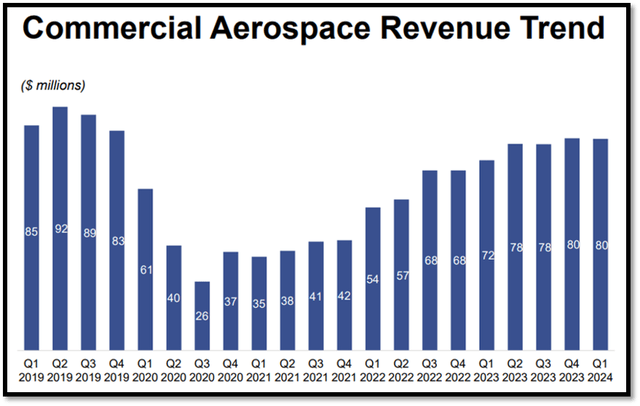

Investor Relations

For eleven straight quarters, DCO’s commercial aerospace’s revenue has been consistently growing, even though the aircraft OEM landscape was plagued with challenges. This result shows the resilience of its commercial aerospace business.

Currently, Boeing (BA) and Spirit (SPR) are facing headwinds caused by 737 MAX quality issues. As a result, the commercial aerospace backlog fell modestly year-over-year to approximately $442 million. However, sequentially, the backlog was up approximately $12 million.

On a brighter note, DCO’s 787 and Airbus programmes, which include the A220, continue to be robust. The recovery in 787 is strong, as DCO reported that revenue has more than doubled year-over-year. Overall, DCO’s business with BA and Airbus is still strong, as its commercial aerospace revenue was up 11% for 1Q24.

Looking ahead, DCO is undertaking actions to gain more market share in 737 MAX and also in the A320. In the short term, 737 MAX production is expected to be softer in the upcoming two quarters but is expected to improve in the long term once BA is able to iron out all of the issues.

Investor Relations

Air Travel Demand

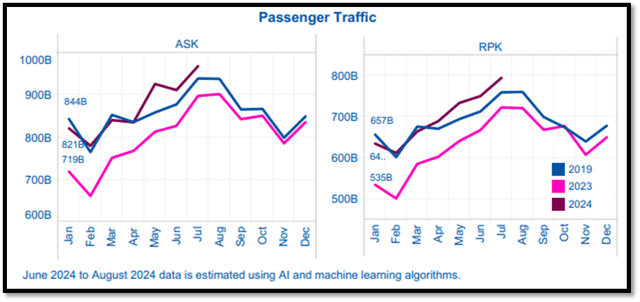

International Civil Aviation Organisation

According to the International Civil Aviation Organisation [ICAO], air travel demand for 2024 is forecast to be approximately 3 to 4% higher than pre-COVID levels. Since April 2024, revenue per kilometre [RPK] has surpassed both 2023 and pre-COVID levels. Therefore, ICAO expects airlines globally to sustain their profit levels in 2024.

As travel demand increases, it will also drive up demand for aircraft. By 2042, Airbus forecasts that the total demand for new aircraft will be approximately 40,850. For context, in 2020, there were only 22,880 aircraft globally. Therefore, looking into the long term, the forecasted increasing demand for air travel and aircraft is expected to bolster DCO’s growth outlook as well.

Relative Valuation Model

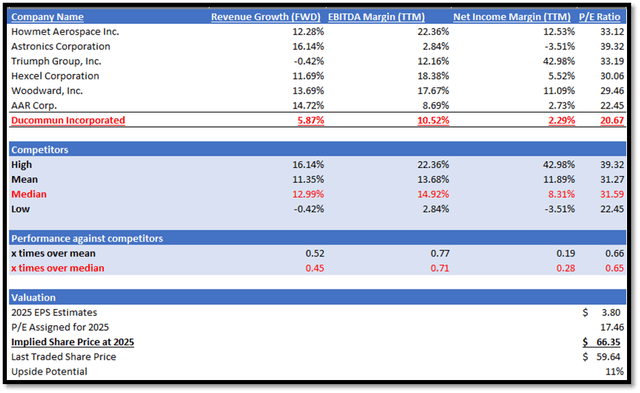

Author’s Relative Valuation Model

Based on Seeking Alpha, DCO operates in the aerospace and defence industries. In my relative valuation model, I will be comparing DCO against its peers in terms of growth outlook and profitability margin trailing twelve months [TTM]. For growth outlook, I will be comparing their forward revenue growth rate, which is a forward-looking metric. For profitability margin TTM, I will be comparing their EBITDA margin TTM and net income margin TTM. These metrics give us a deeper understanding of their core business activities’ strength and performance.

For growth outlook, DCO underperformed its peers. DCO’s forward revenue growth rate of 5.87% is lower than peers’ median of 12.99%. In terms of profitability margin TTM, DCO also underperformed its peers. Regarding EBITDA margin TTM, DCO reported 10.52%, lower than peers’ median of 14.92%. For net income margin TTM, DCO reported 2.29%, which is also lower than peers’ median of 8.31%.

Currently, DCO’s forward non-GAAP P/E ratio is 20.67x, lower than peers’ median of 31.59x. Given DCO’s underperformance against its peers, it is fair for its P/E to be below its peers’ median. In order to remain conservative in my valuation approach, I will be adjusting my 2025 target P/E for DCO down towards its five-year median, which is 17.46x.

For 2024, the market revenue estimate for DCO is $794.05 million, while EPS is $2.89. For 2025, the revenue estimate is $845.55 million, while EPS is $3.80. When analysing its 1Q24 earnings results, DCO did provide guidance. For revenue, it was guided to mid-single-digit growth given the current state of uncertainty surrounding BA, Spirit, and the FAA on the 737 MAX. For margins, DCO forecasted that there would be a short-term impact due to the wind-down of the Monrovia plant. However, in the longer term, margins are expected to improve, supported by DCO’s Electronic Systems segment, which saw significant margin improvement in the quarter.

Together, the management’s guidance and my forward-looking analysis support the market’s estimate. Therefore, by applying my 2025 target P/E to its 2025 EPS, my 2025 target share price is $66.35.

Risk and Conclusion

The risk associated with DCO is related to customer concentrations. As it generates most of its revenue from the aerospace and defence industries, it is dependent on the number of new military and commercial aircraft orders. Currently, DCO has significant sales to Boeing (BA), Spirit AeroSystems (SPR), Viasat (VSAT), General Dynamics Corporation (GD), Northrop Grumman Corporation (NOC), and RTX Corporation (RTX). Based on 2023 data, its top ten customers accounted for 59% of its total net revenue. Therefore, any material or significant change in their production rate would have a substantial impact on its operating performance and profitability.

Looking ahead, the increasing defence backlog is showing us that its defence business is still growing. In addition to increasing backlogs, DCO also revised its run rate forecast for the SPY-6 and other defence programmes upwards from $125 million to $135 million. Therefore, these factors combined are depicting a positive outlook for its defence business.

Moving onto the commercial aerospace business, the growing air travel demand and forecast growth from ICAO are expected to support it. However, currently, Boeing and Spirit are facing headwinds caused by 737 MAX quality issues. This headwind is expected to stay for the coming two quarters but is forecast to improve after that. Given DCO’s positive outlook, I am recommending a buy rating.