Bussiness

Elon Musk’s Robotaxi is still miles away from overtaking Uber and Waymo in the ride-hailing race

- Tesla’s driverless taxi plan has been met with skepticism over its feasibility and competition with rivals.

- Analysts doubt Tesla’s ability to achieve scale without rideshare partnerships.

- Uber is partnering with BYD and others, positioning itself for an autonomous vehicle future.

If Elon Musk can fully deliver on his plans to make Tesla’s Robotaxi the new go-to mode of transport, he could bring an end to the ride-hailing economy as we know it.

But some analysts aren’t convinced that Tesla could upend Uber, Lyft, or Waymo.

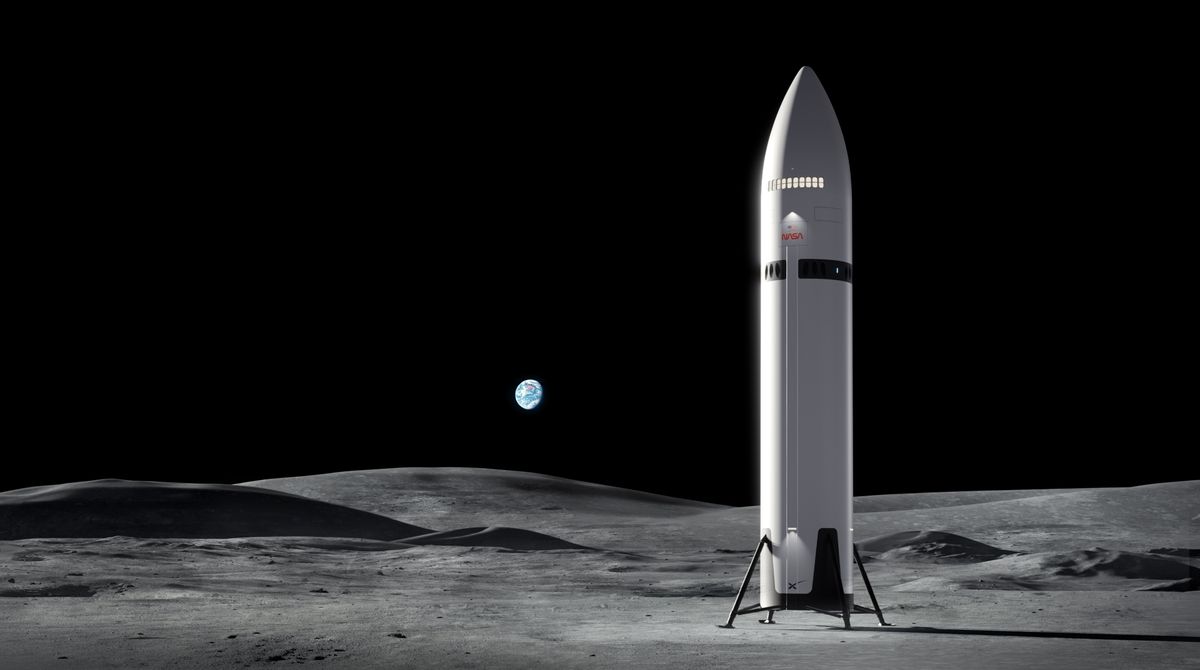

On Thursday, Musk unveiled Tesla’s driverless taxi and a 20-seat Robovan at Warner Bros. studio in Burbank, California.

Customers would be able to hail a Robotaxi and use it for as long as it’s needed, whether for a short trip or a full day, Musk said.

The success of Musk’s autonomous taxi vision depends on Tesla’s advances in self-driving technology. However, analysts at Jefferies wrote in a note on Thursday that the electric vehicle giant had “ambitious targets, but little evidence of feasibility.”

They said that Tesla did not provide evidence of how it plans to achieve higher levels of autonomy, which makes the company less of a threat to existing ride providers like Uber.

“We believe this helps minimize the ongoing overhang on UBER’s stock from TSLA’s aspirations in the robotaxi space,” analysts led by John Colantuoni wrote.

Other analysts have questioned the timeline for Robotaxis, pointing to Musk’s history of missing targets for Tesla’s Full Self-Driving technology, or FSD.

The Tesla CEO said he expects the two-seater Robotaxi, also referred to as Cybercab, to be in production sometime in 2026 “or before 2027” and cost less than $30,000.

Paul Miller, an analyst at the financial services company Forrester, noted that Musk’s announcement must be considered in the context of “a decade or more of his missed targets around autonomous driving.”

Autonomous taxi regulation has traditionally been slow, he added — and Tesla’s approach will come with unique challenges.

“Tesla’s vehicles, sensors, and software will all need to be approved in any market they hope to enter. The Cybercab’s lack of a steering wheel or pedals make sense in some future autonomous vehicles, but may further complicate the process of reassuring cautious regulators today,” he said.

Ride-hailing rivals have a head start on scale

Musk has previously said Tesla would create its own ride-hailing platform, which would be a cross between Uber and Airbnb apps, for riders to summon a driverless car. While a portion of the fleet would be owned by Tesla, individual Tesla customers would also have the option to add their vehicles to the Robotaxi fleet for additional income.

However, it will be tough to compete with the scale and operations of established companies like Uber, Lyft, and Waymo.

Dan O’Dowd, Founder of The Dawn Project and previous Musk critic, noted that the contrast between Tesla and robotaxi competitors like Waymo was “stark.”

“Until Tesla robotaxis are transporting 100,000 paying customers a week around major American cities like Waymo does, Tesla Robotaxi is nothing more than the latest work of fiction to come out of the Warner Bros. Studio,” he said in a note.

Not everyone is pessimistic about Tesla’s latest offering.

Asset management company DeepWater said Tesla had found the “right balance between form and functionality” and praised its FSD capabilities.

“The autonomous drive was smooth, feeling more natural than any of the FSD betas I’ve experienced. Even if some of the fit and finish was due to the controlled, closed-loop nature of the demo on Warner’s back lot, the demonstration was impressive,” DeepWater’s Gene Munster and Brian Baker wrote in a note published Friday.

Lack of partnership deals

Tesla could also struggle to scale its Robotaxi vision because of a lack of partnerships, analysts said.

Tesla “potentially underappreciates the obstacles to scaling a robotaxi fleet” such as the technology, asset ownership, regulation, fleet management, and demand required to run an operation at scale, the Jefferies analysts wrote. “We also believe TSLA could struggle to scale fleet operations without offering access to demand via Uber/Lyft.”

Uber is already preparing for a future of electric cars and autonomous vehicles without Tesla’s involvement.

In August, Uber launched a partnership with Tesla’s biggest competitor, Chinese EV maker BYD. The companies said Uber drivers in various markets could get discounts on 100,000 new electric vehicles from BYD, and the companies plan to collaborate on autonomous driving as well.

“The terms of the deal appear to incentivize Uber’s drivers to choose BYD vehicles given lower pricing,” Wedbush analyst Matt Bryson wrote in a note at the time.

Plus, Uber has already partnered with other robotaxi rivals, including Alphabet-owned Waymo and Aurora Innovation.

“Uber can provide enormous demand without AV players needing to invest capital towards acquiring customers or building the marketplace tech that delivers reliability at the standard that consumers have come to expect,” Uber CEO Dara Khosrowshahi said in an earnings call in August. “We’re in late-stage discussions with additional global AV players to join our platform.”